| From | Dr. Tasha Green Cruzat <[email protected]> |

| Subject | Children's Advocates for Change March Newsletter |

| Date | March 30, 2022 6:39 PM |

Links have been removed from this email. Learn more in the FAQ.

Links have been removed from this email. Learn more in the FAQ.

<[link removed]>

View this email in a browser

Championing the Well-Being of Illinois' Children

<[link removed]>

www.childrensadvocates.org

March Newsletter

A Message from the President

Dr. Tasha Green Cruzat

March is Women’s History Month, and Illinois has a rich history of women working to improve the well-being of others across our state and the country: Ida B. Wells, Jane Addams, and Marva Collins- just to name a few. In fulfilling Children’s Advocates for Change’s mission to see that all children have the resources they need to succeed in life, we need to keep vigilant in our efforts to improve the lives of our children and their families.

While we are recovering from the pandemic, child poverty in Illinois remains and its inequities are persistent. The U.S. Census Bureau’s 2020 American Community Survey 5-Year Estimates Data Profile for Illinois shows 16.2% of our children under the age of 18 in poverty. More detailed data from 2019 (pre-pandemic), showed the child poverty rate for Black children in Illinois more than three times higher than the poverty rate of non-Hispanic Illinois white children (34% vs. 9%). Clearly, we have a long way to go to eliminate our inequities in this state and give every child the resources he or she needs to succeed.

Yet, with all the difficulties we faced, 2021 showed us that as a society we can make that journey. The past year’s increase in the federal child tax credit combined with other federal COVID-19 relief measures cut the nation’s child poverty rate by nearly half. Unfortunately, Congress has not seen fit to continue us on that path. If it does not act, then we need to look at what we can do here in Illinois. In this newsletter we look at some of those steps. I hope you’ll join us in working to fulfill the mission that some of the great ladies of Illinois and others embarked on.

Tax Relief for Renters

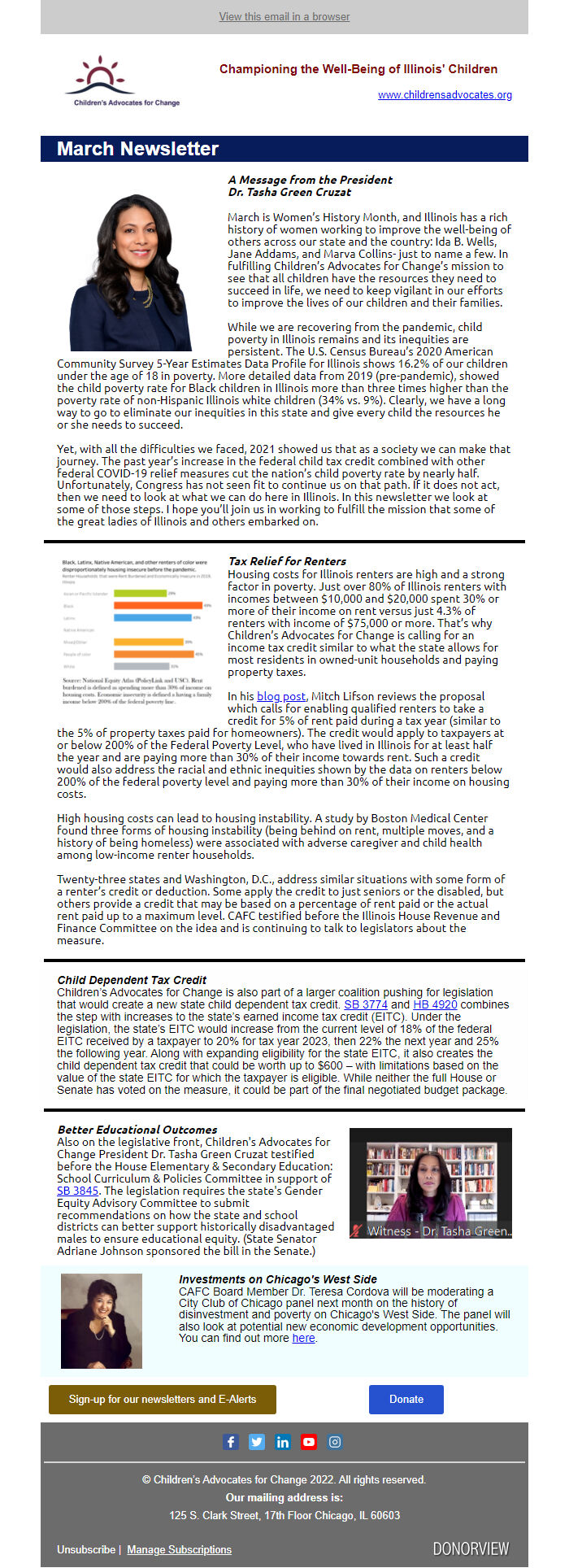

Housing costs for Illinois renters are high and a strong factor in poverty. Just over 80% of Illinois renters with incomes between $10,000 and $20,000 spent 30% or more of their income on rent versus just 4.3% of renters with income of $75,000 or more. That’s why Children’s Advocates for Change is calling for an income tax credit similar to what the state allows for most residents in owned-unit households and paying property taxes.

In his

<[link removed]>

blog post, Mitch Lifson reviews the proposal which calls for enabling qualified renters to take a credit for 5% of rent paid during a tax year (similar to the 5% of property taxes paid for homeowners). The credit would apply to taxpayers at or below 200% of the Federal Poverty Level, who have lived in Illinois for at least half the year and are paying more than 30% of their income towards rent. Such a credit would also address the racial and ethnic inequities shown by the data on renters below 200% of the federal poverty level and paying more than 30% of their income on housing costs.

High housing costs can lead to housing instability. A study by Boston Medical Center found three forms of housing instability (being behind on rent, multiple moves, and a history of being homeless) were associated with adverse caregiver and child health among low-income renter households.

Twenty-three states and Washington, D.C., address similar situations with some form of a renter’s credit or deduction. Some apply the credit to just seniors or the disabled, but others provide a credit that may be based on a percentage of rent paid or the actual rent paid up to a maximum level. CAFC testified before the Illinois House Revenue and Finance Committee on the idea and is continuing to talk to legislators about the measure.

Child Dependent Tax Credit

Children’s Advocates for Change is also part of a larger coalition pushing for legislation that would create a new state child dependent tax credit.

<[link removed]>

SB 3774 and

<[link removed]>

HB 4920 combines the step with increases to the state’s earned income tax credit (EITC). Under the legislation, the state’s EITC would increase from the current level of 18% of the federal EITC received by a taxpayer to 20% for tax year 2023, then 22% the next year and 25% the following year. Along with expanding eligibility for the state EITC, it also creates the child dependent tax credit that could be worth up to $600 – with limitations based on the value of the state EITC for which the taxpayer is eligible. While neither the full House or Senate has voted on the measure, it could be part of the final negotiated budget package.

Better Educational Outcomes

Also on the legislative front, Children's Advocates for Change President Dr. Tasha Green Cruzat testified before the House Elementary & Secondary Education: School Curriculum & Policies Committee in support of

<[link removed]>

SB 3845. The legislation requires the state's Gender Equity Advisory Committee to submit recommendations on how the state and school districts can better support historically disadvantaged males to ensure educational equity. (State Senator Adriane Johnson sponsored the bill in the Senate.)

Investments on Chicago's West Side

CAFC Board Member Dr. Teresa Cordova will be moderating a City Club of Chicago panel next month on the history of disinvestment and poverty on Chicago's West Side. The panel will also look at potential new economic development opportunities. You can find out more

<[link removed]>

here.

<[link removed]>

Sign-up for our newsletters and E-Alerts

<[link removed]>

Donate

<[link removed]>

<[link removed]>

<[link removed]>

<[link removed]>

<[link removed]>

<[link removed]>

<[link removed]>

<[link removed]>

<[link removed]>

<[link removed]>

© Children’s Advocates for Change 2022. All rights reserved.

Our mailing address is:

125 S. Clark Street, 17th Floor Chicago, IL 60603

<[link removed]>

Unsubscribe |

<[link removed]>

Manage Subscriptions

<[link removed]>

View this email in a browser

Championing the Well-Being of Illinois' Children

<[link removed]>

www.childrensadvocates.org

March Newsletter

A Message from the President

Dr. Tasha Green Cruzat

March is Women’s History Month, and Illinois has a rich history of women working to improve the well-being of others across our state and the country: Ida B. Wells, Jane Addams, and Marva Collins- just to name a few. In fulfilling Children’s Advocates for Change’s mission to see that all children have the resources they need to succeed in life, we need to keep vigilant in our efforts to improve the lives of our children and their families.

While we are recovering from the pandemic, child poverty in Illinois remains and its inequities are persistent. The U.S. Census Bureau’s 2020 American Community Survey 5-Year Estimates Data Profile for Illinois shows 16.2% of our children under the age of 18 in poverty. More detailed data from 2019 (pre-pandemic), showed the child poverty rate for Black children in Illinois more than three times higher than the poverty rate of non-Hispanic Illinois white children (34% vs. 9%). Clearly, we have a long way to go to eliminate our inequities in this state and give every child the resources he or she needs to succeed.

Yet, with all the difficulties we faced, 2021 showed us that as a society we can make that journey. The past year’s increase in the federal child tax credit combined with other federal COVID-19 relief measures cut the nation’s child poverty rate by nearly half. Unfortunately, Congress has not seen fit to continue us on that path. If it does not act, then we need to look at what we can do here in Illinois. In this newsletter we look at some of those steps. I hope you’ll join us in working to fulfill the mission that some of the great ladies of Illinois and others embarked on.

Tax Relief for Renters

Housing costs for Illinois renters are high and a strong factor in poverty. Just over 80% of Illinois renters with incomes between $10,000 and $20,000 spent 30% or more of their income on rent versus just 4.3% of renters with income of $75,000 or more. That’s why Children’s Advocates for Change is calling for an income tax credit similar to what the state allows for most residents in owned-unit households and paying property taxes.

In his

<[link removed]>

blog post, Mitch Lifson reviews the proposal which calls for enabling qualified renters to take a credit for 5% of rent paid during a tax year (similar to the 5% of property taxes paid for homeowners). The credit would apply to taxpayers at or below 200% of the Federal Poverty Level, who have lived in Illinois for at least half the year and are paying more than 30% of their income towards rent. Such a credit would also address the racial and ethnic inequities shown by the data on renters below 200% of the federal poverty level and paying more than 30% of their income on housing costs.

High housing costs can lead to housing instability. A study by Boston Medical Center found three forms of housing instability (being behind on rent, multiple moves, and a history of being homeless) were associated with adverse caregiver and child health among low-income renter households.

Twenty-three states and Washington, D.C., address similar situations with some form of a renter’s credit or deduction. Some apply the credit to just seniors or the disabled, but others provide a credit that may be based on a percentage of rent paid or the actual rent paid up to a maximum level. CAFC testified before the Illinois House Revenue and Finance Committee on the idea and is continuing to talk to legislators about the measure.

Child Dependent Tax Credit

Children’s Advocates for Change is also part of a larger coalition pushing for legislation that would create a new state child dependent tax credit.

<[link removed]>

SB 3774 and

<[link removed]>

HB 4920 combines the step with increases to the state’s earned income tax credit (EITC). Under the legislation, the state’s EITC would increase from the current level of 18% of the federal EITC received by a taxpayer to 20% for tax year 2023, then 22% the next year and 25% the following year. Along with expanding eligibility for the state EITC, it also creates the child dependent tax credit that could be worth up to $600 – with limitations based on the value of the state EITC for which the taxpayer is eligible. While neither the full House or Senate has voted on the measure, it could be part of the final negotiated budget package.

Better Educational Outcomes

Also on the legislative front, Children's Advocates for Change President Dr. Tasha Green Cruzat testified before the House Elementary & Secondary Education: School Curriculum & Policies Committee in support of

<[link removed]>

SB 3845. The legislation requires the state's Gender Equity Advisory Committee to submit recommendations on how the state and school districts can better support historically disadvantaged males to ensure educational equity. (State Senator Adriane Johnson sponsored the bill in the Senate.)

Investments on Chicago's West Side

CAFC Board Member Dr. Teresa Cordova will be moderating a City Club of Chicago panel next month on the history of disinvestment and poverty on Chicago's West Side. The panel will also look at potential new economic development opportunities. You can find out more

<[link removed]>

here.

<[link removed]>

Sign-up for our newsletters and E-Alerts

<[link removed]>

Donate

<[link removed]>

<[link removed]>

<[link removed]>

<[link removed]>

<[link removed]>

<[link removed]>

<[link removed]>

<[link removed]>

<[link removed]>

<[link removed]>

© Children’s Advocates for Change 2022. All rights reserved.

Our mailing address is:

125 S. Clark Street, 17th Floor Chicago, IL 60603

<[link removed]>

Unsubscribe |

<[link removed]>

Manage Subscriptions

<[link removed]>

Message Analysis

- Sender: Children’s Advocates for Change

- Political Party: n/a

- Country: United States

- State/Locality: n/a

- Office: n/a

-

Email Providers:

- MailJet