May 18, 2022

Permission to republish original opeds and cartoons granted.

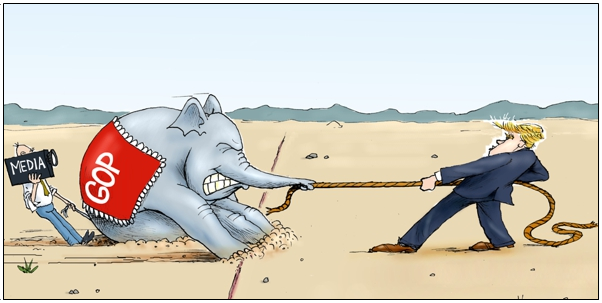

Win or lose, Trump’s presence in the 2022 GOP primaries is bolstering the Republican Party

By Robert Romano

There is no question that without former President Donald Trump’s endorsement, Dr. Mehmet Oz would not be locked in a too close to call race with Dave McCormick for the Republican nomination for Senate in Pennsylvania in 2022. The race has yet to be called with ballots still coming in and a mandatory recount to follow should the margin of victory be 0.5 percent or less.

Still, Trump’s presence in this race cannot be understated, after the former president staged a rally for Oz in Westmoreland County on May 6, generating momentum — and lots of interest — in the race.

Republican turnout in the Pennsylvania Senate Republican Primary was more than 1.3 million and counting as of this writing. In the Democratic primary it was 1.17 million. That is a discernable enthusiasm gap, and about what one would expect to see in a midterm cycle that already favors Republicans simply because they lost the White House in 2020.

In this case, Trump held one of his signature rallies less than two weeks before the primary, leading to a surge for Oz in the polls and a big Primary Day turnout in his favor, particularly in eastern Pennsylvania areas like Bucks County, although to be fair Oz performed well in McCormick strongholds like Westmoreland County as well. With the race so close, every bit of vote across the state made the difference.

And with big statewide victories for Doug Mastriano, the GOP’s nominee for Governor in Pennsylvania, who also had Trump’s endorsement, and another big Trump endorsed win for U.S. Rep. Ted Budd (R-N.C.) for the Senate nomination in North Carolina, all coming on the heels of J.D. Vance’s convincing win for the Republican nomination for the Ohio Senate seat, Trump is clearly onto something as he restores his reputation for winning politically.

Now, the real test will come in November. Going by historical trends, this would be a big Republican year anyway, and so Republican candidates, Trump-endorsed or not, should do very well. If Trump’s candidates should win in November, or if most of them do, it could cement Trump as the putative favorite to run again in 2024 in the eyes of Republican primary voters.

On the other hand, if Trump’s candidates were to fail, Trump’s opponents would almost certainly use it against him. That is where Trump’s risk lies, but it is a risk is to his own political fortunes.

For better or for worse for Republicans, in 2022, the die is now cast.

Right now, the Republican Party still benefits from a robust primary process that generates buzz and is causing Republican candidates to go pedal to the metal in a bid to garnering Trump’s favor. He’s creating an incentive for candidates to perform on the campaign trail, but is also continuing to build a movement all his own in the process.

There seems to be a method to Trump’s madness, as it were.

Trump improved on his 2016 vote total of 62.9 million, garnering 74.2 million during his second run, bringing in millions of new Republican voters. By keeping his rallies going into 2022, Trump is continuing that work. If he runs again in 2024, he will be continuing that work. He can go into any state, stage a rally and it will have a similar impact on Republican turnout this year. No other potential Republican candidate for president can do that right now.

That is why, whether Oz prevails in the Senate race or McCormick — both appear to have waged valiant, well-fought campaigns — it is clear that in Pennsylvania the clear winner is the Republican Party.

Robert Romano is the Vice President of Public Policy at Americans for Limited Government.

To view online: https://dailytorch.com/2022/05/win-or-lose-trumps-presence-in-the-2022-gop-primaries-is-bolstering-the-republican-party/

Ben Weingarten: It's Conservative David vs. the Woke Corporate Green Giant

By Ben Weingarten

Eight years ago, a holder of a modest amount of Apple stock found himself in the peculiar position of being told publicly by an angered CEO Tim Cook that his money was no good in Cupertino. Justin Danhof, a conservative activist investor, had turned up at the company’s annual shareholder meeting to ask Cook, essentially, if his desire to go green trumped his desire to generate green.

Danhof did not tell his broker to sell, but would see his outfit’s related shareholder resolution go down in flames. In 2014, his was not only a losing fight, but a lonely one.

Today, he’s no longer alone. There is a nascent but growing backlash against a corporate America perceived by many as having gone “woke.” The pushback, and the steep uphill climb facing those doing the pushing, can be seen in the record number of conservative shareholder proposals submitted to companies during this year’s annual corporate meeting season – some 48 of them as of late April – but also the record number of progressive proposals, dwarfing conservative ones by more than tenfold at a whopping 500-plus. RealClearInvestigations obtained the data from the Sustainable Investments Institute, co-publisher of the authoritative annual Proxy Preview report.

Shareholder activism is just one front in the brewing counterrevolution against Woke Inc., one particularly evident at the state level, and increasingly in Washington too, with the possibility of control of Congress shifting to Republicans in elections this fall. An illustration this year was the furor that erupted when progressively inclined Disney outspokenly opposed Florida’s law barring public schools from instructing very young children on sexual orientation. In response, Republican Gov. Ron DeSantis engineered a legislative revocation of Disney World’s longstanding special tax status.

Elsewhere, according to New Private Markets, a sustainable investment-focused outlet, Republican legislators and attorneys general across several states have recently launched inquiries into or introduced bills opposing the wide embrace of three initials profoundly transforming capitalism: ESG, short for Environmental, Social, and Governance. That’s an approach increasingly driven by Wall Street and endorsed by regulators to judging companies based on their devotion to achieving environmental and social goals that go beyond maximizing profits on behalf of shareholders. Among recent developments:

- Texas’ comptroller pressed more than 100 financial companies – including asset management giant and leading ESG proponent BlackRock, private equity powerhouse Blackstone, and top investment bank JPMorgan Chase – on whether they were engaged in a “boycott” of energy firms, which would preclude Texas government entities from investing with them.

- Utah officials sent a letter to credit ratings company S&P objecting to its publishing of state ESG scores as part of its credit ratings, which it argued "politiciz[ed] the ratings process" and could "unfairly and adversely" impact the market for its bonds.

- Idaho’s Senate passed legislation that would bar public investing entities like pensions from weighing ESG characteristics above more strictly economic ones, and its House introduced legislation that would prohibit investment boycotts of industries often targeted by ESG proponents, such as energy and mining.

- Wyoming’s Senate took up a bill that would have banned financial institutions from discriminating based on ESG metrics, though it died in committee. West Virginia and Kansas have reportedly introduced similar legislation.

- West Virginia’s Board of Treasury Investments has pulled funds from BlackRock, which has great influence over billions of dollars in public retirement and other investments.

- States are also pursuing ESG as an antitrust issue. Arizona Attorney General Mark Brnovich has said his office is probing “unlawful market manipulation” with firms banding together “to compel companies to shut down coal and natural-gas plants.” As Brnovich puts it: “Your retirement funds are likely helping facilitate these political campaigns to advance far-left policy goals, with consumers bearing the costs of increased energy prices.”

All told, the conservative Heartland Institute says it has identified, proposed, or helped to pass anti-ESG bills in 24 states.

Another legislative push comes from the free market-oriented American Legislative Exchange Council. ALEC has proposed that states enact a State Government Employee Retirement Protection Act to shield pensioners “from politically driven investment strategies.”

In an interview with RealClearInvestigations, ALEC chief economist and Executive Vice President of Policy Jonathan Williams said the legislation came in response to concerns over “corporate boardroom politics,” which his organization believes must be kept out of public pension systems.

The anti-woke backlash comes in response to a years-long surge in progressive activism in corporate America, regarding issues ranging from guns and abortion to immigration, election integrity, and criminal justice. Companies have bowed to the prevailing winds by, for example, pledging to reduce greenhouse gas emissions, embracing “diversity, equity and inclusion” in employee hiring and training, or tying executive compensation to ESG performance. One survey from consulting firm KPMG shows 82% of large U.S. corporations devoting space in regulatory filings to demonstrate their ESG bona fides.

The activism was galvanized by liberals’ alarm at the 2016 election of Donald Trump, an oldline business tycoon and climate change skeptic. A watershed moment came in 2019, when the powerful and prominent Business Roundtable redefined the purpose of a corporation, elevating vaguely defined “stakeholders” in society at large over traditional stock shareholders. More than 180 signatories pledged to “foster diversity and inclusion” among their workforces, and to “protect the environment by embracing sustainable practices.” In 2020, George Floyd’s murder by a white police officer triggered a massive outpouring of corporate support for “racial justice” backed by some $50 billion, and spurred related initiatives.

Stephen Soukup, a longtime consultant to the institutional investment community and author of the 2021 book “The Dictatorship of Woke Capital,” told RCI that corporations face pressure to go woke from the “bottom up,” “top down,” and “outside in.”

“As the American higher education system has gone through its own awokening,” Soukup says, “there’s been a considerable change in the beliefs of a lot of the elite, people who are both the directors and executives and employees of some of these high-profile companies.”

Among those fueling the backlash against “woke capital” or “stakeholder capitalism,” Soukup counts entrepreneur-turned-author and activist Vivek Ramaswamy; journalists such as Rupert Darwall and Andrew Stuttaford; and think-tank scholars such as Richard Morrison of the libertarian Competitive Enterprise Institute. Christopher Rufo of the free market Manhattan Institute is another critic, often drawing on internal corporate material revealing how progressive views on “anti-racism” and gender identity manifest themselves within large corporations, including, lately, The Walt Disney Company.

The critiques from the anti-woke camp are numerous. One is that a political workplace undermines civil society. Ramaswamy, author of the 2021 book “Woke, Inc.,” argues that “apolitical spaces” are “a necessary precondition for social solidarity in a divided polity like ours.” Stuttaford writes that ESG is “a tremendous device for advancing a political agenda without the bother of going through the electoral process.”

Another contention is that ESG is an expensive gimmick. Soukup says the financial community can take exchange-traded funds, “rebrand them as ESG, and then charge double or triple the management fees, and they get people buying into this constantly.”

A related criticism is that ESG’s performance is overstated – an argument put forth in detail for regulatory agencies by the American Securities Association, which bills itself as “America’s voice for Main Street’s investors.”

Soukup challenges ESG proponents’ proposition of “doing well by doing good.” He told RCI that typically any above-market performance of ESG funds “is created for reasons other than ESG. It's created simply because they're good companies. If you buy Apple, for example, Apple does well not because it's ESG, but because it's Apple.”

Larry Fink, the '$10 Trillion Elephant'

To Soukup and other critics of woke capital, one man both personifies corporate America’s woke turn and bears unique responsibility for it: “The 10,000-pound elephant … or the $10 trillion elephant in the corner,” says Soukup, is Larry Fink, CEO of BlackRock, the world’s largest asset manager.

To view online: https://www.realclearinvestigations.com/articles/2022/05/17/its_conservative_david_vs_the_woke_corporate_green_giant_832255.html