Email

CenterPoint boosts CEO pay to $37.8 million, blowing past other utilities

| From | Energy and Policy Institute <[email protected]> |

| Subject | CenterPoint boosts CEO pay to $37.8 million, blowing past other utilities |

| Date | April 20, 2022 12:03 PM |

Links have been removed from this email. Learn more in the FAQ.

Links have been removed from this email. Learn more in the FAQ.

** CenterPoint boosts CEO pay to $37.8 million, blowing past other utilities ([link removed])

------------------------------------------------------------

By Karlee Weinmann on Apr 19, 2022 10:47 am

CenterPoint Energy paid its CEO a total of $37.8 million ([link removed]) last year, far exceeding executive pay at peer companies while it sought massive rate hikes for customers already struggling to keep up with skyrocketing utility bills.

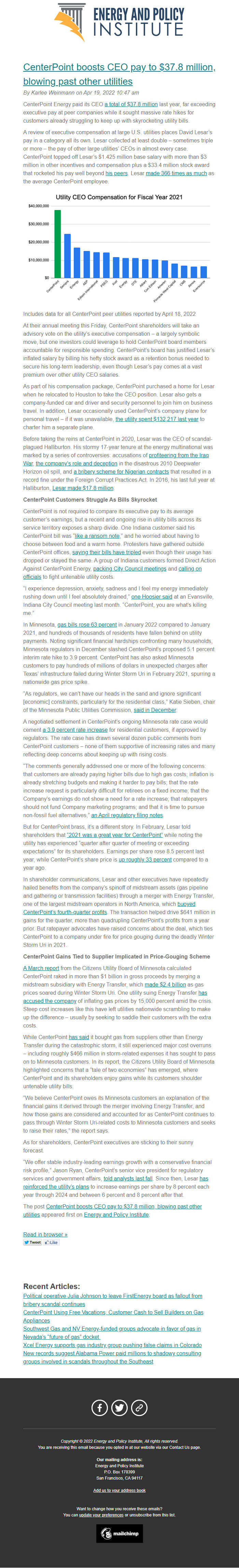

A review of executive compensation at large U.S. utilities places David Lesar’s pay in a category all its own. Lesar collected at least double – sometimes triple or more – the pay of other large utilities’ CEOs in almost every case. CenterPoint topped off Lesar’s $1.425 million base salary with more than $3 million in other incentives and compensation plus a $33.4 million stock award that rocketed his pay well beyond his peers ([link removed]) . Lesar made 366 times as much ([link removed]) as the average CenterPoint employee.

[link removed]

Includes data for all CenterPoint peer utilities reported by April 18, 2022

At their annual meeting this Friday, CenterPoint shareholders will take an advisory vote on the utility’s executive compensation – a largely symbolic move, but one investors could leverage to hold CenterPoint board members accountable for responsible spending. CenterPoint’s board has justified Lesar’s inflated salary by billing his hefty stock award as a retention bonus needed to secure his long-term leadership, even though Lesar’s pay comes at a vast premium over other utility CEO salaries.

As part of his compensation package, CenterPoint purchased a home for Lesar when he relocated to Houston to take the CEO position. Lesar also gets a company-funded car and driver and security personnel to join him on business travel. In addition, Lesar occasionally used CenterPoint’s company plane for personal travel – if it was unavailable, the utility spent $132,217 last year ([link removed]) to charter him a separate plane.

Before taking the reins at CenterPoint in 2020, Lesar was the CEO of scandal-plagued Halliburton. His stormy 17-year tenure at the energy multinational was marked by a series of controversies: accusations of profiteering from the Iraq War ([link removed]) , the company’s role and deception ([link removed]) in the disastrous 2010 Deepwater Horizon oil spill, and a bribery scheme for Nigerian contracts ([link removed]) that resulted in a record fine under the Foreign Corrupt Practices Act. In 2016, his last full year at Halliburton, Lesar made $17.8 million ([link removed]) .

CenterPoint Customers Struggle As Bills Skyrocket

CenterPoint is not required to compare its executive pay to its average customer’s earnings, but a recent and ongoing rise in utility bills across its service territory exposes a sharp divide. One Indiana customer said his CenterPoint bill was “like a ransom note ([link removed]) ,” and he worried about having to choose between food and a warm home. Protesters have gathered outside CenterPoint offices, saying their bills have tripled ([link removed]) even though their usage has dropped or stayed the same. A group of Indiana customers formed Direct Action Against CenterPoint Energy, packing City Council meetings ([link removed])

and calling on officials ([link removed]) to fight untenable utility costs.

“I experience depression, anxiety, sadness and I feel my energy immediately rushing down until I feel absolutely drained,” one Hoosier said ([link removed]) at an Evansville, Indiana City Council meeting last month. “CenterPoint, you are what’s killing me.”

In Minnesota, gas bills rose 63 percent ([link removed]) in January 2022 compared to January 2021, and hundreds of thousands of residents have fallen behind on utility payments. Noting significant financial hardships confronting many households, Minnesota regulators in December slashed CenterPoint’s proposed 5.1 percent interim rate hike to 3.9 percent. CenterPoint has also asked Minnesota customers to pay hundreds of millions of dollars in unexpected charges after Texas’ infrastructure failed during Winter Storm Uri in February 2021, spurring a nationwide gas price spike.

“As regulators, we can’t have our heads in the sand and ignore significant [economic] constraints, particularly for the residential class,” Katie Sieben, chair of the Minnesota Public Utilities Commission, said in December ([link removed]) .

A negotiated settlement in CenterPoint’s ongoing Minnesota rate case would cement a 3.9 percent rate increase ([link removed]) for residential customers, if approved by regulators. The rate case has drawn several dozen public comments from CenterPoint customers – none of them supportive of increasing rates and many reflecting deep concerns about keeping up with rising costs.

“The comments generally addressed one or more of the following concerns: that customers are already paying higher bills due to high gas costs; inflation is already stretching budgets and making it harder to pay bills; that the rate increase request is particularly difficult for retirees on a fixed income; that the Company’s earnings do not show a need for a rate increase; that ratepayers should not fund Company marketing programs; and that it is time to pursue non-fossil fuel alternatives,” an April regulatory filing notes ([link removed]) .

But for CenterPoint brass, it’s a different story. In February, Lesar told shareholders that “2021 was a great year for CenterPoint” ([link removed]) while noting the utility has experienced “quarter after quarter of meeting or exceeding expectations” for its shareholders. Earnings per share rose 8.5 percent last year, while CenterPoint’s share price is up roughly 33 percent ([link removed]) compared to a year ago.

In shareholder communications, Lesar and other executives have repeatedly hailed benefits from the company’s spinoff of midstream assets (gas pipeline and gathering or transmission facilities) through a merger with Energy Transfer, one of the largest midstream operators in North America, which buoyed CenterPoint’s fourth-quarter profits ([link removed]) . The transaction helped drive $641 million in gains for the quarter, more than quadrupling CenterPoint’s profits from a year prior. But ratepayer advocates have raised concerns about the deal, which ties CenterPoint to a company under fire for price gouging during the deadly Winter Storm Uri in 2021.

CenterPoint Gains Tied to Supplier Implicated in Price-Gouging Scheme

A March report ([link removed]) from the Citizens Utility Board of Minnesota calculated CenterPoint raked in more than $1 billion in gross proceeds by merging a midstream subsidiary with Energy Transfer, which made $2.4 billion ([link removed]) as gas prices soared during Winter Storm Uri. One utility suing Energy Transfer has accused the company ([link removed](3-19-2021)%20(002).pdf) of inflating gas prices by 15,000 percent amid the crisis. Steep cost increases like this have left utilities nationwide scrambling to make up the difference – usually by seeking to saddle their customers with the extra costs.

While CenterPoint has said ([link removed]) it bought gas from suppliers other than Energy Transfer during the catastrophic storm, it still experienced major cost overruns – including roughly $466 million in storm-related expenses it has sought to pass on to Minnesota customers. In its report, the Citizens Utility Board of Minnesota highlighted concerns that a “tale of two economies” has emerged, where CenterPoint and its shareholders enjoy gains while its customers shoulder untenable utility bills.

“We believe CenterPoint owes its Minnesota customers an explanation of the financial gains it derived through the merger involving Energy Transfer, and how those gains are considered and accounted for as CenterPoint continues to pass through Winter Storm Uri-related costs to Minnesota customers and seeks to raise their rates,” the report says.

As for shareholders, CenterPoint executives are sticking to their sunny forecast.

“We offer stable industry-leading earnings growth with a conservative financial risk profile,” Jason Ryan, CenterPoint’s senior vice president for regulatory services and government affairs, told analysts last fall ([link removed]) . Since then, Lesar has reinforced the utility’s plans ([link removed]) to increase earnings per share by 8 percent each year through 2024 and between 6 percent and 8 percent after that.

The post CenterPoint boosts CEO pay to $37.8 million, blowing past other utilities ([link removed]) appeared first on Energy and Policy Institute ([link removed]) .

Read in browser » ([link removed])

[link removed] [link removed]

** Recent Articles:

------------------------------------------------------------

** Political operative Julia Johnson to leave FirstEnergy board as fallout from bribery scandal continues ([link removed])

** CenterPoint Using Free Vacations, Customer Cash to Sell Builders on Gas Appliances ([link removed])

** Southwest Gas and NV Energy-funded groups advocate in favor of gas in Nevada’s “future of gas” docket ([link removed])

** Xcel Energy supports gas industry group pushing false claims in Colorado ([link removed])

** New records suggest Alabama Power paid millions to shadowy consulting groups involved in scandals throughout the Southeast ([link removed]

============================================================

** Facebook ([link removed])

** Twitter ([link removed])

** Website ([link removed])

Copyright © 2022 Energy and Policy Institute, All rights reserved.

You are receiving this email because you opted in at our website via our Contact Us page.

Our mailing address is:

Energy and Policy Institute

P.O. Box 170399

San Francisco, CA 94117

USA

Want to change how you receive these emails?

You can ** update your preferences ([link removed])

or ** unsubscribe from this list ([link removed])

.

Email Marketing Powered by Mailchimp

[link removed]

------------------------------------------------------------

By Karlee Weinmann on Apr 19, 2022 10:47 am

CenterPoint Energy paid its CEO a total of $37.8 million ([link removed]) last year, far exceeding executive pay at peer companies while it sought massive rate hikes for customers already struggling to keep up with skyrocketing utility bills.

A review of executive compensation at large U.S. utilities places David Lesar’s pay in a category all its own. Lesar collected at least double – sometimes triple or more – the pay of other large utilities’ CEOs in almost every case. CenterPoint topped off Lesar’s $1.425 million base salary with more than $3 million in other incentives and compensation plus a $33.4 million stock award that rocketed his pay well beyond his peers ([link removed]) . Lesar made 366 times as much ([link removed]) as the average CenterPoint employee.

[link removed]

Includes data for all CenterPoint peer utilities reported by April 18, 2022

At their annual meeting this Friday, CenterPoint shareholders will take an advisory vote on the utility’s executive compensation – a largely symbolic move, but one investors could leverage to hold CenterPoint board members accountable for responsible spending. CenterPoint’s board has justified Lesar’s inflated salary by billing his hefty stock award as a retention bonus needed to secure his long-term leadership, even though Lesar’s pay comes at a vast premium over other utility CEO salaries.

As part of his compensation package, CenterPoint purchased a home for Lesar when he relocated to Houston to take the CEO position. Lesar also gets a company-funded car and driver and security personnel to join him on business travel. In addition, Lesar occasionally used CenterPoint’s company plane for personal travel – if it was unavailable, the utility spent $132,217 last year ([link removed]) to charter him a separate plane.

Before taking the reins at CenterPoint in 2020, Lesar was the CEO of scandal-plagued Halliburton. His stormy 17-year tenure at the energy multinational was marked by a series of controversies: accusations of profiteering from the Iraq War ([link removed]) , the company’s role and deception ([link removed]) in the disastrous 2010 Deepwater Horizon oil spill, and a bribery scheme for Nigerian contracts ([link removed]) that resulted in a record fine under the Foreign Corrupt Practices Act. In 2016, his last full year at Halliburton, Lesar made $17.8 million ([link removed]) .

CenterPoint Customers Struggle As Bills Skyrocket

CenterPoint is not required to compare its executive pay to its average customer’s earnings, but a recent and ongoing rise in utility bills across its service territory exposes a sharp divide. One Indiana customer said his CenterPoint bill was “like a ransom note ([link removed]) ,” and he worried about having to choose between food and a warm home. Protesters have gathered outside CenterPoint offices, saying their bills have tripled ([link removed]) even though their usage has dropped or stayed the same. A group of Indiana customers formed Direct Action Against CenterPoint Energy, packing City Council meetings ([link removed])

and calling on officials ([link removed]) to fight untenable utility costs.

“I experience depression, anxiety, sadness and I feel my energy immediately rushing down until I feel absolutely drained,” one Hoosier said ([link removed]) at an Evansville, Indiana City Council meeting last month. “CenterPoint, you are what’s killing me.”

In Minnesota, gas bills rose 63 percent ([link removed]) in January 2022 compared to January 2021, and hundreds of thousands of residents have fallen behind on utility payments. Noting significant financial hardships confronting many households, Minnesota regulators in December slashed CenterPoint’s proposed 5.1 percent interim rate hike to 3.9 percent. CenterPoint has also asked Minnesota customers to pay hundreds of millions of dollars in unexpected charges after Texas’ infrastructure failed during Winter Storm Uri in February 2021, spurring a nationwide gas price spike.

“As regulators, we can’t have our heads in the sand and ignore significant [economic] constraints, particularly for the residential class,” Katie Sieben, chair of the Minnesota Public Utilities Commission, said in December ([link removed]) .

A negotiated settlement in CenterPoint’s ongoing Minnesota rate case would cement a 3.9 percent rate increase ([link removed]) for residential customers, if approved by regulators. The rate case has drawn several dozen public comments from CenterPoint customers – none of them supportive of increasing rates and many reflecting deep concerns about keeping up with rising costs.

“The comments generally addressed one or more of the following concerns: that customers are already paying higher bills due to high gas costs; inflation is already stretching budgets and making it harder to pay bills; that the rate increase request is particularly difficult for retirees on a fixed income; that the Company’s earnings do not show a need for a rate increase; that ratepayers should not fund Company marketing programs; and that it is time to pursue non-fossil fuel alternatives,” an April regulatory filing notes ([link removed]) .

But for CenterPoint brass, it’s a different story. In February, Lesar told shareholders that “2021 was a great year for CenterPoint” ([link removed]) while noting the utility has experienced “quarter after quarter of meeting or exceeding expectations” for its shareholders. Earnings per share rose 8.5 percent last year, while CenterPoint’s share price is up roughly 33 percent ([link removed]) compared to a year ago.

In shareholder communications, Lesar and other executives have repeatedly hailed benefits from the company’s spinoff of midstream assets (gas pipeline and gathering or transmission facilities) through a merger with Energy Transfer, one of the largest midstream operators in North America, which buoyed CenterPoint’s fourth-quarter profits ([link removed]) . The transaction helped drive $641 million in gains for the quarter, more than quadrupling CenterPoint’s profits from a year prior. But ratepayer advocates have raised concerns about the deal, which ties CenterPoint to a company under fire for price gouging during the deadly Winter Storm Uri in 2021.

CenterPoint Gains Tied to Supplier Implicated in Price-Gouging Scheme

A March report ([link removed]) from the Citizens Utility Board of Minnesota calculated CenterPoint raked in more than $1 billion in gross proceeds by merging a midstream subsidiary with Energy Transfer, which made $2.4 billion ([link removed]) as gas prices soared during Winter Storm Uri. One utility suing Energy Transfer has accused the company ([link removed](3-19-2021)%20(002).pdf) of inflating gas prices by 15,000 percent amid the crisis. Steep cost increases like this have left utilities nationwide scrambling to make up the difference – usually by seeking to saddle their customers with the extra costs.

While CenterPoint has said ([link removed]) it bought gas from suppliers other than Energy Transfer during the catastrophic storm, it still experienced major cost overruns – including roughly $466 million in storm-related expenses it has sought to pass on to Minnesota customers. In its report, the Citizens Utility Board of Minnesota highlighted concerns that a “tale of two economies” has emerged, where CenterPoint and its shareholders enjoy gains while its customers shoulder untenable utility bills.

“We believe CenterPoint owes its Minnesota customers an explanation of the financial gains it derived through the merger involving Energy Transfer, and how those gains are considered and accounted for as CenterPoint continues to pass through Winter Storm Uri-related costs to Minnesota customers and seeks to raise their rates,” the report says.

As for shareholders, CenterPoint executives are sticking to their sunny forecast.

“We offer stable industry-leading earnings growth with a conservative financial risk profile,” Jason Ryan, CenterPoint’s senior vice president for regulatory services and government affairs, told analysts last fall ([link removed]) . Since then, Lesar has reinforced the utility’s plans ([link removed]) to increase earnings per share by 8 percent each year through 2024 and between 6 percent and 8 percent after that.

The post CenterPoint boosts CEO pay to $37.8 million, blowing past other utilities ([link removed]) appeared first on Energy and Policy Institute ([link removed]) .

Read in browser » ([link removed])

[link removed] [link removed]

** Recent Articles:

------------------------------------------------------------

** Political operative Julia Johnson to leave FirstEnergy board as fallout from bribery scandal continues ([link removed])

** CenterPoint Using Free Vacations, Customer Cash to Sell Builders on Gas Appliances ([link removed])

** Southwest Gas and NV Energy-funded groups advocate in favor of gas in Nevada’s “future of gas” docket ([link removed])

** Xcel Energy supports gas industry group pushing false claims in Colorado ([link removed])

** New records suggest Alabama Power paid millions to shadowy consulting groups involved in scandals throughout the Southeast ([link removed]

============================================================

** Facebook ([link removed])

** Twitter ([link removed])

** Website ([link removed])

Copyright © 2022 Energy and Policy Institute, All rights reserved.

You are receiving this email because you opted in at our website via our Contact Us page.

Our mailing address is:

Energy and Policy Institute

P.O. Box 170399

San Francisco, CA 94117

USA

Want to change how you receive these emails?

You can ** update your preferences ([link removed])

or ** unsubscribe from this list ([link removed])

.

Email Marketing Powered by Mailchimp

[link removed]

Message Analysis

- Sender: Energy and Policy Institute

- Political Party: n/a

- Country: United States

- State/Locality: n/a

- Office: n/a

-

Email Providers:

- MailChimp