| From | IPA Financial Inclusion Program <[email protected]> |

| Subject | IPA Consumer Protection Quarterly | Issue 6: April 2022 |

| Date | April 14, 2022 6:39 PM |

Links have been removed from this email. Learn more in the FAQ.

Links have been removed from this email. Learn more in the FAQ.

The newest edition of our consumer protection newsletter.

View this email in your browser

[link removed]

[link removed]

More evidence, less poverty

IPA Consumer Protection Quarterly

Issue No. 6 – April 2022

Welcome back to the Consumer Protection Quarterly, IPA's newsletter on the latest consumer protection research across the globe. This newsletter is part of IPA's Consumer Protection Research Initiative

[link removed]

. Each quarter we send you the latest research, insights, and inspiration for financial consumer protection. If you have something to share, please reach out: [email protected]

mailto:[email protected]?subject=Consumer%20Protection%20Quarterly

.

You are receiving this email because of your past participation in IPA consumer protection or financial inclusion events, and/or because you signed up for our consumer protection practitioner's forum mailing interest list

[link removed]

. If there are others you think may benefit from this newsletter, please forward. You can manage your email preferences here

[link removed]

.

What's New and What's Next

New: Study in Kenya Tests Consumers’ Ability to Identify Scams

If you’re a consumer in Kenya—or anywhere really—you’ve likely experienced a phone scam at some point in time. Phone scams are the most prevalent form of digital finance services fraud in the region

[link removed]

. But are consumers able to identify scams? And how can we use that information to help protect consumers from scams in the future? A new research project “Scam Identification Ability, Confidence, and the Use of Digital Financial Services

[link removed]

” led by Spantig, et al, surveyed consumers to better understand consumers’ ability to identify phone scams. Here’s what researchers found:

[link removed]

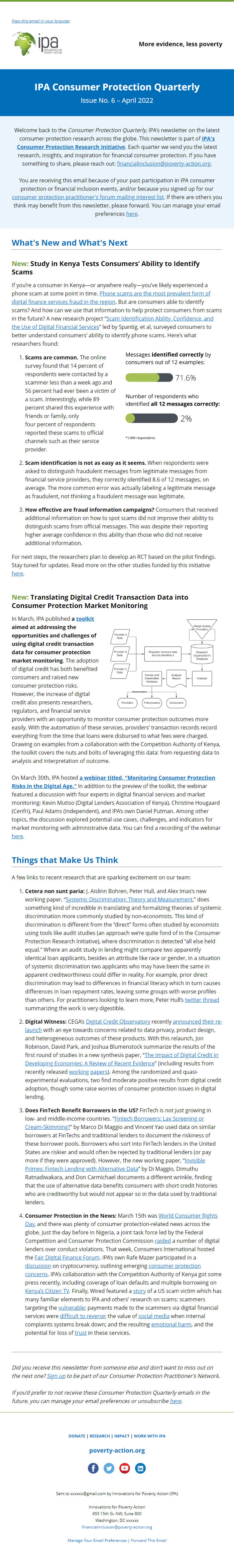

Scams are common. The online survey found that 14 percent of respondents were contacted by a scammer less than a week ago and 56 percent had ever been a victim of a scam. Interestingly, while 89 percent shared this experience with friends or family, only four percent of respondents reported these scams to official channels such as their service provider.

Scam identification is not as easy as it seems. When respondents were asked to distinguish fraudulent messages from legitimate messages from financial service providers, they correctly identified 8.6 of 12 messages, on average. The more common error was actually labeling a legitimate message as fraudulent, not thinking a fraudulent message was legitimate.

How effective are fraud information campaigns? Consumers that received additional information on how to spot scams did not improve their ability to distinguish scams from official messages. This was despite their reporting higher average confidence in this ability than those who did not receive additional information.

For next steps, the researchers plan to develop an RCT based on the pilot findings. Stay tuned for updates. Read more on the other studies funded by this initiative here

[link removed]

.

New: Translating Digital Credit Transaction Data into Consumer Protection Market Monitoring

[link removed]

In March, IPA published a toolkit

[link removed]

aimed at addressing the opportunities and challenges of using digital credit transaction data for consumer protection market monitoring. The adoption of digital credit has both benefited consumers and raised new consumer protection risks. However, the increase of digital credit also presents researchers, regulators, and financial service providers with an opportunity to monitor consumer protection outcomes more easily. With the automation of these services, providers’ transaction records record everything from the time that loans were disbursed to what fees were charged. Drawing on examples from a collaboration with the Competition Authority of Kenya, the toolkit covers the nuts and bolts of leveraging this data: from requesting data to analysis and interpretation of outcome.

On March 30th, IPA hosted a webinar titled, "Monitoring Consumer Protection Risks in the Digital Age."

[link removed]

In addition to the preview of the toolkit, the webinar featured a discussion with four experts in digital financial services and market monitoring: Kevin Mutiso (Digital Lenders Association of Kenya), Christine Hougaard (Cenfri), Paul Adams (Independent), and IPA’s own Daniel Putman. Among other topics, the discussion explored potential use cases, challenges, and indicators for market monitoring with administrative data. You can find a recording of the webinar here

[link removed]

.

Things that Make Us Think

A few links to recent research that are sparking excitement on our team:

Cetera non sunt paria: J. Aislinn Bohren, Peter Hull, and Alex Imas’s new working paper, “Systemic Discrimination: Theory and Measurement

[link removed]

,” does something kind of incredible in translating and formalizing theories of systemic discrimination more commonly studied by non-economists. This kind of discrimination is different from the “direct” forms often studied by economists using tools like audit studies (an approach we’re quite fond of in the Consumer Protection Research Initiative), where discrimination is detected “all else held equal.” Where an audit study in lending might compare two apparently identical loan applicants, besides an attribute like race or gender, in a situation of systemic discrimination two applicants who may have been the same in apparent creditworthiness could differ in reality. For example, prior direct discrimination may lead to differences in financial literacy which in turn causes differences in loan repayment rates, leaving some groups with worse profiles than others. For practitioners looking to learn more, Peter Hull’s twitter thread

[link removed]

summarizing the work is very digestible.

Digital Witness: CEGA’s Digital Credit Observatory

[link removed]

recently announced their re-launch

[link removed]

with an eye towards concerns related to data privacy, product design, and heterogeneous outcomes of these products. With this relaunch, Jon Robinson, David Park, and Joshua Blumenstock summarize the results of the first round of studies in a new synthesis paper, “The Impact of Digital Credit in Developing Economies: A Review of Recent Evidence

[link removed]

” (including results from recently released working

[link removed]

papers

[link removed]

). Among the randomized and quasi-experimental evaluations, two find moderate positive results from digital credit adoption, though some raise worries of consumer protection issues in digital lending.

Does FinTech Benefit Borrowers in the US? FinTech is not just growing in low- and middle-income countries. “Fintech Borrowers: Lax Screening or Cream-Skimming?

[link removed]

” by Marco Di Maggio and Vincent Yao used data on similar borrowers at FinTechs and traditional lenders to document the riskiness of these borrower pools. Borrowers who sort into FinTech lenders in the United States are riskier and would often be rejected by traditional lenders (or pay more if they were approved). However, the new working paper, “Invisible Primes: Fintech Lending with Alternative Data

[link removed]

” by Di Maggio, Dimuthu Ratnadiwakara, and Don Carmichael documents a different wrinkle, finding that the use of alternative data benefits consumers with short credit histories who are creditworthy but would not appear so in the data used by traditional lenders.

Consumer Protection in the News: March 15th was World Consumer Rights Day

[link removed]

, and there was plenty of consumer protection-related news across the globe. Just the day before in Nigeria, a joint task force led by the Federal Competition and Consumer Protection Commission raided

[link removed]

a number of digital lenders over conduct violations. That week, Consumers International hosted the Fair Digital Finance Forum

[link removed]

. IPA’s own Rafe Mazer participated in a discussion

[link removed]

on cryptocurrency, outlining emerging consumer protection concerns

[link removed]

. IPA’s collaboration with the Competition Authority of Kenya got some press recently, including coverage of loan defaults and multiple borrowing on Kenya’s Citizen TV

[link removed]

. Finally, Wired featured a story

[link removed]

of a US scam victim which has many familiar elements to IPA and others’ research on scams: scammers targeting the vulnerable

[link removed]

; payments made to the scammers via digital financial services were difficult to reverse

[link removed]

; the value of social media

[link removed]

when internal complaints systems break down; and the resulting emotional harm

[link removed]

, and the potential for loss of trust

[link removed]

in these services.

Did you receive this newsletter from someone else and don’t want to miss out on the next one? Sign up

[link removed]

to be part of our Consumer Protection Practitioner’s Network.

If you’d prefer to not receive these Consumer Protection Quarterly emails in the future, you can manage your email preferences or unsubscribe here

[link removed]

.

DONATE

[link removed]

| RESEARCH

[link removed]

| IMPACT

[link removed]

| WORK WITH IPA

[link removed]

poverty-action.org

[link removed]

[link removed]

[link removed]

[link removed]

[link removed]

Sent to [email protected] by Innovations for Poverty Action (IPA)

Innovations for Poverty Action

655 15th St. NW, Suite 800

Washington, DC xxxxxx

[email protected]

mailto:[email protected]

Manage Your Email Preferences

[link removed]

| Forward This Email

[link removed]

View this email in your browser

[link removed]

[link removed]

More evidence, less poverty

IPA Consumer Protection Quarterly

Issue No. 6 – April 2022

Welcome back to the Consumer Protection Quarterly, IPA's newsletter on the latest consumer protection research across the globe. This newsletter is part of IPA's Consumer Protection Research Initiative

[link removed]

. Each quarter we send you the latest research, insights, and inspiration for financial consumer protection. If you have something to share, please reach out: [email protected]

mailto:[email protected]?subject=Consumer%20Protection%20Quarterly

.

You are receiving this email because of your past participation in IPA consumer protection or financial inclusion events, and/or because you signed up for our consumer protection practitioner's forum mailing interest list

[link removed]

. If there are others you think may benefit from this newsletter, please forward. You can manage your email preferences here

[link removed]

.

What's New and What's Next

New: Study in Kenya Tests Consumers’ Ability to Identify Scams

If you’re a consumer in Kenya—or anywhere really—you’ve likely experienced a phone scam at some point in time. Phone scams are the most prevalent form of digital finance services fraud in the region

[link removed]

. But are consumers able to identify scams? And how can we use that information to help protect consumers from scams in the future? A new research project “Scam Identification Ability, Confidence, and the Use of Digital Financial Services

[link removed]

” led by Spantig, et al, surveyed consumers to better understand consumers’ ability to identify phone scams. Here’s what researchers found:

[link removed]

Scams are common. The online survey found that 14 percent of respondents were contacted by a scammer less than a week ago and 56 percent had ever been a victim of a scam. Interestingly, while 89 percent shared this experience with friends or family, only four percent of respondents reported these scams to official channels such as their service provider.

Scam identification is not as easy as it seems. When respondents were asked to distinguish fraudulent messages from legitimate messages from financial service providers, they correctly identified 8.6 of 12 messages, on average. The more common error was actually labeling a legitimate message as fraudulent, not thinking a fraudulent message was legitimate.

How effective are fraud information campaigns? Consumers that received additional information on how to spot scams did not improve their ability to distinguish scams from official messages. This was despite their reporting higher average confidence in this ability than those who did not receive additional information.

For next steps, the researchers plan to develop an RCT based on the pilot findings. Stay tuned for updates. Read more on the other studies funded by this initiative here

[link removed]

.

New: Translating Digital Credit Transaction Data into Consumer Protection Market Monitoring

[link removed]

In March, IPA published a toolkit

[link removed]

aimed at addressing the opportunities and challenges of using digital credit transaction data for consumer protection market monitoring. The adoption of digital credit has both benefited consumers and raised new consumer protection risks. However, the increase of digital credit also presents researchers, regulators, and financial service providers with an opportunity to monitor consumer protection outcomes more easily. With the automation of these services, providers’ transaction records record everything from the time that loans were disbursed to what fees were charged. Drawing on examples from a collaboration with the Competition Authority of Kenya, the toolkit covers the nuts and bolts of leveraging this data: from requesting data to analysis and interpretation of outcome.

On March 30th, IPA hosted a webinar titled, "Monitoring Consumer Protection Risks in the Digital Age."

[link removed]

In addition to the preview of the toolkit, the webinar featured a discussion with four experts in digital financial services and market monitoring: Kevin Mutiso (Digital Lenders Association of Kenya), Christine Hougaard (Cenfri), Paul Adams (Independent), and IPA’s own Daniel Putman. Among other topics, the discussion explored potential use cases, challenges, and indicators for market monitoring with administrative data. You can find a recording of the webinar here

[link removed]

.

Things that Make Us Think

A few links to recent research that are sparking excitement on our team:

Cetera non sunt paria: J. Aislinn Bohren, Peter Hull, and Alex Imas’s new working paper, “Systemic Discrimination: Theory and Measurement

[link removed]

,” does something kind of incredible in translating and formalizing theories of systemic discrimination more commonly studied by non-economists. This kind of discrimination is different from the “direct” forms often studied by economists using tools like audit studies (an approach we’re quite fond of in the Consumer Protection Research Initiative), where discrimination is detected “all else held equal.” Where an audit study in lending might compare two apparently identical loan applicants, besides an attribute like race or gender, in a situation of systemic discrimination two applicants who may have been the same in apparent creditworthiness could differ in reality. For example, prior direct discrimination may lead to differences in financial literacy which in turn causes differences in loan repayment rates, leaving some groups with worse profiles than others. For practitioners looking to learn more, Peter Hull’s twitter thread

[link removed]

summarizing the work is very digestible.

Digital Witness: CEGA’s Digital Credit Observatory

[link removed]

recently announced their re-launch

[link removed]

with an eye towards concerns related to data privacy, product design, and heterogeneous outcomes of these products. With this relaunch, Jon Robinson, David Park, and Joshua Blumenstock summarize the results of the first round of studies in a new synthesis paper, “The Impact of Digital Credit in Developing Economies: A Review of Recent Evidence

[link removed]

” (including results from recently released working

[link removed]

papers

[link removed]

). Among the randomized and quasi-experimental evaluations, two find moderate positive results from digital credit adoption, though some raise worries of consumer protection issues in digital lending.

Does FinTech Benefit Borrowers in the US? FinTech is not just growing in low- and middle-income countries. “Fintech Borrowers: Lax Screening or Cream-Skimming?

[link removed]

” by Marco Di Maggio and Vincent Yao used data on similar borrowers at FinTechs and traditional lenders to document the riskiness of these borrower pools. Borrowers who sort into FinTech lenders in the United States are riskier and would often be rejected by traditional lenders (or pay more if they were approved). However, the new working paper, “Invisible Primes: Fintech Lending with Alternative Data

[link removed]

” by Di Maggio, Dimuthu Ratnadiwakara, and Don Carmichael documents a different wrinkle, finding that the use of alternative data benefits consumers with short credit histories who are creditworthy but would not appear so in the data used by traditional lenders.

Consumer Protection in the News: March 15th was World Consumer Rights Day

[link removed]

, and there was plenty of consumer protection-related news across the globe. Just the day before in Nigeria, a joint task force led by the Federal Competition and Consumer Protection Commission raided

[link removed]

a number of digital lenders over conduct violations. That week, Consumers International hosted the Fair Digital Finance Forum

[link removed]

. IPA’s own Rafe Mazer participated in a discussion

[link removed]

on cryptocurrency, outlining emerging consumer protection concerns

[link removed]

. IPA’s collaboration with the Competition Authority of Kenya got some press recently, including coverage of loan defaults and multiple borrowing on Kenya’s Citizen TV

[link removed]

. Finally, Wired featured a story

[link removed]

of a US scam victim which has many familiar elements to IPA and others’ research on scams: scammers targeting the vulnerable

[link removed]

; payments made to the scammers via digital financial services were difficult to reverse

[link removed]

; the value of social media

[link removed]

when internal complaints systems break down; and the resulting emotional harm

[link removed]

, and the potential for loss of trust

[link removed]

in these services.

Did you receive this newsletter from someone else and don’t want to miss out on the next one? Sign up

[link removed]

to be part of our Consumer Protection Practitioner’s Network.

If you’d prefer to not receive these Consumer Protection Quarterly emails in the future, you can manage your email preferences or unsubscribe here

[link removed]

.

DONATE

[link removed]

| RESEARCH

[link removed]

| IMPACT

[link removed]

| WORK WITH IPA

[link removed]

poverty-action.org

[link removed]

[link removed]

[link removed]

[link removed]

[link removed]

Sent to [email protected] by Innovations for Poverty Action (IPA)

Innovations for Poverty Action

655 15th St. NW, Suite 800

Washington, DC xxxxxx

[email protected]

mailto:[email protected]

Manage Your Email Preferences

[link removed]

| Forward This Email

[link removed]

Message Analysis

- Sender: Poverty Action

- Political Party: n/a

- Country: United States

- State/Locality: Washington

- Office: n/a

-

Email Providers:

- Pardot

- Litmus