| From | Badger Institute <[email protected]> |

| Subject | Top Picks: Parents seeking higher standards |

| Date | July 22, 2022 11:03 AM |

Links have been removed from this email. Learn more in the FAQ.

Links have been removed from this email. Learn more in the FAQ.

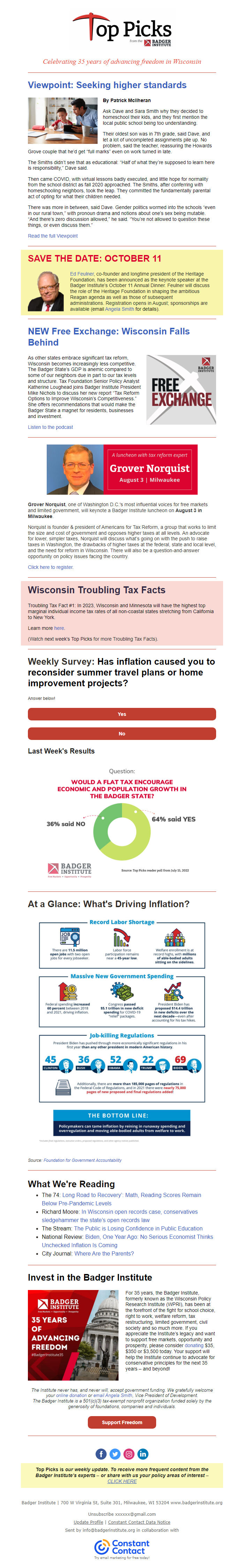

Annual Dinner speaker revealed, Wisconsin falls behind Celebrating 35 years of advancing freedom in Wisconsin Viewpoint: Seeking higher standards By Patrick McIlheran Ask Dave and Sara Smith why they decided to homeschool their kids, and they first mention the local public school being too understanding. Their oldest son was in 7th grade, said Dave, and let a lot of uncompleted assignments pile up. No problem, said the teacher, reassuring the Howards Grove couple that he’d get “full marks” even on work turned in late. The Smiths didn’t see that as educational: “Half of what they’re supposed to learn here is responsibility,” Dave said. Then came COVID, with virtual lessons badly executed, and little hope for normality from the school district as fall 2020 approached. The Smiths, after conferring with homeschooling neighbors, took the leap. They committed the fundamentally parental act of opting for what their children needed. There was more in between, said Dave. Gender politics wormed into the schools “even in our rural town,” with pronoun drama and notions about one’s sex being mutable. “And there’s zero discussion allowed,” he said. “You’re not allowed to question these things, or even discuss them.” Read the full Viewpoint SAVE THE DATE: OCTOBER 11 Ed Feulner, co-founder and longtime president of the Heritage Foundation, has been announced as the keynote speaker at the Badger Institute’s October 11 Annual Dinner. Feulner will discuss the role of the Heritage Foundation in shaping the ambitious Reagan agenda as well as those of subsequent administrations. Registration opens in August; sponsorships are available (email Angela Smith for details). NEW Free Exchange: Wisconsin Falls Behind As other states embrace significant tax reform, Wisconsin becomes increasingly less competitive. The Badger State’s GDP is anemic compared to some of our neighbors due in part to our tax levels and structure. Tax Foundation Senior Policy Analyst Katherine Loughead joins Badger Institute President Mike Nichols to discuss her new report “Tax Reform Options to Improve Wisconsin’s Competitiveness.” She offers recommendations that would make the Badger State a magnet for residents, businesses and investment. Listen to the podcast Grover Norquist, one of Washington D.C.'s most influential voices for free markets and limited government, will keynote a Badger Institute luncheon on August 3 in Milwaukee. Norquist is founder & president of Americans for Tax Reform, a group that works to limit the size and cost of government and opposes higher taxes at all levels. An advocate for lower, simpler taxes, Norquist will discuss what’s going on with the push to raise taxes in Washington, the drawbacks of higher taxes at the federal, state and local level, and the need for reform in Wisconsin. There will also be a question-and-answer opportunity on policy issues facing the country. Click here to register. Wisconsin Troubling Tax Facts Troubling Tax Fact #1: In 2023, Wisconsin and Minnesota will have the highest top marginal individual income tax rates of all non-coastal states stretching from California to New York. Learn more here. (Watch next week’s Top Picks for more Troubling Tax Facts). Weekly Survey: Has inflation caused you to reconsider summer travel plans or home improvement projects? Answer below! Yes No Last Week's Results At a Glance: What's Driving Inflation? Source: Foundation for Government Accountability What We're Reading The 74: Long Road to Recovery’: Math, Reading Scores Remain Below Pre-Pandemic Levels Richard Moore: In Wisconsin open records case, conservatives sledgehammer the state’s open records law The Stream: The Public is Losing Confidence in Public Education National Review: Biden, One Year Ago: No Serious Economist Thinks Unchecked Inflation Is Coming City Journal: Where Are the Parents? Invest in the Badger Institute For 35 years, the Badger Institute, formerly known as the Wisconsin Policy Research Institute (WPRI), has been at the forefront of the fight for school choice, right to work, welfare reform, tax restructuring, limited government, civil society and so much more. If you appreciate the Institute’s legacy and want to support free markets, opportunity and prosperity, please consider donating $35, $350 or $3,500 today. Your support will help the Institute continue to advocate for conservative principles for the next 35 years – and beyond! The Institute never has, and never will, accept government funding. We gratefully welcome your online donation or email Angela Smith, Vice President of Development. The Badger Institute is a 501(c)(3) tax-exempt nonprofit organization funded solely by the generosity of foundations, companies and individuals. Support Freedom Top Picks is our weekly update. To receive more frequent content from the Badger Institute’s experts – or share with us your policy areas of interest – CLICK HERE Badger Institute | 700 W Virginia St, Suite 301, Milwaukee, WI 53204 www.badgerinstitute.org Unsubscribe [email protected] Update Profile | Constant Contact Data Notice Sent by [email protected] in collaboration with Try email marketing for free today!

Message Analysis

- Sender: Badger Institute

- Political Party: n/a

- Country: United States

- State/Locality: Wisconsin

- Office: n/a

-

Email Providers:

- Constant Contact