Email

Stock Market Braces For Fed Pain (Weekly Report)

| From | Irving Wilkinson <[email protected]> |

| Subject | Stock Market Braces For Fed Pain (Weekly Report) |

| Date | August 29, 2022 2:35 PM |

Links have been removed from this email. Learn more in the FAQ.

Links have been removed from this email. Learn more in the FAQ.

Stock Market Braces For Fed Pain

Thank you for being a subscriber of _ALPHABETASTOCK'S REPORT._ This

is only an excerpt and paid subscribers have access to this and all

the features. _SIGN UP NOW FOR $19.95_

[[link removed]]_ OR __SAVE OVER 50% BY

PAYING ANNUALLY FOR $99.95

[[link removed]]__.

[[link removed]]_

This week saw more losses in the financial markets as fears over

central banks’ monetary policy and a faltering global economy

resurfaced.

As the Fed chairman reiterated that monetary tightening would continue

in the coming months to limit inflation, despite the fact that US

growth is anticipated decline, Jerome Powell’s comments at the

Jackson Hole symposium provoked turbulence.

US stocks last week were fluctuating. Major averages moved up somewhat

on Wednesday and Thursday after beginning the five-day period in the

negative.

FED AND INFLATION

After that, on Friday, markets fell after Fed Chairman Jerome Powell

declared that the government would “use our tools decisively” to

combat inflation, which is still running at a four-decade high.

Indicating that battling inflation is more crucial than promoting

growth through an accommodating monetary policy, Powell further stated

that raising rates will cause “some harm” to the US economy.

Not just stocks responded to the news; other asset classes also did.

As traders considered his remarks, Bitcoin and other cryptocurrencies

decreased.

THE FED IS STILL NOT PERSUADED THAT INFLATION HAS REACHED ITS

PEAK. As a result, it doesn’t anticipate ever ceasing its rate

increases. Powell is careful not to stop raising interest rates too

soon, adding, “We must keep at it until the job is done.”

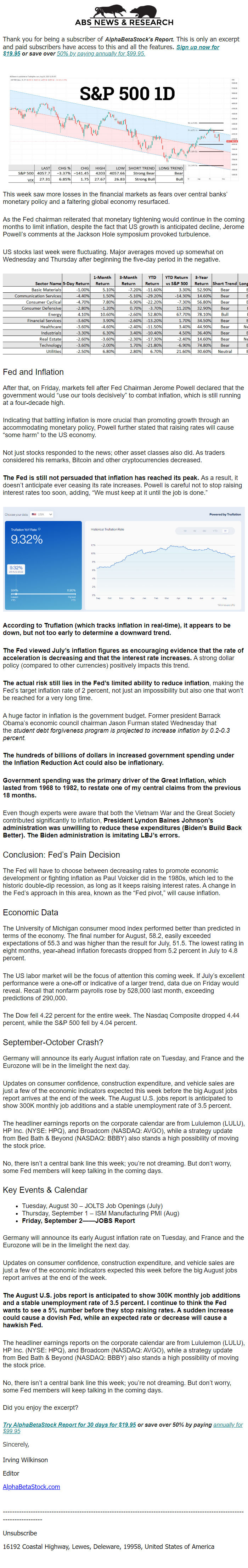

ACCORDING TO TRUFLATION (WHICH TRACKS INFLATION IN REAL-TIME), IT

APPEARS TO BE DOWN, BUT NOT TOO EARLY TO DETERMINE A DOWNWARD TREND.

THE FED VIEWED JULY’S INFLATION FIGURES AS ENCOURAGING EVIDENCE THAT

THE RATE OF ACCELERATION IS DECREASING AND THAT THE INTEREST RATE

INCREASES. A strong dollar policy (compared to other currencies)

positively impacts this trend.

THE ACTUAL RISK STILL LIES IN THE FED’S LIMITED ABILITY TO REDUCE

INFLATION, making the Fed’s target inflation rate of 2 percent, not

just an impossibility but also one that won’t be reached for a very

long time.

A huge factor in inflation is the government budget. Former president

Barrack Obama’s economic council chairman Jason Furman stated

Wednesday that the _student debt forgiveness program is projected to

increase inflation by 0.2-0.3 percent._

THE HUNDREDS OF BILLIONS OF DOLLARS IN INCREASED GOVERNMENT SPENDING

UNDER THE INFLATION REDUCTION ACT COULD ALSO BE INFLATIONARY.

GOVERNMENT SPENDING WAS THE PRIMARY DRIVER OF THE GREAT INFLATION,

WHICH LASTED FROM 1968 TO 1982, TO RESTATE ONE OF MY CENTRAL CLAIMS

FROM THE PREVIOUS 18 MONTHS.

Even though experts were aware that both the Vietnam War and the Great

Society contributed significantly to inflation, PRESIDENT LYNDON

BAINES JOHNSON’S ADMINISTRATION WAS UNWILLING TO REDUCE THESE

EXPENDITURES (BIDEN’S BUILD BACK BETTER). THE BIDEN ADMINISTRATION

IS IMITATING LBJ’S ERRORS.

CONCLUSION: FED’S PAIN DECISION

The Fed will have to choose between decreasing rates to promote

economic development or fighting inflation as Paul Volcker did in the

1980s, which led to the historic double-dip recession, as long as it

keeps raising interest rates. A change in the Fed’s approach in this

area, known as the “Fed pivot,” will cause inflation.

ECONOMIC DATA

The University of Michigan consumer mood index performed better than

predicted in terms of the economy. The final number for August, 58.2,

easily exceeded expectations of 55.3 and was higher than the result

for July, 51.5. The lowest rating in eight months, year-ahead

inflation forecasts dropped from 5.2 percent in July to 4.8 percent.

The US labor market will be the focus of attention this coming week.

If July’s excellent performance were a one-off or indicative of a

larger trend, data due on Friday would reveal. Recall that nonfarm

payrolls rose by 528,000 last month, exceeding predictions of 290,000.

The Dow fell 4.22 percent for the entire week. The Nasdaq Composite

dropped 4.44 percent, while the S&P 500 fell by 4.04 percent.

SEPTEMBER-OCTOBER CRASH?

Germany will announce its early August inflation rate on Tuesday, and

France and the Eurozone will be in the limelight the next day.

Updates on consumer confidence, construction expenditure, and vehicle

sales are just a few of the economic indicators expected this week

before the big August jobs report arrives at the end of the week. The

August U.S. jobs report is anticipated to show 300K monthly job

additions and a stable unemployment rate of 3.5 percent.

The headliner earnings reports on the corporate calendar are from

Lululemon (LULU), HP Inc. (NYSE: HPQ), and Broadcom (NASDAQ: AVGO),

while a strategy update from Bed Bath & Beyond (NASDAQ: BBBY) also

stands a high possibility of moving the stock price.

No, there isn’t a central bank line this week; you’re not

dreaming. But don’t worry, some Fed members will keep talking in the

coming days.

KEY EVENTS & CALENDAR

* Tuesday, August 30 – JOLTS Job Openings (July)

* Thursday, September 1 – ISM Manufacturing PMI (Aug)

* FRIDAY, SEPTEMBER 2——JOBS REPORT

Germany will announce its early August inflation rate on Tuesday, and

France and the Eurozone will be in the limelight the next day.

Updates on consumer confidence, construction expenditure, and vehicle

sales are just a few of the economic indicators expected this week

before the big August jobs report arrives at the end of the week.

THE AUGUST U.S. JOBS REPORT IS ANTICIPATED TO SHOW 300K MONTHLY JOB

ADDITIONS AND A STABLE UNEMPLOYMENT RATE OF 3.5 PERCENT. I CONTINUE TO

THINK THE FED WANTS TO SEE A 5% NUMBER BEFORE THEY STOP RAISING RATES.

A SUDDEN INCREASE COULD CAUSE A DOVISH FED, WHILE AN EXPECTED RATE OR

DECREASE WILL CAUSE A HAWKISH FED.

The headliner earnings reports on the corporate calendar are from

Lululemon (LULU), HP Inc. (NYSE: HPQ), and Broadcom (NASDAQ: AVGO),

while a strategy update from Bed Bath & Beyond (NASDAQ: BBBY) also

stands a high possibility of moving the stock price.

No, there isn’t a central bank line this week; you’re not

dreaming. But don’t worry, some Fed members will keep talking in the

coming days.

Did you enjoy the excerpt?

_TRY ALPHABETASTOCK REPORT FOR 30 DAYS FOR $19.95_

[[link removed]]_ OR __SAVE

OVER 50% BY PAYING ANNUALLY FOR $99.95

[[link removed]]_

SINCERELY,

Irving Wilkinson

Editor

AlphaBetaStock.com [[link removed]]

-------------------------------------------------------------------------------------------------------------------------

Unsubscribe

[[link removed]]

16192 Coastal Highway, Lewes, Deleware, 19958, United States of

America

Thank you for being a subscriber of _ALPHABETASTOCK'S REPORT._ This

is only an excerpt and paid subscribers have access to this and all

the features. _SIGN UP NOW FOR $19.95_

[[link removed]]_ OR __SAVE OVER 50% BY

PAYING ANNUALLY FOR $99.95

[[link removed]]__.

[[link removed]]_

This week saw more losses in the financial markets as fears over

central banks’ monetary policy and a faltering global economy

resurfaced.

As the Fed chairman reiterated that monetary tightening would continue

in the coming months to limit inflation, despite the fact that US

growth is anticipated decline, Jerome Powell’s comments at the

Jackson Hole symposium provoked turbulence.

US stocks last week were fluctuating. Major averages moved up somewhat

on Wednesday and Thursday after beginning the five-day period in the

negative.

FED AND INFLATION

After that, on Friday, markets fell after Fed Chairman Jerome Powell

declared that the government would “use our tools decisively” to

combat inflation, which is still running at a four-decade high.

Indicating that battling inflation is more crucial than promoting

growth through an accommodating monetary policy, Powell further stated

that raising rates will cause “some harm” to the US economy.

Not just stocks responded to the news; other asset classes also did.

As traders considered his remarks, Bitcoin and other cryptocurrencies

decreased.

THE FED IS STILL NOT PERSUADED THAT INFLATION HAS REACHED ITS

PEAK. As a result, it doesn’t anticipate ever ceasing its rate

increases. Powell is careful not to stop raising interest rates too

soon, adding, “We must keep at it until the job is done.”

ACCORDING TO TRUFLATION (WHICH TRACKS INFLATION IN REAL-TIME), IT

APPEARS TO BE DOWN, BUT NOT TOO EARLY TO DETERMINE A DOWNWARD TREND.

THE FED VIEWED JULY’S INFLATION FIGURES AS ENCOURAGING EVIDENCE THAT

THE RATE OF ACCELERATION IS DECREASING AND THAT THE INTEREST RATE

INCREASES. A strong dollar policy (compared to other currencies)

positively impacts this trend.

THE ACTUAL RISK STILL LIES IN THE FED’S LIMITED ABILITY TO REDUCE

INFLATION, making the Fed’s target inflation rate of 2 percent, not

just an impossibility but also one that won’t be reached for a very

long time.

A huge factor in inflation is the government budget. Former president

Barrack Obama’s economic council chairman Jason Furman stated

Wednesday that the _student debt forgiveness program is projected to

increase inflation by 0.2-0.3 percent._

THE HUNDREDS OF BILLIONS OF DOLLARS IN INCREASED GOVERNMENT SPENDING

UNDER THE INFLATION REDUCTION ACT COULD ALSO BE INFLATIONARY.

GOVERNMENT SPENDING WAS THE PRIMARY DRIVER OF THE GREAT INFLATION,

WHICH LASTED FROM 1968 TO 1982, TO RESTATE ONE OF MY CENTRAL CLAIMS

FROM THE PREVIOUS 18 MONTHS.

Even though experts were aware that both the Vietnam War and the Great

Society contributed significantly to inflation, PRESIDENT LYNDON

BAINES JOHNSON’S ADMINISTRATION WAS UNWILLING TO REDUCE THESE

EXPENDITURES (BIDEN’S BUILD BACK BETTER). THE BIDEN ADMINISTRATION

IS IMITATING LBJ’S ERRORS.

CONCLUSION: FED’S PAIN DECISION

The Fed will have to choose between decreasing rates to promote

economic development or fighting inflation as Paul Volcker did in the

1980s, which led to the historic double-dip recession, as long as it

keeps raising interest rates. A change in the Fed’s approach in this

area, known as the “Fed pivot,” will cause inflation.

ECONOMIC DATA

The University of Michigan consumer mood index performed better than

predicted in terms of the economy. The final number for August, 58.2,

easily exceeded expectations of 55.3 and was higher than the result

for July, 51.5. The lowest rating in eight months, year-ahead

inflation forecasts dropped from 5.2 percent in July to 4.8 percent.

The US labor market will be the focus of attention this coming week.

If July’s excellent performance were a one-off or indicative of a

larger trend, data due on Friday would reveal. Recall that nonfarm

payrolls rose by 528,000 last month, exceeding predictions of 290,000.

The Dow fell 4.22 percent for the entire week. The Nasdaq Composite

dropped 4.44 percent, while the S&P 500 fell by 4.04 percent.

SEPTEMBER-OCTOBER CRASH?

Germany will announce its early August inflation rate on Tuesday, and

France and the Eurozone will be in the limelight the next day.

Updates on consumer confidence, construction expenditure, and vehicle

sales are just a few of the economic indicators expected this week

before the big August jobs report arrives at the end of the week. The

August U.S. jobs report is anticipated to show 300K monthly job

additions and a stable unemployment rate of 3.5 percent.

The headliner earnings reports on the corporate calendar are from

Lululemon (LULU), HP Inc. (NYSE: HPQ), and Broadcom (NASDAQ: AVGO),

while a strategy update from Bed Bath & Beyond (NASDAQ: BBBY) also

stands a high possibility of moving the stock price.

No, there isn’t a central bank line this week; you’re not

dreaming. But don’t worry, some Fed members will keep talking in the

coming days.

KEY EVENTS & CALENDAR

* Tuesday, August 30 – JOLTS Job Openings (July)

* Thursday, September 1 – ISM Manufacturing PMI (Aug)

* FRIDAY, SEPTEMBER 2——JOBS REPORT

Germany will announce its early August inflation rate on Tuesday, and

France and the Eurozone will be in the limelight the next day.

Updates on consumer confidence, construction expenditure, and vehicle

sales are just a few of the economic indicators expected this week

before the big August jobs report arrives at the end of the week.

THE AUGUST U.S. JOBS REPORT IS ANTICIPATED TO SHOW 300K MONTHLY JOB

ADDITIONS AND A STABLE UNEMPLOYMENT RATE OF 3.5 PERCENT. I CONTINUE TO

THINK THE FED WANTS TO SEE A 5% NUMBER BEFORE THEY STOP RAISING RATES.

A SUDDEN INCREASE COULD CAUSE A DOVISH FED, WHILE AN EXPECTED RATE OR

DECREASE WILL CAUSE A HAWKISH FED.

The headliner earnings reports on the corporate calendar are from

Lululemon (LULU), HP Inc. (NYSE: HPQ), and Broadcom (NASDAQ: AVGO),

while a strategy update from Bed Bath & Beyond (NASDAQ: BBBY) also

stands a high possibility of moving the stock price.

No, there isn’t a central bank line this week; you’re not

dreaming. But don’t worry, some Fed members will keep talking in the

coming days.

Did you enjoy the excerpt?

_TRY ALPHABETASTOCK REPORT FOR 30 DAYS FOR $19.95_

[[link removed]]_ OR __SAVE

OVER 50% BY PAYING ANNUALLY FOR $99.95

[[link removed]]_

SINCERELY,

Irving Wilkinson

Editor

AlphaBetaStock.com [[link removed]]

-------------------------------------------------------------------------------------------------------------------------

Unsubscribe

[[link removed]]

16192 Coastal Highway, Lewes, Deleware, 19958, United States of

America

Message Analysis

- Sender: n/a

- Political Party: n/a

- Country: n/a

- State/Locality: n/a

- Office: n/a