Email

Market Waits For Inflation Reports As DC Increases Spending and Taxes

| From | Irving Wilkinson <[email protected]> |

| Subject | Market Waits For Inflation Reports As DC Increases Spending and Taxes |

| Date | August 8, 2022 2:44 PM |

Links have been removed from this email. Learn more in the FAQ.

Links have been removed from this email. Learn more in the FAQ.

Market Waits For Inflation Reports As DC Increases

Spending and Taxes

Thank you for being a subscriber of _ALPHABETASTOCK'S REPORT._ This

is only an excerpt and paid subscribers have access to this and all

the features. _SIGN UP NOW FOR $19.95_

[[link removed]]_ OR __SAVE OVER 50% BY

PAYING ANNUALLY FOR $99.95

[[link removed]]__.

[[link removed]]_

Yesterday the US SENATE PASSED THE “INFLATION REDUCTION ACT,”

WHICH REALLY INCREASES GOVERNMENT AND TAXES. The opposite fiscal and

government policy we need now!

I don’t like to rant, but I think it important that our readers

understand the economic consequences of this insanity. (Scroll down

for all the points of it)

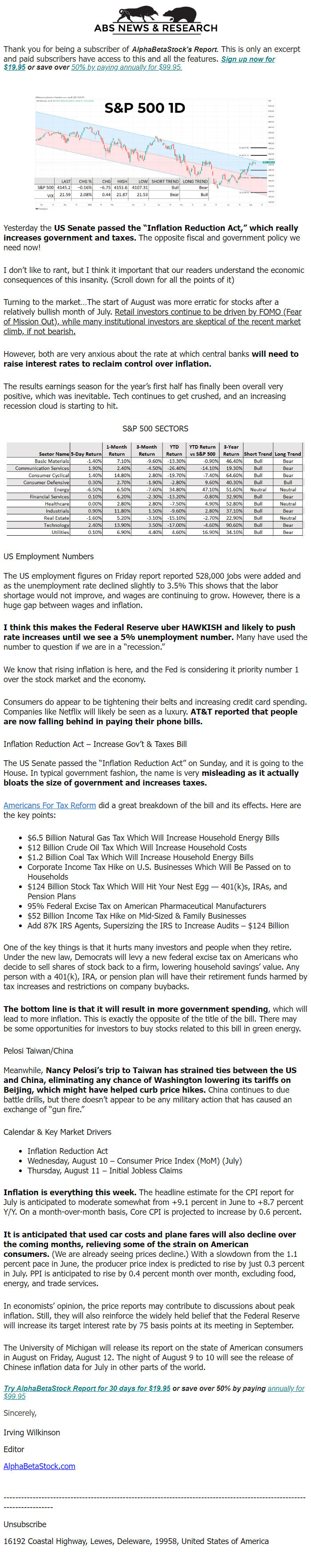

Turning to the market…The start of August was more erratic for

stocks after a relatively bullish month of July. Retail investors

continue to be driven by FOMO (Fear of Mission Out), while many

institutional investors are skeptical of the recent market climb, if

not bearish.

However, both are very anxious about the rate at which central banks

WILL NEED TO RAISE INTEREST RATES TO RECLAIM CONTROL OVER INFLATION.

The results earnings season for the year’s first half has finally

been overall very positive, which was inevitable. Tech continues to

get crushed, and an increasing recession cloud is starting to hit.

S&P 500 SECTORS

US EMPLOYMENT NUMBERS

The US employment figures on Friday report reported 528,000 jobs were

added and as the unemployment rate declined slightly to 3.5% This

shows that the labor shortage would not improve, and wages are

continuing to grow. However, there is a huge gap between wages and

inflation.

I THINK THIS MAKES THE FEDERAL RESERVE UBER HAWKISH AND LIKELY TO PUSH

RATE INCREASES UNTIL WE SEE A 5% UNEMPLOYMENT NUMBER. Many have used

the number to question if we are in a “recession.”

We know that rising inflation is here, and the Fed is considering it

priority number 1 over the stock market and the economy.

Consumers do appear to be tightening their belts and increasing credit

card spending. Companies like Netflix will likely be seen as a

luxury. AT&T REPORTED THAT PEOPLE ARE NOW FALLING BEHIND IN PAYING

THEIR PHONE BILLS.

INFLATION REDUCTION ACT – INCREASE GOV’T & TAXES BILL

The US Senate passed the “Inflation Reduction Act” on Sunday, and

it is going to the House. In typical government fashion, the name is

very MISLEADING AS IT ACTUALLY BLOATS THE SIZE OF GOVERNMENT AND

INCREASES TAXES.

Americans For Tax Reform

[[link removed]] did

a great breakdown of the bill and its effects. Here are the key

points:

* $6.5 Billion Natural Gas Tax Which Will Increase Household Energy

Bills

* $12 Billion Crude Oil Tax Which Will Increase Household Costs

* $1.2 Billion Coal Tax Which Will Increase Household Energy Bills

* Corporate Income Tax Hike on U.S. Businesses Which Will Be Passed

on to Households

* $124 Billion Stock Tax Which Will Hit Your Nest Egg — 401(k)s,

IRAs, and Pension Plans

* 95% Federal Excise Tax on American Pharmaceutical Manufacturers

* $52 Billion Income Tax Hike on Mid-Sized & Family Businesses

* Add 87K IRS Agents, Supersizing the IRS to Increase Audits – $124

Billion

One of the key things is that it hurts many investors and people when

they retire. Under the new law, Democrats will levy a new federal

excise tax on Americans who decide to sell shares of stock back to a

firm, lowering household savings’ value. Any person with a 401(k),

IRA, or pension plan will have their retirement funds harmed by tax

increases and restrictions on company buybacks.

THE BOTTOM LINE IS THAT IT WILL RESULT IN MORE GOVERNMENT SPENDING,

which will lead to more inflation. This is exactly the opposite of the

title of the bill. There may be some opportunities for investors to

buy stocks related to this bill in green energy.

PELOSI TAIWAN/CHINA

Meanwhile, NANCY PELOSI’S TRIP TO TAIWAN HAS STRAINED TIES BETWEEN

THE US AND CHINA, ELIMINATING ANY CHANCE OF WASHINGTON LOWERING ITS

TARIFFS ON BEIJING, WHICH MIGHT HAVE HELPED CURB PRICE HIKES. China

continues to due battle drills, but there doesn’t appear to be any

military action that has caused an exchange of “gun fire.”

CALENDAR & KEY MARKET DRIVERS

* Inflation Reduction Act

* Wednesday, August 10 – Consumer Price Index (MoM) (July)

* Thursday, August 11 – Initial Jobless Claims

INFLATION IS EVERYTHING THIS WEEK. The headline estimate for the CPI

report for July is anticipated to moderate somewhat from +9.1 percent

in June to +8.7 percent Y/Y. On a month-over-month basis, Core CPI is

projected to increase by 0.6 percent.

IT IS ANTICIPATED THAT USED CAR COSTS AND PLANE FARES WILL ALSO

DECLINE OVER THE COMING MONTHS, RELIEVING SOME OF THE STRAIN ON

AMERICAN CONSUMERS. (We are already seeing prices decline.) With a

slowdown from the 1.1 percent pace in June, the producer price index

is predicted to rise by just 0.3 percent in July. PPI is anticipated

to rise by 0.4 percent month over month, excluding food, energy, and

trade services.

In economists’ opinion, the price reports may contribute to

discussions about peak inflation. Still, they will also reinforce the

widely held belief that the Federal Reserve will increase its target

interest rate by 75 basis points at its meeting in September.

The University of Michigan will release its report on the state of

American consumers in August on Friday, August 12. The night of August

9 to 10 will see the release of Chinese inflation data for July in

other parts of the world.

_TRY ALPHABETASTOCK REPORT FOR 30 DAYS FOR $19.95_

[[link removed]]_ OR __SAVE

OVER 50% BY PAYING ANNUALLY FOR $99.95

[[link removed]]_

SINCERELY,

Irving Wilkinson

Editor

AlphaBetaStock.com [[link removed]]

-------------------------------------------------------------------------------------------------------------------------

Unsubscribe

[[link removed]]

16192 Coastal Highway, Lewes, Deleware, 19958, United States of

America

Spending and Taxes

Thank you for being a subscriber of _ALPHABETASTOCK'S REPORT._ This

is only an excerpt and paid subscribers have access to this and all

the features. _SIGN UP NOW FOR $19.95_

[[link removed]]_ OR __SAVE OVER 50% BY

PAYING ANNUALLY FOR $99.95

[[link removed]]__.

[[link removed]]_

Yesterday the US SENATE PASSED THE “INFLATION REDUCTION ACT,”

WHICH REALLY INCREASES GOVERNMENT AND TAXES. The opposite fiscal and

government policy we need now!

I don’t like to rant, but I think it important that our readers

understand the economic consequences of this insanity. (Scroll down

for all the points of it)

Turning to the market…The start of August was more erratic for

stocks after a relatively bullish month of July. Retail investors

continue to be driven by FOMO (Fear of Mission Out), while many

institutional investors are skeptical of the recent market climb, if

not bearish.

However, both are very anxious about the rate at which central banks

WILL NEED TO RAISE INTEREST RATES TO RECLAIM CONTROL OVER INFLATION.

The results earnings season for the year’s first half has finally

been overall very positive, which was inevitable. Tech continues to

get crushed, and an increasing recession cloud is starting to hit.

S&P 500 SECTORS

US EMPLOYMENT NUMBERS

The US employment figures on Friday report reported 528,000 jobs were

added and as the unemployment rate declined slightly to 3.5% This

shows that the labor shortage would not improve, and wages are

continuing to grow. However, there is a huge gap between wages and

inflation.

I THINK THIS MAKES THE FEDERAL RESERVE UBER HAWKISH AND LIKELY TO PUSH

RATE INCREASES UNTIL WE SEE A 5% UNEMPLOYMENT NUMBER. Many have used

the number to question if we are in a “recession.”

We know that rising inflation is here, and the Fed is considering it

priority number 1 over the stock market and the economy.

Consumers do appear to be tightening their belts and increasing credit

card spending. Companies like Netflix will likely be seen as a

luxury. AT&T REPORTED THAT PEOPLE ARE NOW FALLING BEHIND IN PAYING

THEIR PHONE BILLS.

INFLATION REDUCTION ACT – INCREASE GOV’T & TAXES BILL

The US Senate passed the “Inflation Reduction Act” on Sunday, and

it is going to the House. In typical government fashion, the name is

very MISLEADING AS IT ACTUALLY BLOATS THE SIZE OF GOVERNMENT AND

INCREASES TAXES.

Americans For Tax Reform

[[link removed]] did

a great breakdown of the bill and its effects. Here are the key

points:

* $6.5 Billion Natural Gas Tax Which Will Increase Household Energy

Bills

* $12 Billion Crude Oil Tax Which Will Increase Household Costs

* $1.2 Billion Coal Tax Which Will Increase Household Energy Bills

* Corporate Income Tax Hike on U.S. Businesses Which Will Be Passed

on to Households

* $124 Billion Stock Tax Which Will Hit Your Nest Egg — 401(k)s,

IRAs, and Pension Plans

* 95% Federal Excise Tax on American Pharmaceutical Manufacturers

* $52 Billion Income Tax Hike on Mid-Sized & Family Businesses

* Add 87K IRS Agents, Supersizing the IRS to Increase Audits – $124

Billion

One of the key things is that it hurts many investors and people when

they retire. Under the new law, Democrats will levy a new federal

excise tax on Americans who decide to sell shares of stock back to a

firm, lowering household savings’ value. Any person with a 401(k),

IRA, or pension plan will have their retirement funds harmed by tax

increases and restrictions on company buybacks.

THE BOTTOM LINE IS THAT IT WILL RESULT IN MORE GOVERNMENT SPENDING,

which will lead to more inflation. This is exactly the opposite of the

title of the bill. There may be some opportunities for investors to

buy stocks related to this bill in green energy.

PELOSI TAIWAN/CHINA

Meanwhile, NANCY PELOSI’S TRIP TO TAIWAN HAS STRAINED TIES BETWEEN

THE US AND CHINA, ELIMINATING ANY CHANCE OF WASHINGTON LOWERING ITS

TARIFFS ON BEIJING, WHICH MIGHT HAVE HELPED CURB PRICE HIKES. China

continues to due battle drills, but there doesn’t appear to be any

military action that has caused an exchange of “gun fire.”

CALENDAR & KEY MARKET DRIVERS

* Inflation Reduction Act

* Wednesday, August 10 – Consumer Price Index (MoM) (July)

* Thursday, August 11 – Initial Jobless Claims

INFLATION IS EVERYTHING THIS WEEK. The headline estimate for the CPI

report for July is anticipated to moderate somewhat from +9.1 percent

in June to +8.7 percent Y/Y. On a month-over-month basis, Core CPI is

projected to increase by 0.6 percent.

IT IS ANTICIPATED THAT USED CAR COSTS AND PLANE FARES WILL ALSO

DECLINE OVER THE COMING MONTHS, RELIEVING SOME OF THE STRAIN ON

AMERICAN CONSUMERS. (We are already seeing prices decline.) With a

slowdown from the 1.1 percent pace in June, the producer price index

is predicted to rise by just 0.3 percent in July. PPI is anticipated

to rise by 0.4 percent month over month, excluding food, energy, and

trade services.

In economists’ opinion, the price reports may contribute to

discussions about peak inflation. Still, they will also reinforce the

widely held belief that the Federal Reserve will increase its target

interest rate by 75 basis points at its meeting in September.

The University of Michigan will release its report on the state of

American consumers in August on Friday, August 12. The night of August

9 to 10 will see the release of Chinese inflation data for July in

other parts of the world.

_TRY ALPHABETASTOCK REPORT FOR 30 DAYS FOR $19.95_

[[link removed]]_ OR __SAVE

OVER 50% BY PAYING ANNUALLY FOR $99.95

[[link removed]]_

SINCERELY,

Irving Wilkinson

Editor

AlphaBetaStock.com [[link removed]]

-------------------------------------------------------------------------------------------------------------------------

Unsubscribe

[[link removed]]

16192 Coastal Highway, Lewes, Deleware, 19958, United States of

America

Message Analysis

- Sender: n/a

- Political Party: n/a

- Country: n/a

- State/Locality: n/a

- Office: n/a