Email

Ray Dalio Foresees an Economic Apocalypse As Market Sinks To New Lows – (Weekly Market Report)

| From | Irving Wilkinson <[email protected]> |

| Subject | Ray Dalio Foresees an Economic Apocalypse As Market Sinks To New Lows – (Weekly Market Report) |

| Date | September 19, 2022 2:12 PM |

Links have been removed from this email. Learn more in the FAQ.

Links have been removed from this email. Learn more in the FAQ.

Ray Dalio Foresees an Economic Apocalypse As Market Sinks

To New Lows – (Weekly Market Report)

Thank you for being a subscriber of _ALPHABETASTOCK'S REPORT._ This

is only an excerpt and paid subscribers have access to this and all

the features. _SIGN UP NOW FOR $19.95_

[[link removed]]_ OR __SAVE OVER 50% BY

PAYING ANNUALLY FOR $99.95

[[link removed]]__.

[[link removed]]_

Contents [hide

[[link removed]]]

* 0.1 Inflation Reality & Fed Hikes

[[link removed]]

* 0.2 Ray Dalio Foresees an Economic Apocalypse

[[link removed]]

* 0.3 Key Events, Market Movers & Calendar

[[link removed]]

* 1 RATES

[[link removed]]

* 2 COMMODITIES

[[link removed]]

* 2.1 OIL

[[link removed]]

* 2.2 GOLD & PRECIOUS METALS

[[link removed]]

* 3 CRYPTOCURRENCY

[[link removed]]

__

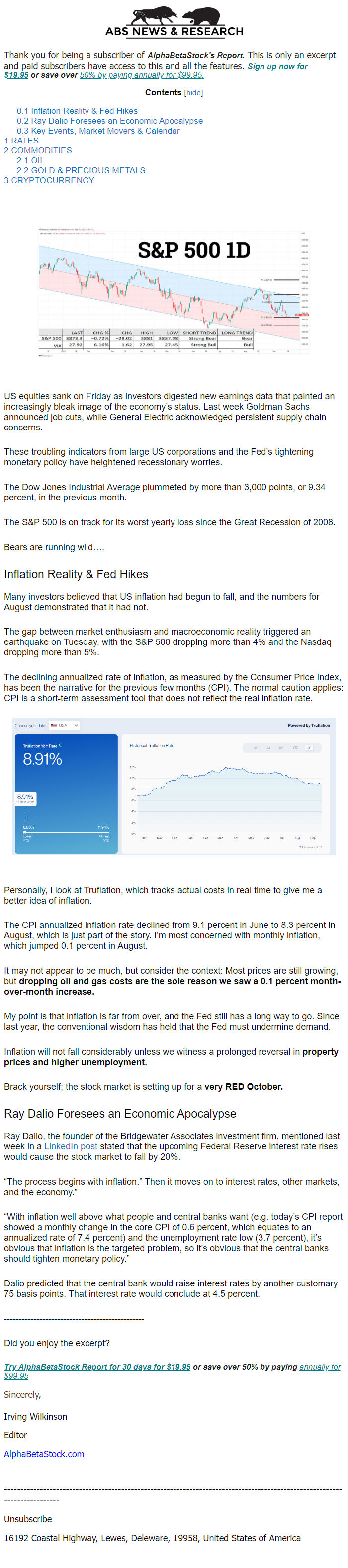

US equities sank on Friday as investors digested new earnings data

that painted an increasingly bleak image of the economy’s status.

Last week Goldman Sachs announced job cuts, while General Electric

acknowledged persistent supply chain concerns.

These troubling indicators from large US corporations and the Fed’s

tightening monetary policy have heightened recessionary worries.

The Dow Jones Industrial Average plummeted by more than 3,000 points,

or 9.34 percent, in the previous month.

The S&P 500 is on track for its worst yearly loss since the Great

Recession of 2008.

Bears are running wild….

INFLATION REALITY & FED HIKES

Many investors believed that US inflation had begun to fall, and the

numbers for August demonstrated that it had not.

The gap between market enthusiasm and macroeconomic reality triggered

an earthquake on Tuesday, with the S&P 500 dropping more than 4% and

the Nasdaq dropping more than 5%.

The declining annualized rate of inflation, as measured by the

Consumer Price Index, has been the narrative for the previous few

months (CPI). The normal caution applies: CPI is a short-term

assessment tool that does not reflect the real inflation rate.

Personally, I look at Truflation, which tracks actual costs in real

time to give me a better idea of inflation.

The CPI annualized inflation rate declined from 9.1 percent in June to

8.3 percent in August, which is just part of the story. I’m most

concerned with monthly inflation, which jumped 0.1 percent in August.

It may not appear to be much, but consider the context: Most prices

are still growing, but DROPPING OIL AND GAS COSTS ARE THE SOLE REASON

WE SAW A 0.1 PERCENT MONTH-OVER-MONTH INCREASE.

My point is that inflation is far from over, and the Fed still has a

long way to go. Since last year, the conventional wisdom has held that

the Fed must undermine demand.

Inflation will not fall considerably unless we witness a prolonged

reversal in PROPERTY PRICES AND HIGHER UNEMPLOYMENT.

Brack yourself; the stock market is setting up for a VERY RED

OCTOBER.

RAY DALIO FORESEES AN ECONOMIC APOCALYPSE

Ray Dalio, the founder of the Bridgewater Associates investment firm,

mentioned last week in a LinkedIn post

[[link removed]] stated

that the upcoming Federal Reserve interest rate rises would cause the

stock market to fall by 20%.

“The process begins with inflation.” Then it moves on to interest

rates, other markets, and the economy.”

“With inflation well above what people and central banks want (e.g.

today’s CPI report showed a monthly change in the core CPI of 0.6

percent, which equates to an annualized rate of 7.4 percent) and the

unemployment rate low (3.7 percent), it’s obvious that inflation is

the targeted problem, so it’s obvious that the central banks should

tighten monetary policy.”

Dalio predicted that the central bank would raise interest rates by

another customary 75 basis points. That interest rate would conclude

at 4.5 percent.

-----------------------------------------------

Did you enjoy the excerpt?

_TRY ALPHABETASTOCK REPORT FOR 30 DAYS FOR $19.95_

[[link removed]]_ OR __SAVE

OVER 50% BY PAYING ANNUALLY FOR $99.95

[[link removed]]_

SINCERELY,

Irving Wilkinson

Editor

AlphaBetaStock.com [[link removed]]

-------------------------------------------------------------------------------------------------------------------------

Unsubscribe

[[link removed]]

16192 Coastal Highway, Lewes, Deleware, 19958, United States of

America

To New Lows – (Weekly Market Report)

Thank you for being a subscriber of _ALPHABETASTOCK'S REPORT._ This

is only an excerpt and paid subscribers have access to this and all

the features. _SIGN UP NOW FOR $19.95_

[[link removed]]_ OR __SAVE OVER 50% BY

PAYING ANNUALLY FOR $99.95

[[link removed]]__.

[[link removed]]_

Contents [hide

[[link removed]]]

* 0.1 Inflation Reality & Fed Hikes

[[link removed]]

* 0.2 Ray Dalio Foresees an Economic Apocalypse

[[link removed]]

* 0.3 Key Events, Market Movers & Calendar

[[link removed]]

* 1 RATES

[[link removed]]

* 2 COMMODITIES

[[link removed]]

* 2.1 OIL

[[link removed]]

* 2.2 GOLD & PRECIOUS METALS

[[link removed]]

* 3 CRYPTOCURRENCY

[[link removed]]

__

US equities sank on Friday as investors digested new earnings data

that painted an increasingly bleak image of the economy’s status.

Last week Goldman Sachs announced job cuts, while General Electric

acknowledged persistent supply chain concerns.

These troubling indicators from large US corporations and the Fed’s

tightening monetary policy have heightened recessionary worries.

The Dow Jones Industrial Average plummeted by more than 3,000 points,

or 9.34 percent, in the previous month.

The S&P 500 is on track for its worst yearly loss since the Great

Recession of 2008.

Bears are running wild….

INFLATION REALITY & FED HIKES

Many investors believed that US inflation had begun to fall, and the

numbers for August demonstrated that it had not.

The gap between market enthusiasm and macroeconomic reality triggered

an earthquake on Tuesday, with the S&P 500 dropping more than 4% and

the Nasdaq dropping more than 5%.

The declining annualized rate of inflation, as measured by the

Consumer Price Index, has been the narrative for the previous few

months (CPI). The normal caution applies: CPI is a short-term

assessment tool that does not reflect the real inflation rate.

Personally, I look at Truflation, which tracks actual costs in real

time to give me a better idea of inflation.

The CPI annualized inflation rate declined from 9.1 percent in June to

8.3 percent in August, which is just part of the story. I’m most

concerned with monthly inflation, which jumped 0.1 percent in August.

It may not appear to be much, but consider the context: Most prices

are still growing, but DROPPING OIL AND GAS COSTS ARE THE SOLE REASON

WE SAW A 0.1 PERCENT MONTH-OVER-MONTH INCREASE.

My point is that inflation is far from over, and the Fed still has a

long way to go. Since last year, the conventional wisdom has held that

the Fed must undermine demand.

Inflation will not fall considerably unless we witness a prolonged

reversal in PROPERTY PRICES AND HIGHER UNEMPLOYMENT.

Brack yourself; the stock market is setting up for a VERY RED

OCTOBER.

RAY DALIO FORESEES AN ECONOMIC APOCALYPSE

Ray Dalio, the founder of the Bridgewater Associates investment firm,

mentioned last week in a LinkedIn post

[[link removed]] stated

that the upcoming Federal Reserve interest rate rises would cause the

stock market to fall by 20%.

“The process begins with inflation.” Then it moves on to interest

rates, other markets, and the economy.”

“With inflation well above what people and central banks want (e.g.

today’s CPI report showed a monthly change in the core CPI of 0.6

percent, which equates to an annualized rate of 7.4 percent) and the

unemployment rate low (3.7 percent), it’s obvious that inflation is

the targeted problem, so it’s obvious that the central banks should

tighten monetary policy.”

Dalio predicted that the central bank would raise interest rates by

another customary 75 basis points. That interest rate would conclude

at 4.5 percent.

-----------------------------------------------

Did you enjoy the excerpt?

_TRY ALPHABETASTOCK REPORT FOR 30 DAYS FOR $19.95_

[[link removed]]_ OR __SAVE

OVER 50% BY PAYING ANNUALLY FOR $99.95

[[link removed]]_

SINCERELY,

Irving Wilkinson

Editor

AlphaBetaStock.com [[link removed]]

-------------------------------------------------------------------------------------------------------------------------

Unsubscribe

[[link removed]]

16192 Coastal Highway, Lewes, Deleware, 19958, United States of

America

Message Analysis

- Sender: n/a

- Political Party: n/a

- Country: n/a

- State/Locality: n/a

- Office: n/a