September 7, 2022

Permission to republish original opeds and cartoons granted.

Europe’s long winter is almost here

By Robert Romano

As global oil prices somewhat ease as Europe’s economy overheats into recession , falling prices will eventually bring along another unfortunate aspect of the business cycle: the impact on labor markets. Inflation and unemployment are said to have an inverse relationship. When prices are generally rising, unemployment is usually falling, and when they start to fall, as in deflation, unemployment usually rises, the worst example being the 1930s and the Great Depression.

Right on schedule, the U.S. unemployment rate ticked up 0.2 percent to 3.7 percent in August, according to the Bureau of Labor Statistics , as oil eased off of more than $120 a barrel in March down to about $87 now. OPEC+ is scaling back production in preparation for lower demand that usually occurs in recessions. That is yet another recession signal.

The question of course, and seems impossible to predict, is just how bad the current recession will be. In Europe, unemployment is still generally dropping from its Covid highs. For example, in Italy, unemployment peaked in the third quarter of 2020 at 11.1 percent. Now, it’s down to 7.9 percent . As far as the business cycle goes, this indicates Europe is just hitting peak employment, even as financial news outlets are reporting recession amid Gross Domestic Product stagnation .

That means the misery to labor markets remains ahead of the world, mostly, likely dragging into 2023 and beyond before eventually, a bottom will be felt in the recession.

As for the whys of the recession in Europe, look no further than the natural gas crunch that has led to skyrocketing electricity and home heating prices. When the wider war in Ukraine began in February, Title Transfer Facility (TTF) in the Netherlands were already up to $25.72 per 1,000 cubic feet . Now, it’s up to $83.62, according to the U.S. Energy Information Administration (EIA) .

Even in the U.S., which has abundant natural gas supplies, Henry Hub natural gas prices rose from $4.40 in February to more than $8 today, almost doubling.

It all hurts so much more because the push for this century has been to move away from coal electricity production and onto natural gas as a less-carbon intensive alternative. In 2007 , coal-generated electricity made up 49 percent of the total U.S. grid, while natural gas was just 21 percent, according to the Energy Information Administration. In 2021 , natural gas now makes up 38.3 percent of the grid, and coal is down to 21 percent.

In fact, the U.S. is not producing a single kilowatt hour (kWh) more than it was 15 years ago despite rising demand and the U.S. population growing by 30 million to more than 331 million from 2007 to 2021. Instead, overall electricity generation in the U.S. has dropped from 4.005 trillion kWh in 2007 to 3.96 trillion kWh in 2021.

In Europe, the situation is far more dire. In 2020, the European Union imported 9.1 trillion cubic feet of natural gas , according to Eurostat . And about 41 percent Europe’s imports come from Russia , or about 3.73 trillion cubic feet a year, 24 percent from Norway at 2.2 trillion cubic feet and 11 percent from Algeria at 1 trillion.

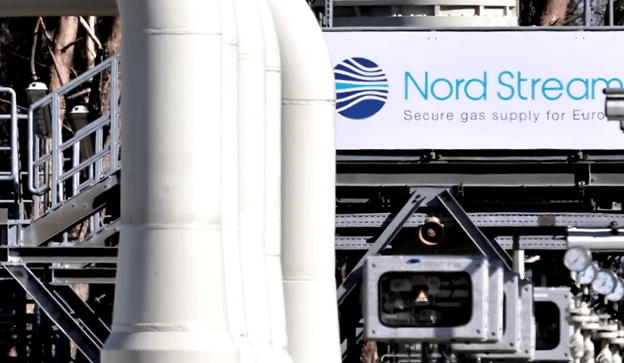

The Nord Stream 2 was built from 2018 and finished construction in Sept. 2021 at a cost of $11 billion, and would have doubled the old pipeline’s distribution of 1.9 trillion cubic feet a year to 3.9 trillion cubic feet a year. Instead, because of the war, Russia has ended output through Nord Stream 1 and Nord Stream 2 has been cancelled. Before the war, Germany purchased about 55 percent of its natural gas from Russia .

Now, winter in Europe is rapidly approaching when homes particularly in northern Europe will need gas the most to keep their homes warm and one hopes the weather itself will be a mercifully temperate. As recession looms, the only thing overheating right now are prices. Unemployment will surely follow. Stay tuned.

Robert Romano is the Vice President of Public Policy at Americans for Limited Government Foundation.

To view online: https://dailytorch.com/2022/09/europes-long-winter-is-almost-here/

Cartoon: Where There’s Smoke…

By A.F. Branco

Click here for a higher level resolution version.

To view online: https://dailytorch.com/2022/09/cartoon-where-theres-smoke/

David Hoyt: ESG and Corporate Totalitarianism

By David Hoyt

Environmental, social, and governance (ESG) scores are a Trojan horse for left-wing totalitarianism; yet, the American right was largely caught off guard by its sudden rise . The world's largest private capital firms, government institutions, and NGOs have discovered, seemingly in concert, the need to remake the global economy in the image of this arbitrary left-wing metric, which poses a serious threat to ordered liberty the world over.

Tellingly, the proponents of ESG value quixotic goals such as carbon dioxide emissions reduction above sensible environmental protections and conservation. ESG’s “social” goals are even more nebulous, as social justice itself is entirely subjective. However, the point of ESG is not actually to improve the environment or protect social justice. In reality, the point is to establish control over the many by the few.

What the radical Left could not achieve by force with the typical levers of government power, it is now poised to accomplish with nominally public-private enterprise partnerships. This new strategy has confused the conservative and libertarian response. If such heavy-handedness were attached to the arm of the state, free-market organizations and policymakers would mobilize quickly against it. Coming primarily from the private sector, however, has forestalled an effective response to the ESG agenda.

Unlike government bureaucrats, private sector proponents of ESG are happy to immodestly expose their totalitarian urges in public. Bank of America Chairman and CEO Brian Moynihan explained his plans to enforce ESG with characteristic subtlety, in describing Bank of America's war chest: "200,000 people, a three trillion-dollar balance sheet, 60 billion in expenses; you start aiming that gun, and you take that across all these companies, it is huge." The true lightbearer of the ESG movement may be BlackRock's aptly named CEO, Larry Fink. He summarizes his firm's role in promoting ESG with equal artfulness, noting, "...at BlackRock we are forcing behaviors."

If a nominee for the president's cabinet exercised such candor, even the ossified U.S. Senate would yawn into action and reject them. But policymakers have struggled to respond to left-wing totalitarianism when it comes from corporate America. They should not hesitate to act, though. These are multinational firms, and they are not products of free and fair competition. Their business model intentionally blurs the lines of distinction between public and private enterprise, making effective regulation a murky, but very necessary, affair.

The old Left versus Right paradigm of government versus business is a complete farce in the age of neoliberal triumphalism. BlackRock lives in the nexus of nationless corporations, governments, and quasi-governmental bodies. BlackRock's leadership enjoys a cozy relationship with the Biden administration, as it did with the now-dormant House of Clinton, possibly even the CIA , and of course the World Economic Forum .

BlackRock, Vanguard, and State Street Capital are the top three shareholders in a startlingly large number of the world's largest and most influential companies. They all sing from the same dark hymnal on governance, which is how they have cartelized private global enterprise to promote their left-wing agenda. Perhaps unsurprisingly, the purpose of their hard-won power seems to be the attainment of ever more power .

It could be inferred that BlackRock's role in the cartel is to financially leverage compliance with the "voluntary" standards set by nongovernmental bodies like the World Economic Forum, itself a leader of even more obscure policymaking bodies . The U.S. Securities and Exchange Commission polices compliance , and spins the revolving door of Fortune 100 executives, nongovernmental technocrats, and public administrators. The boot on the neck of the middle class is the commonality of both government and corporations. At the highest levels, there is no meaningful difference.

BlackRock has been rewarded handsomely for its leadership of the cartel. The U.S. Federal Reserve Bank made an unprecedented arrangement with BlackRock last year, allowing the firm to purchase securities on behalf of the Fed, which in turn invested in BlackRock funds, its first ever purchase of ETFs or corporate bonds. What a lucky break for the world's largest private asset manager.

The Fed itself is perhaps the paragon of government-corporate opacity. Despite its statutory privilege to print dollars and purchase the sovereign debt of the American taxpayer, its ownership is a conglomeration of regional banks owned by unspecified private entities . When former Rep. Ron Paul (R-TX) humbly proposed that the American public deserved to know how the Fed decides whom to bail out and why, Congress' greatest libertarian was cynically told his questions constituted undue government interference in the free market.

Corporate-government power is now being turned against the credulous Right. Its victims are the very conservatives and libertarians who have developed a neurological inhibitory structure that prevents them from criticizing megacorporations as a class. In their heart of hearts, they believe that private enterprise exists only to make us all rich, and government exists only to destroy private capital. While there are kernels of truth in these sentiments, the unquestioning loyalty of the upper middle class to nationless corporations precludes closer inspection of how "free" this market really is and who actually runs it.

It should not surprise anyone that corporate-government power would now lurch Left. This new leftist elite is only one side of a controlled dialectic in a centuries-long campaign to undermine and destroy the concept of a constitutional republic . Totalitarianism is as useful to the left as it is to the right, despite the insistence of political "scientists" that it is exclusive to the latter.

For example, Benito Mussolini's government could be considered the purest expression of fascism in modern history, largely inspired by his court philosopher Giovanni Gentile. Although Gentile was squarely a man of the Right, he shared many influences with the far Left, including Benedetto Croce , who was foundational to arch neo-Marxist Antonio Gramsci. Neo-Marxism is the indisputable fountainhead of the Left's war on all that is good and pure in the world, even though the mainstream media writes it off as the anti-Semitic fever dream of right-wing terrorists.

Conservatives and libertarians are correct to approach the regulation of private enterprise with caution. It is important to create regulatory tools that cannot be turned against small, independent businesses. The Right should not, however, hesitate to take whatever action is necessary to defeat the ESG plutocracy. It is thoroughly totalitarian and destructive in nature.

Fortunately, there are rays of hope on the horizon that the Right may rise to the occasion. These efforts are politically popular , and they must be greatly expanded if constitutional republicanism is to survive in the world.

David Hoyt ( [email protected] ) is the Executive Director of Development at The Heartland Institute.

To view online:

https://www.americanthinker.com/articles/2022/09/esg_and_corporate_totalitarianism_.html