| From | Official AOC Campaign <[email protected]> |

| Subject | The super rich pay the lowest taxes |

| Date | April 18, 2022 8:19 PM |

Links have been removed from this email. Learn more in the FAQ.

Links have been removed from this email. Learn more in the FAQ.

[ [link removed] ]Alexandria Ocasio-Cortez for Congress

Every day

is a good day to talk about taxing the rich.

But today is officially Tax Day, so we want to go into a little more

detail on what exactly we mean when we say "tax the rich." Our leaders

have historically taken the opposite approach: cutting taxes for the rich

and expecting wealth to "trickle down" to the rest of us (spoiler alert:

it doesn't).

As we work to reshape our economy and make it work for everyone — not just

the people at the top — taxing the rich is the clear and necessary

solution.

So, why do we need to tax the rich?

* The super rich pay lower taxes than the poorest Americans. The United

States has a regressive tax system in which the richest people

actually pay lower effective tax rates across all levels of government

than the poorest people in our country. Seems hard to believe, right?

But it’s true.^1

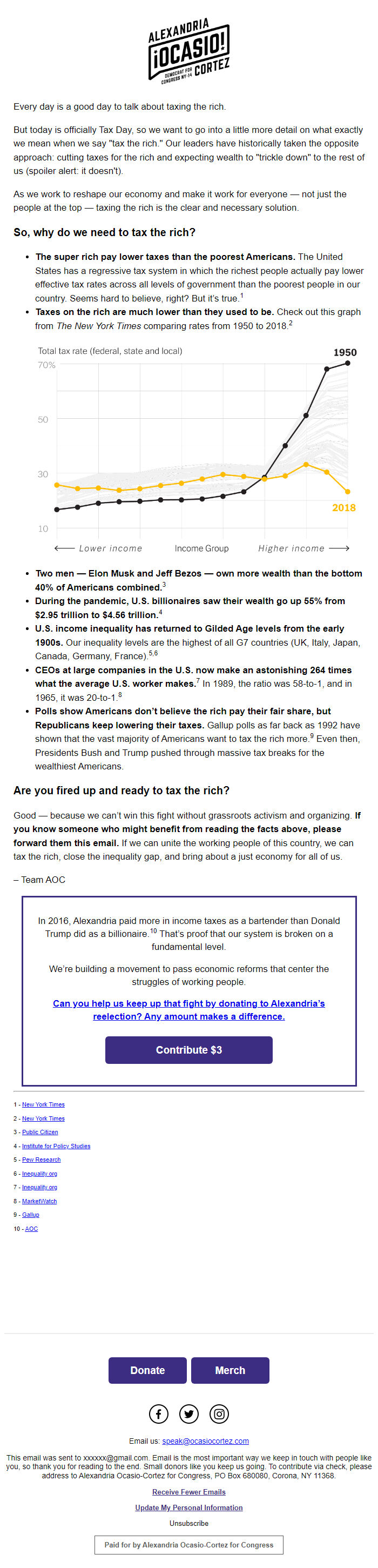

* Taxes on the rich are much lower than they used to be. Check out this

graph from The New York Times comparing rates from 1950 to 2018.^2

[1]NYT Graph

* Two men — Elon Musk and Jeff Bezos — own more wealth than the bottom

40% of Americans combined.^3

* During the pandemic, U.S. billionaires saw their wealth go up 55% from

$2.95 trillion to $4.56 trillion.^4

* U.S. income inequality has returned to Gilded Age levels from the

early 1900s. Our inequality levels are the highest of all G7 countries

(UK, Italy, Japan, Canada, Germany, France).^5,6

* CEOs at large companies in the U.S. now make an astonishing 264 times

what the average U.S. worker makes.^7 In 1989, the ratio was 58-to-1,

and in 1965, it was 20-to-1.^8

* Polls show Americans don’t believe the rich pay their fair share, but

Republicans keep lowering their taxes. Gallup polls as far back as

1992 have shown that the vast majority of Americans want to tax the

rich more.^9 Even then, Presidents Bush and Trump pushed through

massive tax breaks for the wealthiest Americans.

Are you fired up and ready to tax the rich?

Good — because we can’t win this fight without grassroots activism and

organizing. If you know someone who might benefit from reading the facts

above, please forward them this email. If we can unite the working people

of this country, we can tax the rich, close the inequality gap, and bring

about a just economy for all of us.

– Team AOC

In 2016, Alexandria paid more in income taxes as a bartender than Donald

Trump did as a billionaire.^10 That’s proof that our system is broken on a

fundamental level.

We’re building a movement to pass economic reforms that center the

struggles of working people.

[ [link removed] ]Can you help us keep up that fight by donating to Alexandria’s

reelection? Any amount makes a difference.

[ [link removed] ]Contribute $3

--------------------------------------------------------------------------

1 - [ [link removed] ]New York Times

2 - [ [link removed] ]New York Times

3 - [ [link removed] ]Public Citizen

4 - [ [link removed] ]Institute for Policy Studies

5 - [ [link removed] ]Pew Research

6 - [ [link removed] ]Inequality.org

7 - [ [link removed] ]Inequality.org

8 - [ [link removed] ]MarketWatch

9 - [ [link removed] ]Gallup

10 - [ [link removed] ]AOC

This email was sent to [email protected]. Email is the most important way we keep in touch with people like you, so thank you for reading to the end. Small donors like you keep us going. To contribute via check, please address to Alexandria Ocasio-Cortez for Congress, PO Box 680080, Corona, NY 11368.

You can unsubscribe from this mailing list at any time:

[link removed]

PAID FOR BY ALEXANDRIA OCASIO-CORTEZ FOR CONGRESS

Message Analysis

- Sender: Alexandria Ocasio-Cortez

- Political Party: Democratic

- Country: United States

- State/Locality: New York

- Office: United States House of Representatives

-

Email Providers:

- ActionKit