| From | Fraser Institute <[email protected]> |

| Subject | Is it enough to tax the top 1%? |

| Date | April 9, 2022 5:00 PM |

Links have been removed from this email. Learn more in the FAQ.

Links have been removed from this email. Learn more in the FAQ.

Having trouble viewing? Try the web version [link removed] of this email.

===============

FRASER UPDATE

A weekly digest of our latest research, commentary, and blog posts

===============

Latest Research

--------------------

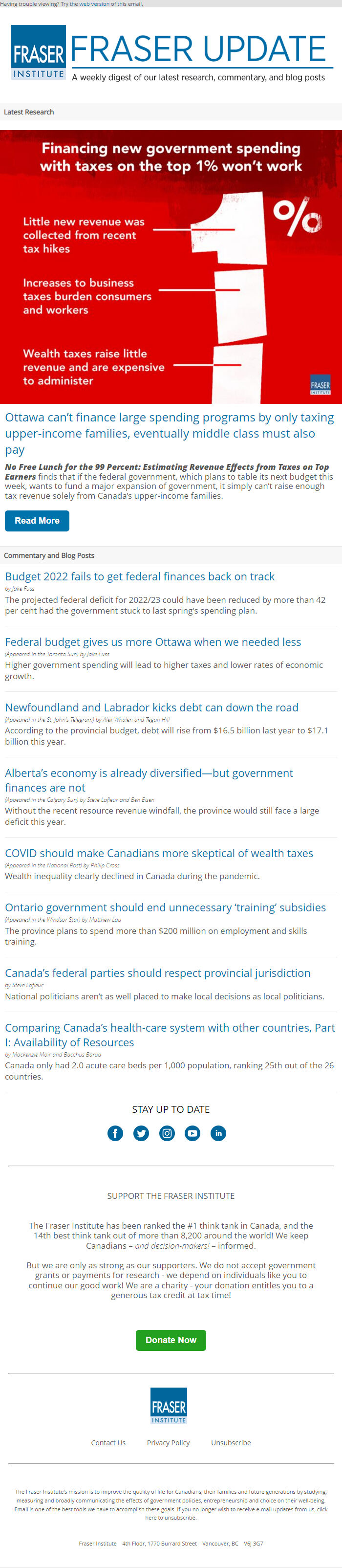

Ottawa can’t finance large spending programs by only taxing upper-income families, eventually middle class must also pay

No Free Lunch for the 99 Percent: Estimating Revenue Effects from Taxes on Top Earners finds that if the federal government, which plans to table its next budget this week, wants to fund a major expansion of government, it simply can’t raise enough tax revenue solely from Canada’s upper-income families.

Read More [[link removed]]

Commentary and Blog Posts

--------------------

Budget 2022 fails to get federal finances back on track [[link removed]]

by Jake Fuss

The projected federal deficit for 2022/23 could have been reduced by more than 42 per cent had the government stuck to last spring's spending plan.

Federal budget gives us more Ottawa when we needed less [[link removed]]

(Appeared in the Toronto Sun) by Jake Fuss

Higher government spending will lead to higher taxes and lower rates of economic growth.

Newfoundland and Labrador kicks debt can down the road [[link removed]]

(Appeared in the St. John's Telegram) by Alex Whalen and Tegan Hill

According to the provincial budget, debt will rise from $16.5 billion last year to $17.1 billion this year.

Alberta’s economy is already diversified—but government finances are not [[link removed]]

(Appeared in the Calgary Sun) by Steve Lafleur and Ben Eisen

Without the recent resource revenue windfall, the province would still face a large deficit this year.

COVID should make Canadians more skeptical of wealth taxes [[link removed]]

(Appeared in the National Post) by Philip Cross

Wealth inequality clearly declined in Canada during the pandemic.

Ontario government should end unnecessary ‘training’ subsidies [[link removed]]

(Appeared in the Windsor Star) by Matthew Lau

The province plans to spend more than $200 million on employment and skills training.

Canada’s federal parties should respect provincial jurisdiction [[link removed]]

by Steve Lafleur

National politicians aren’t as well placed to make local decisions as local politicians.

Comparing Canada’s health-care system with other countries, Part I: Availability of Resources [[link removed]] by Mackenzie Moir and Bacchus Barua

Canada only had 2.0 acute care beds per 1,000 population, ranking 25th out of the 26 countries.

SUPPORT THE FRASER INSTITUTE

--------------------

The Fraser Institute has been ranked the #1 think tank in Canada, and the 14th best think tank out of more than 8,200 around the world! We keep Canadians – and decision-makers! – informed.

But we are only as strong as our supporters. We do not accept government grants or payments for research - we depend on individuals like you to continue our good work! We are a charity - your donation entitles you to a generous tax credit at tax time!

Donate Now [[link removed][campaignid]]

Contact Us [[link removed]]

Privacy Policy [[link removed]]

Unsubscribe [link removed]

The Fraser Institute's mission is to improve the quality of life for Canadians, their families and future generations by studying, measuring and broadly communicating the effects of government policies, entrepreneurship and choice on their well-being. Email is one of the best tools we have to accomplish these goals. If you no longer wish to receive e-mail updates from us, click here to unsubscribe [link removed].

Fraser Institute | 4th Floor, 1770 Burrard Street, Vancouver, BC V6J 3G7

===============

FRASER UPDATE

A weekly digest of our latest research, commentary, and blog posts

===============

Latest Research

--------------------

Ottawa can’t finance large spending programs by only taxing upper-income families, eventually middle class must also pay

No Free Lunch for the 99 Percent: Estimating Revenue Effects from Taxes on Top Earners finds that if the federal government, which plans to table its next budget this week, wants to fund a major expansion of government, it simply can’t raise enough tax revenue solely from Canada’s upper-income families.

Read More [[link removed]]

Commentary and Blog Posts

--------------------

Budget 2022 fails to get federal finances back on track [[link removed]]

by Jake Fuss

The projected federal deficit for 2022/23 could have been reduced by more than 42 per cent had the government stuck to last spring's spending plan.

Federal budget gives us more Ottawa when we needed less [[link removed]]

(Appeared in the Toronto Sun) by Jake Fuss

Higher government spending will lead to higher taxes and lower rates of economic growth.

Newfoundland and Labrador kicks debt can down the road [[link removed]]

(Appeared in the St. John's Telegram) by Alex Whalen and Tegan Hill

According to the provincial budget, debt will rise from $16.5 billion last year to $17.1 billion this year.

Alberta’s economy is already diversified—but government finances are not [[link removed]]

(Appeared in the Calgary Sun) by Steve Lafleur and Ben Eisen

Without the recent resource revenue windfall, the province would still face a large deficit this year.

COVID should make Canadians more skeptical of wealth taxes [[link removed]]

(Appeared in the National Post) by Philip Cross

Wealth inequality clearly declined in Canada during the pandemic.

Ontario government should end unnecessary ‘training’ subsidies [[link removed]]

(Appeared in the Windsor Star) by Matthew Lau

The province plans to spend more than $200 million on employment and skills training.

Canada’s federal parties should respect provincial jurisdiction [[link removed]]

by Steve Lafleur

National politicians aren’t as well placed to make local decisions as local politicians.

Comparing Canada’s health-care system with other countries, Part I: Availability of Resources [[link removed]] by Mackenzie Moir and Bacchus Barua

Canada only had 2.0 acute care beds per 1,000 population, ranking 25th out of the 26 countries.

SUPPORT THE FRASER INSTITUTE

--------------------

The Fraser Institute has been ranked the #1 think tank in Canada, and the 14th best think tank out of more than 8,200 around the world! We keep Canadians – and decision-makers! – informed.

But we are only as strong as our supporters. We do not accept government grants or payments for research - we depend on individuals like you to continue our good work! We are a charity - your donation entitles you to a generous tax credit at tax time!

Donate Now [[link removed][campaignid]]

Contact Us [[link removed]]

Privacy Policy [[link removed]]

Unsubscribe [link removed]

The Fraser Institute's mission is to improve the quality of life for Canadians, their families and future generations by studying, measuring and broadly communicating the effects of government policies, entrepreneurship and choice on their well-being. Email is one of the best tools we have to accomplish these goals. If you no longer wish to receive e-mail updates from us, click here to unsubscribe [link removed].

Fraser Institute | 4th Floor, 1770 Burrard Street, Vancouver, BC V6J 3G7

Message Analysis

- Sender: Fraser Institute

- Political Party: n/a

- Country: Canada

- State/Locality: n/a

- Office: n/a

-

Email Providers:

- Campaign Monitor