| From | Badger Institute <[email protected]> |

| Subject | Top Picks: The other numbers you won’t hear from the mainstream media |

| Date | August 26, 2022 11:02 AM |

Links have been removed from this email. Learn more in the FAQ.

Links have been removed from this email. Learn more in the FAQ.

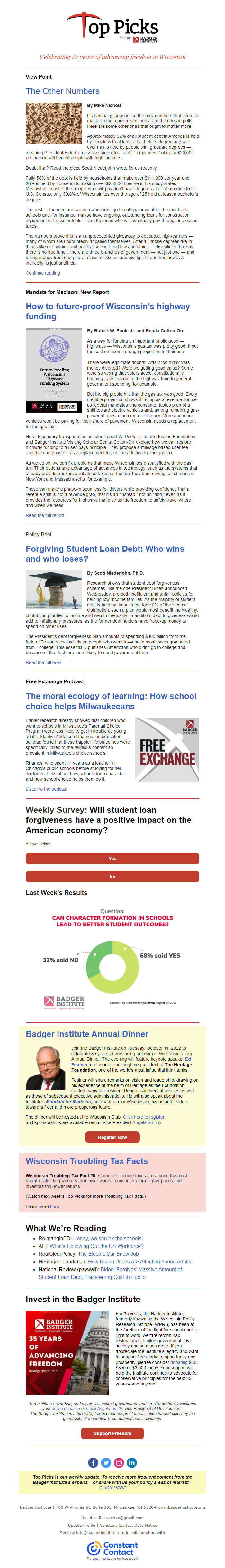

The future of highway funding, who wins with student loan forgiveness, and school choice as character choice Celebrating 35 years of advancing freedom in Wisconsin View Point The Other Numbers By Mike Nichols It’s campaign season, so the only numbers that seem to matter to the mainstream media are the ones in polls. Here are some other ones that ought to matter more. Approximately 92% of all student debt in America is held by people with at least a bachelor’s degree and well over half is held by people with graduate degrees — meaning President Biden’s massive student loan debt “forgiveness” of up to $20,000 per person will benefit people with high incomes. Doubt that? Read the piece Scott Niederjohn wrote for us recently. Fully 58% of the debt is held by households that make over $111,000 per year and 26% is held by households making over $256,000 per year, his study states. Meanwhile, most of the people who will pay don’t have degrees at all. According to the U.S. Census, only 30.8% of Wisconsinites over the age of 25 hold at least a bachelor’s degree. The rest — the men and women who didn’t go to college or went to cheaper trade schools and, for instance, maybe have ongoing, outstanding loans for construction equipment or trucks or tools — are the ones who will eventually pay through increased taxes. The numbers prove this is an unprecedented giveaway to educated, high-earners — many of whom are undoubtedly appalled themselves. After all, those degrees are in things like economics and political science and law and ethics — disciplines that say there is no free lunch, there are three branches of government — not just one — and taking money from one poorer class of citizens and giving it to another, however indirectly, is just unethical. Continue reading Mandate for Madison: New Report How to future-proof Wisconsin’s highway funding By Robert W. Poole Jr. and Benita Cotton-Orr As a way for funding an important public good — highways — Wisconsin’s gas tax was pretty good: It put the cost on users in rough proportion to their use. There were legitimate doubts: Was it too high? Was money diverted? Were we getting good value? Some were so vexing that voters acted, constitutionally banning transfers out of the highway fund to general government spending, for example. But the big problem is that the gas tax was good. Every credible projection shows it fading as a revenue source as federal mandates and consumer tastes prompt a shift toward electric vehicles and, among remaining gas-powered ones, much more efficiency. More and more vehicles won’t be paying for their share of pavement. Wisconsin needs a replacement for the gas tax. Here, legendary transportation scholar Robert W. Poole Jr. of the Reason Foundation and Badger Institute Visiting Scholar Benita Cotton-Orr explore how we can restore highway funding to a user-pays principle. They propose a mileage-based user fee — one that can phase in as a replacement for, not an addition to, the gas tax. As we do so, we can fix problems that made Wisconsinites dissatisfied with the gas tax. Their options take advantage of advances in technology, such as the systems that already provide truckers a rebate of taxes on the fuel they burn driving tolled roads in New York and Massachusetts, for example. These can make a phase-in seamless for drivers while providing confidence that a revenue shift is not a revenue grab, that it’s an “instead,” not an “and,” even as it provides the resources for highways that give us the freedom to safely travel where and when we need. Read the full report Policy Brief Forgiving Student Loan Debt: Who wins and who loses? By Scott Niederjohn, Ph.D. Research shows that student debt forgiveness schemes, like the one President Biden announced Wednesday, are both inefficient and unfair policies for helping low-income families. As the majority of student debt is held by those in the top 40% of the income distribution, such a plan would most benefit the wealthy, contributing further to income and wealth inequality. In addition, debt forgiveness would add to inflationary pressures, as the former debt holders have freed-up money to spend on other uses. The President’s debt forgiveness plan amounts to spending $300 billion from the federal Treasury exclusively on people who went to—and in most cases graduated from—college. This essentially punishes Americans who didn’t go to college and, because of that fact, are more likely to need government help. Read the full brief Free Exchange Podcast The moral ecology of learning: How school choice helps Milwaukeeans Earlier research already showed that children who went to schools in Milwaukee’s Parental Choice Program were less likely to get in trouble as young adults. Marilyn Anderson Rhames, an education scholar, found that these happier life outcomes were specifically linked to the religious content so prevalent in Milwaukee’s choice schools. Rhames, who spent 14 years as a teacher in Chicago’s public schools before studying for her doctorate, talks about how schools form character and how school choice helps them do it. Listen to the podcast Weekly Survey: Will student loan forgiveness have a positive impact on the American economy? Answer below! Yes No Last Week’s Results Badger Institute Annual Dinner Join the Badger Institute on Tuesday, October 11, 2022 to celebrate 35 years of advancing freedom in Wisconsin at our Annual Dinner. The evening will feature keynote speaker Ed Feulner, co-founder and longtime president of The Heritage Foundation, one of the world's most influential think tanks. Feulner will share remarks on vision and leadership, drawing on his experience at the helm of Heritage as the Foundation crafted many of President Reagan’s influential policies as well as those of subsequent executive administrations. He will also speak about the Institute's Mandate for Madison, our roadmap for Wisconsin citizens and leaders toward a freer and more prosperous future. The dinner will be hosted at the Wisconsin Club. Click here to register and sponsorships are available (email Vice President Angela Smith). Register Now Wisconsin Troubling Tax Facts Wisconsin Troubling Tax Fact #6: Corporate income taxes are among the most harmful, affecting workers thru lower wages, consumers thru higher prices and investors thru lower returns (Watch next week’s Top Picks for more Troubling Tax Facts.) Learn more here. What We’re Reading ReimanginED: Honey, we shrunk the schools! AEI: What’s Hollowing Out the US Workforce? RealClearPolicy: The Electric Car Snow Job Heritage Foundation: How Rising Prices Are Affecting Young Adults National Review (paywall): Biden ‘Forgives’ Massive Amount of Student-Loan Debt, Transferring Cost to Public Invest in the Badger Institute For 35 years, the Badger Institute, formerly known as the Wisconsin Policy Research Institute (WPRI), has been at the forefront of the fight for school choice, right to work, welfare reform, tax restructuring, limited government, civil society and so much more. If you appreciate the Institute’s legacy and want to support free markets, opportunity and prosperity, please consider donating $35, $350 or $3,500 today. Your support will help the Institute continue to advocate for conservative principles for the next 35 years – and beyond! The Institute never has, and never will, accept government funding. We gratefully welcome your online donation or email Angela Smith, Vice President of Development. The Badger Institute is a 501(c)(3) tax-exempt nonprofit organization funded solely by the generosity of foundations, companies and individuals. Support Freedom Top Picks is our weekly update. To receive more frequent content from the Badger Institute’s experts – or share with us your policy areas of interest – CLICK HERE Badger Institute | 700 W Virginia St, Suite 301, Milwaukee, WI 53204 www.badgerinstitute.org Unsubscribe [email protected] Update Profile | Constant Contact Data Notice Sent by [email protected] in collaboration with Try email marketing for free today!

Message Analysis

- Sender: Badger Institute

- Political Party: n/a

- Country: United States

- State/Locality: Wisconsin

- Office: n/a

-

Email Providers:

- Constant Contact