Email

The Rundown: Fix permitting for critical minerals — new CCUS partnership — nuclear and critical minerals a global solution

| From | ClearPath Action <[email protected]> |

| Subject | The Rundown: Fix permitting for critical minerals — new CCUS partnership — nuclear and critical minerals a global solution |

| Date | April 1, 2022 1:40 PM |

Links have been removed from this email. Learn more in the FAQ.

Links have been removed from this email. Learn more in the FAQ.

[link removed]

Happy Friday!

We’re hiring — apply to be our Government Affairs Associate

[link removed]

.

1. Defense Production Act is a small step, but critical minerals need modernized permitting

Invoking the Defense Production Act

[link removed]

to increase U.S. production of critical minerals may be a small step, but doesn’t solve the root problem — the need to modernize permitting.

Critical minerals including lithium…nickel…graphite…cobalt…manganese, are hardly produced in the U.S. today.

Current permitting and siting regulations make critical mineral production and clean energy infrastructure development difficult.

What’s clear: When it comes to critical mineral production, the U.S. has not just fallen behind — we're almost nowhere to be found. In order to ensure a reliable supply of American-sourced critical minerals, our federal permitting process must be streamlined and modernized

[link removed]

.

Plug in: The Senate Committee on Energy and Natural Resources held a full-committee hearing Thursday morning on opportunities and challenges in domestic critical mineral mining

[link removed]

.

2. Oxy and Weyerhaeuser join forces on carbon capture

A site in Louisiana to store captured carbon dioxide has been agreed upon by Oxy Low Carbon Ventures and timberland company Weyerhaeuser.

The potential project, a geologic storage facility utilizing Weyerhaeuser-owned pore space

[link removed]

, would be an important step for CCUS momentum, and both groups’ climate goals.

Oxy’s subsidiary 1PointFive aims to tackle carbon emissions in hard-to-decarbonize sectors through development of CCS hubs throughout the U.S.

Weyerhaeuser’s new Natural Climate Solutions business is focused on various emissions-reduction projects from mitigation solutions to conservation.

Plug in: European aerospace company Airbus recently purchased 400,000 tonnes of carbon removal credits

[link removed]

from 1PointFive’s planned direct air capture facility — another important milestone for Oxy’s emissions-reduction goals.

3. Nuclear, critical minerals as energy market solutions (The Economist)

Unrest in the global energy market and rising gas prices are prompting a market response

[link removed]

. As the U.S. and other nations cut reliance on Russian fossil fuels, The Economist highlights how increased demand for critical minerals and nuclear power could give them a chance to shine.

Both public and private clean energy solutions are already on the rise:

French and British governments have committed to expanding their nuclear capacities.

Tesla and Canadian mining company Barrick have struck critical mineral supply deals with New Caledonia and Pakistan respectively to support their energy innovations.

What’s clear: Nuclear has the opportunity to play a significant role in bolstering clean energy economies in the U.S. and worldwide as global energy markets remain unstable.

Plug in: Our CEO Rich Powell appeared on Just the News this week to discuss the benefits of nuclear energy in the U.S. and around the world.

Russia is currently the only commercial supplier of HALEU, which is needed by the next generation of nuclear reactors — Marketplace dives into the role of domestic HALEU

[link removed]

amid global conflict.

4. ICYMI

The Nuclear Regulatory Commission (NRC) is proposing a budget of $929.2 million

[link removed]

for FY23, and $23.8 million will be for developing regulatory infrastructure for advanced reactors.

A study from several climate groups found that several major banks financially back fossil fuels

[link removed]

despite touting long-term net-zero pledges.

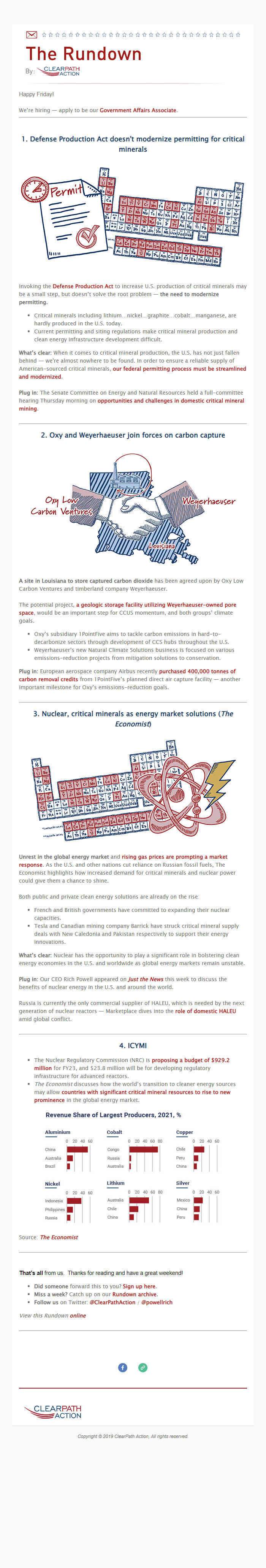

The Economist discusses how the world’s transition to cleaner energy sources may allow countries with significant critical mineral resources to rise to new prominence

[link removed]

in the global energy market.

Source: The Economist

[link removed]

That’s all from us. Thanks for reading and have a great weekend!

Did someone forward this to you? Sign up here

[link removed]

.

Miss a week? Catch up on our Rundown archive

[link removed]

.

Follow us on Twitter: @ClearPathAction

[link removed]

/ @powellrich

[link removed]

View this Rundown online

[link removed]

[link removed]

[link removed]

-->

[link removed]

Copyright © 2019 ClearPath Action, All rights reserved.

This email was sent to [email protected]

why did I get this?

*|ABOUT_LIST|*

unsubscribe from this list

[link removed]

[link removed]

update subscription preferences

ClearPath, Inc.

518 C St NE Suite 300

Washington DC 20002

Happy Friday!

We’re hiring — apply to be our Government Affairs Associate

[link removed]

.

1. Defense Production Act is a small step, but critical minerals need modernized permitting

Invoking the Defense Production Act

[link removed]

to increase U.S. production of critical minerals may be a small step, but doesn’t solve the root problem — the need to modernize permitting.

Critical minerals including lithium…nickel…graphite…cobalt…manganese, are hardly produced in the U.S. today.

Current permitting and siting regulations make critical mineral production and clean energy infrastructure development difficult.

What’s clear: When it comes to critical mineral production, the U.S. has not just fallen behind — we're almost nowhere to be found. In order to ensure a reliable supply of American-sourced critical minerals, our federal permitting process must be streamlined and modernized

[link removed]

.

Plug in: The Senate Committee on Energy and Natural Resources held a full-committee hearing Thursday morning on opportunities and challenges in domestic critical mineral mining

[link removed]

.

2. Oxy and Weyerhaeuser join forces on carbon capture

A site in Louisiana to store captured carbon dioxide has been agreed upon by Oxy Low Carbon Ventures and timberland company Weyerhaeuser.

The potential project, a geologic storage facility utilizing Weyerhaeuser-owned pore space

[link removed]

, would be an important step for CCUS momentum, and both groups’ climate goals.

Oxy’s subsidiary 1PointFive aims to tackle carbon emissions in hard-to-decarbonize sectors through development of CCS hubs throughout the U.S.

Weyerhaeuser’s new Natural Climate Solutions business is focused on various emissions-reduction projects from mitigation solutions to conservation.

Plug in: European aerospace company Airbus recently purchased 400,000 tonnes of carbon removal credits

[link removed]

from 1PointFive’s planned direct air capture facility — another important milestone for Oxy’s emissions-reduction goals.

3. Nuclear, critical minerals as energy market solutions (The Economist)

Unrest in the global energy market and rising gas prices are prompting a market response

[link removed]

. As the U.S. and other nations cut reliance on Russian fossil fuels, The Economist highlights how increased demand for critical minerals and nuclear power could give them a chance to shine.

Both public and private clean energy solutions are already on the rise:

French and British governments have committed to expanding their nuclear capacities.

Tesla and Canadian mining company Barrick have struck critical mineral supply deals with New Caledonia and Pakistan respectively to support their energy innovations.

What’s clear: Nuclear has the opportunity to play a significant role in bolstering clean energy economies in the U.S. and worldwide as global energy markets remain unstable.

Plug in: Our CEO Rich Powell appeared on Just the News this week to discuss the benefits of nuclear energy in the U.S. and around the world.

Russia is currently the only commercial supplier of HALEU, which is needed by the next generation of nuclear reactors — Marketplace dives into the role of domestic HALEU

[link removed]

amid global conflict.

4. ICYMI

The Nuclear Regulatory Commission (NRC) is proposing a budget of $929.2 million

[link removed]

for FY23, and $23.8 million will be for developing regulatory infrastructure for advanced reactors.

A study from several climate groups found that several major banks financially back fossil fuels

[link removed]

despite touting long-term net-zero pledges.

The Economist discusses how the world’s transition to cleaner energy sources may allow countries with significant critical mineral resources to rise to new prominence

[link removed]

in the global energy market.

Source: The Economist

[link removed]

That’s all from us. Thanks for reading and have a great weekend!

Did someone forward this to you? Sign up here

[link removed]

.

Miss a week? Catch up on our Rundown archive

[link removed]

.

Follow us on Twitter: @ClearPathAction

[link removed]

/ @powellrich

[link removed]

View this Rundown online

[link removed]

[link removed]

[link removed]

-->

[link removed]

Copyright © 2019 ClearPath Action, All rights reserved.

This email was sent to [email protected]

why did I get this?

*|ABOUT_LIST|*

unsubscribe from this list

[link removed]

[link removed]

update subscription preferences

ClearPath, Inc.

518 C St NE Suite 300

Washington DC 20002

Message Analysis

- Sender: ClearPath Action

- Political Party: n/a

- Country: United States

- State/Locality: n/a

- Office: n/a

-

Email Providers:

- Pardot

- Litmus