| From | Dave Beaudoin <[email protected]> |

| Subject | Ballotpedia's Daily Brew: Oregon voters to decide cigarette tax increases |

| Date | July 26, 2019 9:43 AM |

Links have been removed from this email. Learn more in the FAQ.

Links have been removed from this email. Learn more in the FAQ.

Today's Brew highlights an Oregon measure raising cigarette taxes for healthcare programs + an optometry-related veto referendum in Arkansas

------------------------------------------------------------

------------------------------------------------------------

[link removed]

Welcome to the Friday, July 26, Brew. Here’s what’s in store for you as you start your day:

* Oregon amendment that would increase cigarette taxes goes to voters in 2020

* Arkansas group attempts to qualify 2020 referendum on bill that allows optometrists to perform surgical procedures

* What's the tea?

------------------------------------------------------------

** OREGON AMENDMENT THAT WOULD INCREASE CIGARETTE TAXES GOES TO VOTERS IN 2020

------------------------------------------------------------

Oregon voters will decide a state constitutional amendment in 2020 that would increase the tax on cigarettes and create a new tax on e-cigarettes to fund healthcare-related programs. The new tax revenue would be appropriated to the Oregon Health Authority for medical and healthcare-related programs such as the state's Medical Assistance Program, mental health programs, and other programs concerning tobacco and nicotine health issues.

If approved by voters, the state would apply the following taxes beginning Jan. 1, 2021:

*

Increase the cigarette tax from $1.33 per pack to $3.33 per pack;

*

Impose a tax on inhalant delivery systems (such as e-cigarettes) at a rate of 65% of the wholesale price; and

*

Increase the cap on cigar taxes from $0.50 to $1.00.

Oregon’s current tax rate on cigarettes of $1.33 per pack is the 32nd highest rate in the country.

The measure was introduced at the request of Gov. Kate Brown (D). The state House passed the amendment 39 to 21, largely along party lines. Most Democrats voted for the proposal, while most Republicans opposed it. One Democratic representative voted against the measure, and two Republican representatives voted in favor. The Senate passed the measure 18-8, also along party lines. Four Republican senators were absent or excused. In Oregon, legislature-referred statutes are not subject to gubernatorial veto and do not require the governor's signature.

The last state to vote on a cigarette tax measure was Montana, in 2018, where voters defeated that measure, 52.7% to 47.3%. That measure would have raised taxes on tobacco products, including cigarettes, electronic cigarettes and vaping products, and chewing tobacco. The state would have used the revenue to extend and fund expanded eligibility of Medicaid coverage under the Affordable Care Act as well as other healthcare-related programs.

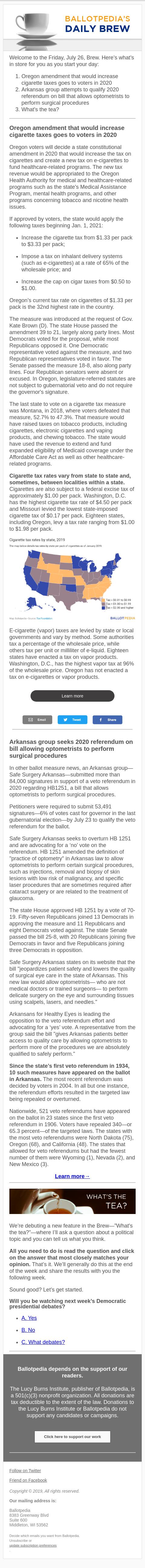

CIGARETTE TAX RATES VARY FROM STATE TO STATE AND, SOMETIMES, BETWEEN LOCALITIES WITHIN A STATE. Cigarettes are also subject to a federal excise tax of approximately $1.00 per pack. Washington, D.C. has the highest cigarette tax rate of $4.50 per pack and Missouri levied the lowest state-imposed cigarette tax of $0.17 per pack. Eighteen states, including Oregon, levy a tax rate ranging from $1.00 to $1.98 per pack.

[Cigarette tax by state]

E-cigarette (vapor) taxes are levied by state or local governments and vary by method. Some authorities tax a percentage of the wholesale price, while others tax per unit or milliliter of e-liquid. Eighteen states have enacted a tax on vapor products. Washington, D.C., has the highest vapor tax at 96% of the wholesale price. Oregon has not enacted a tax on e-cigarettes or vapor products.

Learn more ([link removed])

mailto:?&[email protected]&subject=Check out this info I found from Ballotpedia&body=[link removed] [blank] [link removed]'s%20Daily%20Brew [blank] [blank] [link removed]

------------------------------------------------------------

[blank]

** ARKANSAS GROUP SEEKS 2020 REFERENDUM ON BILL ALLOWING OPTOMETRISTS TO PERFORM SURGICAL PROCEDURES

------------------------------------------------------------

In other ballot measure news, an Arkansas group—Safe Surgery Arkansas—submitted more than 84,000 signatures in support of a veto referendum in 2020 regarding HB1251, a bill that allows optometrists to perform surgical procedures.

Petitioners were required to submit 53,491 signatures—6% of votes cast for governor in the last gubernatorial election—by July 23 to qualify the veto referendum for the ballot.

Safe Surgery Arkansas seeks to overturn HB 1251 and are advocating for a ‘no’ vote on the referendum. HB 1251 amended the definition of "practice of optometry" in Arkansas law to allow optometrists to perform certain surgical procedures, such as injections, removal and biopsy of skin lesions with low risk of malignancy, and specific laser procedures that are sometimes required after cataract surgery or are related to the treatment of glaucoma.

The state House approved HB 1251 by a vote of 70-19. Fifty-seven Republicans joined 13 Democrats in approving the measure and 11 Republicans and eight Democrats voted against. The state Senate passed the bill 25-8, with 20 Republicans joining five Democrats in favor and five Republicans joining three Democrats in opposition.

Safe Surgery Arkansas states on its website that the bill "jeopardizes patient safety and lowers the quality of surgical eye care in the state of Arkansas. This new law would allow optometrists— who are not medical doctors or trained surgeons— to perform delicate surgery on the eye and surrounding tissues using scalpels, lasers, and needles."

Arkansans for Healthy Eyes is leading the opposition to the veto referendum effort and advocating for a ‘yes’ vote. A representative from the group said the bill "gives Arkansas patients better access to quality care by allowing optometrists to perform more of the procedures we are absolutely qualified to safely perform."

SINCE THE STATE’S FIRST VETO REFERENDUM IN 1934, 10 SUCH MEASURES HAVE APPEARED ON THE BALLOT IN ARKANSAS. The most recent referendum was decided by voters in 2004. In all but one instance, the referendum efforts resulted in the targeted law being repealed or overturned.

Nationwide, 521 veto referendums have appeared on the ballot in 23 states since the first veto referendum in 1906. Voters have repealed 340—or 65.3 percent—of the targeted laws. The states with the most veto referendums were North Dakota (75), Oregon (68), and California (48). The states that allowed for veto referendums but had the fewest number of them were Wyoming (1), Nevada (2), and New Mexico (3).

Learn more→ ([link removed])

------------------------------------------------------------

** [WHAT'S THE TEA?]

------------------------------------------------------------

We’re debuting a new feature in the Brew—”What's the tea?”—where I’ll ask a question about a political topic and you can tell us what you think.

ALL YOU NEED TO DO IS READ THE QUESTION AND CLICK ON THE ANSWER THAT MOST CLOSELY MATCHES YOUR OPINION. That’s it. We’ll generally do this at the end of the week and share the results with you the following week.

Sound good? Let’s get started.

** WILL YOU BE WATCHING NEXT WEEK’S DEMOCRATIC PRESIDENTIAL DEBATES?

------------------------------------------------------------

*

A. Yes ([link removed])

*

B. No ([link removed])

*

C. What debates? ([link removed])

------------------------------------------------------------

BALLOTPEDIA DEPENDS ON THE SUPPORT OF OUR READERS.

The Lucy Burns Institute, publisher of Ballotpedia, is a 501(c)(3) nonprofit organization. All donations are tax deductible to the extent of the law. Donations to the Lucy Burns Institute or Ballotpedia do not support any candidates or campaigns.

Click here to support our work ([link removed])

------------------------------------------------------------

============================================================

** Follow on Twitter ([link removed])

** Friend on Facebook ([link removed])

_Copyright © 2019, All rights reserved._

OUR MAILING ADDRESS IS:

Ballotpedia

8383 Greenway Blvd

Suite 600

Middleton, WI 53562

Decide which emails you want from Ballotpedia.

** Unsubscribe ( [link removed] )

or ** update subscription preferences ( [link removed] )

.

------------------------------------------------------------

------------------------------------------------------------

[link removed]

Welcome to the Friday, July 26, Brew. Here’s what’s in store for you as you start your day:

* Oregon amendment that would increase cigarette taxes goes to voters in 2020

* Arkansas group attempts to qualify 2020 referendum on bill that allows optometrists to perform surgical procedures

* What's the tea?

------------------------------------------------------------

** OREGON AMENDMENT THAT WOULD INCREASE CIGARETTE TAXES GOES TO VOTERS IN 2020

------------------------------------------------------------

Oregon voters will decide a state constitutional amendment in 2020 that would increase the tax on cigarettes and create a new tax on e-cigarettes to fund healthcare-related programs. The new tax revenue would be appropriated to the Oregon Health Authority for medical and healthcare-related programs such as the state's Medical Assistance Program, mental health programs, and other programs concerning tobacco and nicotine health issues.

If approved by voters, the state would apply the following taxes beginning Jan. 1, 2021:

*

Increase the cigarette tax from $1.33 per pack to $3.33 per pack;

*

Impose a tax on inhalant delivery systems (such as e-cigarettes) at a rate of 65% of the wholesale price; and

*

Increase the cap on cigar taxes from $0.50 to $1.00.

Oregon’s current tax rate on cigarettes of $1.33 per pack is the 32nd highest rate in the country.

The measure was introduced at the request of Gov. Kate Brown (D). The state House passed the amendment 39 to 21, largely along party lines. Most Democrats voted for the proposal, while most Republicans opposed it. One Democratic representative voted against the measure, and two Republican representatives voted in favor. The Senate passed the measure 18-8, also along party lines. Four Republican senators were absent or excused. In Oregon, legislature-referred statutes are not subject to gubernatorial veto and do not require the governor's signature.

The last state to vote on a cigarette tax measure was Montana, in 2018, where voters defeated that measure, 52.7% to 47.3%. That measure would have raised taxes on tobacco products, including cigarettes, electronic cigarettes and vaping products, and chewing tobacco. The state would have used the revenue to extend and fund expanded eligibility of Medicaid coverage under the Affordable Care Act as well as other healthcare-related programs.

CIGARETTE TAX RATES VARY FROM STATE TO STATE AND, SOMETIMES, BETWEEN LOCALITIES WITHIN A STATE. Cigarettes are also subject to a federal excise tax of approximately $1.00 per pack. Washington, D.C. has the highest cigarette tax rate of $4.50 per pack and Missouri levied the lowest state-imposed cigarette tax of $0.17 per pack. Eighteen states, including Oregon, levy a tax rate ranging from $1.00 to $1.98 per pack.

[Cigarette tax by state]

E-cigarette (vapor) taxes are levied by state or local governments and vary by method. Some authorities tax a percentage of the wholesale price, while others tax per unit or milliliter of e-liquid. Eighteen states have enacted a tax on vapor products. Washington, D.C., has the highest vapor tax at 96% of the wholesale price. Oregon has not enacted a tax on e-cigarettes or vapor products.

Learn more ([link removed])

mailto:?&[email protected]&subject=Check out this info I found from Ballotpedia&body=[link removed] [blank] [link removed]'s%20Daily%20Brew [blank] [blank] [link removed]

------------------------------------------------------------

[blank]

** ARKANSAS GROUP SEEKS 2020 REFERENDUM ON BILL ALLOWING OPTOMETRISTS TO PERFORM SURGICAL PROCEDURES

------------------------------------------------------------

In other ballot measure news, an Arkansas group—Safe Surgery Arkansas—submitted more than 84,000 signatures in support of a veto referendum in 2020 regarding HB1251, a bill that allows optometrists to perform surgical procedures.

Petitioners were required to submit 53,491 signatures—6% of votes cast for governor in the last gubernatorial election—by July 23 to qualify the veto referendum for the ballot.

Safe Surgery Arkansas seeks to overturn HB 1251 and are advocating for a ‘no’ vote on the referendum. HB 1251 amended the definition of "practice of optometry" in Arkansas law to allow optometrists to perform certain surgical procedures, such as injections, removal and biopsy of skin lesions with low risk of malignancy, and specific laser procedures that are sometimes required after cataract surgery or are related to the treatment of glaucoma.

The state House approved HB 1251 by a vote of 70-19. Fifty-seven Republicans joined 13 Democrats in approving the measure and 11 Republicans and eight Democrats voted against. The state Senate passed the bill 25-8, with 20 Republicans joining five Democrats in favor and five Republicans joining three Democrats in opposition.

Safe Surgery Arkansas states on its website that the bill "jeopardizes patient safety and lowers the quality of surgical eye care in the state of Arkansas. This new law would allow optometrists— who are not medical doctors or trained surgeons— to perform delicate surgery on the eye and surrounding tissues using scalpels, lasers, and needles."

Arkansans for Healthy Eyes is leading the opposition to the veto referendum effort and advocating for a ‘yes’ vote. A representative from the group said the bill "gives Arkansas patients better access to quality care by allowing optometrists to perform more of the procedures we are absolutely qualified to safely perform."

SINCE THE STATE’S FIRST VETO REFERENDUM IN 1934, 10 SUCH MEASURES HAVE APPEARED ON THE BALLOT IN ARKANSAS. The most recent referendum was decided by voters in 2004. In all but one instance, the referendum efforts resulted in the targeted law being repealed or overturned.

Nationwide, 521 veto referendums have appeared on the ballot in 23 states since the first veto referendum in 1906. Voters have repealed 340—or 65.3 percent—of the targeted laws. The states with the most veto referendums were North Dakota (75), Oregon (68), and California (48). The states that allowed for veto referendums but had the fewest number of them were Wyoming (1), Nevada (2), and New Mexico (3).

Learn more→ ([link removed])

------------------------------------------------------------

** [WHAT'S THE TEA?]

------------------------------------------------------------

We’re debuting a new feature in the Brew—”What's the tea?”—where I’ll ask a question about a political topic and you can tell us what you think.

ALL YOU NEED TO DO IS READ THE QUESTION AND CLICK ON THE ANSWER THAT MOST CLOSELY MATCHES YOUR OPINION. That’s it. We’ll generally do this at the end of the week and share the results with you the following week.

Sound good? Let’s get started.

** WILL YOU BE WATCHING NEXT WEEK’S DEMOCRATIC PRESIDENTIAL DEBATES?

------------------------------------------------------------

*

A. Yes ([link removed])

*

B. No ([link removed])

*

C. What debates? ([link removed])

------------------------------------------------------------

BALLOTPEDIA DEPENDS ON THE SUPPORT OF OUR READERS.

The Lucy Burns Institute, publisher of Ballotpedia, is a 501(c)(3) nonprofit organization. All donations are tax deductible to the extent of the law. Donations to the Lucy Burns Institute or Ballotpedia do not support any candidates or campaigns.

Click here to support our work ([link removed])

------------------------------------------------------------

============================================================

** Follow on Twitter ([link removed])

** Friend on Facebook ([link removed])

_Copyright © 2019, All rights reserved._

OUR MAILING ADDRESS IS:

Ballotpedia

8383 Greenway Blvd

Suite 600

Middleton, WI 53562

Decide which emails you want from Ballotpedia.

** Unsubscribe ( [link removed] )

or ** update subscription preferences ( [link removed] )

.

Message Analysis

- Sender: Ballotpedia

- Political Party: n/a

- Country: United States

- State/Locality: n/a

- Office: n/a

-

Email Providers:

- Pardot

- Litmus