Email

Money, Money, Money

| From | Treasurer of State <[email protected]> |

| Subject | Money, Money, Money |

| Date | September 16, 2022 4:22 PM |

Links have been removed from this email. Learn more in the FAQ.

Links have been removed from this email. Learn more in the FAQ.

TOS Newsletter Header

Newsletter

September 16, 2022

It?s no secret finances occupy a large chunk of life. Whether earning, saving, spending, donating, budgeting or planning, money is something we constantly have to think about. As State Treasurer, it is my mission to make Iowans comfortable & confident when it comes to their financial health. So, in this newsletter, I?m providing you with information on how you can get a boost to the education fund of a child in your life, how to plan for retirement like a pro and a way you can get money for free (think: unclaimed property). Hope you enjoy!

Sincerely,

Michael L. Fitzgerald

State Treasurer of Iowa

________________________________________________________________________

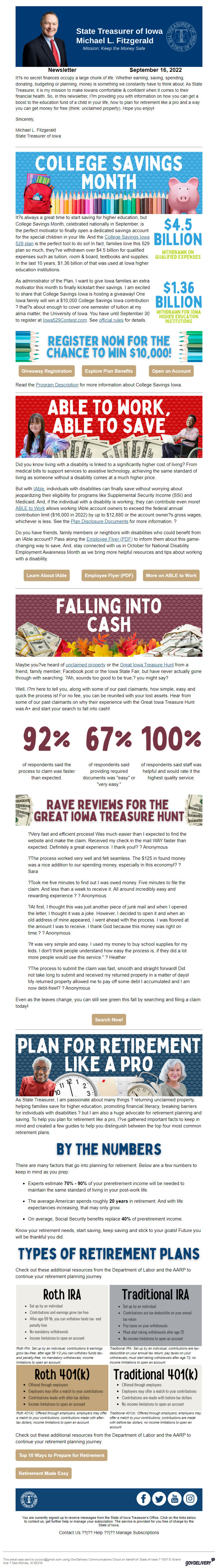

College Savings Month

It?s always a great time to start saving for higher education, but College Savings Month, celebrated nationally in September, is the perfect motivator to finally open a dedicated savings account for the special children in your life. And the College Savings Iowa 529 plan [ [link removed] ] is the perfect tool to do so! In fact, families love this 529 plan so much, they?ve withdrawn over $4.5 billion for qualified expenses such as tuition, room & board, textbooks and supplies. In the last 10 years, $1.36 billion of that was used at Iowa higher education institutions.

$4.5 billion withdrawn on qualified expenses

As administrator of the Plan, I want to give Iowa families an extra motivator this month to finally kickstart their savings. I am excited to share that College Savings Iowa is hosting a giveaway! One Iowa family will win a $10,000 College Savings Iowa contribution ? that?s about enough to cover one semester of tuition at my alma matter, the University of Iowa. You have until September 30 to register at Iowa529Contest.com [ [link removed] ]. See official rules [ [link removed] ] for details.

$1.36 billion withdrawn for Iowa higher education institutions

Register now for the chance to win $10,000

*Giveaway Registration* [ [link removed] ]

*Explore Plan Benefits* [ [link removed] ]

*Open an Account* [ [link removed] ]

Read the Program Description [ [link removed] ] for more information about College Savings Iowa.

________________________________________________________________________

ABLE to Work, ABLE to Save

Did you know living with a disability is linked to a significantly higher cost of living? From medical bills to support services to assistive technology, achieving the same standard of living as someone without a disability comes at a much higher price.

But with IAble [ [link removed] ], individuals with disabilities can finally save without worrying about jeopardizing their eligibility for programs like Supplemental Security Income (SSI) and Medicaid. And, if the individual with a disability is working, they can contribute even more! ABLE to Work [ [link removed] ] allows working IAble account owners to exceed the federal annual contribution limit ($16,000 in 2022) by up to $12,880 or the account owner?s gross wages, whichever is less. See the Plan Disclosure Documents [ [link removed] ] for more information. ?

Do you have friends, family members or neighbors with disabilities who could benefit from an IAble account? Pass along the Employee Flyer (PDF) [ [link removed] ] to inform them about this game-changing way to save. And, stay connected with us in October for National Disability Employment Awareness Month as we bring more helpful resources and tips about working with a disability.

*Learn About IAble* [ [link removed] ]

*Employee Flyer (PDF)* [ [link removed] ]

*More on ABLE to Work* [ [link removed] ]

________________________________________________________________________

Falling into Cash

Maybe you?ve heard of unclaimed property [ [link removed] ] or the Great Iowa Treasure Hunt [ [link removed] ] from a friend, family member, Facebook post or the Iowa State Fair, but have never actually gone through with searching. ?Ah, sounds too good to be true,? you might say?

Well, I?m here to tell you, along with some of our past claimants, how simple, easy and quick the process is! For no fee, you can be reunited with your lost assets. Hear from some of our past claimants on why their experience with the Great Iowa Treasure Hunt was A+ and start your search to fall into cash!

92%

of respondents said the process to claim was faster than expected.

67%

of respondents said providing required documents was "easy" or "very easy."

100%

of respondents said staff was helpful and would rate it the highest quality service.

Rave reviews for the Great Iowa Treasure Hunt

?Very fast and efficient process! Was much easier than I expected to find the website and make the claim. Received my check in the mail WAY faster than expected. Definitely a great experience. I thank you!? ? Anonymous

?The process worked very well and felt seamless. The $125 in found money was a nice addition to our spending money, especially in this economy!? ? Sara

?Took me five minutes to find out I was owed money. Five minutes to file the claim. And less than a week to receive it. All around incredibly easy and rewarding experience.? ? Anonymous

?At first, I thought this was just another piece of junk mail and when I opened the letter, I thought it was a joke. However, I decided to open it and when an old address of mine appeared, I went ahead with the process. I was floored at the amount I was to receive. I thank God because this money was right on time.? ? Anonymous

?It was very simple and easy. I used my money to buy school supplies for my kids. I don't think people understand how easy the process is, if they did a lot more people would use this service." ? Heather

?The process to submit the claim was fast, smooth and straight forward! Did not take long to submit and received my returned property in a matter of days! My returned property allowed me to pay off some debt I accumulated and I am now debt-free!? ? Anonymous

Even as the leaves change, you can still see green this fall by searching and filing a claim today!

*Search Now!* [ [link removed] ]

________________________________________________________________________

Plan for retirement like a pro [ [link removed] ]

As State Treasurer, I am passionate about many things ? returning unclaimed property, helping families save for higher education, promoting financial literacy, breaking barriers for individuals with disabilities ? but I am also a huge advocate for retirement planning and saving. To help you plan for retirement like a pro, I?ve gathered important facts to keep in mind and created a few guides to help you distinguish between the top four most common retirement plans.

By the numbers

There are many factors that go into planning for retirement. Below are a few numbers to keep in mind as you prep:

* Experts estimate *70% - 90%* of your preretirement income will be needed to maintain the same standard of living in your post-work life.

* The average American spends roughly *20 years* in retirement. And with life expectancies increasing, that may only grow.

* On average, Social Security benefits replace *40%* of preretirement income.

Know your retirement needs, start saving, keep saving and stick to your goals! Future you will be thankful you did.

Types of retirement plans

Check out these additional resources from the Department of Labor and the AARP to continue your retirement planning journey.

Roth IRA

Roth IRA: Set up by an individual; contributions & earnings grow tax-free; after age 59 1/2 you can withdraw funds tax- and penalty-free; no mandatory withdrawals; income limitations to open an account.

Roth 401(k)

Roth 401(k): Offered through employers; employers may offer a match to your contributions; contributions made with after-tax dollars; income limitations to open an account.

Traditional IRA

Traditional IRA: Set up by an individual; contributions are tax-deductible on your annual tax return; pay taxes on your withdrawals; must start taking withdrawals after age 72; no income limitations to open an account

Traditional 401(k)

Traditional 401(k): Offered through employers; employers may offer a match to your contributions; contributions are made with before-tax dollars; no income limitations to open an account

Check out these additional resources from the Department of Labor and the AARP to continue your retirement planning journey.

*Top 10 Ways to Prepare for Retirement* [ [link removed] ]

*Retirement Made Easy* [ [link removed] ]

State of Iowa Treasurers Office

facebook [ [link removed] ]twitter [ [link removed] ]youtube [ [link removed] ]instagram [ [link removed] ]

You are currently signed up to receive messages from the State of Iowa Treasurer's Office. Click on the links below to contact us, get further help or manage your subscription. The service is provided for you free of charge by the State of Iowa.

Contact Us [ [link removed] ] ??|?? Help [ [link removed] ] ??|?? Manage Subscriptions [ [link removed] ]

________________________________________________________________________

This email was sent to [email protected] using GovDelivery Communications Cloud on behalf of: State of Iowa ? 1007 E Grand Ave ? Des Moines, IA 50319 GovDelivery logo [ [link removed] ]

body .abe-column-block { min-height: 5px; } table.gd_combo_table img {margin-left:10px; margin-right:10px;} table.gd_combo_table div.govd_image_display img, table.gd_combo_table td.gd_combo_image_cell img {margin-left:0px; margin-right:0px;}

Newsletter

September 16, 2022

It?s no secret finances occupy a large chunk of life. Whether earning, saving, spending, donating, budgeting or planning, money is something we constantly have to think about. As State Treasurer, it is my mission to make Iowans comfortable & confident when it comes to their financial health. So, in this newsletter, I?m providing you with information on how you can get a boost to the education fund of a child in your life, how to plan for retirement like a pro and a way you can get money for free (think: unclaimed property). Hope you enjoy!

Sincerely,

Michael L. Fitzgerald

State Treasurer of Iowa

________________________________________________________________________

College Savings Month

It?s always a great time to start saving for higher education, but College Savings Month, celebrated nationally in September, is the perfect motivator to finally open a dedicated savings account for the special children in your life. And the College Savings Iowa 529 plan [ [link removed] ] is the perfect tool to do so! In fact, families love this 529 plan so much, they?ve withdrawn over $4.5 billion for qualified expenses such as tuition, room & board, textbooks and supplies. In the last 10 years, $1.36 billion of that was used at Iowa higher education institutions.

$4.5 billion withdrawn on qualified expenses

As administrator of the Plan, I want to give Iowa families an extra motivator this month to finally kickstart their savings. I am excited to share that College Savings Iowa is hosting a giveaway! One Iowa family will win a $10,000 College Savings Iowa contribution ? that?s about enough to cover one semester of tuition at my alma matter, the University of Iowa. You have until September 30 to register at Iowa529Contest.com [ [link removed] ]. See official rules [ [link removed] ] for details.

$1.36 billion withdrawn for Iowa higher education institutions

Register now for the chance to win $10,000

*Giveaway Registration* [ [link removed] ]

*Explore Plan Benefits* [ [link removed] ]

*Open an Account* [ [link removed] ]

Read the Program Description [ [link removed] ] for more information about College Savings Iowa.

________________________________________________________________________

ABLE to Work, ABLE to Save

Did you know living with a disability is linked to a significantly higher cost of living? From medical bills to support services to assistive technology, achieving the same standard of living as someone without a disability comes at a much higher price.

But with IAble [ [link removed] ], individuals with disabilities can finally save without worrying about jeopardizing their eligibility for programs like Supplemental Security Income (SSI) and Medicaid. And, if the individual with a disability is working, they can contribute even more! ABLE to Work [ [link removed] ] allows working IAble account owners to exceed the federal annual contribution limit ($16,000 in 2022) by up to $12,880 or the account owner?s gross wages, whichever is less. See the Plan Disclosure Documents [ [link removed] ] for more information. ?

Do you have friends, family members or neighbors with disabilities who could benefit from an IAble account? Pass along the Employee Flyer (PDF) [ [link removed] ] to inform them about this game-changing way to save. And, stay connected with us in October for National Disability Employment Awareness Month as we bring more helpful resources and tips about working with a disability.

*Learn About IAble* [ [link removed] ]

*Employee Flyer (PDF)* [ [link removed] ]

*More on ABLE to Work* [ [link removed] ]

________________________________________________________________________

Falling into Cash

Maybe you?ve heard of unclaimed property [ [link removed] ] or the Great Iowa Treasure Hunt [ [link removed] ] from a friend, family member, Facebook post or the Iowa State Fair, but have never actually gone through with searching. ?Ah, sounds too good to be true,? you might say?

Well, I?m here to tell you, along with some of our past claimants, how simple, easy and quick the process is! For no fee, you can be reunited with your lost assets. Hear from some of our past claimants on why their experience with the Great Iowa Treasure Hunt was A+ and start your search to fall into cash!

92%

of respondents said the process to claim was faster than expected.

67%

of respondents said providing required documents was "easy" or "very easy."

100%

of respondents said staff was helpful and would rate it the highest quality service.

Rave reviews for the Great Iowa Treasure Hunt

?Very fast and efficient process! Was much easier than I expected to find the website and make the claim. Received my check in the mail WAY faster than expected. Definitely a great experience. I thank you!? ? Anonymous

?The process worked very well and felt seamless. The $125 in found money was a nice addition to our spending money, especially in this economy!? ? Sara

?Took me five minutes to find out I was owed money. Five minutes to file the claim. And less than a week to receive it. All around incredibly easy and rewarding experience.? ? Anonymous

?At first, I thought this was just another piece of junk mail and when I opened the letter, I thought it was a joke. However, I decided to open it and when an old address of mine appeared, I went ahead with the process. I was floored at the amount I was to receive. I thank God because this money was right on time.? ? Anonymous

?It was very simple and easy. I used my money to buy school supplies for my kids. I don't think people understand how easy the process is, if they did a lot more people would use this service." ? Heather

?The process to submit the claim was fast, smooth and straight forward! Did not take long to submit and received my returned property in a matter of days! My returned property allowed me to pay off some debt I accumulated and I am now debt-free!? ? Anonymous

Even as the leaves change, you can still see green this fall by searching and filing a claim today!

*Search Now!* [ [link removed] ]

________________________________________________________________________

Plan for retirement like a pro [ [link removed] ]

As State Treasurer, I am passionate about many things ? returning unclaimed property, helping families save for higher education, promoting financial literacy, breaking barriers for individuals with disabilities ? but I am also a huge advocate for retirement planning and saving. To help you plan for retirement like a pro, I?ve gathered important facts to keep in mind and created a few guides to help you distinguish between the top four most common retirement plans.

By the numbers

There are many factors that go into planning for retirement. Below are a few numbers to keep in mind as you prep:

* Experts estimate *70% - 90%* of your preretirement income will be needed to maintain the same standard of living in your post-work life.

* The average American spends roughly *20 years* in retirement. And with life expectancies increasing, that may only grow.

* On average, Social Security benefits replace *40%* of preretirement income.

Know your retirement needs, start saving, keep saving and stick to your goals! Future you will be thankful you did.

Types of retirement plans

Check out these additional resources from the Department of Labor and the AARP to continue your retirement planning journey.

Roth IRA

Roth IRA: Set up by an individual; contributions & earnings grow tax-free; after age 59 1/2 you can withdraw funds tax- and penalty-free; no mandatory withdrawals; income limitations to open an account.

Roth 401(k)

Roth 401(k): Offered through employers; employers may offer a match to your contributions; contributions made with after-tax dollars; income limitations to open an account.

Traditional IRA

Traditional IRA: Set up by an individual; contributions are tax-deductible on your annual tax return; pay taxes on your withdrawals; must start taking withdrawals after age 72; no income limitations to open an account

Traditional 401(k)

Traditional 401(k): Offered through employers; employers may offer a match to your contributions; contributions are made with before-tax dollars; no income limitations to open an account

Check out these additional resources from the Department of Labor and the AARP to continue your retirement planning journey.

*Top 10 Ways to Prepare for Retirement* [ [link removed] ]

*Retirement Made Easy* [ [link removed] ]

State of Iowa Treasurers Office

facebook [ [link removed] ]twitter [ [link removed] ]youtube [ [link removed] ]instagram [ [link removed] ]

You are currently signed up to receive messages from the State of Iowa Treasurer's Office. Click on the links below to contact us, get further help or manage your subscription. The service is provided for you free of charge by the State of Iowa.

Contact Us [ [link removed] ] ??|?? Help [ [link removed] ] ??|?? Manage Subscriptions [ [link removed] ]

________________________________________________________________________

This email was sent to [email protected] using GovDelivery Communications Cloud on behalf of: State of Iowa ? 1007 E Grand Ave ? Des Moines, IA 50319 GovDelivery logo [ [link removed] ]

body .abe-column-block { min-height: 5px; } table.gd_combo_table img {margin-left:10px; margin-right:10px;} table.gd_combo_table div.govd_image_display img, table.gd_combo_table td.gd_combo_image_cell img {margin-left:0px; margin-right:0px;}

Message Analysis

- Sender: n/a

- Political Party: n/a

- Country: n/a

- State/Locality: n/a

- Office: n/a

-

Email Providers:

- govDelivery