Email

Investors Brace For Stock Market and Real Estate Crash- (Weekly Market Report)

| From | Irving Wilkinson <[email protected]> |

| Subject | Investors Brace For Stock Market and Real Estate Crash- (Weekly Market Report) |

| Date | September 26, 2022 1:59 PM |

Links have been removed from this email. Learn more in the FAQ.

Links have been removed from this email. Learn more in the FAQ.

Investors Brace For Stock Market and Real Estate Crash-

(Weekly Market Report)

Good morning,

Thank you for being a subscriber of _ALPHABETASTOCK'S REPORT._

Stocks in the United States sank dramatically on Friday, pulled down

by concerns about rising interest rates. Investors in the United

States and abroad are anxious that the Federal Reserve’s aggressive

approach to controlling inflation would result in a full-fledged

recession.

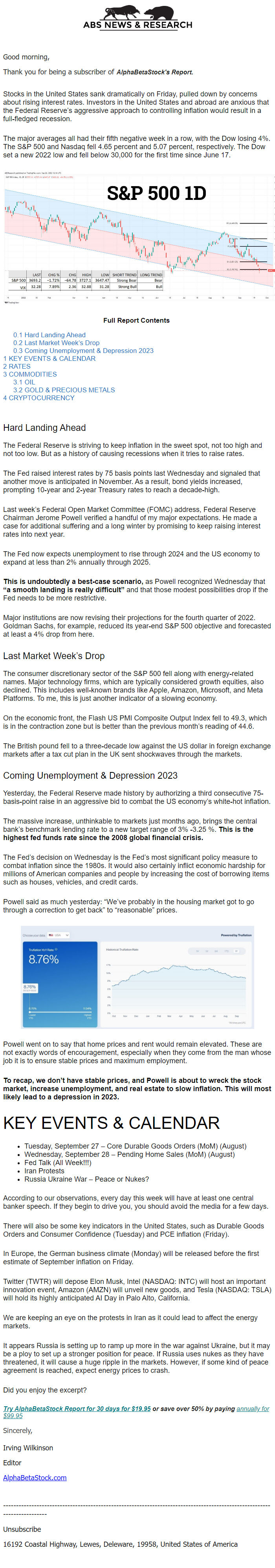

The major averages all had their fifth negative week in a row, with

the Dow losing 4%. The S&P 500 and Nasdaq fell 4.65 percent and 5.07

percent, respectively. The Dow set a new 2022 low and fell below

30,000 for the first time since June 17.

Full Report Contents

* 0.1 Hard Landing Ahead

[[link removed]]

* 0.2 Last Market Week’s Drop

[[link removed]]

* 0.3 Coming Unemployment & Depression 2023

[[link removed]]

* 1 KEY EVENTS & CALENDAR

[[link removed]]

* 2 RATES

[[link removed]]

* 3 COMMODITIES

[[link removed]]

* 3.1 OIL

[[link removed]]

* 3.2 GOLD & PRECIOUS METALS

[[link removed]]

* 4 CRYPTOCURRENCY

[[link removed]]

HARD LANDING AHEAD

The Federal Reserve is striving to keep inflation in the sweet spot,

not too high and not too low. But as a history of causing recessions

when it tries to raise rates.

The Fed raised interest rates by 75 basis points last Wednesday and

signaled that another move is anticipated in November. As a result,

bond yields increased, prompting 10-year and 2-year Treasury rates to

reach a decade-high.

Last week’s Federal Open Market Committee (FOMC) address, Federal

Reserve Chairman Jerome Powell verified a handful of my major

expectations. He made a case for additional suffering and a long

winter by promising to keep raising interest rates into next year.

The Fed now expects unemployment to rise through 2024 and the US

economy to expand at less than 2% annually through 2025.

THIS IS UNDOUBTEDLY A BEST-CASE SCENARIO, as Powell recognized

Wednesday that “A SMOOTH LANDING IS REALLY DIFFICULT” and that

those modest possibilities drop if the Fed needs to be more

restrictive.

Major institutions are now revising their projections for the fourth

quarter of 2022. Goldman Sachs, for example, reduced its year-end S&P

500 objective and forecasted at least a 4% drop from here.

LAST MARKET WEEK’S DROP

The consumer discretionary sector of the S&P 500 fell along with

energy-related names. Major technology firms, which are typically

considered growth equities, also declined. This includes well-known

brands like Apple, Amazon, Microsoft, and Meta Platforms. To me, this

is just another indicator of a slowing economy.

On the economic front, the Flash US PMI Composite Output Index fell to

49.3, which is in the contraction zone but is better than the previous

month’s reading of 44.6.

The British pound fell to a three-decade low against the US dollar in

foreign exchange markets after a tax cut plan in the UK sent

shockwaves through the markets.

COMING UNEMPLOYMENT & DEPRESSION 2023

Yesterday, the Federal Reserve made history by authorizing a third

consecutive 75-basis-point raise in an aggressive bid to combat the US

economy’s white-hot inflation.

The massive increase, unthinkable to markets just months ago, brings

the central bank’s benchmark lending rate to a new target range of

3% -3.25 %. THIS IS THE HIGHEST FED FUNDS RATE SINCE THE 2008 GLOBAL

FINANCIAL CRISIS.

The Fed’s decision on Wednesday is the Fed’s most significant

policy measure to combat inflation since the 1980s. It would also

certainly inflict economic hardship for millions of American companies

and people by increasing the cost of borrowing items such as houses,

vehicles, and credit cards.

Powell said as much yesterday: “We’ve probably in the housing

market got to go through a correction to get back” to

“reasonable” prices.

Powell went on to say that home prices and rent would remain elevated.

These are not exactly words of encouragement, especially when they

come from the man whose job it is to ensure stable prices and maximum

employment.

TO RECAP, WE DON’T HAVE STABLE PRICES, AND POWELL IS ABOUT TO WRECK

THE STOCK MARKET, INCREASE UNEMPLOYMENT, AND REAL ESTATE TO SLOW

INFLATION. THIS WILL MOST LIKELY LEAD TO A DEPRESSION IN 2023.

KEY EVENTS & CALENDAR

* Tuesday, September 27 – Core Durable Goods Orders (MoM) (August)

* Wednesday, September 28 – Pending Home Sales (MoM) (August)

* Fed Talk (All Week!!!)

* Iran Protests

* Russia Ukraine War – Peace or Nukes?

According to our observations, every day this week will have at least

one central banker speech. If they begin to drive you, you should

avoid the media for a few days.

There will also be some key indicators in the United States, such as

Durable Goods Orders and Consumer Confidence (Tuesday) and PCE

inflation (Friday).

In Europe, the German business climate (Monday) will be released

before the first estimate of September inflation on Friday.

Twitter (TWTR) will depose Elon Musk, Intel (NASDAQ: INTC) will host

an important innovation event, Amazon (AMZN) will unveil new goods,

and Tesla (NASDAQ: TSLA) will hold its highly anticipated AI Day in

Palo Alto, California.

We are keeping an eye on the protests in Iran as it could lead to

affect the energy markets.

It appears Russia is setting up to ramp up more in the war against

Ukraine, but it may be a ploy to set up a stronger position for peace.

If Russia uses nukes as they have threatened, it will cause a huge

ripple in the markets. However, if some kind of peace agreement is

reached, expect energy prices to crash.

Did you enjoy the excerpt?

_TRY ALPHABETASTOCK REPORT FOR 30 DAYS FOR $19.95_

[[link removed]]_ OR __SAVE

OVER 50% BY PAYING ANNUALLY FOR $99.95

[[link removed]]_

SINCERELY,

Irving Wilkinson

Editor

AlphaBetaStock.com [[link removed]]

-------------------------------------------------------------------------------------------------------------------------

Unsubscribe

[[link removed]]

16192 Coastal Highway, Lewes, Deleware, 19958, United States of

America

(Weekly Market Report)

Good morning,

Thank you for being a subscriber of _ALPHABETASTOCK'S REPORT._

Stocks in the United States sank dramatically on Friday, pulled down

by concerns about rising interest rates. Investors in the United

States and abroad are anxious that the Federal Reserve’s aggressive

approach to controlling inflation would result in a full-fledged

recession.

The major averages all had their fifth negative week in a row, with

the Dow losing 4%. The S&P 500 and Nasdaq fell 4.65 percent and 5.07

percent, respectively. The Dow set a new 2022 low and fell below

30,000 for the first time since June 17.

Full Report Contents

* 0.1 Hard Landing Ahead

[[link removed]]

* 0.2 Last Market Week’s Drop

[[link removed]]

* 0.3 Coming Unemployment & Depression 2023

[[link removed]]

* 1 KEY EVENTS & CALENDAR

[[link removed]]

* 2 RATES

[[link removed]]

* 3 COMMODITIES

[[link removed]]

* 3.1 OIL

[[link removed]]

* 3.2 GOLD & PRECIOUS METALS

[[link removed]]

* 4 CRYPTOCURRENCY

[[link removed]]

HARD LANDING AHEAD

The Federal Reserve is striving to keep inflation in the sweet spot,

not too high and not too low. But as a history of causing recessions

when it tries to raise rates.

The Fed raised interest rates by 75 basis points last Wednesday and

signaled that another move is anticipated in November. As a result,

bond yields increased, prompting 10-year and 2-year Treasury rates to

reach a decade-high.

Last week’s Federal Open Market Committee (FOMC) address, Federal

Reserve Chairman Jerome Powell verified a handful of my major

expectations. He made a case for additional suffering and a long

winter by promising to keep raising interest rates into next year.

The Fed now expects unemployment to rise through 2024 and the US

economy to expand at less than 2% annually through 2025.

THIS IS UNDOUBTEDLY A BEST-CASE SCENARIO, as Powell recognized

Wednesday that “A SMOOTH LANDING IS REALLY DIFFICULT” and that

those modest possibilities drop if the Fed needs to be more

restrictive.

Major institutions are now revising their projections for the fourth

quarter of 2022. Goldman Sachs, for example, reduced its year-end S&P

500 objective and forecasted at least a 4% drop from here.

LAST MARKET WEEK’S DROP

The consumer discretionary sector of the S&P 500 fell along with

energy-related names. Major technology firms, which are typically

considered growth equities, also declined. This includes well-known

brands like Apple, Amazon, Microsoft, and Meta Platforms. To me, this

is just another indicator of a slowing economy.

On the economic front, the Flash US PMI Composite Output Index fell to

49.3, which is in the contraction zone but is better than the previous

month’s reading of 44.6.

The British pound fell to a three-decade low against the US dollar in

foreign exchange markets after a tax cut plan in the UK sent

shockwaves through the markets.

COMING UNEMPLOYMENT & DEPRESSION 2023

Yesterday, the Federal Reserve made history by authorizing a third

consecutive 75-basis-point raise in an aggressive bid to combat the US

economy’s white-hot inflation.

The massive increase, unthinkable to markets just months ago, brings

the central bank’s benchmark lending rate to a new target range of

3% -3.25 %. THIS IS THE HIGHEST FED FUNDS RATE SINCE THE 2008 GLOBAL

FINANCIAL CRISIS.

The Fed’s decision on Wednesday is the Fed’s most significant

policy measure to combat inflation since the 1980s. It would also

certainly inflict economic hardship for millions of American companies

and people by increasing the cost of borrowing items such as houses,

vehicles, and credit cards.

Powell said as much yesterday: “We’ve probably in the housing

market got to go through a correction to get back” to

“reasonable” prices.

Powell went on to say that home prices and rent would remain elevated.

These are not exactly words of encouragement, especially when they

come from the man whose job it is to ensure stable prices and maximum

employment.

TO RECAP, WE DON’T HAVE STABLE PRICES, AND POWELL IS ABOUT TO WRECK

THE STOCK MARKET, INCREASE UNEMPLOYMENT, AND REAL ESTATE TO SLOW

INFLATION. THIS WILL MOST LIKELY LEAD TO A DEPRESSION IN 2023.

KEY EVENTS & CALENDAR

* Tuesday, September 27 – Core Durable Goods Orders (MoM) (August)

* Wednesday, September 28 – Pending Home Sales (MoM) (August)

* Fed Talk (All Week!!!)

* Iran Protests

* Russia Ukraine War – Peace or Nukes?

According to our observations, every day this week will have at least

one central banker speech. If they begin to drive you, you should

avoid the media for a few days.

There will also be some key indicators in the United States, such as

Durable Goods Orders and Consumer Confidence (Tuesday) and PCE

inflation (Friday).

In Europe, the German business climate (Monday) will be released

before the first estimate of September inflation on Friday.

Twitter (TWTR) will depose Elon Musk, Intel (NASDAQ: INTC) will host

an important innovation event, Amazon (AMZN) will unveil new goods,

and Tesla (NASDAQ: TSLA) will hold its highly anticipated AI Day in

Palo Alto, California.

We are keeping an eye on the protests in Iran as it could lead to

affect the energy markets.

It appears Russia is setting up to ramp up more in the war against

Ukraine, but it may be a ploy to set up a stronger position for peace.

If Russia uses nukes as they have threatened, it will cause a huge

ripple in the markets. However, if some kind of peace agreement is

reached, expect energy prices to crash.

Did you enjoy the excerpt?

_TRY ALPHABETASTOCK REPORT FOR 30 DAYS FOR $19.95_

[[link removed]]_ OR __SAVE

OVER 50% BY PAYING ANNUALLY FOR $99.95

[[link removed]]_

SINCERELY,

Irving Wilkinson

Editor

AlphaBetaStock.com [[link removed]]

-------------------------------------------------------------------------------------------------------------------------

Unsubscribe

[[link removed]]

16192 Coastal Highway, Lewes, Deleware, 19958, United States of

America

Message Analysis

- Sender: n/a

- Political Party: n/a

- Country: n/a

- State/Locality: n/a

- Office: n/a