April 19, 2022

Permission to republish original opeds and cartoons granted.

Biden allowing increased ethanol in fuel this summer is nearly useless and may violate the Administrative Procedures Act—againBy David Potter

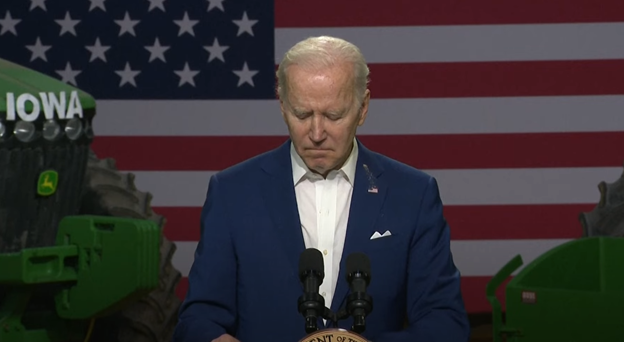

President Joe Biden's plan to extend the availability of higher biofuel blends of gasoline during the summer months is a tiny bandage on a massive wound. Biden intends to allow the sale of E15, or gasoline containing 15 percent ethanol, to continue through the summer.

The move, announced during a trip to an ethanol plant in Iowa, is the latest attempt by the Biden administration to slow inflation, which hit a new 40-year high last week. The last time inflation reached 8.5 percent was December of 1981.

The Biden administration asserts that this move will save Americans 10 cents per gallon at the pump. But E15 consumption only accounts 814 million gallons, or 0.6 percent, of all gasoline sales in America, of which the U.S. consumed 134 billion gallons in 2021.

Additionally, out of roughly 145,000 gas stations across America, the White House admits that only 2,300 of those stations sell E15. E15 accounts for less than 1 percent of fuel of all fuel sales in America and is only available at 1.6 percent of gas stations nationwide. Average Americans are unlikely to drive additional miles to visit one of these rare stations.

With the national gas price average at $4.087 today and ethanol 30 percent less energy dense than gasoline, it is difficult to overstate how inconsequential the impact of this decision will be on lowering fuel prices. It will do almost nothing.

Under the 2005 federal Renewable Fuel Standard, and later expanded by the 2007 Energy Independence and Security Act (EISA) of 2007, renewable fuels such as ethanol are required to be increasingly blended into transportation fuels in an effort to reduce greenhouse gases. E10 fuel, or a gasoline 90 percent gasoline, 10 percent ethanol mix, is sold all year long.

Contradictory to the environmental claims of ethanol, the sale of is E15 is typically banned from June 1 to September 15 due to environmental concerns. Under the 1990 Clean Air Act, the E15 blend fails to meet the Reid Vapor Pressure (RVP) requirements and creates smog that is harmful to the ozone layer during the summer.

Furthermore, Biden’s move raises significant Administrative Procedures Act concerns. In fact, the D.C. Circuit Court of Appeals struck down a prior bid by President Donald Trump to extend E15 waiver allowing sales throughout the summer. Considering that have been no major legislative changes, it appears unlikely that Biden will experience a different outcome from the court’s 2021 ruling.

The primary cause of high gasoline prices is failure of supply to keep up with demand. Virtue signaling with feed corn (the type of corn used in ethanol production) may sound good to environmentalists and Iowa farmers, but it does little to help the 50 percent of Americans who say gas price increases have created a financial hardship. 10 cent savings per gallon does not help the average American when there is just a 3 out of 200 chance the cheaper alternative will be available at their local station.

Green energy is not an inherently evil concept. However, forcing expensive green energy policies prematurely before they’re at sufficient scale, and telling Americans to suck it up and buy a $50,000 electric car, when their average annual household income is only roughly $67,000, is either evil or astoundingly ignorant.

The real answer is to drill more American oil. Allow for new leases on federal lands and do not reduce the number of acres available by 80 percent. Remove ESG goals from national oil companies. These goals are inherently contradictory to the existential purpose of an oil company. Allowing E15 this summer won’t even make a scratch in addressing these problems.

David Potter is a contributing editor at Americans for Limited Government.

Cartoon: TDS, Truth Derangement Syndrome

To view online: https://dailytorch.com/2022/04/cartoon-tds-truth-derangement-syndrome/

Video: Governor Greg Abbott sending illegal immigrants to D.C.

To view online: https://youtube.com/shorts/X20fIoSRCro

Mortgage rates shoot up to 5 percent amid high inflation. So, how long will high inflation last?

By Robert Romano

30-year mortgage interest rates shot up to 5 percent on April 14 according to the latest data complied by Freddie Mac, as banks adjust to the new normal of high inflation after 8.5 percent consumer inflation and 11.2 percent producer inflation was reported in March by the Bureau of Labor Statistics the past 12 months.

That was the highest reading since 2011 when rates were about 5.1 percent. Oct. 2018 came in at 4.9 percent. So, the current rates are not unprecedented, but prior incidences of higher rates came at times with much lower inflation.

When interest rates are rising, that means more mortgage-backed securities are being offered for sale than are being bought on the market by banks. In other words, banks are asking for a higher rate of return in order to make loans.

Typically, in economic cycles, interest rates tend to rise with inflation, albeit in this instance, it came belatedly after the Federal Reserve had been holding its own interest rate at near-zero percent since 2020 until just last month. Now that the Fed began raising interest rates in March, banks are immediately following suit.

How long it lasts is a good question. Mortgage interest rates are usually higher than the inflation rate, so the longer inflation remains elevated, then so too should mortgage interest rates. Also, the Fed typically begins raising interest rates about midway through an economic cycle, and then will start cutting them as a recession approaches.

But interest rates are a symptom — not the cure.

A better question might be how much longer the U.S. economy can continue growing before the current bout of inflation overheats the economy. In the short term, while inflation remains elevated, expect to see higher interest rates. And it might take a recession before the current bout of inflation comes under control, so stay tuned.

Robert Romano is the Vice President of Public Policy at Americans for Limited Government Foundation.

To view online: https://dailytorch.com/2022/04/mortgage-rates-shoot-up-to-5-percent-amid-high-inflation-so-how-long-will-high-inflation-last/

![]()

Katie Pavlich: On tax day, Biden pushes for a more powerful IRS

By Katie Pavlich

It's April 18, which means it's tax day in America.

President Joe Biden and the Treasury Department are marking the occasion by pushing Congress for additional IRS funding, which will make the agency even more powerful.

"The IRS needs stable, long-term funding. $80 billion over the course of the next decade will finally give the IRS the capacity to modernize and invest in a 21st century workforce," Counselor for Tax Policy and Implementation Natasha Sarin released in a statement Monday. "It will be a fairer and more equitable tax system, with the agency able to collect from top-earning evaders who currently skirt their responsibilities. And it will mean an IRS that is able to serve the American people the way that it wants to, and the way that they deserve. These changes will not happen overnight, but meaningful progress can be made swiftly—well in time for next Tax Day, and certainly those beyond."

Sarin laments the IRS has too few workers and therefore, a backlog of tax return processing persists. She also claims the agency is "chronically underfunded" and "starving" of taxpayer dollars.

"Today’s deadline is an inflection point in what has been the agency’s most challenging filing season in recent history. This is the byproduct of chronic underfunding that has starved the IRS of the tools it needs to serve the American people, coupled with a historic pandemic that introduced new responsibilities alongside mammoth challenges," she continued.

But a recent Government Accountability Office report found the IRS isn't necessarily underfunded but instead, is very badly managed.

"The Internal Revenue Service (IRS) experienced multiple challenges during the 2021 filing season as it struggled to respond to an unprecedented workload that included delivering COVID-19 relief. IRS began the filing season with a backlog of 8 million individual and business returns from the prior year that it processed alongside incoming returns. IRS reduced the backlog of prior year returns, but as of late December 2021, had about 10.5 million returns to process from 2021," the report states. "Further, IRS suspended and reviewed 35 million returns with errors primarily due to new or modified tax credits. As a result, millions of taxpayers experienced long delays in receiving refunds. GAO found that some categories of errors occur each year; however, IRS does not assess the underlying causes of taxpayer errors on returns. Doing so could help reduce future errors, refund delays, and strains on IRS resources."

"IRS has paid nearly $14 billion in refund interest in the last 7 fiscal years, with $3.3 billion paid in fiscal year 2021. Using IRS data, GAO identified some characteristics of refund interest payments, such as amended returns. However, IRS does not identify, monitor, and mitigate issues contributing to refund interest payments. Accordingly, IRS is missing an opportunity to reduce costs," the report continues.

Meanwhile, the federal government continues to take in record amounts of taxpayer dollars.

To view online: https://townhall.com/tipsheet/katiepavlich/2022/04/18/on-tax-day-biden-pushes-for-more-irs-funding-n2605995