| From | Texas Workforce Commission <[email protected]> |

| Subject | Texas Business Today - July 2022 |

| Date | July 14, 2022 2:57 PM |

Links have been removed from this email. Learn more in the FAQ.

Links have been removed from this email. Learn more in the FAQ.

Texas Business Today Header

Updates from the Office of the Commissioner Representing Employers

July Header

________________________________________________________________________

Dear Fellow Texans,

Welcome to your July issue of "Texas Business Today"! We are excited to continue our Texas Interns Unite! series of events in July!

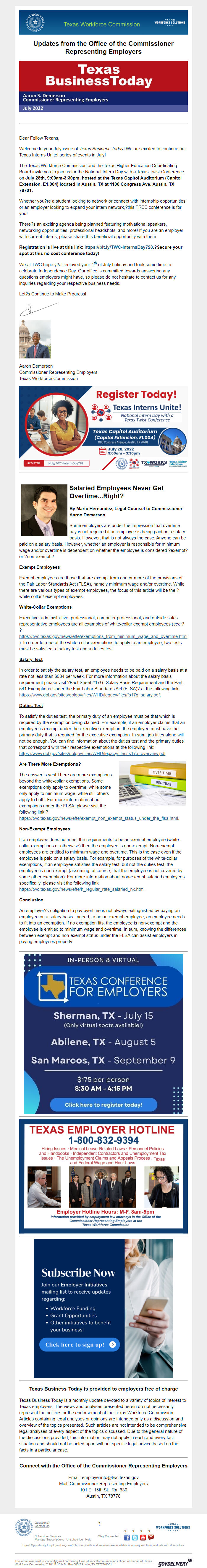

The Texas Workforce Commission and the Texas Higher Education Coordinating Board invite you to join us for the National Intern Day with a Texas Twist Conference on *July 28th, 9:00am-3:30pm, hosted at the Texas Capitol Auditorium (Capitol Extension, E1.004) located in Austin, TX at 1100 Congress Ave. Austin, TX 78701. *

Whether you?re a student looking to network or connect with internship opportunities, or an employer looking to expand your intern network,?this FREE conference is for you!

There?s an exciting agenda being planned featuring motivational speakers, networking opportunities, professional headshots, and more! If you are an employer with current interns, please share this beneficial opportunity with them.

*Registration is live at this link: [link removed] [ [link removed] ].?Secure your spot at this no cost conference today!*

We at TWC hope y?all enjoyed your 4th of July holiday and took some time to celebrate Independence Day. Our office is committed towards answering any questions employers might have, so please do not hesitate to contact us for any inquiries regarding your respective business needs.

Let?s Continue to Make Progress!

Commissioner Demerson signature and headshot

Aaron Demerson

Commissioner Representing Employers

Texas Workforce Commission

Texas Interns Unite [ [link removed] ]________________________________________________________________________

Mario Hernandez

Salaried Employees Never Get Overtime...Right?

*By Mario Hernandez, Legal Counsel to Commissioner Aaron Demerson*

Some employers are under the impression that overtime pay is not required if an employee is being paid on a salary basis. However, that is not always the case. Anyone can be paid on a salary basis. However, whether an employer is responsible for minimum wage and/or overtime is dependent on whether the employee is considered ?exempt? or ?non-exempt.?

*_Exempt Employees_*

Exempt employees are those that are exempt from one or more of the provisions of the Fair Labor Standards Act (FLSA), namely minimum wage and/or overtime. While there are various types of exempt employees, the focus of this article will be the ?white-collar? exempt employees.

*_White-Collar Exemptions_*

Executive, administrative, professional, computer professional, and outside sales representative employees are all examples of white-collar exempt employees ("see:? "?[link removed]). In order for one of the white-collar exemptions to apply to an employee, two tests must be satisfied: a salary test and a duties test.

*_Salary Test_*

In order to satisfy the salary test, an employee needs to be paid on a salary basis at a rate not less than $684 per week. For more information about the salary basis requirement please visit ?Fact Sheet #17G: Salary Basis Requirement and the Part 541 Exemptions Under the Fair Labor Standards Act (FLSA)? at the following link: [link removed].

*_Duties Test_*

To satisfy the duties test, the primary duty of an employee must be that which is required by the exemption being claimed. For example, if an employer claims that an employee is exempt under the executive exemption, the employee must have the primary duty that is required for the executive exemption. In sum, job titles alone will not be enough. You can find information about the duties test and the primary duties that correspond with their respective exemptions at the following link: [link removed].

overtime

*_Are There More Exemptions?_*

The answer is yes! There are more exemptions beyond the white-collar exemptions. Some exemptions only apply to overtime, while some only apply to minimum wage, while still others apply to both. For more information about exemptions under the FLSA, please visit the following link:? [link removed]

*_Non-Exempt Employees_*

If an employee does not meet the requirements to be an exempt employee (white-collar exemptions or otherwise) then the employee is non-exempt. Non-exempt employees are entitled to minimum wage and overtime. This is the case even if the employee is paid on a salary basis. For example, for purposes of the white-collar exemptions, if an employee satisfies the salary test, but not the duties test, the employee is non-exempt (assuming, of course, that the employee is not covered by some other exemption). For more information about non-exempt salaried employees specifically, please visit the following link: [link removed].

*_Conclusion_*

An employer?s obligation to pay overtime is not always extinguished by paying an employee on a salary basis. Indeed, to be an exempt employee, an employee needs to fit into an exemption. If no exemption fits, the employee is non-exempt and the employee is entitled to minimum wage and overtime. In sum, knowing the differences between exempt and non-exempt status under the FLSA can assist employers in paying employees properly.

________________________________________________________________________

Texas Conference for Employers [ [link removed] ]

________________________________________________________________________

Employer Hotline

________________________________________________________________________

Employer Initiatives [ [link removed] ]

________________________________________________________________________

Texas Business Today is provided to employers free of charge

Texas Business Today is a monthly update devoted to a variety of topics of interest to Texas employers. The views and analyses presented herein do not necessarily represent the policies or the endorsement of the Texas Workforce Commission. Articles containing legal analyses or opinions are intended only as a discussion and overview of the topics presented. Such articles are not intended to be comprehensive legal analyses of every aspect of the topics discussed. Due to the general nature of the discussions provided, this information may not apply in each and every fact situation and should not be acted upon without specific legal advice based on the facts in a particular case.

________________________________________________________________________

Connect with the Office of the Commissioner Representing Employers

Email: [email protected]

Mail: Commissioner Representing Employers

101 E. 15th St., Rm 630

Austin, TX 78778

Texas Workforce Commission Questions?

Contact Us [ [link removed] ] ?

?

?

?

?

Texas Workforce Solutions Subscriber Services:

Manage Subscriptions [ [link removed] ] | Unsubscribe [ [link removed] ] | Help [ [link removed] ] Stay Connected: Facebook [ [link removed] ] Twitter [ [link removed] ] Youtube [ [link removed] ] GovDelivery [ [link removed] ]

Equal Opportunity Employer/Program.? Auxiliary aids and services are available upon request to individuals with disabilities.

________________________________________________________________________

This email was sent to [email protected] using GovDelivery Communications Cloud on behalf of: Texas Workforce Commission ? 101 E 15th St, Rm 665 ? Austin, TX 78778-0001 GovDelivery logo [ [link removed] ]

Updates from the Office of the Commissioner Representing Employers

July Header

________________________________________________________________________

Dear Fellow Texans,

Welcome to your July issue of "Texas Business Today"! We are excited to continue our Texas Interns Unite! series of events in July!

The Texas Workforce Commission and the Texas Higher Education Coordinating Board invite you to join us for the National Intern Day with a Texas Twist Conference on *July 28th, 9:00am-3:30pm, hosted at the Texas Capitol Auditorium (Capitol Extension, E1.004) located in Austin, TX at 1100 Congress Ave. Austin, TX 78701. *

Whether you?re a student looking to network or connect with internship opportunities, or an employer looking to expand your intern network,?this FREE conference is for you!

There?s an exciting agenda being planned featuring motivational speakers, networking opportunities, professional headshots, and more! If you are an employer with current interns, please share this beneficial opportunity with them.

*Registration is live at this link: [link removed] [ [link removed] ].?Secure your spot at this no cost conference today!*

We at TWC hope y?all enjoyed your 4th of July holiday and took some time to celebrate Independence Day. Our office is committed towards answering any questions employers might have, so please do not hesitate to contact us for any inquiries regarding your respective business needs.

Let?s Continue to Make Progress!

Commissioner Demerson signature and headshot

Aaron Demerson

Commissioner Representing Employers

Texas Workforce Commission

Texas Interns Unite [ [link removed] ]________________________________________________________________________

Mario Hernandez

Salaried Employees Never Get Overtime...Right?

*By Mario Hernandez, Legal Counsel to Commissioner Aaron Demerson*

Some employers are under the impression that overtime pay is not required if an employee is being paid on a salary basis. However, that is not always the case. Anyone can be paid on a salary basis. However, whether an employer is responsible for minimum wage and/or overtime is dependent on whether the employee is considered ?exempt? or ?non-exempt.?

*_Exempt Employees_*

Exempt employees are those that are exempt from one or more of the provisions of the Fair Labor Standards Act (FLSA), namely minimum wage and/or overtime. While there are various types of exempt employees, the focus of this article will be the ?white-collar? exempt employees.

*_White-Collar Exemptions_*

Executive, administrative, professional, computer professional, and outside sales representative employees are all examples of white-collar exempt employees ("see:? "?[link removed]). In order for one of the white-collar exemptions to apply to an employee, two tests must be satisfied: a salary test and a duties test.

*_Salary Test_*

In order to satisfy the salary test, an employee needs to be paid on a salary basis at a rate not less than $684 per week. For more information about the salary basis requirement please visit ?Fact Sheet #17G: Salary Basis Requirement and the Part 541 Exemptions Under the Fair Labor Standards Act (FLSA)? at the following link: [link removed].

*_Duties Test_*

To satisfy the duties test, the primary duty of an employee must be that which is required by the exemption being claimed. For example, if an employer claims that an employee is exempt under the executive exemption, the employee must have the primary duty that is required for the executive exemption. In sum, job titles alone will not be enough. You can find information about the duties test and the primary duties that correspond with their respective exemptions at the following link: [link removed].

overtime

*_Are There More Exemptions?_*

The answer is yes! There are more exemptions beyond the white-collar exemptions. Some exemptions only apply to overtime, while some only apply to minimum wage, while still others apply to both. For more information about exemptions under the FLSA, please visit the following link:? [link removed]

*_Non-Exempt Employees_*

If an employee does not meet the requirements to be an exempt employee (white-collar exemptions or otherwise) then the employee is non-exempt. Non-exempt employees are entitled to minimum wage and overtime. This is the case even if the employee is paid on a salary basis. For example, for purposes of the white-collar exemptions, if an employee satisfies the salary test, but not the duties test, the employee is non-exempt (assuming, of course, that the employee is not covered by some other exemption). For more information about non-exempt salaried employees specifically, please visit the following link: [link removed].

*_Conclusion_*

An employer?s obligation to pay overtime is not always extinguished by paying an employee on a salary basis. Indeed, to be an exempt employee, an employee needs to fit into an exemption. If no exemption fits, the employee is non-exempt and the employee is entitled to minimum wage and overtime. In sum, knowing the differences between exempt and non-exempt status under the FLSA can assist employers in paying employees properly.

________________________________________________________________________

Texas Conference for Employers [ [link removed] ]

________________________________________________________________________

Employer Hotline

________________________________________________________________________

Employer Initiatives [ [link removed] ]

________________________________________________________________________

Texas Business Today is provided to employers free of charge

Texas Business Today is a monthly update devoted to a variety of topics of interest to Texas employers. The views and analyses presented herein do not necessarily represent the policies or the endorsement of the Texas Workforce Commission. Articles containing legal analyses or opinions are intended only as a discussion and overview of the topics presented. Such articles are not intended to be comprehensive legal analyses of every aspect of the topics discussed. Due to the general nature of the discussions provided, this information may not apply in each and every fact situation and should not be acted upon without specific legal advice based on the facts in a particular case.

________________________________________________________________________

Connect with the Office of the Commissioner Representing Employers

Email: [email protected]

Mail: Commissioner Representing Employers

101 E. 15th St., Rm 630

Austin, TX 78778

Texas Workforce Commission Questions?

Contact Us [ [link removed] ] ?

?

?

?

?

Texas Workforce Solutions Subscriber Services:

Manage Subscriptions [ [link removed] ] | Unsubscribe [ [link removed] ] | Help [ [link removed] ] Stay Connected: Facebook [ [link removed] ] Twitter [ [link removed] ] Youtube [ [link removed] ] GovDelivery [ [link removed] ]

Equal Opportunity Employer/Program.? Auxiliary aids and services are available upon request to individuals with disabilities.

________________________________________________________________________

This email was sent to [email protected] using GovDelivery Communications Cloud on behalf of: Texas Workforce Commission ? 101 E 15th St, Rm 665 ? Austin, TX 78778-0001 GovDelivery logo [ [link removed] ]

Message Analysis

- Sender: Texas Workforce Commission

- Political Party: n/a

- Country: United States

- State/Locality: Texas

- Office: n/a

-

Email Providers:

- govDelivery