March 10, 2022

Permission to republish original opeds and cartoons granted.

Why FINRA must butt out of individual investor choices

By Richard Manning

For decades, Americans of all incomes have looked to the investment markets as an opportunity to build wealth and achieve goals such as putting their kids through college and retiring among other things. Over the years those opportunities have continued to increase with increasing levels of innovative offerings from simple stocks and bonds to mutual funds, ETF’s, IPO’s, dividends, cryptocurrencies and much more.

These investments come with risks and rewards and investors buying through brokers or on their own are made aware of, and acknowledge, those risks through disclosures. Though this system has delivered great benefits to investors and an ever-expanded number of investment products, regulators and know it all’s have decided otherwise.

If a congressionally created federal board of unelected appointees known as the Financial Industry Regulatory Authority (FINRA) has their way, you would be unable to invest in what they deem as products that are too “complex” unless you took an in-depth financial services test and had a high net worth prior to purchase among other requirements.

FINRA’s mission is benign enough, to ensure fair financial markets. And FINRA spends a lot of time, energy and effort monitoring markets to identify and weed out any manipulation which puts private investors at an unfair disadvantage. But, it is absurd for this group to determine that certain investment should be restricted to those who can pass a complex test and were already wealthy.

What’s more, the proposed FINRA regulation would prevent unapproved private investors from purchasing common investment choices like closed end mutual funds, high yield bond funds, funds using cryptocurrency futures, commodities funds, currency funds among many other types of assets. The precedent this sets could allow FINRA, as well as government regulators, to impose such requirements on other investment products – IPO’s for example.

Obviously, each investor should make certain that they have an understanding of what they are investing in, that is their responsibility. As an example, I knew years ago that cryptocurrency was going to be the next big thing, yet I did not invest in it, because I fundamentally did not understand where non-governmental backed currencies got underlying value, and was unwilling to accept the risks involved. That was my choice to make, whether the investment went to zero, or as Bitcoin did, exploded up 40 times above its value five years ago.

Yet, FINRA would even deny investors access to mutual funds that buy a market basket of cryptocurrencies. This mutual fund approach saves the investor from having to choose between Bitcoin, Dogecoin, Etherium and countless other emerging cryptos, but instead would invest in the overall market. This type of diversification is exactly what many FINRA certified financial service advisors push, where an investment is shielded from the volatility of one type of crypto, while being able to invest based upon the potential upside of the overall crypto market.

Apparently, the more than 100,000 Bitcoin millionaires really should have gotten approval from this quasi-government agency before they invested.

To be fair, FINRA would be correct to ensure that the cryptocurrency trading markets like Coinbase are operated fairly and ethically, that is their job. But they need to butt out when it comes to telling private investors what investments they need to pass an extensive test or already be wealthy in order to invest their money.

Ironically, while FINRA is more than willing to shut the door on American investors accessing an array of widely used investments, but eerily quiet when it comes to investments in Chinese stocks and bonds which pose real threats to private investors on public markets. Mutual funds run by Vanguard, Fidelity and many others put their clients into Chinese companies which do not meet the same transparency standards that the Securities and Exchange Commission requires of other foreign and domestic companies. Chinese companies are fraught with price manipulation and insider trading. Just last year, the government of China decided that publicly traded Chinese banks made too much money so they confiscated shareholder profits to invest that money back into the Chinese economy due to the Coronavirus pandemic. Neat trick to get US investors to partially finance the bailout of Chinese companies by redirecting the very dividends that initially drew these investors into the Chinese banking sector.

Yet, while FINRA wants to make investment decisions for each of us through a misguided regulation, they allow investment in the shadowy world of Chinese Communist Party controlled business entities.

If FINRA wants to do something to protect private investors and the integrity of the markets, it would do well to drop the overreaching restrictions on choices that private investors can make, and concentrate instead on investments which, on their face, don’t meet basic fiduciary standards.

Richard Manning is president of Americans for Limited Government.

To view online: https://www.realclearmarkets.com/articles/2022/05/09/why_finra_must_butt_out_of_individual_investor_choices_831105.html

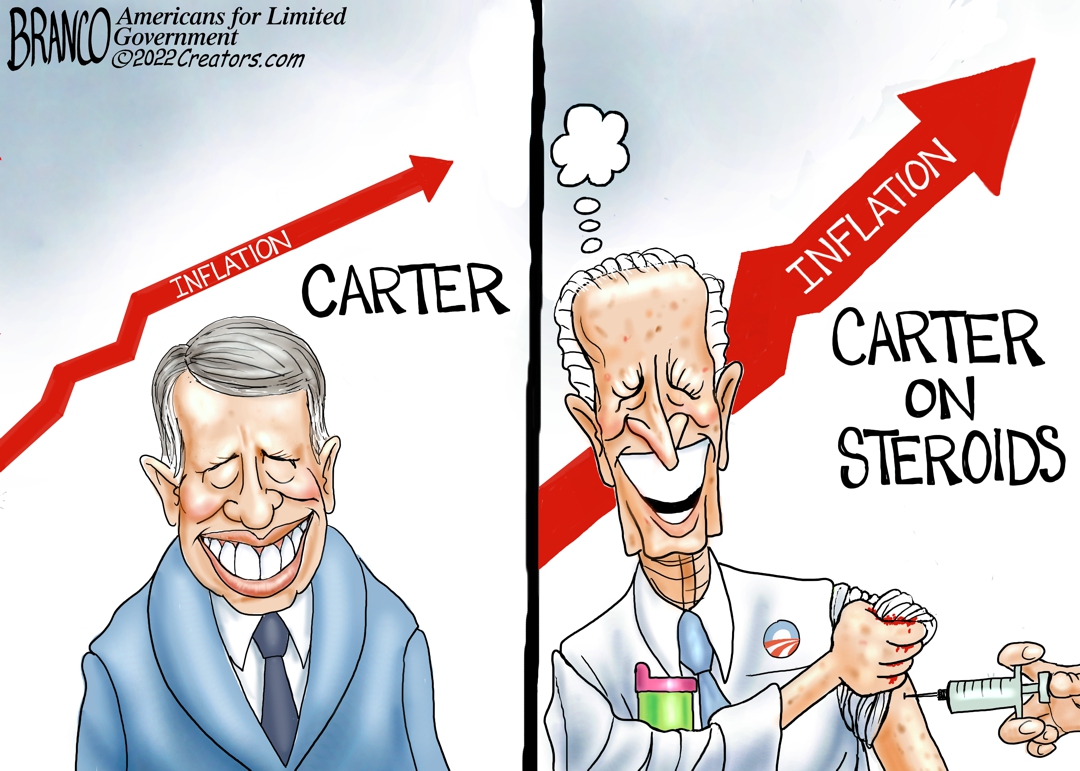

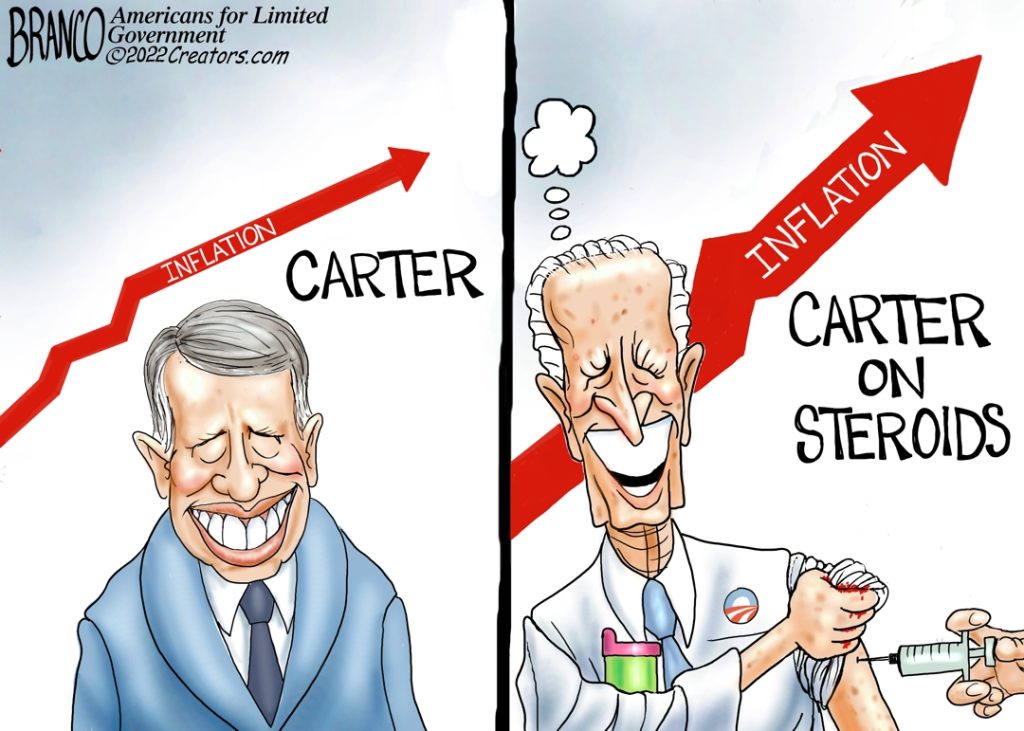

Cartoon: Blast from the past

Click here for a higher level resolution version.

To view online: https://dailytorch.com/2022/05/cartoon-blast-from-the-past/

David Freddoso: First congressional poll since Roe leak shows record Republican advantage

By David Freddoso

The Washington Examiner's insightful David Drucker filmed a debriefing segment Friday with Sarah Westwood in which he discussed the effect that the likely overturning of the Roe v. Wade abortion decision will have on the 2022 election. He noted that strategists from both parties are unusually open about their ignorance. The consequences are much less predictable than most run-of-the-mill political happenings.

Drucker quoted one Democratic operative as stating, “If anybody thinks they know exactly what's going to happen, then they don't know what they're talking about."

He is probably right. Personally, I doubt that Roe will save Democrats, just based on the history. In the last 15 years since the Gonzales v. Carhart decision weakened Roe, the issue never has bolstered the Democrats. Republicans have been passing restrictive state-level abortion laws, and Democrats have often (most recently in 2021 in the Virginia governor's race) tried unsuccessfully to campaign against them. In every case I'm aware of, exit polling has shown that efforts to make abortion a big campaign issue motivate pro-life voters more than they motivate the other side. As Mark Shields used to observe after presidential elections, there is usually a modest net benefit to the pro-life candidate when abortion becomes the issue.

However, one must at least allow for the possibility that with Roe itself in danger, there could be a different or stronger reaction among voters supportive of legal abortion. In other words, you need to be on the lookout for some kind of evidence that things are different this time.

And that may yet materialize. But we haven't seen it so far.

Since the May 2 leak of Justice Alito’s draft decision overturning Roe, there has been exactly one poll taken on the congressional generic ballot question — the one that asks voters which party's candidate they intend to support this November. CNN had actually polled this question in the three days immediately before the leak and found Republicans with a 1-point advantage. But when CNN polled again after the leak, between May 3 and May 5, Republicans suddenly had a 7-point advantage — the largest GOP advantage in the history of CNN’s generic ballot poll. From what I could tell, it is tied only with one other CNN survey this century, taken in September 2010.

I'm not saying that this is a result of the leak — only that the leak does not yet seem to be having the effect that Democrats were hoping for. Obviously, Supreme Court justices should not make decisions based on the potential electoral consequences. Also, most pro-lifers I know would be proud to lose an election for doing what’s right on the abortion issue. But maybe the choice between doing the right thing and losing is a false choice.

The CNN poll is just the first indication — not proof, but evidence — that Roe has long been a paper tiger in the Democrats’ hands. The Supreme Court decision that forbids states from restricting or even properly regulating abortion is something that most people still tell pollsters they support, but they may not be too bothered when it's gone and many U.S. states either abolish abortion or restrict it in a manner similar to European countries, just like the Mississippi law that is the subject of the Supreme Court's impending decision.

To view online: https://www.washingtonexaminer.com/opinion/first-congressional-poll-since-the-roe-leak-shows-a-record-republican-advantage