April 7, 2022

Permission to republish original opeds and cartoons granted.

Can Elon Musk save Twitter? Should he?

By David Potter

Twitter has been struggling to find its footing in recent years with the social media platform under fire for political censorship and a lack of transparency. But, Twitter may have found a new ally in Elon Musk. The tech mogul recently disclosed that he now owns 9.2 percent of the Twitter's shares, making him single the largest shareholder of the company.

Less than 24 hours after Musk disclosed his new share ownership, Twitter CEO Parag Agrawal Tweeted an announcement that Musk is being appointed to Twitter’s Board of Directors, writing, “Musk’s term as a director will last until 2024, and under the new agreement with Twitter, Musk is prohibited from acquiring more than 14.9 percent of the company, a clause meant to limit how much power he can wield over Twitter.”

Given Musk's clout and influence, some believe that he could be the key to saving Twitter. However, it remains unclear exactly how much influence Musk will yield over the platform. For example, he appears to have significant authority with regards to the development and introduction of new features.

Musk recently Tweeted two polls which collectively received over 5 million votes. In one, he asked if the Twitter algorithm should be open source. 82.7 percent of respondents agreed. In the second poll, Musk asked if users wanted an edit button. 73.6 percent of respondents voted “yse” [sic]. For Musk to poll users on such specific topics, it’s reasonable to assume that he aspires to make a personal impact on both the platform’s transparency and functionality.

Although Musk is a self-proclaimed free speech absolutist, and he polled users asking if Twitter “rigorously adheres” to the principle of “Free speech is essential to a functioning democracy”, to which 70 percent of respondents voted no, there have been no major announcements so far regarding any changes to Twitter’s terms of service since he arrived.

Twitter and other social media companies are currently protected under Section 230 of the Communications Decency Act, which authorizes those companies to police and censor content on their platforms while simultaneously shielding those companies from liability that might arise from those users, either for copyright infringement, defamation, or other litigation.

After Musk’s acquisition, many prominent conservatives took to Twitter and asked him to restore the permanently suspended account of former President Donald Trump, who was removed from Facebook and Twitter after the Jan. 6, 2021 riot at the U.S. Capitol. This request was denied within 24 hours.

In an emailed statement to the Daily News, a Twitter spokesperson reasserted the authority of company executives: “Twitter is committed to impartiality in the development and enforcement of its policies and rules. Our policy decisions are not determined by the board or shareholders, and we have no plans to reverse any policy decisions. As always, our board plays an important advisory and feedback role across the entirety of our service. Our day-to-day operations and decisions are made by Twitter management and employees.”

This clarifying statement raises legitimate questions about whether Musk will truly have a meaningful impact over Twitter’s culture and treatment of free speech. Although board member Musk may help craft a long-term vision for Twitter, the executives might still refuse to listen to any of his policy concerns. The power dynamic between board members appears to vary between companies, so time will be necessary to see how this plays out.

This development at Twitter took place against a backdrop of several alternate social media platforms vying for market share and name recognition. The most prominent platforms to have recently emerged are: Truth Social, Rumble, Gettr, Gab, CloutHub, and the now defunct Parler. Each of these platforms take a distinct approach to defining their social media experience.

Truth Social, backed by President Trump, has had a successful, but limited release. The app has not been released yet while their team is working to scale resources to meet the massive demand from conservatives and free speech advocates across the country. Americans for Limited Government has already reserved its usernames @LimitGov and @DailyTorch and will be active on Truth Social as soon as the platform launches. If you’re already on Truth Social, be on the lookout for us and give us a follow for the latest liberty updates. If you haven’t already, you can reserve your Truth Social username by downloading the app from the Apple’s App Store.

Rumble, an alternative video platform to YouTube, is unique in that it allows users to pit their videos against other videos in a battle for likes. The winner with the most likes advances to the next round of the bracket. The final, overall winner of the bracket receives a monetary award for creating engaging content. Rumble recently received a multi-billion-dollar investment and their user base has exploded. The founder still maintains corporate control and has publicly vowed to protect free speech on the platform.

Gettr, founded by former Trump advisor Jason Miller, is a Twitter alternative with a rapidly growing user base and frequent app updates. It’s quite impressive to watch such a new tech platform make user experience enhancements this rapidly. One questionable feature is their desire to maintain Twitter integration. Please follow us @limitgov.

Gab appears to seek to be an alt Facebook. Their owner Andrew Torba is also a free speech absolutist. So much so that payment platforms have cancelled him for allowing certain speech to remain on his site. The site is funded exclusively by cryptocurrency donations and payments from their membership. While possessing a great technological foundation, Gab seems to attract staunch conservatives who only talk about politics. There isn’t much discussion of non-political topics. Follow us @limitgovt.

CloutHub is a young and developing social media platform. It is designed as a social networking platform with some fascinating built-in core technologies. It allows for virtual events with up to 100,000 participants that can be divided into subgroups. It also has built in video and the algorithm gives all users exposure. ALG also has presence on the platform and can be found @limitgov.

Sadly, Parler has had a declining user base since their website, Google Play, and iOS apps were restored after Parler’s server was terminated by Amazon Web Services and their apps were suspended by Google and Apple following the Jan. 6, 2021 riot. You can follow us there @limitgov.

With these alternative tech platforms making some gains in market share, with varying success, and Twitter executives asserting their operational dominance, should Musk really be trying to save Twitter from its self-defeating political censorship? While clearly Twitter will accept Musk’s capital and technical expertise for developing new features and visionary thinking about upcoming needs and trends, behind closed doors, they may not actually care what he has to say about political censorship or free speech.

Perhaps Musk the rocket scientist bought Twitter shares for the pure enjoyment of influencing the development of a better functioning product and witnessing financial gains as a bonus. Alternatively, Musk might know that he has more influence at Twitter than Twitter cares to admit. Only time will tell if Elon Musk can, or even should, try to save Twitter.

David Potter is a contributing editor at Americans for Limited Government.

To view online: https://dailytorch.com/2022/04/can-elon-musk-save-twitter-should-he/

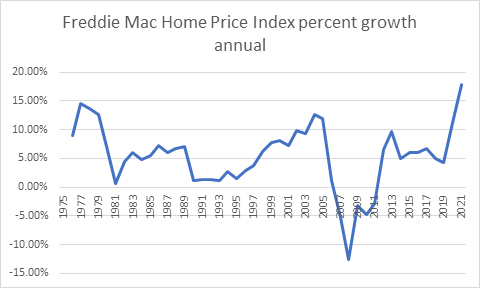

The Freddie Mac Home Price Index skyrocketed by a record 17.8 percent in 2021. Are we in another housing bubble?

By Robert Romano

Home values went up an astonishing 17.8 percent in 2021, according to the Freddie Mac Home Price Index, the highest appreciation of housing prices on record, with data going all the way back to 1975. One has to go back to 2004-2005 and 1977-1979 for the last times home values were accelerating by double digits.

In both instances, following the high inflation, there were recessions in 1980 and again in 2008 and 2009, respectively. But in the first instance, the growth rate of prices slowed down to just 0.65 percent growth in 1981, and in 2007-2011, home values actually declined nationally a combined 28.6 percent. The biggest decrease came in 2008, when home values declined nationally by 12.5 percent. Why the difference?

Clearly, the size of the inflation is not the predicter. From 1976-1980, home values increased a combined 57 percent, and from 2000-2005, they rose a combined 58 percent. Same amount, but vastly different outcomes.

From 2016 to 2021, home values have increased a combined 51 percent.

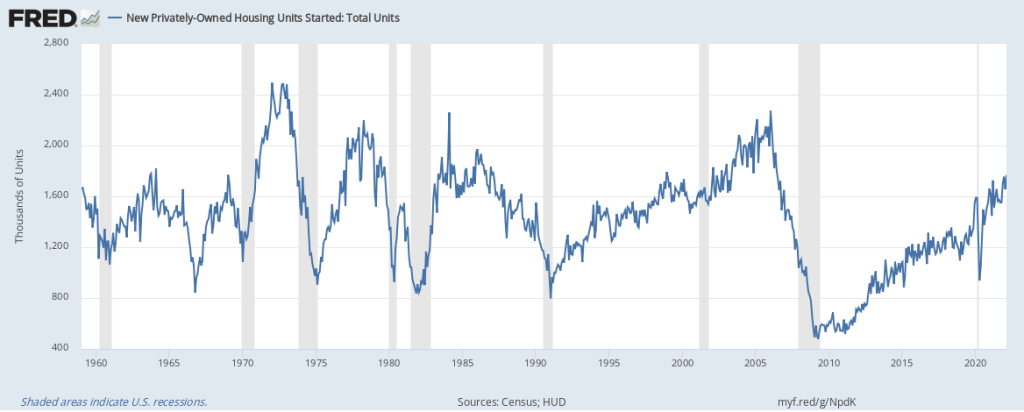

One difference could have to do with home construction, and another to do with housing finance in the 2000s. In the late 1970s, yes, there was a lot of new home construction, but Baby Boomers were hitting their mid-thirties and having families, and so there was surplus demand for housing, even with double digit interest rates.

Whereas, in the 2000s, there was also a lot of new home construction — even through the Dotcom bubble popping and the 2001 recession — but eventually fewer potential homebuyers, resulting in the construction of ghost towns in states like Florida and Arizona, combined with much lower interest rates and very loose credit conditions. In fact, new housing starts peaked in Jan. 2006, but housing prices would not decline nationally year over year until 2007 as demand fell off a cliff.

The combination was toxic, resulting in the price declines, which led many homeowners who had bought at the top of the market to simply default on their mortgages rather than sell their homes for a loss.

Millions of foreclosures later, Bear Stearns failed, Congress nationalized Fannie Mae and Freddie Mac, passed the $700 billion Troubled Asset Relief Program, the Federal Reserve nationalized AIG, the company that had sold derivatives insuring privately issued mortgage backed securities from losses, and, finally, bringing an end to the crisis, the Fed bought over $1.7 trillion of mortgage backed securities (MBS), essentially removing bad paper from the market, allowing banks to clear their balance sheets.

Since that time, the Fed began selling the MBS back to the market, reducing its holdings to $1.4 trillion by Jan. 2020, until Covid struck and the central bank resumed quantitative easing. Now, it holds a record $2 trillion of MBS. Which, love it or hate it, is a significant difference between now and 2008, when it held none.

In other words, even if there is a downturn in housing in the coming years, because the Fed has remained so active on the backend of the housing market — providing liquidity for banks to provide home loans without fear of default — by maintaining its MBS holdings, in the very least that should mitigate the risk of a financial crisis, where losses in a few firms could cascade into a system-wide failure.

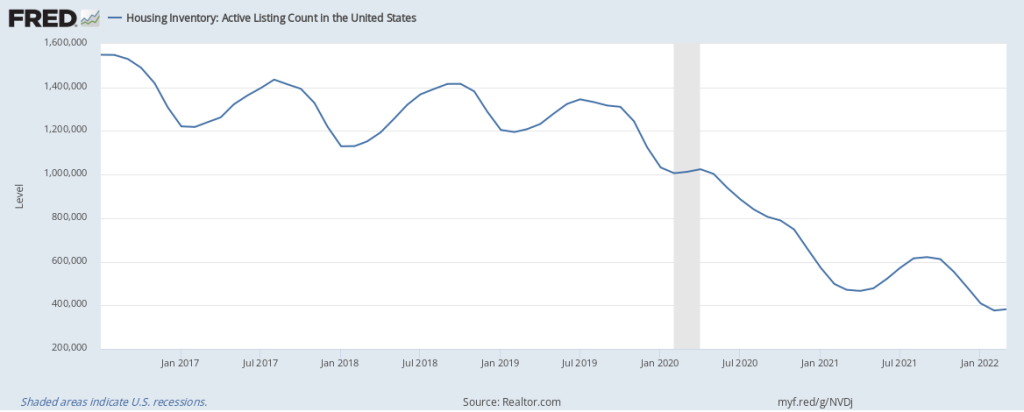

That said, credit conditions remain very loose. If you want a home loan, you can get one, essentially, with little money down and relatively low interest rates. On the other hand, the amount of homes being listed for sale has been declining nationally for the past four years amid the housing boom, according to data compiled by Realtor.com, indicating housing shortages if anything.

Which, makes a case that there may be a housing shortage rather than a surplus that would lead to a bubble popping as in the financial crisis. These shortages, the so-called supply chain crisis, owe to major production slowdowns during Covid in 2020 of everything from oil, to natural gas, to semiconductors and, yes, housing.

Then, demand recovered sooner than expected, combined with more than $6 trillion of spending, borrowing and printing by Congress and the Fed to combat Covid and its ensuing economic lockdowns, and we have quite literally had Milton Friedman’s “too much money chasing too few goods.”

In short, while the housing market remains very hot, expect to see a slowdown in the growth rate of home prices if not an outright decline as the current bout of inflation boils over and the economy overheats. And while we might expect a recession in the not so distant future, we likely lack the tools to fully predict its severity and how it will specifically will impact the housing market. Are we in another housing bubble? Stay tuned.

Robert Romano is the Vice President of Public Policy at Americans for Limited Government Foundation.

To view online: https://dailytorch.com/2022/04/the-freddie-mac-home-price-index-skyrocketed-by-a-record-17-8-percent-in-2021-are-we-in-another-housing-bubble/

ALG Editor’s Note: In the following featured editorial from the New York Post, the board calls attention a San Francisco Federal Reserve study showing U.S. inflation far outpacing OECD countries after massive spending, borrowing and printing of $6 trillion Covid by the federal government to combat Covid:

![]()

New York Post: New Fed study shows Biden owns our economic disaster

President Joe Biden loves to blame our sky-high inflation on corporate greed and Vladimir Putin. But a new study from the San Francisco Fed shows it was Biden himself who put America on this grim trajectory.

Specifically, it was the massive $1.9 trillion stimulus dumped into the US economy in early 2021 by the president’s American Rescue Plan.

As the nearby chart demonstrates, the nation began heading into the inflationary stratosphere in early 2021, while other advanced economies, the other countries in the Organization for Economic Co-operation and Development, haven’t seen anything like the soaring prices now punishing workers across America.

Which means that the spike is due to something US-specific, rather than global prevailing conditions. That policy, was, of course, Biden’s signature economic “achievement.”

The damage it did has been massive. Median OECD inflation went from around 1% to 2.5% during 2021. Here? From under 2% to 7% (5% excluding food and energy). And it kept on rising after that, to the nearly 8% we see now. The details are uglier still: Per the latest data, fuel oil is up almost 44%; gasoline, 38%; meat and eggs, 13%.

Put in concrete terms, a recent Bloomberg calculation translates this to an added $433 per month in household expenses for 2022.

And historic producer price inflation, a shocking 10%, guarantees even more pain ahead.

It was utterly unnecessary: Biden’s stimulus was pure political favor-currying dumped into an economy already overheating on the demand side. Little of it had much to do with the COVID relief it claimed was the point.

And don’t forget: The same Fed data also show that the 2020 stimulus did not touch off an inflation explosion, suggesting it was properly timed and directed.

Also, while Biden’s move didn’t officially happen until March and inflation was heading up before that, he was clearly signaling from the start what he was going to do, thus opening the floodgates.

The Biden White House, despite being proved wrong over and over on the economy, is sticking to its guns — still talking about “Putin’s price hike” and stupidly tapping our Strategic Petroleum Reserve instead of getting out of the way and letting America move back toward energy independence.

Yet those Fed numbers don’t lie, and that chart is worth a thousand words (adjusted for inflation). Biden owns our economic nightmare.

And it’s going to keep getting worse unless he does an about-face.

To view online: https://nypost.com/2022/04/04/new-fed-study-shows-biden-owns-our-economic-disaster/