Email

Government interference with Bank of Canada, and Economic costs of raising income taxes

| From | Fraser Institute <[email protected]> |

| Subject | Government interference with Bank of Canada, and Economic costs of raising income taxes |

| Date | April 30, 2022 5:00 PM |

Links have been removed from this email. Learn more in the FAQ.

Links have been removed from this email. Learn more in the FAQ.

Having trouble viewing? Try the web version [link removed] of this email.

=============

FRASER UPDATE

A weekly digest of our latest research, commentary, and blog posts

=============

Latest Research

-------------------

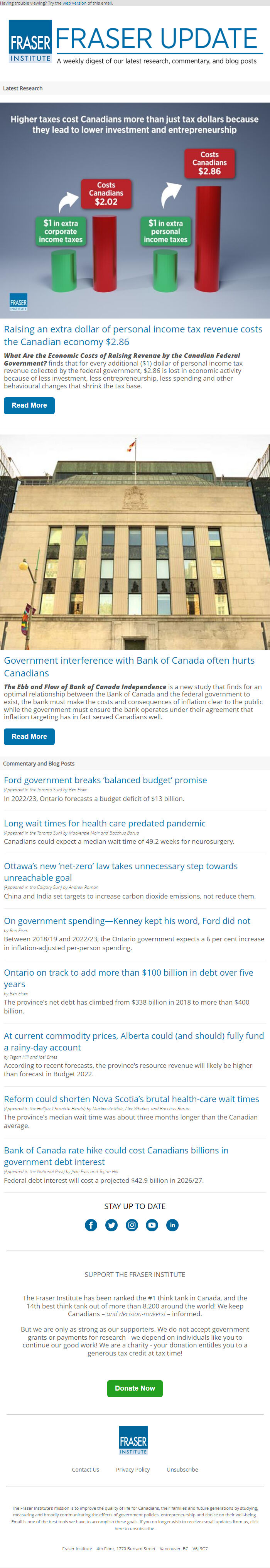

Raising an extra dollar of personal income tax revenue costs the Canadian economy $2.86

What Are the Economic Costs of Raising Revenue by the Canadian Federal Government? finds that for every additional ($1) dollar of personal income tax revenue collected by the federal government, $2.86 is lost in economic activity because of less investment, less entrepreneurship, less spending and other behavioural changes that shrink the tax base.

Read More [[link removed]]

Government interference with Bank of Canada often hurts Canadians

The Ebb and Flow of Bank of Canada Independence is a new study that finds for an optimal relationship between the Bank of Canada and the federal government to exist, the bank must make the costs and consequences of inflation clear to the public while the government must ensure the bank operates under their agreement that inflation targeting has in fact served Canadians well.

Read More [[link removed]]

Commentary and Blog Posts

-------------------

Ford government breaks ‘balanced budget’ promise [[link removed]]

(Appeared in the Toronto Sun) by Ben Eisen

In 2022/23, Ontario forecasts a budget deficit of $13 billion.

Long wait times for health care predated pandemic [[link removed]]

(Appeared in the Toronto Sun) by Mackenzie Moir and Bacchus Barua

Canadians could expect a median wait time of 49.2 weeks for neurosurgery.

Ottawa’s new ‘net-zero’ law takes unnecessary step towards unreachable goal [[link removed]]

(Appeared in the Calgary Sun) by Andrew Roman

China and India set targets to increase carbon dioxide emissions, not reduce them.

On government spending—Kenney kept his word, Ford did not [[link removed]]

by Ben Eisen

Between 2018/19 and 2022/23, the Ontario government expects a 6 per cent increase in inflation-adjusted per-person spending.

Ontario on track to add more than $100 billion in debt over five years [[link removed]]

by Ben Eisen

The province's net debt has climbed from $338 billion in 2018 to more than $400 billion.

At current commodity prices, Alberta could (and should) fully fund a rainy-day account [[link removed]]

by Tegan Hill and Joel Emes

According to recent forecasts, the province's resource revenue will likely be higher than forecast in Budget 2022.

Reform could shorten Nova Scotia’s brutal health-care wait times [[link removed]]

(Appeared in the Halifax Chronicle Herald) by Mackenzie Moir, Alex Whalen, and Bacchus Barua

The province's median wait time was about three months longer than the Canadian average.

Bank of Canada rate hike could cost Canadians billions in government debt interest [[link removed]]

(Appeared in the National Post) by Jake Fuss and Tegan Hill

Federal debt interest will cost a projected $42.9 billion in 2026/27.

SUPPORT THE FRASER INSTITUTE

-------------------

The Fraser Institute has been ranked the #1 think tank in Canada, and the 14th best think tank out of more than 8,200 around the world! We keep Canadians – and decision-makers! – informed.

But we are only as strong as our supporters. We do not accept government grants or payments for research - we depend on individuals like you to continue our good work! We are a charity - your donation entitles you to a generous tax credit at tax time!

Donate Now [[link removed][campaignid]]

Contact Us [[link removed]]

Privacy Policy [[link removed]]

Unsubscribe [link removed]

The Fraser Institute's mission is to improve the quality of life for Canadians, their families and future generations by studying, measuring and broadly communicating the effects of government policies, entrepreneurship and choice on their well-being. Email is one of the best tools we have to accomplish these goals. If you no longer wish to receive e-mail updates from us, click here to unsubscribe [link removed].

Fraser Institute | 4th Floor, 1770 Burrard Street, Vancouver, BC V6J 3G7

=============

FRASER UPDATE

A weekly digest of our latest research, commentary, and blog posts

=============

Latest Research

-------------------

Raising an extra dollar of personal income tax revenue costs the Canadian economy $2.86

What Are the Economic Costs of Raising Revenue by the Canadian Federal Government? finds that for every additional ($1) dollar of personal income tax revenue collected by the federal government, $2.86 is lost in economic activity because of less investment, less entrepreneurship, less spending and other behavioural changes that shrink the tax base.

Read More [[link removed]]

Government interference with Bank of Canada often hurts Canadians

The Ebb and Flow of Bank of Canada Independence is a new study that finds for an optimal relationship between the Bank of Canada and the federal government to exist, the bank must make the costs and consequences of inflation clear to the public while the government must ensure the bank operates under their agreement that inflation targeting has in fact served Canadians well.

Read More [[link removed]]

Commentary and Blog Posts

-------------------

Ford government breaks ‘balanced budget’ promise [[link removed]]

(Appeared in the Toronto Sun) by Ben Eisen

In 2022/23, Ontario forecasts a budget deficit of $13 billion.

Long wait times for health care predated pandemic [[link removed]]

(Appeared in the Toronto Sun) by Mackenzie Moir and Bacchus Barua

Canadians could expect a median wait time of 49.2 weeks for neurosurgery.

Ottawa’s new ‘net-zero’ law takes unnecessary step towards unreachable goal [[link removed]]

(Appeared in the Calgary Sun) by Andrew Roman

China and India set targets to increase carbon dioxide emissions, not reduce them.

On government spending—Kenney kept his word, Ford did not [[link removed]]

by Ben Eisen

Between 2018/19 and 2022/23, the Ontario government expects a 6 per cent increase in inflation-adjusted per-person spending.

Ontario on track to add more than $100 billion in debt over five years [[link removed]]

by Ben Eisen

The province's net debt has climbed from $338 billion in 2018 to more than $400 billion.

At current commodity prices, Alberta could (and should) fully fund a rainy-day account [[link removed]]

by Tegan Hill and Joel Emes

According to recent forecasts, the province's resource revenue will likely be higher than forecast in Budget 2022.

Reform could shorten Nova Scotia’s brutal health-care wait times [[link removed]]

(Appeared in the Halifax Chronicle Herald) by Mackenzie Moir, Alex Whalen, and Bacchus Barua

The province's median wait time was about three months longer than the Canadian average.

Bank of Canada rate hike could cost Canadians billions in government debt interest [[link removed]]

(Appeared in the National Post) by Jake Fuss and Tegan Hill

Federal debt interest will cost a projected $42.9 billion in 2026/27.

SUPPORT THE FRASER INSTITUTE

-------------------

The Fraser Institute has been ranked the #1 think tank in Canada, and the 14th best think tank out of more than 8,200 around the world! We keep Canadians – and decision-makers! – informed.

But we are only as strong as our supporters. We do not accept government grants or payments for research - we depend on individuals like you to continue our good work! We are a charity - your donation entitles you to a generous tax credit at tax time!

Donate Now [[link removed][campaignid]]

Contact Us [[link removed]]

Privacy Policy [[link removed]]

Unsubscribe [link removed]

The Fraser Institute's mission is to improve the quality of life for Canadians, their families and future generations by studying, measuring and broadly communicating the effects of government policies, entrepreneurship and choice on their well-being. Email is one of the best tools we have to accomplish these goals. If you no longer wish to receive e-mail updates from us, click here to unsubscribe [link removed].

Fraser Institute | 4th Floor, 1770 Burrard Street, Vancouver, BC V6J 3G7

Message Analysis

- Sender: Fraser Institute

- Political Party: n/a

- Country: Canada

- State/Locality: n/a

- Office: n/a

-

Email Providers:

- Campaign Monitor