|

|||

|

In this Update:

Op-Ed: Pennsylvanians Losing Hope Over Inflation WoesEmpty pantries. Unfilled medications. Depleted savings. I recently poured over hundreds of comments like these from my constituents regarding the issue concerning them most: the growing toll inflation takes on their survival. Of the roughly 650 people who responded to my poll, 92% said they are worse off today than they were last year. Another 95% said they feel the pain of inflation at the gas pump and the grocery store. Many told me the cost to fill their tank has tripled, while electric bills and food purchases have risen by hundreds of dollars each month. Others say they’ve dipped into savings and delayed retirement just to handle the worsening economic situation. Parents forgo new clothing and school supplies as their children embark on another academic year, elderly and disabled residents on fixed incomes fret over property tax hikes, small business owners watch sales plummet and income halved, while others consider fleeing Pennsylvania altogether. This widespread suffering weighs on my mind every day and the responsibility I bear to fix it grows heavier by the minute. I wish I could say the same for my colleagues across the aisle, spurred on by a feckless gubernatorial administration only interested in throwing money at our problems in hopes they’ll just disappear. Ordinary Pennsylvanians know this tactic only makes things worse. There’s no such thing as free money, especially when it’s our hard-earned dollars the state is using to appease Gov. Tom Wolf’s progressive allies. It’s the same pattern we see at the congressional level, where President Joe Biden just signed the Inflation Reduction Act – a misnomer, at best, to distract from the billions in handouts it awards to green energy. Even the nonpartisan Congressional Office of the Budget admits the legislation will increase taxes on the middle class – those making under $400,000 annually – by $20 billion over the next decade. This, on top of the $410 million carbon tax the Wolf administration is fighting tooth and nail to impose on electricity ratepayers through the Regional Greenhouse Gas Initiative (RGGI). A bipartisan mix of lawmakers oppose RGGI because it could nearly quadruple energy costs by 2030 with virtually zero reduction in carbon emissions. It threatens tens of thousands of jobs and punishes millions of residents unable to afford greener options, like electric heat pumps and solar panels. My constituents tell me their electricity bills have already inflated by hundreds of dollars each month, leaving them with difficult choices to make about which bills get paid. If Senate Republicans’ legal challenge to stop RGGI once and for all fails, these costs will skyrocket even more. But Wolf’s policies don’t exist in a vacuum. Rather, the Biden administration’s ruinous strategies amplify the struggle we all face just to drive to work and keep our lights on. From restrictive gas drilling regulations to the billions in aid we funnel to Ukraine to defeat a war against Russia we swear we aren’t fighting, both Democratic leaders believe the middle class should fund their self-serving ambitions. That’s why I sponsored Senate Bill 813 to temporarily institute a gas tax holiday that would shave 15 cents off the price per gallon for six months. The legislation also implements registration fees for electric and hybrid vehicles to offset the lost revenue from the tax cut to maintain funding for roads and bridges. We know, however, that energy is just one facet of this spiraling economic crisis. Local governments often lean on property taxes to fill widening budget gaps, a strategy that hits residents surviving on fixed incomes the hardest. With more than 2.2 million seniors living in Pennsylvania, this hardship isn’t limited to my district alone. Eliminating property taxes for residents 65 and older could benefit as many as 176,000 seniors currently living below the poverty line. Legislation I introduced last year would extend this relief to elderly residents who’ve lived in Pennsylvania for 10 years or longer and make less than $40,000 annually. Our seniors have spent decades working and contributing taxes to our state. They shouldn’t fear losing their homes because of the inflationary spiral that’s wreaking havoc on our lives. I’m not the only one taking action to quell this disaster. My Republican colleagues and I have likewise championed legislation to lower taxes on businesses, which will translate into wage growth and economic prosperity. We’ve dismissed the governor’s proposals to increase personal income taxes, collect higher fees from oil and gas operators and drain our state’s savings account. We’ve sued to block his onerous regulations meant to punish industry and raise prices for all. We’ve asked voters to step in and tell us where they stand on our most fundamental issues, rather than letting the administration dictate to us what they think is best. In that vein, I’ll conclude with just a handful of the hundreds of comments I’ve received from my constituents about the hardships they face. Don’t just take my word for it:

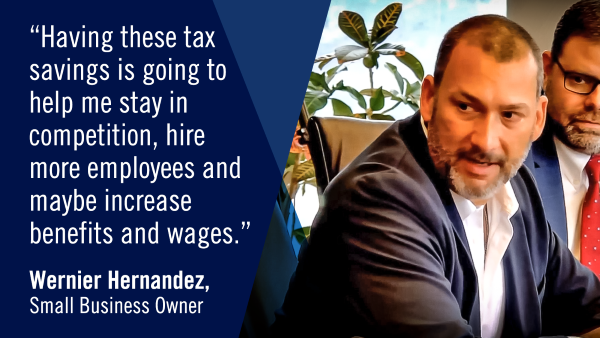

State Tax Reform Helps PA Job Creators, Families

The Pennsylvania Independent Fiscal Office recently confirmed that real average hourly earnings – a measure of workers’ pay adjusted for inflation – declined by 3.9% in June. In addition, the massive, new spending bill enacted in Washington will end up forcing working-class Americans to pay billions of dollars in new taxes, according to the nonpartisan Congressional Budget Office. The pressures on families and job creators, caused by reckless action at the federal level and outdated policy at the state level, are real and mounting. Boosting wages and providing new income opportunities to Pennsylvanians are the reasons the General Assembly approved sweeping tax reform in July as part of the new state budget. Business operators big and small are telling us these changes will allow them to invest more money in their businesses and workers. Creating a climate for good-paying jobs is vital to supporting families and allowing healthy communities to flourish. Free Webinar on Sweeping Business Tax Reform

Tax reforms enacted by the General Assembly are a huge boost for job creators, and the Pennsylvania Chamber of Business and Industry is hosting a free webinar to explore the impact on your business. You’ll learn details about what the changes mean for businesses of all sizes and be able to ask tax experts questions about various provisions in the tax package. The webinar will take place Aug. 25 from 10 a.m. to noon. You can find more information and register here. Financial Assistance for Eligible Children of Veterans

As the school year approaches, the Department of Military and Veterans Affairs reminds veterans with children that financial assistance is available to those attending post-high school education or training at an approved institution in the commonwealth through its Educational Gratuity Program. The program supports children of honorably discharged veterans who have 100% service-connected disabilities and served during a period of war or armed conflict, or children of veterans who die or died in service during a period of war or armed conflict. To be eligible, a child of a veteran must be between the ages of 16 and 23, living within the Commonwealth of Pennsylvania five years prior to application and must attend a school within the commonwealth. All applicants must have a financial need. Payments will not exceed $500 per term or semester per qualified child to each approved educational institution over a total of eight terms or semesters. For more information about the program’s criteria, eligibility and needed documentation, go to Educational Gratuity Program. Beat Sept. 1 College Tuition Hikes with PA 529

Families who contribute to their PA 529 Guaranteed Savings Plan (GSP) account by Aug. 31 can boost their savings by taking advantage of the fact that many college tuition credit rates are scheduled to increase Sept. 1. The PA 529 GSP program allows families to save for a future education at today’s cost. Because the effect of tuition inflation is generally applied to PA 529 GSP accounts on Sept. 1, contributions made by Aug. 31 often receive an increase in value the very next day – and the earnings can be used as soon as the summer semester of the next calendar year. If used the following fall semester, two years of tuition inflation benefits would be available. Before new PA 529 GSP credit rates take effect for the 2022-23 school year, families may compare PA 529 GSP credit rates at popular levels. Nearly 440 Vehicles Available at Commonwealth Auction

Nearly 440 used vehicles will be up for public purchase at the latest Commonwealth Vehicle Auction taking place on Tuesday, Aug. 23, at 10 a.m. at Manheim Keystone Pennsylvania, 488 Firehouse Road in Grantville, Dauphin County. In-person preview of vehicles is open from this Thursday through Sunday, Aug. 21. Pre-registration is mandatory and must be completed on or before Sunday at 4 p.m. This auction will feature several vehicles seized by state law enforcement agencies including: 2014 Chevrolet Cruze, 2014 Ford Taurus, 2013 Land Rover Range Rover, 2011 BMW X5, 2011 Chevrolet Traverse, 2011 Jaguar XF and more. Other vehicles include a variety of 4-wheel drive SUVs, utility vehicles and pickup trucks from Chevrolet, Dodge, Ford, GMC and Jeep as well as front- and all-wheel drive sedans and mini-vans. Buyers must purchase with certified funds in the form of money order, cashier’s check or certified check. No cash will be accepted. |

|||

|

|||

|

If you do not wish to receive this email, click here to unsubscribe. 2022 © Senate of Pennsylvania | https://senatormastriano.com | Privacy Policy |