Email

Recession 2023? (Weekly Market Report)

| From | Irving Wilkinson <[email protected]> |

| Subject | Recession 2023? (Weekly Market Report) |

| Date | September 12, 2022 1:17 PM |

Links have been removed from this email. Learn more in the FAQ.

Links have been removed from this email. Learn more in the FAQ.

Recession 2023? (Weekly Market Report)

Thank you for being a subscriber of _ALPHABETASTOCK'S REPORT._ This

is only an excerpt and paid subscribers have access to this and all

the features. _SIGN UP NOW FOR $19.95_

[[link removed]]_ OR __SAVE OVER 50% BY

PAYING ANNUALLY FOR $99.95

[[link removed]]__.

[[link removed]]_

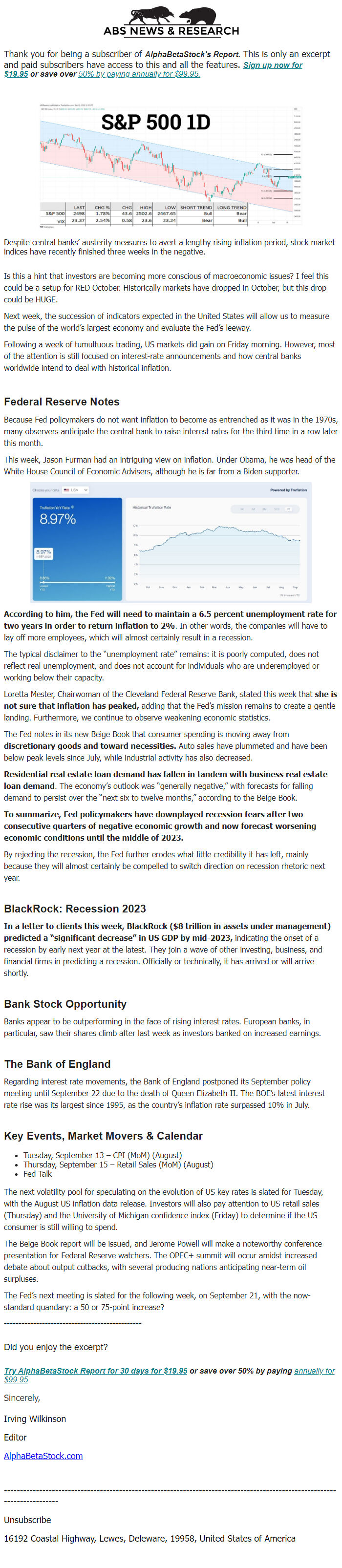

Despite central banks’ austerity measures to avert a lengthy rising

inflation period, stock market indices have recently finished three

weeks in the negative.

Is this a hint that investors are becoming more conscious of

macroeconomic issues? I feel this could be a setup for RED October.

Historically markets have dropped in October, but this drop could be

HUGE.

Next week, the succession of indicators expected in the United States

will allow us to measure the pulse of the world’s largest economy

and evaluate the Fed’s leeway.

Following a week of tumultuous trading, US markets did gain on Friday

morning. However, most of the attention is still focused on

interest-rate announcements and how central banks worldwide intend to

deal with historical inflation.

FEDERAL RESERVE NOTES

Because Fed policymakers do not want inflation to become as entrenched

as it was in the 1970s, many observers anticipate the central bank to

raise interest rates for the third time in a row later this month.

This week, Jason Furman had an intriguing view on inflation. Under

Obama, he was head of the White House Council of Economic Advisers,

although he is far from a Biden supporter.

ACCORDING TO HIM, THE FED WILL NEED TO MAINTAIN A 6.5 PERCENT

UNEMPLOYMENT RATE FOR TWO YEARS IN ORDER TO RETURN INFLATION TO 2%. In

other words, the companies will have to lay off more employees, which

will almost certainly result in a recession.

The typical disclaimer to the “unemployment rate” remains: it is

poorly computed, does not reflect real unemployment, and does not

account for individuals who are underemployed or working below their

capacity.

Loretta Mester, Chairwoman of the Cleveland Federal Reserve Bank,

stated this week that SHE IS NOT SURE THAT INFLATION HAS PEAKED,

adding that the Fed’s mission remains to create a gentle landing.

Furthermore, we continue to observe weakening economic statistics.

The Fed notes in its new Beige Book that consumer spending is moving

away from DISCRETIONARY GOODS AND TOWARD NECESSITIES. Auto sales have

plummeted and have been below peak levels since July, while industrial

activity has also decreased.

RESIDENTIAL REAL ESTATE LOAN DEMAND HAS FALLEN IN TANDEM WITH BUSINESS

REAL ESTATE LOAN DEMAND. The economy’s outlook was “generally

negative,” with forecasts for falling demand to persist over the

“next six to twelve months,” according to the Beige Book.

TO SUMMARIZE, FED POLICYMAKERS HAVE DOWNPLAYED RECESSION FEARS AFTER

TWO CONSECUTIVE QUARTERS OF NEGATIVE ECONOMIC GROWTH AND NOW FORECAST

WORSENING ECONOMIC CONDITIONS UNTIL THE MIDDLE OF 2023.

By rejecting the recession, the Fed further erodes what little

credibility it has left, mainly because they will almost certainly be

compelled to switch direction on recession rhetoric next year.

BLACKROCK: RECESSION 2023

IN A LETTER TO CLIENTS THIS WEEK, BLACKROCK ($8 TRILLION IN ASSETS

UNDER MANAGEMENT) PREDICTED A “SIGNIFICANT DECREASE” IN US GDP BY

MID-2023, indicating the onset of a recession by early next year at

the latest. They join a wave of other investing, business, and

financial firms in predicting a recession. Officially or technically,

it has arrived or will arrive shortly.

BANK STOCK OPPORTUNITY

Banks appear to be outperforming in the face of rising interest rates.

European banks, in particular, saw their shares climb after last week

as investors banked on increased earnings.

THE BANK OF ENGLAND

Regarding interest rate movements, the Bank of England postponed its

September policy meeting until September 22 due to the death of Queen

Elizabeth II. The BOE’s latest interest rate rise was its largest

since 1995, as the country’s inflation rate surpassed 10% in July.

KEY EVENTS, MARKET MOVERS & CALENDAR

* Tuesday, September 13 – CPI (MoM) (August)

* Thursday, September 15 – Retail Sales (MoM) (August)

* Fed Talk

The next volatility pool for speculating on the evolution of US key

rates is slated for Tuesday, with the August US inflation data

release. Investors will also pay attention to US retail sales

(Thursday) and the University of Michigan confidence index (Friday) to

determine if the US consumer is still willing to spend.

The Beige Book report will be issued, and Jerome Powell will make a

noteworthy conference presentation for Federal Reserve watchers. The

OPEC+ summit will occur amidst increased debate about output cutbacks,

with several producing nations anticipating near-term oil surpluses.

The Fed’s next meeting is slated for the following week, on

September 21, with the now-standard quandary: a 50 or 75-point

increase?

-----------------------------------------------

Did you enjoy the excerpt?

_TRY ALPHABETASTOCK REPORT FOR 30 DAYS FOR $19.95_

[[link removed]]_ OR __SAVE

OVER 50% BY PAYING ANNUALLY FOR $99.95

[[link removed]]_

SINCERELY,

Irving Wilkinson

Editor

AlphaBetaStock.com [[link removed]]

-------------------------------------------------------------------------------------------------------------------------

Unsubscribe

[[link removed]]

16192 Coastal Highway, Lewes, Deleware, 19958, United States of

America

Thank you for being a subscriber of _ALPHABETASTOCK'S REPORT._ This

is only an excerpt and paid subscribers have access to this and all

the features. _SIGN UP NOW FOR $19.95_

[[link removed]]_ OR __SAVE OVER 50% BY

PAYING ANNUALLY FOR $99.95

[[link removed]]__.

[[link removed]]_

Despite central banks’ austerity measures to avert a lengthy rising

inflation period, stock market indices have recently finished three

weeks in the negative.

Is this a hint that investors are becoming more conscious of

macroeconomic issues? I feel this could be a setup for RED October.

Historically markets have dropped in October, but this drop could be

HUGE.

Next week, the succession of indicators expected in the United States

will allow us to measure the pulse of the world’s largest economy

and evaluate the Fed’s leeway.

Following a week of tumultuous trading, US markets did gain on Friday

morning. However, most of the attention is still focused on

interest-rate announcements and how central banks worldwide intend to

deal with historical inflation.

FEDERAL RESERVE NOTES

Because Fed policymakers do not want inflation to become as entrenched

as it was in the 1970s, many observers anticipate the central bank to

raise interest rates for the third time in a row later this month.

This week, Jason Furman had an intriguing view on inflation. Under

Obama, he was head of the White House Council of Economic Advisers,

although he is far from a Biden supporter.

ACCORDING TO HIM, THE FED WILL NEED TO MAINTAIN A 6.5 PERCENT

UNEMPLOYMENT RATE FOR TWO YEARS IN ORDER TO RETURN INFLATION TO 2%. In

other words, the companies will have to lay off more employees, which

will almost certainly result in a recession.

The typical disclaimer to the “unemployment rate” remains: it is

poorly computed, does not reflect real unemployment, and does not

account for individuals who are underemployed or working below their

capacity.

Loretta Mester, Chairwoman of the Cleveland Federal Reserve Bank,

stated this week that SHE IS NOT SURE THAT INFLATION HAS PEAKED,

adding that the Fed’s mission remains to create a gentle landing.

Furthermore, we continue to observe weakening economic statistics.

The Fed notes in its new Beige Book that consumer spending is moving

away from DISCRETIONARY GOODS AND TOWARD NECESSITIES. Auto sales have

plummeted and have been below peak levels since July, while industrial

activity has also decreased.

RESIDENTIAL REAL ESTATE LOAN DEMAND HAS FALLEN IN TANDEM WITH BUSINESS

REAL ESTATE LOAN DEMAND. The economy’s outlook was “generally

negative,” with forecasts for falling demand to persist over the

“next six to twelve months,” according to the Beige Book.

TO SUMMARIZE, FED POLICYMAKERS HAVE DOWNPLAYED RECESSION FEARS AFTER

TWO CONSECUTIVE QUARTERS OF NEGATIVE ECONOMIC GROWTH AND NOW FORECAST

WORSENING ECONOMIC CONDITIONS UNTIL THE MIDDLE OF 2023.

By rejecting the recession, the Fed further erodes what little

credibility it has left, mainly because they will almost certainly be

compelled to switch direction on recession rhetoric next year.

BLACKROCK: RECESSION 2023

IN A LETTER TO CLIENTS THIS WEEK, BLACKROCK ($8 TRILLION IN ASSETS

UNDER MANAGEMENT) PREDICTED A “SIGNIFICANT DECREASE” IN US GDP BY

MID-2023, indicating the onset of a recession by early next year at

the latest. They join a wave of other investing, business, and

financial firms in predicting a recession. Officially or technically,

it has arrived or will arrive shortly.

BANK STOCK OPPORTUNITY

Banks appear to be outperforming in the face of rising interest rates.

European banks, in particular, saw their shares climb after last week

as investors banked on increased earnings.

THE BANK OF ENGLAND

Regarding interest rate movements, the Bank of England postponed its

September policy meeting until September 22 due to the death of Queen

Elizabeth II. The BOE’s latest interest rate rise was its largest

since 1995, as the country’s inflation rate surpassed 10% in July.

KEY EVENTS, MARKET MOVERS & CALENDAR

* Tuesday, September 13 – CPI (MoM) (August)

* Thursday, September 15 – Retail Sales (MoM) (August)

* Fed Talk

The next volatility pool for speculating on the evolution of US key

rates is slated for Tuesday, with the August US inflation data

release. Investors will also pay attention to US retail sales

(Thursday) and the University of Michigan confidence index (Friday) to

determine if the US consumer is still willing to spend.

The Beige Book report will be issued, and Jerome Powell will make a

noteworthy conference presentation for Federal Reserve watchers. The

OPEC+ summit will occur amidst increased debate about output cutbacks,

with several producing nations anticipating near-term oil surpluses.

The Fed’s next meeting is slated for the following week, on

September 21, with the now-standard quandary: a 50 or 75-point

increase?

-----------------------------------------------

Did you enjoy the excerpt?

_TRY ALPHABETASTOCK REPORT FOR 30 DAYS FOR $19.95_

[[link removed]]_ OR __SAVE

OVER 50% BY PAYING ANNUALLY FOR $99.95

[[link removed]]_

SINCERELY,

Irving Wilkinson

Editor

AlphaBetaStock.com [[link removed]]

-------------------------------------------------------------------------------------------------------------------------

Unsubscribe

[[link removed]]

16192 Coastal Highway, Lewes, Deleware, 19958, United States of

America

Message Analysis

- Sender: n/a

- Political Party: n/a

- Country: n/a

- State/Locality: n/a

- Office: n/a