| From | Center for Jobs and the Economy <[email protected]> |

| Subject | California Energy Price Data for May 2022 |

| Date | June 6, 2022 9:00 PM |

Links have been removed from this email. Learn more in the FAQ.

Links have been removed from this email. Learn more in the FAQ.

Web Version [link removed] | Update Preferences [link removed] [link removed] California Energy Price Data

May 2022

Below are the monthly updates from the most current May 2022 fuel price data (GasBuddy.com) and March 2022 electricity and natural gas price data (US Energy Information Administration). To view additional data and analysis related to the California economy, visit our website at [[link removed]].

Energy costs continued rising across the board in the latest data. While the fuel cost gaps (as indicated by the shift to blue) show marginal improvement over prior months, this outcome only comes as global crude prices driven by Russia’s war on Ukraine affect fuel costs throughout the country. Compared to a year ago, the price gap between California and the rest of the states rose from $1.22 a gallon in May 2021 to the $1.60 shown below for May 2022. The diesel price gap went from $1.05 a gallon to $1.11 in the latest results. Even in an intense inflationary period, California’s regulations continue to affect prices paid by Californians to a greater extent.

The effects on natural gas and electricity were also pronounced and again broke new barriers. Residential natural gas rate rose from 4th to 3rd highest among the contiguous states. Residential electricity rates remained the highest among the contiguous states but also rose above Alaska’s to the point where now only Hawaii is more costly.

Both gasoline and diesel reached new highs in our tracking series, but with prices continuing to rise since the May data. In the latest results from CSAA [[link removed]], gasoline on June 5 averaged $6.326 in California compared to $4.848 in the US. Within the state, average prices ranged from $6.062 in Imperial County to $7.147 in Mono County.

Soaring inflation and the role played by rising fuel costs have sharpened the focus on both the state and federal levels on the need to provide some form of relief, with proposals ranging from fuel tax holidays to direct assistance for varying subsets of households. In California, the two primary proposals on the table appear to be: (1) the governor’s May Revise proposal for $12.7 billion composed of $11.5 billion in vehicle registration rebates, $750 million for 3 months of free public transit, and $439 million over two years to pause the general fund portion of the diesel fuel and (2) the recent June 1 counter-proposal from legislative Democrats of $8 billion for BFF (Better for Families) tax rebates to specified households and for increased benefits under CalWORKS and SSI/SSP.

These proposals are being driven by the sharp rise that turned fuel prices into a headline issue. California, however, has been subjected to these cost pressures for a much longer period of time, not as the result of Russian predatory actions but from deliberate policy and regulatory decisions to push fuel costs well above the national average.

To put the relative effects in perspective, inflation first breached the 3% annual rate in April 2021. Using the GasBuddy monthly average prices and net monthly gasoline sales [[link removed]] from Department of Tax and Fee Administration, Californians paid about an additional $7.4 billion between April 2021 and February 2022 due to rising gasoline prices. In this same period, they paid far more due to the regulations and policies driving costs even higher in this state—$16.8 billion more in this 11-month period when comparing the price difference between California and the rest of the states, of which about $3.4 billion was due to the difference in gasoline taxes.

Note that these costs are estimates and are based on the price differences for retail sales of regular unleaded, the primary gasoline sold in the state, and total net gasoline sold. The estimates shown assume these margins are similar for other grades and sales channels, but any differences from this assumption would have only a minor effect on the results.

The monthly sales data also is only currently available through February, or just short of the price spikes that began in March. The costs paid due to rising prices have since grown even with likely cutbacks in gasoline purchases, but so has the amount paid due to California policies as the gap has also widened in this period. Using the 2021 monthly data to estimate sales through May, including these months would bring the additional amount paid by Californians to $14.3 billion to date due to the rising price, and $22.7 billion for the differential due to California regulations.

But with these caveats, the point of these calculations is that Californians have been in a cost-of-living crisis driven by state decisions for far longer than the current pressures coming from inflation. Yet the current proposals are to produce only temporary relief to deal with the portion that has reached the headlines, without more deliberate actions to stem the constantly rising costs coming from state energy policies. Fuel prices are only the most visible at the moment. As detailed below, rising electricity and natural gas costs add to the household and employer pain as well, with state electricity prices alone now adding $23.1 billion annually to the cost of being in California compared to the average for the rest of the states.

The current relief proposals attempt to deal with an immediate cost challenge to Californians but do so only in a transitory way. But global oil markets are in the process of recovery [[link removed]]. Prices can come down with new supply. But the more fundamental drivers and far larger effect of rising fuel and more broadly all energy costs in California will continue unabated long after the headline attention has passed.

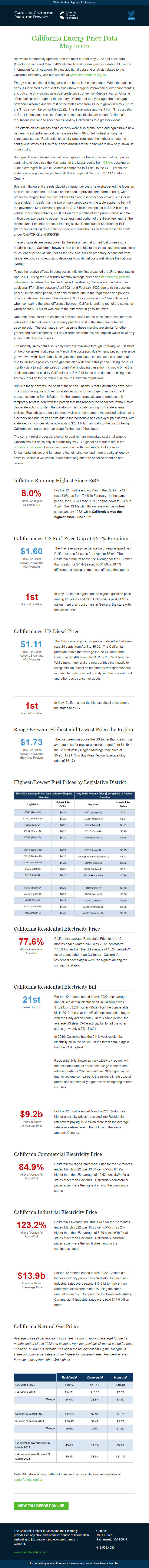

Inflation Running Highest Since 1982 8.0% Annual Change in

California CPI

For the 12 months ending March, the California CPI rose 8.0%, up from 7.4% in February. In the same period, the US CPI rose 8.5%, edging down to 8.3% in April. The US March inflation rate was the highest since January 1982, while California’s was the highest since June 1982.

California vs. US Fuel Price Gap at 36.1% Premium $1.60 Price Per Gallon

Above US Average

(CA Average)

The May average price per gallon of regular gasoline in California rose 31 cents from April to $6.04. The California premium above the average for the US other than California ($4.44) eased to $1.60, a 36.1% difference, as rising crude prices affected the country.

1st Ranked by Price

In May, California again had the highest gasoline price among the states and DC. Californians paid $1.97 a gallon more than consumers in Georgia, the state with the lowest price.

California vs. US Diesel Price $1.11 Price Per Gallon

Above US Average

(CA Average)

The May average price per gallon of diesel in California rose 24 cents from April to $6.60. The California premium above the average for the US other than California ($5.48) eased to $1.11, a 20.3% difference. While fuels in general are now contributing heavily to rising inflation, diesel as the primary transportation fuel in particular gets reflected quickly into the costs of food and other basic consumer goods.

1st Ranked by Price

In May, California had the highest diesel price among the states and DC.

Range Between Highest and Lowest Prices by Region $1.73 Price Per Gallon

Above US Average

(Bay Area Region)

The cost premium above the US (other than California) average price for regular gasoline ranged from $1.49 in the Central Valley Region (average May price of $5.93), to $1.73 in Bay Area Region (average May price of $6.17).

Highest/Lowest Fuel Prices by Legislative District: California Residential Electricity Price 77.6% Above Average for

Rest of US

California's average Residential Price for the 12 months ended March 2022 was 23.51 cents/kWh, 77.6% higher than the US average of 13.24 cents/kWh for all states other than California. California's residential prices again were the highest among the contiguous states.

California Residential Electricity Bill 21st Ranked by Cost

For the 12 months ended March 2022, the average annual Residential electricity bill in California was $1,523, or 53.2% higher ($529) than the comparable bill in 2010 (the year the AB 32 implementation began with the Early Action items). In this same period, the average US (less CA) electricity bill for all the other states grew only 9.7% ($132).

In 2010, California had the 9th lowest residential electricity bill in the nation. In the latest data, it again had the 21st highest.

Residential bills, however, vary widely by region, with the estimated annual household usage in the recent released data for 2020 as much as 78% higher in the interior regions compared to the milder climate coastal areas, and substantially higher when comparing across counties.

$9.2b Premium Above

US Average Price

For the 12 months ended March 2022, California's higher electricity prices translated into Residential ratepayers paying $9.2 billion more than the average ratepayers elsewhere in the US using the same amount of energy.

California Commercial Electricity Price 84.9% Above Average for

Rest of US

California average Commercial Price for the 12 months ended March 2022 was 19.64 cents/kWh, 84.9% higher than the US average of 10.62 cents/kWh for all states other than California. California's commercial prices again were the highest among the contiguous states.

California Industrial Electricity Price 123.2% Above Average for

Rest of US

California's average Industrial Price for the 12 months ended March 2022 was 15.38 cents/kWh, 123.2% higher than the US average of 6.89 cents/kWh for all states other than California. California's industrial prices again were the 3rd highest among the contiguous states.

$13.9b Premium Above

US Average Price

For the 12 months ended March 2022, California's higher electricity prices translated into Commercial & Industrial ratepayers paying $13.9 billion more than ratepayers elsewhere in the US using the same amount of energy. Compared to the lowest rate states, Commercial & Industrial ratepayers paid $17.5 billion more.

California Natural Gas Prices

Average prices ($ per thousand cubic feet, 12-month moving average) for the 12 months ended March 2022 and changes from the previous 12-month period for each end user. In March, California was again the 6th highest among the contiguous states for commercial rates and 3rd highest for industrial rates. Residential rates, however, moved from 4th to 3rd highest.

Note: All data sources, methodologies and historical data series available at [[link removed]]

View this Report Online [[link removed]] The California Center for Jobs and the Economy provides an objective and definitive source of information pertaining to job creation and economic trends in California. [[link removed]] Contact 1301 I Street Sacramento, CA 95814 916.553.4093 If you no longer wish to receive these emails, select here to unsubscribe. [link removed]

May 2022

Below are the monthly updates from the most current May 2022 fuel price data (GasBuddy.com) and March 2022 electricity and natural gas price data (US Energy Information Administration). To view additional data and analysis related to the California economy, visit our website at [[link removed]].

Energy costs continued rising across the board in the latest data. While the fuel cost gaps (as indicated by the shift to blue) show marginal improvement over prior months, this outcome only comes as global crude prices driven by Russia’s war on Ukraine affect fuel costs throughout the country. Compared to a year ago, the price gap between California and the rest of the states rose from $1.22 a gallon in May 2021 to the $1.60 shown below for May 2022. The diesel price gap went from $1.05 a gallon to $1.11 in the latest results. Even in an intense inflationary period, California’s regulations continue to affect prices paid by Californians to a greater extent.

The effects on natural gas and electricity were also pronounced and again broke new barriers. Residential natural gas rate rose from 4th to 3rd highest among the contiguous states. Residential electricity rates remained the highest among the contiguous states but also rose above Alaska’s to the point where now only Hawaii is more costly.

Both gasoline and diesel reached new highs in our tracking series, but with prices continuing to rise since the May data. In the latest results from CSAA [[link removed]], gasoline on June 5 averaged $6.326 in California compared to $4.848 in the US. Within the state, average prices ranged from $6.062 in Imperial County to $7.147 in Mono County.

Soaring inflation and the role played by rising fuel costs have sharpened the focus on both the state and federal levels on the need to provide some form of relief, with proposals ranging from fuel tax holidays to direct assistance for varying subsets of households. In California, the two primary proposals on the table appear to be: (1) the governor’s May Revise proposal for $12.7 billion composed of $11.5 billion in vehicle registration rebates, $750 million for 3 months of free public transit, and $439 million over two years to pause the general fund portion of the diesel fuel and (2) the recent June 1 counter-proposal from legislative Democrats of $8 billion for BFF (Better for Families) tax rebates to specified households and for increased benefits under CalWORKS and SSI/SSP.

These proposals are being driven by the sharp rise that turned fuel prices into a headline issue. California, however, has been subjected to these cost pressures for a much longer period of time, not as the result of Russian predatory actions but from deliberate policy and regulatory decisions to push fuel costs well above the national average.

To put the relative effects in perspective, inflation first breached the 3% annual rate in April 2021. Using the GasBuddy monthly average prices and net monthly gasoline sales [[link removed]] from Department of Tax and Fee Administration, Californians paid about an additional $7.4 billion between April 2021 and February 2022 due to rising gasoline prices. In this same period, they paid far more due to the regulations and policies driving costs even higher in this state—$16.8 billion more in this 11-month period when comparing the price difference between California and the rest of the states, of which about $3.4 billion was due to the difference in gasoline taxes.

Note that these costs are estimates and are based on the price differences for retail sales of regular unleaded, the primary gasoline sold in the state, and total net gasoline sold. The estimates shown assume these margins are similar for other grades and sales channels, but any differences from this assumption would have only a minor effect on the results.

The monthly sales data also is only currently available through February, or just short of the price spikes that began in March. The costs paid due to rising prices have since grown even with likely cutbacks in gasoline purchases, but so has the amount paid due to California policies as the gap has also widened in this period. Using the 2021 monthly data to estimate sales through May, including these months would bring the additional amount paid by Californians to $14.3 billion to date due to the rising price, and $22.7 billion for the differential due to California regulations.

But with these caveats, the point of these calculations is that Californians have been in a cost-of-living crisis driven by state decisions for far longer than the current pressures coming from inflation. Yet the current proposals are to produce only temporary relief to deal with the portion that has reached the headlines, without more deliberate actions to stem the constantly rising costs coming from state energy policies. Fuel prices are only the most visible at the moment. As detailed below, rising electricity and natural gas costs add to the household and employer pain as well, with state electricity prices alone now adding $23.1 billion annually to the cost of being in California compared to the average for the rest of the states.

The current relief proposals attempt to deal with an immediate cost challenge to Californians but do so only in a transitory way. But global oil markets are in the process of recovery [[link removed]]. Prices can come down with new supply. But the more fundamental drivers and far larger effect of rising fuel and more broadly all energy costs in California will continue unabated long after the headline attention has passed.

Inflation Running Highest Since 1982 8.0% Annual Change in

California CPI

For the 12 months ending March, the California CPI rose 8.0%, up from 7.4% in February. In the same period, the US CPI rose 8.5%, edging down to 8.3% in April. The US March inflation rate was the highest since January 1982, while California’s was the highest since June 1982.

California vs. US Fuel Price Gap at 36.1% Premium $1.60 Price Per Gallon

Above US Average

(CA Average)

The May average price per gallon of regular gasoline in California rose 31 cents from April to $6.04. The California premium above the average for the US other than California ($4.44) eased to $1.60, a 36.1% difference, as rising crude prices affected the country.

1st Ranked by Price

In May, California again had the highest gasoline price among the states and DC. Californians paid $1.97 a gallon more than consumers in Georgia, the state with the lowest price.

California vs. US Diesel Price $1.11 Price Per Gallon

Above US Average

(CA Average)

The May average price per gallon of diesel in California rose 24 cents from April to $6.60. The California premium above the average for the US other than California ($5.48) eased to $1.11, a 20.3% difference. While fuels in general are now contributing heavily to rising inflation, diesel as the primary transportation fuel in particular gets reflected quickly into the costs of food and other basic consumer goods.

1st Ranked by Price

In May, California had the highest diesel price among the states and DC.

Range Between Highest and Lowest Prices by Region $1.73 Price Per Gallon

Above US Average

(Bay Area Region)

The cost premium above the US (other than California) average price for regular gasoline ranged from $1.49 in the Central Valley Region (average May price of $5.93), to $1.73 in Bay Area Region (average May price of $6.17).

Highest/Lowest Fuel Prices by Legislative District: California Residential Electricity Price 77.6% Above Average for

Rest of US

California's average Residential Price for the 12 months ended March 2022 was 23.51 cents/kWh, 77.6% higher than the US average of 13.24 cents/kWh for all states other than California. California's residential prices again were the highest among the contiguous states.

California Residential Electricity Bill 21st Ranked by Cost

For the 12 months ended March 2022, the average annual Residential electricity bill in California was $1,523, or 53.2% higher ($529) than the comparable bill in 2010 (the year the AB 32 implementation began with the Early Action items). In this same period, the average US (less CA) electricity bill for all the other states grew only 9.7% ($132).

In 2010, California had the 9th lowest residential electricity bill in the nation. In the latest data, it again had the 21st highest.

Residential bills, however, vary widely by region, with the estimated annual household usage in the recent released data for 2020 as much as 78% higher in the interior regions compared to the milder climate coastal areas, and substantially higher when comparing across counties.

$9.2b Premium Above

US Average Price

For the 12 months ended March 2022, California's higher electricity prices translated into Residential ratepayers paying $9.2 billion more than the average ratepayers elsewhere in the US using the same amount of energy.

California Commercial Electricity Price 84.9% Above Average for

Rest of US

California average Commercial Price for the 12 months ended March 2022 was 19.64 cents/kWh, 84.9% higher than the US average of 10.62 cents/kWh for all states other than California. California's commercial prices again were the highest among the contiguous states.

California Industrial Electricity Price 123.2% Above Average for

Rest of US

California's average Industrial Price for the 12 months ended March 2022 was 15.38 cents/kWh, 123.2% higher than the US average of 6.89 cents/kWh for all states other than California. California's industrial prices again were the 3rd highest among the contiguous states.

$13.9b Premium Above

US Average Price

For the 12 months ended March 2022, California's higher electricity prices translated into Commercial & Industrial ratepayers paying $13.9 billion more than ratepayers elsewhere in the US using the same amount of energy. Compared to the lowest rate states, Commercial & Industrial ratepayers paid $17.5 billion more.

California Natural Gas Prices

Average prices ($ per thousand cubic feet, 12-month moving average) for the 12 months ended March 2022 and changes from the previous 12-month period for each end user. In March, California was again the 6th highest among the contiguous states for commercial rates and 3rd highest for industrial rates. Residential rates, however, moved from 4th to 3rd highest.

Note: All data sources, methodologies and historical data series available at [[link removed]]

View this Report Online [[link removed]] The California Center for Jobs and the Economy provides an objective and definitive source of information pertaining to job creation and economic trends in California. [[link removed]] Contact 1301 I Street Sacramento, CA 95814 916.553.4093 If you no longer wish to receive these emails, select here to unsubscribe. [link removed]

Message Analysis

- Sender: California Center for Jobs and the Economy

- Political Party: n/a

- Country: United States

- State/Locality: California

- Office: n/a

-

Email Providers:

- Campaign Monitor