| From | City of Auburn Maine <[email protected]> |

| Subject | A message from the Auburn City Manager |

| Date | August 5, 2022 9:34 PM |

Links have been removed from this email. Learn more in the FAQ.

Links have been removed from this email. Learn more in the FAQ.

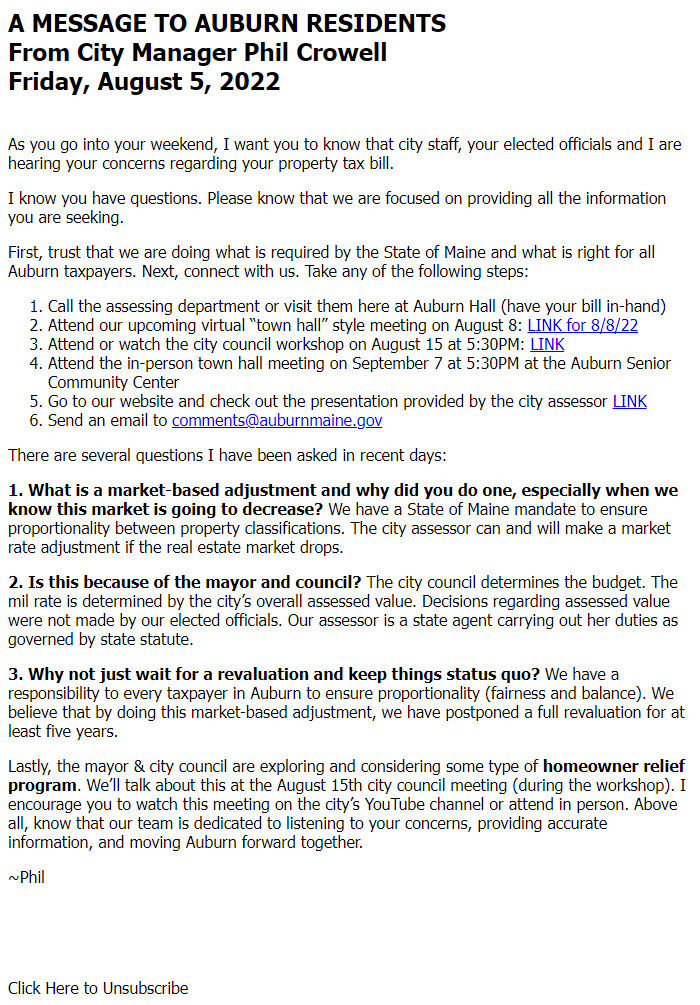

<h2><strong>A MESSAGE TO AUBURN RESIDENTS</strong><br />From City Manager Phil Crowell<br />Friday, August 5, 2022</h2>

<p><br />As you go into your weekend, I want you to know that city staff, your elected officials and I are hearing your concerns regarding your property tax bill.</p>

<p>I know you have questions. Please know that we are focused on providing all the information you are seeking.</p>

<p>First, trust that we are doing what is required by the State of Maine and what is right for all Auburn taxpayers. Next, connect with us. Take any of the following steps:</p>

<ul style="list-style-type: undefined;">

<li>Call the assessing department or visit them here at Auburn Hall (have your bill in-hand)</li>

<li>Attend our upcoming virtual “town hall” style meeting on August 8: <a href="[link removed]" target="_blank">LINK for 8/8/22</a></li>

<li>Attend or watch the city council workshop on August 15 at 5:30PM: <a href="[link removed]" target="_blank">LINK</a></li>

<li>Attend the in-person town hall meeting on September 7 at 5:30PM at the Auburn Senior Community Center</li>

<li>Go to our website and check out the presentation provided by the city assessor <a href="[link removed]" target="_blank">LINK</a></li>

<li>Send an email to <a href="mailto:[email protected]">[email protected]</a></li>

</ul>

<p>There are several questions I have been asked in recent days:</p>

<p><strong>1. What is a market-based adjustment and why did you do one, especially when we know this market is going to decrease?</strong> We have a State of Maine mandate to ensure proportionality between property classifications. The city assessor can and will make a market rate adjustment if the real estate market drops.</p>

<p><strong>2. Is this because of the mayor and council?</strong> The city council determines the budget. The mil rate is determined by the city’s overall assessed value. Decisions regarding assessed value were not made by our elected officials. Our assessor is a state agent carrying out her duties as governed by state statute.</p>

<p><strong>3. Why not just wait for a revaluation and keep things status quo?</strong> We have a responsibility to every taxpayer in Auburn to ensure proportionality (fairness and balance). We believe that by doing this market-based adjustment, we have postponed a full revaluation for at least five years.</p>

<p>Lastly, the mayor & city council are exploring and considering some type of <strong>homeowner relief program</strong>. We’ll talk about this at the August 15th city council meeting (during the workshop). I encourage you to watch this meeting on the city’s YouTube channel or attend in person. Above all, know that our team is dedicated to listening to your concerns, providing accurate information, and moving Auburn forward together.</p>

<p>~Phil</p>

<p></p>

Click Here to Unsubscribe: [link removed]

<p><br />As you go into your weekend, I want you to know that city staff, your elected officials and I are hearing your concerns regarding your property tax bill.</p>

<p>I know you have questions. Please know that we are focused on providing all the information you are seeking.</p>

<p>First, trust that we are doing what is required by the State of Maine and what is right for all Auburn taxpayers. Next, connect with us. Take any of the following steps:</p>

<ul style="list-style-type: undefined;">

<li>Call the assessing department or visit them here at Auburn Hall (have your bill in-hand)</li>

<li>Attend our upcoming virtual “town hall” style meeting on August 8: <a href="[link removed]" target="_blank">LINK for 8/8/22</a></li>

<li>Attend or watch the city council workshop on August 15 at 5:30PM: <a href="[link removed]" target="_blank">LINK</a></li>

<li>Attend the in-person town hall meeting on September 7 at 5:30PM at the Auburn Senior Community Center</li>

<li>Go to our website and check out the presentation provided by the city assessor <a href="[link removed]" target="_blank">LINK</a></li>

<li>Send an email to <a href="mailto:[email protected]">[email protected]</a></li>

</ul>

<p>There are several questions I have been asked in recent days:</p>

<p><strong>1. What is a market-based adjustment and why did you do one, especially when we know this market is going to decrease?</strong> We have a State of Maine mandate to ensure proportionality between property classifications. The city assessor can and will make a market rate adjustment if the real estate market drops.</p>

<p><strong>2. Is this because of the mayor and council?</strong> The city council determines the budget. The mil rate is determined by the city’s overall assessed value. Decisions regarding assessed value were not made by our elected officials. Our assessor is a state agent carrying out her duties as governed by state statute.</p>

<p><strong>3. Why not just wait for a revaluation and keep things status quo?</strong> We have a responsibility to every taxpayer in Auburn to ensure proportionality (fairness and balance). We believe that by doing this market-based adjustment, we have postponed a full revaluation for at least five years.</p>

<p>Lastly, the mayor & city council are exploring and considering some type of <strong>homeowner relief program</strong>. We’ll talk about this at the August 15th city council meeting (during the workshop). I encourage you to watch this meeting on the city’s YouTube channel or attend in person. Above all, know that our team is dedicated to listening to your concerns, providing accurate information, and moving Auburn forward together.</p>

<p>~Phil</p>

<p></p>

Click Here to Unsubscribe: [link removed]

Message Analysis

- Sender: City of Auburn, Maine

- Political Party: n/a

- Country: United States

- State/Locality: Maine Auburn, Maine

- Office: n/a