Sept. 23, 2022

Permission to republish original opeds and cartoons granted.

Fed’s interest rate hikes have only destroyed $398 billion of the $6 trillion it printed for Covid so far

By Robert Romano

“Our expectation has been we would begin to see inflation come down, largely because of supply side healing. We haven’t. We have seen some supply side healing but inflation has not really come down.”

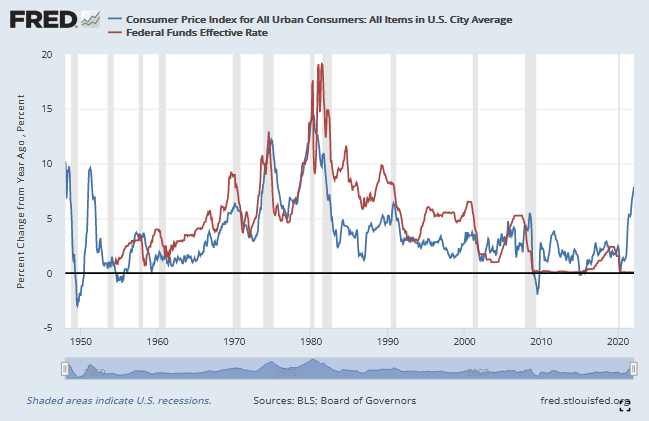

That was Federal Reserve Chairman Jerome Powell on Sept. 21, speaking to reporters following the central bank’s meeting where the Federal Funds Rate was once again increased 0.75 percent to its current range of 3 percent to 3.25 percent in a bid to combat sticky 8.3 percent consumer inflation the past year.

To be sure, inflation has been above 5 percent for 15 straight months now dating back to June 2021, and the Fed was late to react, not hiking rates the first time until inflation was already above 8 percent in March 2022.

Even now, the rate the Fed is charging banks to borrow is nowhere near to inflation rate, which is unusual for most of the Fed’s history. Throughout the postwar period — with the notable exception of the mid-1970s — the central bank would keep interest rates well above that of the inflation rate, something that was true until the dotcom bubble popped in the late 1990s.

Then, starting in the 2000s, it stopped doing that. It let the inflation rate run above bank borrowing rates and asset bubbles formed everywhere, particularly in housing, which eventually crashed, leading to an even more pronounced spread between inflation and borrowing costs under Federal Reserve Chairman Ben Bernanke who moved towards the zero-bound interest rates structure that persisted throughout the Obama years, and even as rates increased during the Trump years, it was still less than the rate of inflation.

That is relatively cheap credit—a way to boost consumer spending and to prevent households from getting underwater—but because it comes at times of vast expansions of federal government spending, on the wars in Afghanistan and Iraq, Medicare expansion, the financial crisis, the stimulus, Obamacare, defense expansion, Covid, checks, forgivable small business loans, etc. the unfortunate side effect is more money is being created than destroyed, and at a rate faster than the economy can grow.

From 2001 to 2020, before Covid, the national debt increased from $5.7 trillion to $23.2 trillion, a 307 percent increase. Meanwhile, the M2 money supply increased from $5 trillion to $15.4 trillion, a 208 percent increase, while the nominal Gross Domestic Product increased from $10.5 trillion to $21.6 trillion, just a 106 percent increase. Whatever we couldn’t borrow from the domestic and global economy’s financial system, we printed.

Our spending, borrowing and printing has far outpaced economic growth. In the past inflation was averted by running massive trade deficits but also tends to come down in really big recessions, when the reverse problem, deflation, comes into play. We’re still running massive trade deficits, but now it’s no longer enough to offset the sheer amount of borrowing and printing. Since Covid, the M2 money supply has increased another $6 trillion, to its current level $21.6 trillion.

Since inflation is defined as too much money chasing too few goods — and both factors are notably at play — to the extent that the real economy cannot keep up with demand via production, the implication is that whatever cannot be done to boost production therefore must be taken out of the money supply in order to combat the inflation, hence the interest rate hikes. But are they enough?

So far, since the Fed’s rate hikes, there is not too much money destruction. M2 peaked in April at $22 trillion and now about $400 billion have been destroyed, a 1.8 percent cut, coming off a 44 percent increase. Is that enough?

That’s a lot of excess money supply to sop up. While producers continue catching up to global demand following the Covid lockdowns, central banks have a supply problem as well to contend with, but must be careful not to spark outright deflation. 30-year mortgage rates are 6.3 percent now and 10-year treasuries are about 3.73 percent. Those are pretty high compared to recent history, but are they high enough to destroy even some of the money we created during Covid?

The proof will be in the pudding. There are still uncertainties related to continued supply disruptions to Europe’s natural gas supply amid the worsening war in Ukraine atop artificial constraints on energy production as President Joe Biden attempts to transition America to a green economy and oil production is still below pre-Covid levels, and just how bad the current recession will be as it relates to labor markets disruption. Unemployment is still historically low at 3.7 percent and tends to be a lagging indicator in recessions.

For now, it appears that the Fed is betting that with inflation still high, until labor markets offer their own recession signal, it still has room to hike interest rates some more until either the inflation rate comes down or unemployment goes up — or both. Stay tuned.

Robert Romano is the Vice President of Public Policy at Americans for Limited Government Foundation.

To view online: https://dailytorch.com/2022/09/feds-interest-rate-hikes-have-only-destroyed-398-billion-of-the-6-trillion-it-printed-for-covid-so-far/

Cartoon: Dressed For Success

By A.F. Branco

Click here for a higher level resolution version.

Kaelan Deese: Supreme Court loss could cripple Marc Elias's crusade against GOP election laws

By Kaelan Deese

Democratic election lawyer Marc Elias, one of the top attorneys in the nation pushing back against GOP redistricting and voting policy, could see his efforts stifled if the Supreme Court rules against him in an upcoming court case, according to the conservative-leaning Honest Elections Project.

Elias, a lifelong Democrat who suffered a 2021 defeat at the Supreme Court level, is behind another major voting case before the high court this fall that is poised to redefine state congressional redistricting efforts. For Elias, he considers it a valiant fight for democracy, but if he falls short once again, Democrats may lose access to a major tool to challenge gerrymandering, according to Jason Snead, the executive director of the Honest Elections Project.

The case in question is Moore v. Harper, a dispute that stems from a lower court victory by Elias's legal team when it represented Democratic voters in the state who took aim at a Republican-drawn North Carolina congressional redistricting map that was ruled as a partisan gerrymander by the state Supreme Court. Now, Elias is fighting for the Supreme Court to uphold the inferior court's determination after Republican state lawmakers successfully petitioned the justices to take up the case.

"A sound, constitutional ruling from the U.S. Supreme Court would be a major blow to Elias's program to use courts to rewrite democratically enacted election laws for partisan gain," Snead, whose group filed an amicus brief in the Moore case, told the Washington Examiner. Conversely, a ruling favoring the state Supreme Court's decision would "leave the door wide open to the Left's anti-democracy campaign, which has saturated the courts with politicized lawsuits and introduced chaos to our elections," Snead added.

Justices on the 6-3 Republican-appointed high court are poised to hold oral arguments over Moore in its upcoming term, a case that could determine whether courts or legislatures have the final say on congressional district lines and one that Elias predicts will be "the biggest case of the term," according to a recent interview with the New Yorker's Sue Halpern.

The dispute stems from the state Supreme Court's decision to smack down the GOP-drawn map on Feb. 14 by a 4-3 vote, ruling the districts were gerrymandered, or drawn in a way that was intentionally biased against Democrats.

Republicans who petitioned the high court to review Moore hope the Supreme Court will favor the independent state legislature doctrine, a contentious constitutional theory that argues only state legislatures have authority over the administration of federal elections in their states. A victory for the Republicans could clear the way for state legislatures to enact redistricting proposals essentially unencumbered by state-level judicial scrutiny.

In a recent 2021 petition by Elias to the Supreme Court, he lost the case Brnovich v. Democratic National Committee, which resulted in weakening Section 2 of the Voting Rights Act, seen by Democrats as one of the last remaining legal tools to constrain Republican states that have enacted voter integrity laws that aim to prevent ballot harvesting and out-of-precinct voting.

Rick Hasen, a professor at the UCLA Law School, wrote that as far back as 2015, some voting rights advocates have shared a viewpoint that "Elias was not following good strategy in pushing an aggressive reading of the Voting Rights Act in cases going to increasingly conservative federal courts," according to a Jan. 30 post on Election Law Blog, which referenced Elias's defeat in Brnovich.

Snead said the court decisions as a result of Elias's legal challenges could "make it harder" for voting advocacy groups to file lawsuits, such as the NAACP, the League of Women Voters, and Common Cause, that have historically engaged in major voting rights and election-related litigation.

Despite his previous criticism, Hasen told the Washington Examiner in an emailed statement that he would "not put the blame on Marc in this case. At all," saying that the onus is on the North Carolina lawmakers who appealed the case to the Supreme Court.

Case Western University law professor Jonathan Entin also disagreed with Snead's analysis, telling the Washington Examiner that "it's hard to fault the lawyer for the original plaintiffs," referencing that Elias was involved in the legal dispute long before the state's GOP leadership petitioned to the high court.

Indeed, it was the Elias Law Group that argued on behalf of a group associated with the National Democratic Redistricting Committee before the North Carolina Supreme Court's 4-3 ruling in February, prompting Republican state House Speaker Tim Moore, Senate Leader Phil Berger, and other lawmakers to petition to the Supreme Court and claim the Constitution's election clause holds that state executive and judicial branches should have no say in the process.

Elias has defended the North Carolina Supreme Court's February ruling by citing a 2019 Supreme Court 5-4 opinion in Rucho v. Common Cause, which held partisan gerrymandering claims present political questions beyond the reach of the federal courts.

And he told Halpern on Sept. 16 that the GOP justification for its high court petition made Moore a "dangerous case. Because their theory, and it is just a theory, it's not anything that any court has ever adopted."

For critics who have alleged Elias has the potential to set a bad precedent in the event that his side loses in Moore, he counters with his belief that there is little time to challenge the North Carolina GOP's position and "If not now, when?"

"We're there, guys. We're not saving all of this for the future. If we don't use the tools we have to save democracy today, then we may have a wonderful museum of unused tools in the future, but we won't have a democracy to use them in the future," Elias told Halpern.

Democratic court watchers have dubbed the independent state legislature doctrine as a so-called "right-wing constitutional theory" that has no basis in the Constitution. Regardless, its reference has continued to show up in the writings of Supreme Court justices, namely one of Chief Justice John Roberts's writings in his 2015 dissent in Arizona State Legislature v. Arizona Independent Redistricting Commission.

The Supreme Court initially rejected the request to restore immediately the GOP-drawn congressional maps on March 7, a ruling that was affirmed by Justice Brett Kavanaugh, who argued the high court should examine the matter after the 2022 midterm elections. But three Republican-appointed justices — Samuel Alito, Clarence Thomas, and Neil Gorsuch — would have upheld the GOP-drawn map, arguing it was likely that the state Supreme Court had violated the Constitution in overriding the state legislature.

Oral argument dates have not been scheduled over Moore, though the justices will likely return a ruling before the end of the fall 2022-23 high court term next summer.

To view online: https://www.washingtonexaminer.com/policy/courts/scotus-loss-could-cripple-elias-crusade-gop-election-laws