Email

Stock Market Braces For Fed Jackson Hole Meeting. Pull Back or Recovery? (Weekly Report)

| From | Irving Wilkinson <[email protected]> |

| Subject | Stock Market Braces For Fed Jackson Hole Meeting. Pull Back or Recovery? (Weekly Report) |

| Date | August 22, 2022 3:12 PM |

Links have been removed from this email. Learn more in the FAQ.

Links have been removed from this email. Learn more in the FAQ.

Weekly Market Report

Thank you for being a subscriber of _ALPHABETASTOCK'S REPORT._ This

is only an excerpt and paid subscribers have access to this and all

the features. _SIGN UP NOW FOR $19.95_

[[link removed]]_ OR __SAVE OVER 50% BY

PAYING ANNUALLY FOR $99.95

[[link removed]]__.

[[link removed]]_

My wife constantly tells me that not everything is logical, but these

markets, monetary and fiscal policies are purely insane.

CONSUMPTION, THE PHILLY FED INDEX, AND UNEMPLOYMENT WERE GENERALLY

POSITIVE. At the same time, the EMPIRE STATE INDEX AND REAL ESTATE

ARE WORSE.

Everyone knows that one of the biggest accelerators of inflation is

government spending…SO THE GOVERNMENT PASSES ANOTHER MASSIVE

SPENDING BILL TO “COMBAT” INFLATION.

This has confused me. I am not alone, as many battle-hardened

investors are perplexed by the US macroeconomic numbers.

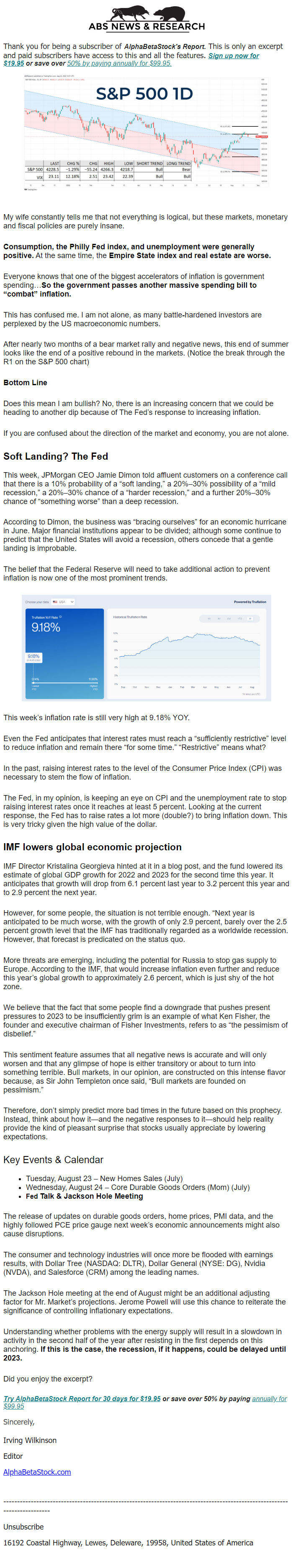

After nearly two months of a bear market rally and negative news, this

end of summer looks like the end of a positive rebound in the markets.

(Notice the break through the R1 on the S&P 500 chart)

BOTTOM LINE

Does this mean I am bullish? No, there is an increasing concern that

we could be heading to another dip because of The Fed’s response to

increasing inflation.

If you are confused about the direction of the market and economy, you

are not alone.

SOFT LANDING? THE FED

This week, JPMorgan CEO Jamie Dimon told affluent customers on a

conference call that there is a 10% probability of a “soft

landing,” a 20%–30% possibility of a “mild recession,” a

20%–30% chance of a “harder recession,” and a further 20%–30%

chance of “something worse” than a deep recession.

According to Dimon, the business was “bracing ourselves” for an

economic hurricane in June. Major financial institutions appear to be

divided; although some continue to predict that the United States will

avoid a recession, others concede that a gentle landing is improbable.

The belief that the Federal Reserve will need to take additional

action to prevent inflation is now one of the most prominent trends.

This week’s inflation rate is still very high at 9.18% YOY.

Even the Fed anticipates that interest rates must reach a

“sufficiently restrictive” level to reduce inflation and remain

there “for some time.” “Restrictive” means what?

In the past, raising interest rates to the level of the Consumer Price

Index (CPI) was necessary to stem the flow of inflation.

The Fed, in my opinion, is keeping an eye on CPI and the unemployment

rate to stop raising interest rates once it reaches at least 5

percent. Looking at the current response, the Fed has to raise rates a

lot more (double?) to bring inflation down. This is very tricky given

the high value of the dollar.

IMF LOWERS GLOBAL ECONOMIC PROJECTION

IMF Director Kristalina Georgieva hinted at it in a blog post, and the

fund lowered its estimate of global GDP growth for 2022 and 2023 for

the second time this year. It anticipates that growth will drop from

6.1 percent last year to 3.2 percent this year and to 2.9 percent the

next year.

However, for some people, the situation is not terrible enough.

“Next year is anticipated to be much worse, with the growth of only

2.9 percent, barely over the 2.5 percent growth level that the IMF has

traditionally regarded as a worldwide recession. However, that

forecast is predicated on the status quo.

More threats are emerging, including the potential for Russia to stop

gas supply to Europe. According to the IMF, that would increase

inflation even further and reduce this year’s global growth to

approximately 2.6 percent, which is just shy of the hot zone.

We believe that the fact that some people find a downgrade that pushes

present pressures to 2023 to be insufficiently grim is an example of

what Ken Fisher, the founder and executive chairman of Fisher

Investments, refers to as “the pessimism of disbelief.”

This sentiment feature assumes that all negative news is accurate and

will only worsen and that any glimpse of hope is either transitory or

about to turn into something terrible. Bull markets, in our opinion,

are constructed on this intense flavor because, as Sir John Templeton

once said, “Bull markets are founded on pessimism.”

Therefore, don’t simply predict more bad times in the future based

on this prophecy. Instead, think about how it—and the negative

responses to it—should help reality provide the kind of pleasant

surprise that stocks usually appreciate by lowering expectations.

KEY EVENTS & CALENDAR

* Tuesday, August 23 – New Homes Sales (July)

* Wednesday, August 24 – Core Durable Goods Orders (Mom) (July)

* FED TALK & JACKSON HOLE MEETING

The release of updates on durable goods orders, home prices, PMI data,

and the highly followed PCE price gauge next week’s economic

announcements might also cause disruptions.

The consumer and technology industries will once more be flooded with

earnings results, with Dollar Tree (NASDAQ: DLTR), Dollar General

(NYSE: DG), Nvidia (NVDA), and Salesforce (CRM) among the leading

names.

The Jackson Hole meeting at the end of August might be an additional

adjusting factor for Mr. Market’s projections. Jerome Powell will

use this chance to reiterate the significance of controlling

inflationary expectations.

Understanding whether problems with the energy supply will result in a

slowdown in activity in the second half of the year after resisting in

the first depends on this anchoring. IF THIS IS THE CASE, THE

RECESSION, IF IT HAPPENS, COULD BE DELAYED UNTIL 2023.

Did you enjoy the excerpt?

_TRY ALPHABETASTOCK REPORT FOR 30 DAYS FOR $19.95_

[[link removed]]_ OR __SAVE

OVER 50% BY PAYING ANNUALLY FOR $99.95

[[link removed]]_

SINCERELY,

Irving Wilkinson

Editor

AlphaBetaStock.com [[link removed]]

-------------------------------------------------------------------------------------------------------------------------

Unsubscribe

[[link removed]]

16192 Coastal Highway, Lewes, Deleware, 19958, United States of

America

Thank you for being a subscriber of _ALPHABETASTOCK'S REPORT._ This

is only an excerpt and paid subscribers have access to this and all

the features. _SIGN UP NOW FOR $19.95_

[[link removed]]_ OR __SAVE OVER 50% BY

PAYING ANNUALLY FOR $99.95

[[link removed]]__.

[[link removed]]_

My wife constantly tells me that not everything is logical, but these

markets, monetary and fiscal policies are purely insane.

CONSUMPTION, THE PHILLY FED INDEX, AND UNEMPLOYMENT WERE GENERALLY

POSITIVE. At the same time, the EMPIRE STATE INDEX AND REAL ESTATE

ARE WORSE.

Everyone knows that one of the biggest accelerators of inflation is

government spending…SO THE GOVERNMENT PASSES ANOTHER MASSIVE

SPENDING BILL TO “COMBAT” INFLATION.

This has confused me. I am not alone, as many battle-hardened

investors are perplexed by the US macroeconomic numbers.

After nearly two months of a bear market rally and negative news, this

end of summer looks like the end of a positive rebound in the markets.

(Notice the break through the R1 on the S&P 500 chart)

BOTTOM LINE

Does this mean I am bullish? No, there is an increasing concern that

we could be heading to another dip because of The Fed’s response to

increasing inflation.

If you are confused about the direction of the market and economy, you

are not alone.

SOFT LANDING? THE FED

This week, JPMorgan CEO Jamie Dimon told affluent customers on a

conference call that there is a 10% probability of a “soft

landing,” a 20%–30% possibility of a “mild recession,” a

20%–30% chance of a “harder recession,” and a further 20%–30%

chance of “something worse” than a deep recession.

According to Dimon, the business was “bracing ourselves” for an

economic hurricane in June. Major financial institutions appear to be

divided; although some continue to predict that the United States will

avoid a recession, others concede that a gentle landing is improbable.

The belief that the Federal Reserve will need to take additional

action to prevent inflation is now one of the most prominent trends.

This week’s inflation rate is still very high at 9.18% YOY.

Even the Fed anticipates that interest rates must reach a

“sufficiently restrictive” level to reduce inflation and remain

there “for some time.” “Restrictive” means what?

In the past, raising interest rates to the level of the Consumer Price

Index (CPI) was necessary to stem the flow of inflation.

The Fed, in my opinion, is keeping an eye on CPI and the unemployment

rate to stop raising interest rates once it reaches at least 5

percent. Looking at the current response, the Fed has to raise rates a

lot more (double?) to bring inflation down. This is very tricky given

the high value of the dollar.

IMF LOWERS GLOBAL ECONOMIC PROJECTION

IMF Director Kristalina Georgieva hinted at it in a blog post, and the

fund lowered its estimate of global GDP growth for 2022 and 2023 for

the second time this year. It anticipates that growth will drop from

6.1 percent last year to 3.2 percent this year and to 2.9 percent the

next year.

However, for some people, the situation is not terrible enough.

“Next year is anticipated to be much worse, with the growth of only

2.9 percent, barely over the 2.5 percent growth level that the IMF has

traditionally regarded as a worldwide recession. However, that

forecast is predicated on the status quo.

More threats are emerging, including the potential for Russia to stop

gas supply to Europe. According to the IMF, that would increase

inflation even further and reduce this year’s global growth to

approximately 2.6 percent, which is just shy of the hot zone.

We believe that the fact that some people find a downgrade that pushes

present pressures to 2023 to be insufficiently grim is an example of

what Ken Fisher, the founder and executive chairman of Fisher

Investments, refers to as “the pessimism of disbelief.”

This sentiment feature assumes that all negative news is accurate and

will only worsen and that any glimpse of hope is either transitory or

about to turn into something terrible. Bull markets, in our opinion,

are constructed on this intense flavor because, as Sir John Templeton

once said, “Bull markets are founded on pessimism.”

Therefore, don’t simply predict more bad times in the future based

on this prophecy. Instead, think about how it—and the negative

responses to it—should help reality provide the kind of pleasant

surprise that stocks usually appreciate by lowering expectations.

KEY EVENTS & CALENDAR

* Tuesday, August 23 – New Homes Sales (July)

* Wednesday, August 24 – Core Durable Goods Orders (Mom) (July)

* FED TALK & JACKSON HOLE MEETING

The release of updates on durable goods orders, home prices, PMI data,

and the highly followed PCE price gauge next week’s economic

announcements might also cause disruptions.

The consumer and technology industries will once more be flooded with

earnings results, with Dollar Tree (NASDAQ: DLTR), Dollar General

(NYSE: DG), Nvidia (NVDA), and Salesforce (CRM) among the leading

names.

The Jackson Hole meeting at the end of August might be an additional

adjusting factor for Mr. Market’s projections. Jerome Powell will

use this chance to reiterate the significance of controlling

inflationary expectations.

Understanding whether problems with the energy supply will result in a

slowdown in activity in the second half of the year after resisting in

the first depends on this anchoring. IF THIS IS THE CASE, THE

RECESSION, IF IT HAPPENS, COULD BE DELAYED UNTIL 2023.

Did you enjoy the excerpt?

_TRY ALPHABETASTOCK REPORT FOR 30 DAYS FOR $19.95_

[[link removed]]_ OR __SAVE

OVER 50% BY PAYING ANNUALLY FOR $99.95

[[link removed]]_

SINCERELY,

Irving Wilkinson

Editor

AlphaBetaStock.com [[link removed]]

-------------------------------------------------------------------------------------------------------------------------

Unsubscribe

[[link removed]]

16192 Coastal Highway, Lewes, Deleware, 19958, United States of

America

Message Analysis

- Sender: n/a

- Political Party: n/a

- Country: n/a

- State/Locality: n/a

- Office: n/a