| From | USAFacts <[email protected]> |

| Subject | How much does your state contribute to US GDP? |

| Date | August 15, 2022 10:30 PM |

Links have been removed from this email. Learn more in the FAQ.

Links have been removed from this email. Learn more in the FAQ.

Plus, what's in the CHIPS Act?

Not displaying correctly? View this email in your browser ([link removed]) .

[link removed]

What's your state's GDP?

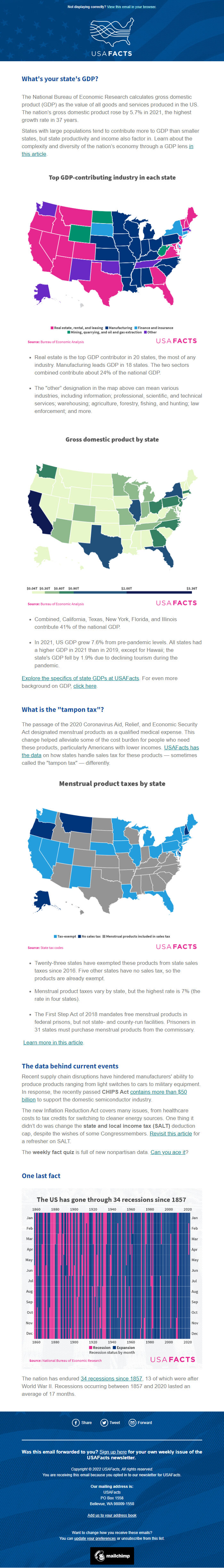

The National Bureau of Economic Research calculates gross domestic product (GDP) as the value of all goods and services produced in the US. The nation’s gross domestic product rose by 5.7% in 2021, the highest growth rate in 37 years.

States with large populations tend to contribute more to GDP than smaller states, but state productivity and income also factor in. Learn about the complexity and diversity of the nation’s economy through a GDP lens in this article ([link removed]) .

[link removed]

* Real estate is the top GDP contributor in 20 states, the most of any industry. Manufacturing leads GDP in 18 states. The two sectors combined contribute about 24% of the national GDP.

* The "other” designation in the map above can mean various industries, including information; professional, scientific, and technical services; warehousing; agriculture, forestry, fishing, and hunting; law enforcement; and more.

[link removed]

* Combined, California, Texas, New York, Florida, and Illinois contribute 41% of the national GDP.

* In 2021, US GDP grew 7.6% from pre-pandemic levels. All states had a higher GDP in 2021 than in 2019, except for Hawaii; the state's GDP fell by 1.9% due to declining tourism during the pandemic.

Explore the specifics of state GDPs at USAFacts ([link removed]) . For even more background on GDP, click here ([link removed]) .

What is the "tampon tax"?

The passage of the 2020 Coronavirus Aid, Relief, and Economic Security Act designated menstrual products as a qualified medical expense. This change helped alleviate some of the cost burden for people who need these products, particularly Americans with lower incomes. USAFacts has the data ([link removed]) on how states handle sales tax for these products — sometimes called the "tampon tax" — differently.

[link removed]

* Twenty-three states have exempted these products from state sales taxes since 2016. Five other states have no sales tax, so the products are already exempt.

* Menstrual product taxes vary by state, but the highest rate is 7% (the rate in four states).

* The First Step Act of 2018 mandates free menstrual products in federal prisons, but not state- and county-run facilities. Prisoners in 31 states must purchase menstrual products from the commissary.

Learn more in this article ([link removed]) .

The data behind current events

Recent supply chain disruptions have hindered manufacturers' ability to produce products ranging from light switches to cars to military equipment. In response, the recently passed CHIPS Act contains more than $50 billion ([link removed]) to support the domestic semiconductor industry.

The new Inflation Reduction Act covers many issues, from healthcare costs to tax credits for switching to cleaner energy sources. One thing it didn’t do was change the state and local income tax (SALT) deduction cap, despite the wishes of some Congressmembers. Revisit this article ([link removed]) for a refresher on SALT.

The weekly fact quiz is full of new nonpartisan data. Can you ace it ([link removed]) ?

One last fact

[link removed]

The nation has endured 34 recessions since 1857 ([link removed]) , 13 of which were after World War II. Recessions occurring between 1857 and 2020 lasted an average of 17 months.

============================================================

** Share ([link removed])

** Share ([link removed])

** Tweet ([link removed] http%3A%2F%2Feepurl.com%2Fh8SqHP)

** Tweet ([link removed] http%3A%2F%2Feepurl.com%2Fh8SqHP)

** Forward ([link removed])

** Forward ([link removed])

Was this email forwarded to you? ** Sign up here ([link removed])

for your own weekly issue of the USAFacts newsletter.

Copyright © 2022 USAFacts, All rights reserved.

You are receiving this email because you opted in to our newsletter for USAFacts.

Our mailing address is:

USAFacts

PO Box 1558

Bellevue, WA 98009-1558

USA

Want to change how you receive these emails?

You can ** update your preferences ([link removed])

or ** unsubscribe from this list ([link removed])

.

Email Marketing Powered by Mailchimp

[link removed]

Not displaying correctly? View this email in your browser ([link removed]) .

[link removed]

What's your state's GDP?

The National Bureau of Economic Research calculates gross domestic product (GDP) as the value of all goods and services produced in the US. The nation’s gross domestic product rose by 5.7% in 2021, the highest growth rate in 37 years.

States with large populations tend to contribute more to GDP than smaller states, but state productivity and income also factor in. Learn about the complexity and diversity of the nation’s economy through a GDP lens in this article ([link removed]) .

[link removed]

* Real estate is the top GDP contributor in 20 states, the most of any industry. Manufacturing leads GDP in 18 states. The two sectors combined contribute about 24% of the national GDP.

* The "other” designation in the map above can mean various industries, including information; professional, scientific, and technical services; warehousing; agriculture, forestry, fishing, and hunting; law enforcement; and more.

[link removed]

* Combined, California, Texas, New York, Florida, and Illinois contribute 41% of the national GDP.

* In 2021, US GDP grew 7.6% from pre-pandemic levels. All states had a higher GDP in 2021 than in 2019, except for Hawaii; the state's GDP fell by 1.9% due to declining tourism during the pandemic.

Explore the specifics of state GDPs at USAFacts ([link removed]) . For even more background on GDP, click here ([link removed]) .

What is the "tampon tax"?

The passage of the 2020 Coronavirus Aid, Relief, and Economic Security Act designated menstrual products as a qualified medical expense. This change helped alleviate some of the cost burden for people who need these products, particularly Americans with lower incomes. USAFacts has the data ([link removed]) on how states handle sales tax for these products — sometimes called the "tampon tax" — differently.

[link removed]

* Twenty-three states have exempted these products from state sales taxes since 2016. Five other states have no sales tax, so the products are already exempt.

* Menstrual product taxes vary by state, but the highest rate is 7% (the rate in four states).

* The First Step Act of 2018 mandates free menstrual products in federal prisons, but not state- and county-run facilities. Prisoners in 31 states must purchase menstrual products from the commissary.

Learn more in this article ([link removed]) .

The data behind current events

Recent supply chain disruptions have hindered manufacturers' ability to produce products ranging from light switches to cars to military equipment. In response, the recently passed CHIPS Act contains more than $50 billion ([link removed]) to support the domestic semiconductor industry.

The new Inflation Reduction Act covers many issues, from healthcare costs to tax credits for switching to cleaner energy sources. One thing it didn’t do was change the state and local income tax (SALT) deduction cap, despite the wishes of some Congressmembers. Revisit this article ([link removed]) for a refresher on SALT.

The weekly fact quiz is full of new nonpartisan data. Can you ace it ([link removed]) ?

One last fact

[link removed]

The nation has endured 34 recessions since 1857 ([link removed]) , 13 of which were after World War II. Recessions occurring between 1857 and 2020 lasted an average of 17 months.

============================================================

** Share ([link removed])

** Share ([link removed])

** Tweet ([link removed] http%3A%2F%2Feepurl.com%2Fh8SqHP)

** Tweet ([link removed] http%3A%2F%2Feepurl.com%2Fh8SqHP)

** Forward ([link removed])

** Forward ([link removed])

Was this email forwarded to you? ** Sign up here ([link removed])

for your own weekly issue of the USAFacts newsletter.

Copyright © 2022 USAFacts, All rights reserved.

You are receiving this email because you opted in to our newsletter for USAFacts.

Our mailing address is:

USAFacts

PO Box 1558

Bellevue, WA 98009-1558

USA

Want to change how you receive these emails?

You can ** update your preferences ([link removed])

or ** unsubscribe from this list ([link removed])

.

Email Marketing Powered by Mailchimp

[link removed]

Message Analysis

- Sender: USAFacts

- Political Party: n/a

- Country: United States

- State/Locality: n/a

- Office: n/a

-

Email Providers:

- MailChimp