April 1, 2022

Permission to republish original opeds and cartoons granted.

A Biden recession is virtually guaranteed after 10-year, 2-year treasuries spread inverts as economy overheats from rampant inflation

By Robert Romano

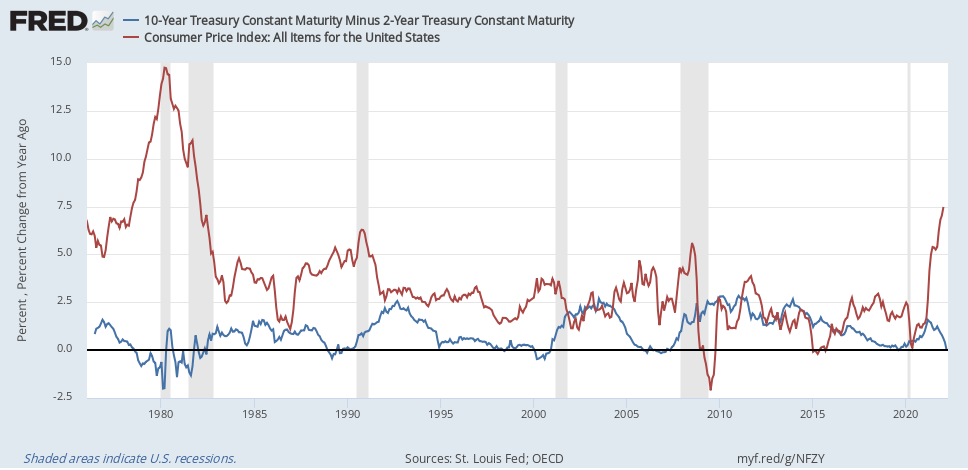

The spread between 10-year treasuries and 2-year treasuries, a leading recession indicator whose inversions have predicted almost all of the U.S. economic recessions in modern history, on March 31 inverted for the first time since Sept. 2019.

When the 10-year, 2-year spread inverts, a recession tends to result on average 14 months afterward, sometimes sooner, sometimes later. The one time there was a head fake on the 10-year, 2-year was in the mid-1990s at a time when inflation was much lower than it is now.

As an aside, potentially the Sept. 2019 inversion might have ended up being a premature indicator, too, but then Covid and global economic lockdowns in early 2020 went ahead and ensured a recession even if one was not due. On the other hand, at that point it had been 11 years since the prior recession and so the business cycle was going to end sooner or later.

In this case, with 7.9 percent consumer inflation and 10 percent producer inflation, plus peak employment, the economy is almost certainly overheating. In fact, in modern economic history, when inflation gets above 5 percent, similar to the 10-year, 2-year, a recession tends to follow on average 14 months later. And inflation has been above 5 percent since June 2021.

Which, by the way, is no surprise.

Congress spent and borrowed more than $6 trillion to fight Covid after Jan. 2020: the $2.2 trillion CARES Act and the $900 billion phase four legislation under former President Donald Trump, and the $1.9 trillion stimulus and $550 billion of new infrastructure spending under President Joe Biden.

As a result, the national debt has increased by $6.8 trillion to $30 trillion since Jan. 2020, of which the Fed monetized half, or $3.4 trillion, by increasing its share of U.S. treasuries to a record $5.7 trillion while the M2 money supply has increased by $6.4 trillion to $21.8 trillion, a 42 percent increase, since Jan. 2020.

Throw in the supply chain crisis — production slowed down significantly in 2020 but then recovered sooner than expected, leading to supply strains in everything from oil and gas to semiconductors — and the war in Ukraine and consequent sanctions that have made the global economy that much smaller by restricting supplies further.

Particularly, the $1.9 stimulus in 2021 looms large as an additional catalyst for the current bout of high inflation. It was unneeded. 16 million out of the 25 million jobs lost to Covid had already been recovered before Biden was even sworn into office. The recovery was already well underway. It was an unforced error. He could have passed legislation that did a lot of things instead he opted for more helicopter money checks and child tax credits, and as a result inflation has been above 5 percent since June 2021.

Another confirming indicator could be the Job Openings and Labor Turnover Survey by the Bureau of Labor Statistics, which shows that the number of job openings has dropped for two consecutive months by almost 200,000 jobs. Usually, at the end of the business cycle, the amount of job openings first peaks and then months later declines when the recession strikes. Certainly something else to be watchful of.

Finally, there’s the Federal Reserve, which has belatedly begun hiking interest rates in March. Usually, the Fed starts to raise interest rates towards the end of the business cycle, mostly so it has room to maneuver when the next recession strikes.

For Biden’s sake, he better hope that if there is a recession, it happens before the midterms so the American people get their discontent out of their system in November and not in 2024. If not, a 2023 or 2024 recession could be putting the final nails in the coffin of another one-term presidency. Stay tuned.

Robert Romano is the Vice President of Public Policy at Americans for Limited Government Foundation.

Video: Trump was right about oil reserves

To view online: https://www.youtube.com/watch?v=Vm-B7k_K4yg

ALG Editor’s Note: In the following featured oped from Newsweek, the Claremont Institute’s Ben Weingarten makes the case against President Joe Biden’s executive order on cryptocurrencies:

![]()

Ben Weingarten: Biden crypto executive order portends dollar destruction, liberty erosion

By Ben Weingarten

If you like what the Biden administration has done to the paper dollar, then you'll love what it could do to a digital dollar.

The odds of that perilous prospect becoming reality increased exponentially on March 9, when the White House introduced its "Executive Order on Ensuring Responsible Development of Digital Assets."

The order might not only foretell the further erosion of the world's reserve currency—and with it the wealth, economic dynamism and power that currency underpins—but the further erosion of our liberties.

It calls for mobilizing the federal bureaucracy to regulate digital assets, including cryptocurrencies, and to prepare for the creation of a U.S. central bank digital currency (CBDC) —an electronic dollar one might hold in a digital account with the Federal Reserve.

The two go hand in hand.

On the regulatory side, the order notes that: "The new and unique uses and functions that digital assets can facilitate may create additional economic and financial risks requiring an evolution to a regulatory approach that adequately addresses those risks." [Emphasis mine.]

Translation: "Nice business you've got there. It'd be a shame if something happened to it." That is, the administration could use the threat of regulation to legally extort players in a booming multi-trillion-dollar digital asset industry—that very growth being the pretext to regulate. This might be the best-case scenario.

Worse, the administration could impose regulations aimed at making cryptocurrencies—which have risen, while the dollar has fallen—less attractive versus today's paper dollar, and tomorrow's potential digital one. That is, it could use regulations to try to kill, or at minimum hamstring, competitors.

There's an irony here. Cryptocurrencies were created in part as a decentralized, non-governmental alternative to fiat money controlled by central banks like the quasi-governmental Federal Reserve. In the view of crypto enthusiasts, the Fed has irresponsibly managed the dollar, inflating it away. Hence the need for Bitcoin. Yet now the U.S. government claims it wants to ensure cryptocurrencies' responsible development? Notwithstanding their unbacked and digital form, cryptocurrencies are antithetical to CBDCs. This should not be lost on anyone.

To view online: https://www.newsweek.com/biden-crypto-executive-order-portends-dollar-destruction-liberty-erosion-opinion-1692741