Email

The corruption of American capitalism – update from your favorite think tank

| From | Douglas Carswell <[email protected]> |

| Subject | The corruption of American capitalism – update from your favorite think tank |

| Date | August 13, 2022 12:44 PM |

Links have been removed from this email. Learn more in the FAQ.

Links have been removed from this email. Learn more in the FAQ.

View this email in your browser ([link removed])

Dear Jack,

Fifty one years ago this week, Richard Nixon made the most consequential decision of his presidency – and it had nothing to do with Watergate.

On August 15^th 1971, Nixon announced that the US dollar could no longer be converted into gold. Up until that moment, the dollar was pegged to gold at $35 per ounce under what was called the Bretton Woods System. This international agreement committed the American government to backing every dollar overseas with gold.

“Big deal”, you might say. “What has some distant decision got to do with today?” Quite a lot, actually. It explains why government is big, inflation high, capitalism corrupted and why young Americans are voting left.

For as long as dollars could be converted into gold, there was a limit on the number of dollars that the US government could put into circulation. Why? Because someone might come along with dollars and ask to exchange it for gold. Once dollars could no longer be converted into gold, the US government was free to create as many dollars as it liked.

This is pretty much what has happened ever since.

Following Nixon’s announcement, the only thing restricting the amount of dollars that the government creates is the government. And governments, sadly, are not very good at saying "no" to themselves.

This has produced persistent inflation. The graph below shows how inflation since 1971 dwarfs even the worst price increases during the whole of the nineteenth century and two world wars.

The next graph shows how the amount of money (M3) in circulation has grown since 1971, with the most astronomical increases since 2019.

The United States was founded by rebels demanding “no taxation without representation”.

Thanks to Nixon’s decision, in order to raise revenue today the US government does not need permission from our representatives in Congress to raise tax. They can simply borrow instead.

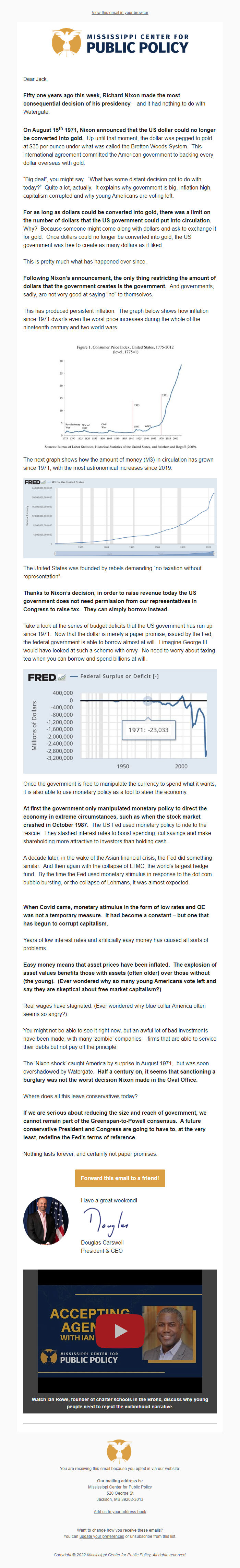

Take a look at the series of budget deficits that the US government has run up since 1971. Now that the dollar is merely a paper promise, issued by the Fed, the federal government is able to borrow almost at will. I imagine George III would have looked at such a scheme with envy. No need to worry about taxing tea when you can borrow and spend billions at will.

Once the government is free to manipulate the currency to spend what it wants, it is also able to use monetary policy as a tool to steer the economy.

At first the government only manipulated monetary policy to direct the economy in extreme circumstances, such as when the stock market crashed in October 1987. The US Fed used monetary policy to ride to the rescue. They slashed interest rates to boost spending, cut savings and make shareholding more attractive to investors than holding cash.

A decade later, in the wake of the Asian financial crisis, the Fed did something similar. And then again with the collapse of LTMC, the world’s largest hedge fund. By the time the Fed used monetary stimulus in response to the dot com bubble bursting, or the collapse of Lehmans, it was almost expected.

When Covid came, monetary stimulus in the form of low rates and QE was not a temporary measure. It had become a constant – but one that has begun to corrupt capitalism.

Years of low interest rates and artificially easy money has caused all sorts of problems.

Easy money means that asset prices have been inflated. The explosion of asset values benefits those with assets (often older) over those without (the young). (Ever wondered why so many young Americans vote left and say they are skeptical about free market capitalism?)

Real wages have stagnated. (Ever wondered why blue collar America often seems so angry?)

You might not be able to see it right now, but an awful lot of bad investments have been made, with many ‘zombie’ companies – firms that are able to service their debts but not pay off the principle.

The ‘Nixon shock’ caught America by surprise in August 1971, but was soon overshadowed by Watergate. Half a century on, it seems that sanctioning a burglary was not the worst decision Nixon made in the Oval Office.

Where does all this leave conservatives today?

If we are serious about reducing the size and reach of government, we cannot remain part of the Greenspan-to-Powell consensus. A future conservative President and Congress are going to have to, at the very least, redefine the Fed’s terms of reference.

Nothing lasts forever, and certainly not paper promises.

Forward this email to a friend! ([link removed])

Have a great weekend!

Douglas Carswell

President & CEO

[link removed]

Watch Ian Rowe, founder of charter schools in the Bronx, discuss why young people need to reject the victimhood narrative.

============================================================

You are receiving this email because you opted in via our website.

Our mailing address is:

Mississippi Center for Public Policy

520 George St

Jackson, MS 39202-3013

USA

Want to change how you receive these emails?

You can ** update your preferences ([link removed])

or ** unsubscribe from this list ([link removed])

.

Copyright © 2022 Mississippi Center for Public Policy, All rights reserved.

Dear Jack,

Fifty one years ago this week, Richard Nixon made the most consequential decision of his presidency – and it had nothing to do with Watergate.

On August 15^th 1971, Nixon announced that the US dollar could no longer be converted into gold. Up until that moment, the dollar was pegged to gold at $35 per ounce under what was called the Bretton Woods System. This international agreement committed the American government to backing every dollar overseas with gold.

“Big deal”, you might say. “What has some distant decision got to do with today?” Quite a lot, actually. It explains why government is big, inflation high, capitalism corrupted and why young Americans are voting left.

For as long as dollars could be converted into gold, there was a limit on the number of dollars that the US government could put into circulation. Why? Because someone might come along with dollars and ask to exchange it for gold. Once dollars could no longer be converted into gold, the US government was free to create as many dollars as it liked.

This is pretty much what has happened ever since.

Following Nixon’s announcement, the only thing restricting the amount of dollars that the government creates is the government. And governments, sadly, are not very good at saying "no" to themselves.

This has produced persistent inflation. The graph below shows how inflation since 1971 dwarfs even the worst price increases during the whole of the nineteenth century and two world wars.

The next graph shows how the amount of money (M3) in circulation has grown since 1971, with the most astronomical increases since 2019.

The United States was founded by rebels demanding “no taxation without representation”.

Thanks to Nixon’s decision, in order to raise revenue today the US government does not need permission from our representatives in Congress to raise tax. They can simply borrow instead.

Take a look at the series of budget deficits that the US government has run up since 1971. Now that the dollar is merely a paper promise, issued by the Fed, the federal government is able to borrow almost at will. I imagine George III would have looked at such a scheme with envy. No need to worry about taxing tea when you can borrow and spend billions at will.

Once the government is free to manipulate the currency to spend what it wants, it is also able to use monetary policy as a tool to steer the economy.

At first the government only manipulated monetary policy to direct the economy in extreme circumstances, such as when the stock market crashed in October 1987. The US Fed used monetary policy to ride to the rescue. They slashed interest rates to boost spending, cut savings and make shareholding more attractive to investors than holding cash.

A decade later, in the wake of the Asian financial crisis, the Fed did something similar. And then again with the collapse of LTMC, the world’s largest hedge fund. By the time the Fed used monetary stimulus in response to the dot com bubble bursting, or the collapse of Lehmans, it was almost expected.

When Covid came, monetary stimulus in the form of low rates and QE was not a temporary measure. It had become a constant – but one that has begun to corrupt capitalism.

Years of low interest rates and artificially easy money has caused all sorts of problems.

Easy money means that asset prices have been inflated. The explosion of asset values benefits those with assets (often older) over those without (the young). (Ever wondered why so many young Americans vote left and say they are skeptical about free market capitalism?)

Real wages have stagnated. (Ever wondered why blue collar America often seems so angry?)

You might not be able to see it right now, but an awful lot of bad investments have been made, with many ‘zombie’ companies – firms that are able to service their debts but not pay off the principle.

The ‘Nixon shock’ caught America by surprise in August 1971, but was soon overshadowed by Watergate. Half a century on, it seems that sanctioning a burglary was not the worst decision Nixon made in the Oval Office.

Where does all this leave conservatives today?

If we are serious about reducing the size and reach of government, we cannot remain part of the Greenspan-to-Powell consensus. A future conservative President and Congress are going to have to, at the very least, redefine the Fed’s terms of reference.

Nothing lasts forever, and certainly not paper promises.

Forward this email to a friend! ([link removed])

Have a great weekend!

Douglas Carswell

President & CEO

[link removed]

Watch Ian Rowe, founder of charter schools in the Bronx, discuss why young people need to reject the victimhood narrative.

============================================================

You are receiving this email because you opted in via our website.

Our mailing address is:

Mississippi Center for Public Policy

520 George St

Jackson, MS 39202-3013

USA

Want to change how you receive these emails?

You can ** update your preferences ([link removed])

or ** unsubscribe from this list ([link removed])

.

Copyright © 2022 Mississippi Center for Public Policy, All rights reserved.

Message Analysis

- Sender: Mississippi Center for Public Policy

- Political Party: n/a

- Country: United States

- State/Locality: Mississippi

- Office: n/a

-

Email Providers:

- MailChimp