|

|||||

|

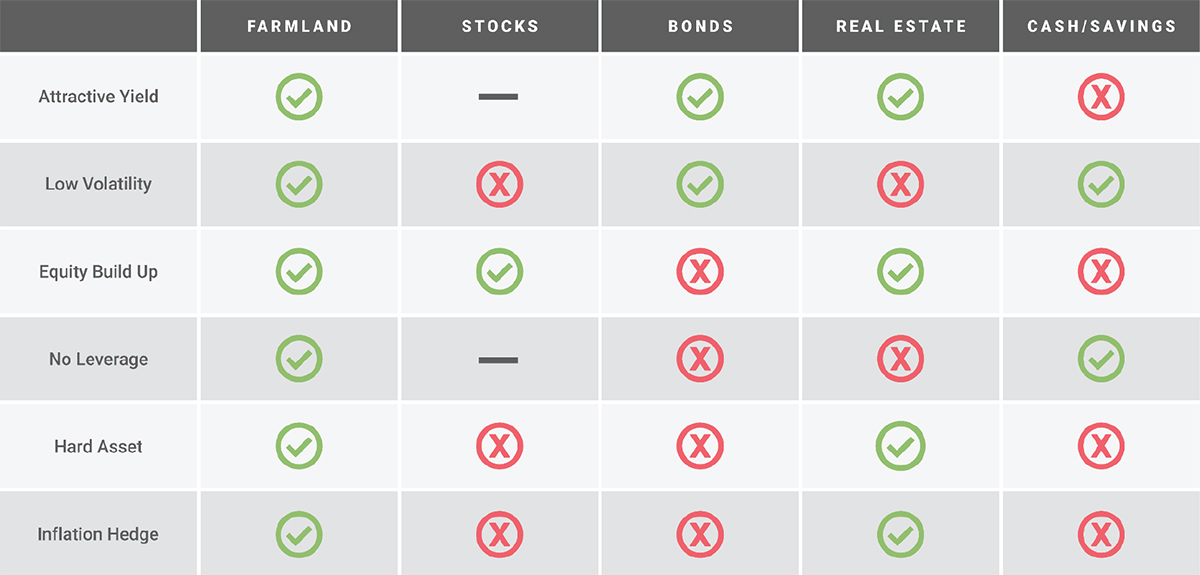

You may not know this, but endowments, pension funds, and the ultra wealthy have quietly stowed funds in farmland for decades...and it's paid off. U.S. Farmland owners made a 15.8% return on their land investment in 2008. And that was in the midst of the biggest recession in U.S. history since WWII. Investments in farmland have generated average returns of 11% per year for the past 30 years*, staying positive through the dot-com crash, Covid-19, and the Great Recession. In fact, farmland outperforms most other major asset classes on most fronts. |

|||||

|

|||||

|

Once upon a time, this asset class was all but unavailable to any but the elite. AcreTrader changed that. AcreTrader is the farmland investing platform that makes it easy to invest in thoroughly reviewed farm offerings quickly and securely online. Their team of agriculture experts does all the work, while you could collect rent payments from your land investment. Don't believe it? Check out historical farmland returns in each state. |

|||||

| See Investment Returns | |||||

|

Learn more by visiting AcreTrader.com or by calling 888-958-1470. |

|||||

|

*According to the NCREIF Farmland Index |

|||||

|

|||||