Email

Market Bounces Up. Pull Back or Recovery? (Weekly Report)

| From | Irving Wilkinson <[email protected]> |

| Subject | Market Bounces Up. Pull Back or Recovery? (Weekly Report) |

| Date | August 15, 2022 2:22 PM |

Links have been removed from this email. Learn more in the FAQ.

Links have been removed from this email. Learn more in the FAQ.

Market Bounces Up. Pull Back or Recovery?

Thank you for being a subscriber of _ALPHABETASTOCK'S REPORT._ This

is only an excerpt and paid subscribers have access to this and all

the features. _SIGN UP NOW FOR $19.95_

[[link removed]]_ OR __SAVE OVER 50% BY

PAYING ANNUALLY FOR $99.95

[[link removed]]__.

[[link removed]]_

__

__

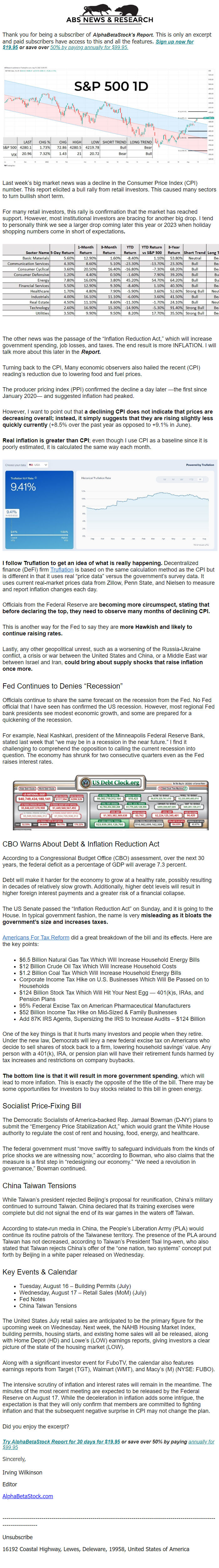

Last week’s big market news was a decline in the Consumer Price

Index (CPI) number. This report elicited a bull rally from retail

investors. This caused many sectors to turn bullish short term.

For many retail investors, this rally is confirmation that the market

has reached support. However, most institutional investors are bracing

for another big drop. I tend to personally think we see a larger drop

coming later this year or 2023 when holiday shopping numbers come in

short of expectations.

The other news was the passage of the “Inflation Reduction Act,”

which will increase government spending, job losses, and taxes. The

end result is more INFLATION. I will talk more about this later in

the _REPORT._

Turning back to the CPI, Many economic observers also hailed the

recent (CPI) reading’s reduction due to lowering food and fuel

prices.

The producer pricing index (PPI) confirmed the decline a day later

—the first since January 2020— and suggested inflation had peaked.

However, I want to point out that A DECLINING CPI DOES NOT INDICATE

THAT PRICES ARE DECREASING OVERALL; INSTEAD, IT SIMPLY SUGGESTS THAT

THEY ARE RISING SLIGHTLY LESS QUICKLY CURRENTLY (+8.5% over the past

year as opposed to +9.1% in June).

REAL INFLATION IS GREATER THAN CPI; even though I use CPI as a

baseline since it is poorly estimated, it is calculated the same way

each month.

I FOLLOW TRUFLATION TO GET AN IDEA OF WHAT IS REALLY

HAPPENING. Decentralized finance (DeFi) firm Truflation

[[link removed]] is based on the same calculation method

as the CPI but is different in that it uses real “price data”

versus the government’s survey data. It uses current real-market

prices data from Zillow, Penn State, and Nielsen to measure and report

inflation changes each day.

Officials from the Federal Reserve are BECOMING MORE CIRCUMSPECT,

STATING THAT BEFORE DECLARING THE TOP, THEY NEED TO OBSERVE MANY

MONTHS OF DECLINING CPI.

This is another way for the Fed to say they are MORE HAWKISH AND

LIKELY TO CONTINUE RAISING RATES.

Lastly, any other geopolitical unrest, such as a worsening of the

Russia-Ukraine conflict, a crisis or war between the United States and

China, or a Middle East war between Israel and Iran, COULD BRING

ABOUT SUPPLY SHOCKS THAT RAISE INFLATION ONCE MORE.

FED CONTINUES TO DENIES “RECESSION”

Officials continue to share the same forecast on the recession from

the Fed. No Fed official that I have seen has confirmed the US

recession. However, most regional Fed bank presidents see modest

economic growth, and some are prepared for a quickening of the

recession.

For example, Neal Kashkari, president of the Minneapolis Federal

Reserve Bank, stated last week that “we may be in a recession in the

near future.” I find it challenging to comprehend the opposition to

calling the current recession into question. The economy has shrunk

for two consecutive quarters even as the Fed raises interest rates.

CBO WARNS ABOUT DEBT & INFLATION REDUCTION ACT

According to a Congressional Budget Office (CBO) assessment, over the

next 30 years, the federal deficit as a percentage of GDP will average

7.3 percent.

Debt will make it harder for the economy to grow at a healthy rate,

possibly resulting in decades of relatively slow growth. Additionally,

higher debt levels will result in higher foreign interest payments and

a greater risk of a financial collapse.

The US Senate passed the “Inflation Reduction Act” on Sunday, and

it is going to the House. In typical government fashion, the name is

very MISLEADING AS IT BLOATS THE GOVERNMENT’S SIZE AND INCREASES

TAXES.

Americans For Tax Reform

[[link removed]]

did a great breakdown of the bill and its effects. Here are the key

points:

* $6.5 Billion Natural Gas Tax Which Will Increase Household Energy

Bills

* $12 Billion Crude Oil Tax Which Will Increase Household Costs

* $1.2 Billion Coal Tax Which Will Increase Household Energy Bills

* Corporate Income Tax Hike on U.S. Businesses Which Will Be Passed

on to Households

* $124 Billion Stock Tax Which Will Hit Your Nest Egg — 401(k)s,

IRAs, and Pension Plans

* 95% Federal Excise Tax on American Pharmaceutical Manufacturers

* $52 Billion Income Tax Hike on Mid-Sized & Family Businesses

* Add 87K IRS Agents, Supersizing the IRS to Increase Audits – $124

Billion

One of the key things is that it hurts many investors and people when

they retire. Under the new law, Democrats will levy a new federal

excise tax on Americans who decide to sell shares of stock back to a

firm, lowering household savings’ value. Any person with a 401(k),

IRA, or pension plan will have their retirement funds harmed by tax

increases and restrictions on company buybacks.

THE BOTTOM LINE IS THAT IT WILL RESULT IN MORE GOVERNMENT SPENDING,

which will lead to more inflation. This is exactly the opposite of the

title of the bill. There may be some opportunities for investors to

buy stocks related to this bill in green energy.

SOCIALIST PRICE-FIXING BILL

The Democratic Socialists of America-backed Rep. Jamaal Bowman (D-NY)

plans to submit the “Emergency Price Stabilization Act,” which

would grant the White House authority to regulate the cost of rent and

housing, food, energy, and healthcare.

The federal government must “move swiftly to safeguard individuals

from the kinds of price shocks we are witnessing now,” according to

Bowman, who also claims that the measure is a first step in

“redesigning our economy.” “We need a revolution in

governance,” Bowman continued.

CHINA TAIWAN TENSIONS

While Taiwan’s president rejected Beijing’s proposal for

reunification, China’s military continued to surround Taiwan. China

declared that its training exercises were complete but did not signal

the end of its war games in the waters off Taiwan.

According to state-run media in China, the People’s Liberation Army

(PLA) would continue its routine patrols of the Taiwanese territory.

The presence of the PLA around Taiwan has not decreased, according to

Taiwan’s President Tsai Ing-wen, who also stated that Taiwan rejects

China’s offer of the “one nation, two systems” concept put forth

by Beijing in a white paper released on Wednesday.

KEY EVENTS & CALENDAR

* Tuesday, August 16 – Building Permits (July)

* Wednesday, August 17 – Retail Sales (MoM) (July)

* Fed Notes

* China Taiwan Tensions

The United States July retail sales are anticipated to be the primary

figure for the upcoming week on Wednesday. Next week, the NAHB Housing

Market Index, building permits, housing starts, and existing home

sales will all be released, along with Home Depot (HD) and Lowe’s

(LOW) earnings reports, giving investors a clear picture of the state

of the housing market (LOW).

Along with a significant investor event for FuboTV, the calendar also

features earnings reports from Target (TGT), Walmart (WMT), and

Macy’s (M) (NYSE: FUBO).

The intensive scrutiny of inflation and interest rates will remain in

the meantime. The minutes of the most recent meeting are expected to

be released by the Federal Reserve on August 17. While the

deceleration in inflation adds some intrigue, the expectation is that

they will only confirm that members are committed to fighting

inflation and that the subsequent negative surprise in CPI may not

change the plan.

Did you enjoy the excerpt?

_TRY ALPHABETASTOCK REPORT FOR 30 DAYS FOR $19.95_

[[link removed]]_ OR __SAVE

OVER 50% BY PAYING ANNUALLY FOR $99.95

[[link removed]]_

SINCERELY,

Irving Wilkinson

Editor

AlphaBetaStock.com [[link removed]]

-------------------------------------------------------------------------------------------------------------------------

Unsubscribe

[[link removed]]

16192 Coastal Highway, Lewes, Deleware, 19958, United States of

America

Thank you for being a subscriber of _ALPHABETASTOCK'S REPORT._ This

is only an excerpt and paid subscribers have access to this and all

the features. _SIGN UP NOW FOR $19.95_

[[link removed]]_ OR __SAVE OVER 50% BY

PAYING ANNUALLY FOR $99.95

[[link removed]]__.

[[link removed]]_

__

__

Last week’s big market news was a decline in the Consumer Price

Index (CPI) number. This report elicited a bull rally from retail

investors. This caused many sectors to turn bullish short term.

For many retail investors, this rally is confirmation that the market

has reached support. However, most institutional investors are bracing

for another big drop. I tend to personally think we see a larger drop

coming later this year or 2023 when holiday shopping numbers come in

short of expectations.

The other news was the passage of the “Inflation Reduction Act,”

which will increase government spending, job losses, and taxes. The

end result is more INFLATION. I will talk more about this later in

the _REPORT._

Turning back to the CPI, Many economic observers also hailed the

recent (CPI) reading’s reduction due to lowering food and fuel

prices.

The producer pricing index (PPI) confirmed the decline a day later

—the first since January 2020— and suggested inflation had peaked.

However, I want to point out that A DECLINING CPI DOES NOT INDICATE

THAT PRICES ARE DECREASING OVERALL; INSTEAD, IT SIMPLY SUGGESTS THAT

THEY ARE RISING SLIGHTLY LESS QUICKLY CURRENTLY (+8.5% over the past

year as opposed to +9.1% in June).

REAL INFLATION IS GREATER THAN CPI; even though I use CPI as a

baseline since it is poorly estimated, it is calculated the same way

each month.

I FOLLOW TRUFLATION TO GET AN IDEA OF WHAT IS REALLY

HAPPENING. Decentralized finance (DeFi) firm Truflation

[[link removed]] is based on the same calculation method

as the CPI but is different in that it uses real “price data”

versus the government’s survey data. It uses current real-market

prices data from Zillow, Penn State, and Nielsen to measure and report

inflation changes each day.

Officials from the Federal Reserve are BECOMING MORE CIRCUMSPECT,

STATING THAT BEFORE DECLARING THE TOP, THEY NEED TO OBSERVE MANY

MONTHS OF DECLINING CPI.

This is another way for the Fed to say they are MORE HAWKISH AND

LIKELY TO CONTINUE RAISING RATES.

Lastly, any other geopolitical unrest, such as a worsening of the

Russia-Ukraine conflict, a crisis or war between the United States and

China, or a Middle East war between Israel and Iran, COULD BRING

ABOUT SUPPLY SHOCKS THAT RAISE INFLATION ONCE MORE.

FED CONTINUES TO DENIES “RECESSION”

Officials continue to share the same forecast on the recession from

the Fed. No Fed official that I have seen has confirmed the US

recession. However, most regional Fed bank presidents see modest

economic growth, and some are prepared for a quickening of the

recession.

For example, Neal Kashkari, president of the Minneapolis Federal

Reserve Bank, stated last week that “we may be in a recession in the

near future.” I find it challenging to comprehend the opposition to

calling the current recession into question. The economy has shrunk

for two consecutive quarters even as the Fed raises interest rates.

CBO WARNS ABOUT DEBT & INFLATION REDUCTION ACT

According to a Congressional Budget Office (CBO) assessment, over the

next 30 years, the federal deficit as a percentage of GDP will average

7.3 percent.

Debt will make it harder for the economy to grow at a healthy rate,

possibly resulting in decades of relatively slow growth. Additionally,

higher debt levels will result in higher foreign interest payments and

a greater risk of a financial collapse.

The US Senate passed the “Inflation Reduction Act” on Sunday, and

it is going to the House. In typical government fashion, the name is

very MISLEADING AS IT BLOATS THE GOVERNMENT’S SIZE AND INCREASES

TAXES.

Americans For Tax Reform

[[link removed]]

did a great breakdown of the bill and its effects. Here are the key

points:

* $6.5 Billion Natural Gas Tax Which Will Increase Household Energy

Bills

* $12 Billion Crude Oil Tax Which Will Increase Household Costs

* $1.2 Billion Coal Tax Which Will Increase Household Energy Bills

* Corporate Income Tax Hike on U.S. Businesses Which Will Be Passed

on to Households

* $124 Billion Stock Tax Which Will Hit Your Nest Egg — 401(k)s,

IRAs, and Pension Plans

* 95% Federal Excise Tax on American Pharmaceutical Manufacturers

* $52 Billion Income Tax Hike on Mid-Sized & Family Businesses

* Add 87K IRS Agents, Supersizing the IRS to Increase Audits – $124

Billion

One of the key things is that it hurts many investors and people when

they retire. Under the new law, Democrats will levy a new federal

excise tax on Americans who decide to sell shares of stock back to a

firm, lowering household savings’ value. Any person with a 401(k),

IRA, or pension plan will have their retirement funds harmed by tax

increases and restrictions on company buybacks.

THE BOTTOM LINE IS THAT IT WILL RESULT IN MORE GOVERNMENT SPENDING,

which will lead to more inflation. This is exactly the opposite of the

title of the bill. There may be some opportunities for investors to

buy stocks related to this bill in green energy.

SOCIALIST PRICE-FIXING BILL

The Democratic Socialists of America-backed Rep. Jamaal Bowman (D-NY)

plans to submit the “Emergency Price Stabilization Act,” which

would grant the White House authority to regulate the cost of rent and

housing, food, energy, and healthcare.

The federal government must “move swiftly to safeguard individuals

from the kinds of price shocks we are witnessing now,” according to

Bowman, who also claims that the measure is a first step in

“redesigning our economy.” “We need a revolution in

governance,” Bowman continued.

CHINA TAIWAN TENSIONS

While Taiwan’s president rejected Beijing’s proposal for

reunification, China’s military continued to surround Taiwan. China

declared that its training exercises were complete but did not signal

the end of its war games in the waters off Taiwan.

According to state-run media in China, the People’s Liberation Army

(PLA) would continue its routine patrols of the Taiwanese territory.

The presence of the PLA around Taiwan has not decreased, according to

Taiwan’s President Tsai Ing-wen, who also stated that Taiwan rejects

China’s offer of the “one nation, two systems” concept put forth

by Beijing in a white paper released on Wednesday.

KEY EVENTS & CALENDAR

* Tuesday, August 16 – Building Permits (July)

* Wednesday, August 17 – Retail Sales (MoM) (July)

* Fed Notes

* China Taiwan Tensions

The United States July retail sales are anticipated to be the primary

figure for the upcoming week on Wednesday. Next week, the NAHB Housing

Market Index, building permits, housing starts, and existing home

sales will all be released, along with Home Depot (HD) and Lowe’s

(LOW) earnings reports, giving investors a clear picture of the state

of the housing market (LOW).

Along with a significant investor event for FuboTV, the calendar also

features earnings reports from Target (TGT), Walmart (WMT), and

Macy’s (M) (NYSE: FUBO).

The intensive scrutiny of inflation and interest rates will remain in

the meantime. The minutes of the most recent meeting are expected to

be released by the Federal Reserve on August 17. While the

deceleration in inflation adds some intrigue, the expectation is that

they will only confirm that members are committed to fighting

inflation and that the subsequent negative surprise in CPI may not

change the plan.

Did you enjoy the excerpt?

_TRY ALPHABETASTOCK REPORT FOR 30 DAYS FOR $19.95_

[[link removed]]_ OR __SAVE

OVER 50% BY PAYING ANNUALLY FOR $99.95

[[link removed]]_

SINCERELY,

Irving Wilkinson

Editor

AlphaBetaStock.com [[link removed]]

-------------------------------------------------------------------------------------------------------------------------

Unsubscribe

[[link removed]]

16192 Coastal Highway, Lewes, Deleware, 19958, United States of

America

Message Analysis

- Sender: n/a

- Political Party: n/a

- Country: n/a

- State/Locality: n/a

- Office: n/a