| From | Internal Revenue Service (IRS) <[email protected]> |

| Subject | e-News for Tax Professionals 2022-24 |

| Date | June 17, 2022 7:41 PM |

Links have been removed from this email. Learn more in the FAQ.

Links have been removed from this email. Learn more in the FAQ.

Bookmark and Share [ [link removed] ]

a { color:#0073AF !important;} a:hover { color:#004673 !important;}

IRS.gov Banner

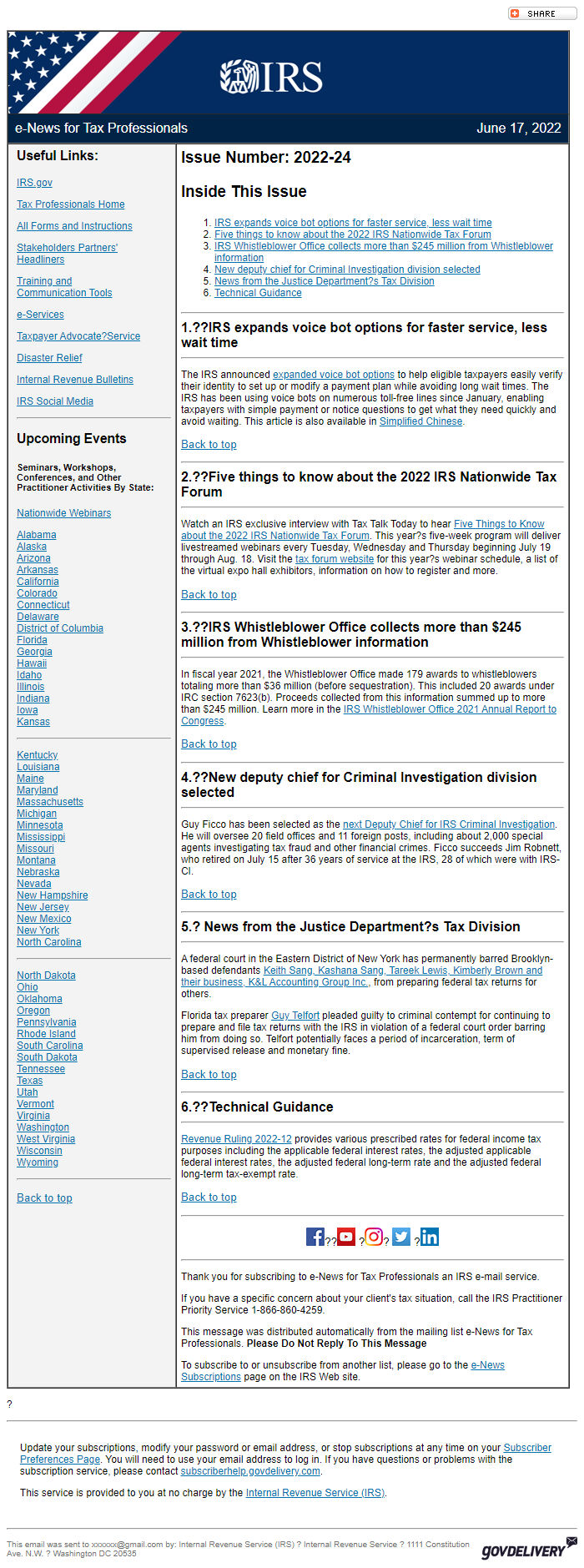

e-News for Tax Professionals June 17, 2022

Useful Links:

IRS.gov [ [link removed] ]

Tax Professionals Home [ [link removed] ]

All Forms and Instructions [ [link removed] ]

Stakeholders Partners' [ [link removed] ]

Headliners [ [link removed] ]

Training and [ [link removed] ]

Communication Tools [ [link removed] ]

e-Services [ [link removed] ]

Taxpayer Advocate?Service [ [link removed] ]

Disaster Relief [ [link removed] ]

Internal Revenue Bulletins [ [link removed] ]

IRS Social Media [ [link removed] ]

________________________________________________________________________

Upcoming Events

Seminars, Workshops, Conferences, and Other Practitioner Activities By State:

Nationwide Webinars [ [link removed] ]

Alabama [ [link removed] ]

Alaska [ [link removed] ]

Arizona [ [link removed] ]

Arkansas [ [link removed] ]

California [ [link removed] ]

Colorado [ [link removed] ]

Connecticut [ [link removed] ]

Delaware [ [link removed] ]

District of Columbia [ [link removed] ]

Florida [ [link removed] ]

Georgia [ [link removed] ]

Hawaii [ [link removed] ]

Idaho [ [link removed] ]

Illinois [ [link removed] ]

Indiana [ [link removed] ]

Iowa [ [link removed] ]

Kansas [ [link removed] ]

________________________________________________________________________

Kentucky [ [link removed] ]

Louisiana [ [link removed] ]

Maine [ [link removed] ]

Maryland [ [link removed] ]

Massachusetts [ [link removed] ]

Michigan [ [link removed] ]

Minnesota [ [link removed] ]

Mississippi [ [link removed] ]

Missouri [ [link removed] ]

Montana [ [link removed] ]

Nebraska [ [link removed] ]

Nevada [ [link removed] ]

New Hampshire [ [link removed] ]

New Jersey [ [link removed] ]

New Mexico [ [link removed] ]

New York [ [link removed] ]

North Carolina [ [link removed] ]

________________________________________________________________________

North Dakota [ [link removed] ]

Ohio [ [link removed] ]

Oklahoma [ [link removed] ]

Oregon [ [link removed] ]

Pennsylvania [ [link removed] ]

Rhode Island [ [link removed] ]

South Carolina [ [link removed] ]

South Dakota [ [link removed] ]

Tennessee [ [link removed] ]

Texas [ [link removed] ]

Utah [ [link removed] ]

Vermont [ [link removed] ]

Virginia [ [link removed] ]

Washington [ [link removed] ]

West Virginia [ [link removed] ]

Wisconsin [ [link removed] ]

Wyoming [ [link removed] ]

________________________________________________________________________

Back to top [ #top ]

Issue Number: 2022-24

Inside This Issue

* IRS expands voice bot options for faster service, less wait time [ #First ]

* Five things to know about the 2022 IRS Nationwide Tax Forum [ #Second ]

* IRS Whistleblower Office collects more than $245 million from Whistleblower information [ #Third ]

* New deputy chief for Criminal Investigation division selected [ #Fourth ]

* News from the Justice Department?s Tax Division [ #Fifth ]

* Technical Guidance [ #Sixth ]

________________________________________________________________________

*1.??IRS expands voice bot options for faster service, less wait time*________________________________________________________________________

The IRS announced expanded voice bot options [ [link removed] ] to help eligible taxpayers easily verify their identity to set up or modify a payment plan while avoiding long wait times. The IRS has been using voice bots on numerous toll-free lines since January, enabling taxpayers with simple payment or notice questions to get what they need quickly and avoid waiting. This article is also available in Simplified Chinese [ [link removed] ].

Back to top [ #top ]

________________________________________________________________________

*2.??Five things to know about the 2022 IRS Nationwide Tax Forum*________________________________________________________________________

Watch an IRS exclusive interview with Tax Talk Today to hear Five Things to Know about the 2022 IRS Nationwide Tax Forum [ [link removed] ]. This year?s five-week program will deliver livestreamed webinars every Tuesday, Wednesday and Thursday beginning July 19 through Aug. 18. Visit the tax forum website [ [link removed] ] for this year?s webinar schedule, a list of the virtual expo hall exhibitors, information on how to register and more.

Back to top [ #top ]

________________________________________________________________________

*3.??IRS Whistleblower Office collects more than $245 million from Whistleblower information*________________________________________________________________________

In fiscal year 2021, the Whistleblower Office made 179 awards to whistleblowers totaling more than $36 million (before sequestration). This included 20 awards under IRC section 7623(b). Proceeds collected from this information summed up to more than $245 million. Learn more in the IRS Whistleblower Office 2021 Annual Report to Congress [ [link removed] ].

Back to top [ #top ]

________________________________________________________________________

*4.??New deputy chief for Criminal Investigation division selected*________________________________________________________________________

Guy Ficco has been selected as the next Deputy Chief for IRS Criminal Investigation [ [link removed] ]. He will oversee 20 field offices and 11 foreign posts, including about 2,000 special agents investigating tax fraud and other financial crimes. Ficco succeeds Jim Robnett, who retired on July 15 after 36 years of service at the IRS, 28 of which were with IRS-CI.

Back to top [ #top ]

________________________________________________________________________

*5.? News from the Justice Department?s Tax Division*________________________________________________________________________

A federal court in the Eastern District of New York has permanently barred Brooklyn-based defendants Keith Sang, Kashana Sang, Tareek Lewis, Kimberly Brown and their business, K&L Accounting Group Inc. [ [link removed] ], from preparing federal tax returns for others.

Florida tax preparer Guy Telfort [ [link removed] ] pleaded guilty to criminal contempt for continuing to prepare and file tax returns with the IRS in violation of a federal court order barring him from doing so. Telfort potentially faces a period of incarceration, term of supervised release and monetary fine.

Back to top [ #top ]

________________________________________________________________________

*6.??Technical Guidance*________________________________________________________________________

Revenue Ruling 2022-12 [ [link removed] ] provides various prescribed rates for federal income tax purposes including the applicable federal interest rates, the adjusted applicable federal interest rates, the adjusted federal long-term rate and the adjusted federal long-term tax-exempt rate.

Back to top [ #top ]

________________________________________________________________________

FaceBook Logo [ [link removed] ]??YouTube Logo [ [link removed] ] ?Instagram Logo [ [link removed] ]? Twitter Logo [ [link removed] ] ?LinkedIn Logo [ [link removed] ]

________________________________________________________________________

Thank you for subscribing to e-News for Tax Professionals an IRS e-mail service.

If you have a specific concern about your client's tax situation, call the IRS Practitioner Priority Service 1-866-860-4259.

This message was distributed automatically from the mailing list e-News for Tax Professionals. *Please Do Not Reply To This Message *

To subscribe to or unsubscribe from another list, please go to the e-News Subscriptions [ [link removed] ] page on the IRS Web site.

?

________________________________________________________________________

Update your subscriptions, modify your password or email address, or stop subscriptions at any time on your Subscriber Preferences Page [ [link removed] ]. You will need to use your email address to log in. If you have questions or problems with the subscription service, please contact subscriberhelp.govdelivery.com [ [link removed] ].

This service is provided to you at no charge by the Internal Revenue Service (IRS) [ [link removed] ].

body .abe-column-block {min-height: 5px;} ________________________________________________________________________

This email was sent to [email protected] by: Internal Revenue Service (IRS) ? Internal Revenue Service ? 1111 Constitution Ave. N.W. ? Washington DC 20535 GovDelivery logo [ [link removed] ]

a { color:#0073AF !important;} a:hover { color:#004673 !important;}

IRS.gov Banner

e-News for Tax Professionals June 17, 2022

Useful Links:

IRS.gov [ [link removed] ]

Tax Professionals Home [ [link removed] ]

All Forms and Instructions [ [link removed] ]

Stakeholders Partners' [ [link removed] ]

Headliners [ [link removed] ]

Training and [ [link removed] ]

Communication Tools [ [link removed] ]

e-Services [ [link removed] ]

Taxpayer Advocate?Service [ [link removed] ]

Disaster Relief [ [link removed] ]

Internal Revenue Bulletins [ [link removed] ]

IRS Social Media [ [link removed] ]

________________________________________________________________________

Upcoming Events

Seminars, Workshops, Conferences, and Other Practitioner Activities By State:

Nationwide Webinars [ [link removed] ]

Alabama [ [link removed] ]

Alaska [ [link removed] ]

Arizona [ [link removed] ]

Arkansas [ [link removed] ]

California [ [link removed] ]

Colorado [ [link removed] ]

Connecticut [ [link removed] ]

Delaware [ [link removed] ]

District of Columbia [ [link removed] ]

Florida [ [link removed] ]

Georgia [ [link removed] ]

Hawaii [ [link removed] ]

Idaho [ [link removed] ]

Illinois [ [link removed] ]

Indiana [ [link removed] ]

Iowa [ [link removed] ]

Kansas [ [link removed] ]

________________________________________________________________________

Kentucky [ [link removed] ]

Louisiana [ [link removed] ]

Maine [ [link removed] ]

Maryland [ [link removed] ]

Massachusetts [ [link removed] ]

Michigan [ [link removed] ]

Minnesota [ [link removed] ]

Mississippi [ [link removed] ]

Missouri [ [link removed] ]

Montana [ [link removed] ]

Nebraska [ [link removed] ]

Nevada [ [link removed] ]

New Hampshire [ [link removed] ]

New Jersey [ [link removed] ]

New Mexico [ [link removed] ]

New York [ [link removed] ]

North Carolina [ [link removed] ]

________________________________________________________________________

North Dakota [ [link removed] ]

Ohio [ [link removed] ]

Oklahoma [ [link removed] ]

Oregon [ [link removed] ]

Pennsylvania [ [link removed] ]

Rhode Island [ [link removed] ]

South Carolina [ [link removed] ]

South Dakota [ [link removed] ]

Tennessee [ [link removed] ]

Texas [ [link removed] ]

Utah [ [link removed] ]

Vermont [ [link removed] ]

Virginia [ [link removed] ]

Washington [ [link removed] ]

West Virginia [ [link removed] ]

Wisconsin [ [link removed] ]

Wyoming [ [link removed] ]

________________________________________________________________________

Back to top [ #top ]

Issue Number: 2022-24

Inside This Issue

* IRS expands voice bot options for faster service, less wait time [ #First ]

* Five things to know about the 2022 IRS Nationwide Tax Forum [ #Second ]

* IRS Whistleblower Office collects more than $245 million from Whistleblower information [ #Third ]

* New deputy chief for Criminal Investigation division selected [ #Fourth ]

* News from the Justice Department?s Tax Division [ #Fifth ]

* Technical Guidance [ #Sixth ]

________________________________________________________________________

*1.??IRS expands voice bot options for faster service, less wait time*________________________________________________________________________

The IRS announced expanded voice bot options [ [link removed] ] to help eligible taxpayers easily verify their identity to set up or modify a payment plan while avoiding long wait times. The IRS has been using voice bots on numerous toll-free lines since January, enabling taxpayers with simple payment or notice questions to get what they need quickly and avoid waiting. This article is also available in Simplified Chinese [ [link removed] ].

Back to top [ #top ]

________________________________________________________________________

*2.??Five things to know about the 2022 IRS Nationwide Tax Forum*________________________________________________________________________

Watch an IRS exclusive interview with Tax Talk Today to hear Five Things to Know about the 2022 IRS Nationwide Tax Forum [ [link removed] ]. This year?s five-week program will deliver livestreamed webinars every Tuesday, Wednesday and Thursday beginning July 19 through Aug. 18. Visit the tax forum website [ [link removed] ] for this year?s webinar schedule, a list of the virtual expo hall exhibitors, information on how to register and more.

Back to top [ #top ]

________________________________________________________________________

*3.??IRS Whistleblower Office collects more than $245 million from Whistleblower information*________________________________________________________________________

In fiscal year 2021, the Whistleblower Office made 179 awards to whistleblowers totaling more than $36 million (before sequestration). This included 20 awards under IRC section 7623(b). Proceeds collected from this information summed up to more than $245 million. Learn more in the IRS Whistleblower Office 2021 Annual Report to Congress [ [link removed] ].

Back to top [ #top ]

________________________________________________________________________

*4.??New deputy chief for Criminal Investigation division selected*________________________________________________________________________

Guy Ficco has been selected as the next Deputy Chief for IRS Criminal Investigation [ [link removed] ]. He will oversee 20 field offices and 11 foreign posts, including about 2,000 special agents investigating tax fraud and other financial crimes. Ficco succeeds Jim Robnett, who retired on July 15 after 36 years of service at the IRS, 28 of which were with IRS-CI.

Back to top [ #top ]

________________________________________________________________________

*5.? News from the Justice Department?s Tax Division*________________________________________________________________________

A federal court in the Eastern District of New York has permanently barred Brooklyn-based defendants Keith Sang, Kashana Sang, Tareek Lewis, Kimberly Brown and their business, K&L Accounting Group Inc. [ [link removed] ], from preparing federal tax returns for others.

Florida tax preparer Guy Telfort [ [link removed] ] pleaded guilty to criminal contempt for continuing to prepare and file tax returns with the IRS in violation of a federal court order barring him from doing so. Telfort potentially faces a period of incarceration, term of supervised release and monetary fine.

Back to top [ #top ]

________________________________________________________________________

*6.??Technical Guidance*________________________________________________________________________

Revenue Ruling 2022-12 [ [link removed] ] provides various prescribed rates for federal income tax purposes including the applicable federal interest rates, the adjusted applicable federal interest rates, the adjusted federal long-term rate and the adjusted federal long-term tax-exempt rate.

Back to top [ #top ]

________________________________________________________________________

FaceBook Logo [ [link removed] ]??YouTube Logo [ [link removed] ] ?Instagram Logo [ [link removed] ]? Twitter Logo [ [link removed] ] ?LinkedIn Logo [ [link removed] ]

________________________________________________________________________

Thank you for subscribing to e-News for Tax Professionals an IRS e-mail service.

If you have a specific concern about your client's tax situation, call the IRS Practitioner Priority Service 1-866-860-4259.

This message was distributed automatically from the mailing list e-News for Tax Professionals. *Please Do Not Reply To This Message *

To subscribe to or unsubscribe from another list, please go to the e-News Subscriptions [ [link removed] ] page on the IRS Web site.

?

________________________________________________________________________

Update your subscriptions, modify your password or email address, or stop subscriptions at any time on your Subscriber Preferences Page [ [link removed] ]. You will need to use your email address to log in. If you have questions or problems with the subscription service, please contact subscriberhelp.govdelivery.com [ [link removed] ].

This service is provided to you at no charge by the Internal Revenue Service (IRS) [ [link removed] ].

body .abe-column-block {min-height: 5px;} ________________________________________________________________________

This email was sent to [email protected] by: Internal Revenue Service (IRS) ? Internal Revenue Service ? 1111 Constitution Ave. N.W. ? Washington DC 20535 GovDelivery logo [ [link removed] ]

Message Analysis

- Sender: Internal Revenue Service

- Political Party: n/a

- Country: United States

- State/Locality: n/a

- Office: n/a

-

Email Providers:

- govDelivery