| From | TaxPayers' Alliance <[email protected]> |

| Subject | 📢 SPECIAL BULLETIN: Rishi takes with one hand and gives with the other |

| Date | March 27, 2022 9:59 AM |

Links have been removed from this email. Learn more in the FAQ.

Links have been removed from this email. Learn more in the FAQ.

The spring statement was a chance to shift away from short-term revenue-raising, and set out policies that limit public spending and go for growth.

View this email in your browser ([link removed])

Good morning,

It’s been an incredibly busy week at the TaxPayers’ Alliance, as we set to task reacting to and analysing the chancellor’s spring statement. In this bulletin, we’ll look at what Rishi got right and what he needs to do to boost Britain’s economy.

It’s fair to say this year that our response set the tone, leading the headlines ([link removed]) and setting the political weather.

There were some wins for taxpayers

Let’s start with the positives. With millions of households across the country facing a cost of living crisis, it was vital that the chancellor cut taxes and ease the burden on them. As had been heavily touted in the press the day before, a 5p per litre drop in fuel duty is a much-needed helping hand.

[link removed]

In addition, the national insurance threshold will be raised by £3,000 to bring it into alignment with income tax. This is something that the TPA called for in 2020 ([link removed]) and has long campaigned for ([link removed]) . It’s a big stride forward to simplifying our ridiculously complicated tax system.

The chancellor also pledged to cut the basic rate of income tax to 19p before the end of the parliament. Something we would very much welcome. But we’ll be reminding the chancellor that he should use this opportunity to go a step further and combine the two into a single income tax - that really would be a radical reform!

But HM Treasury is taking with one hand to give away with the other

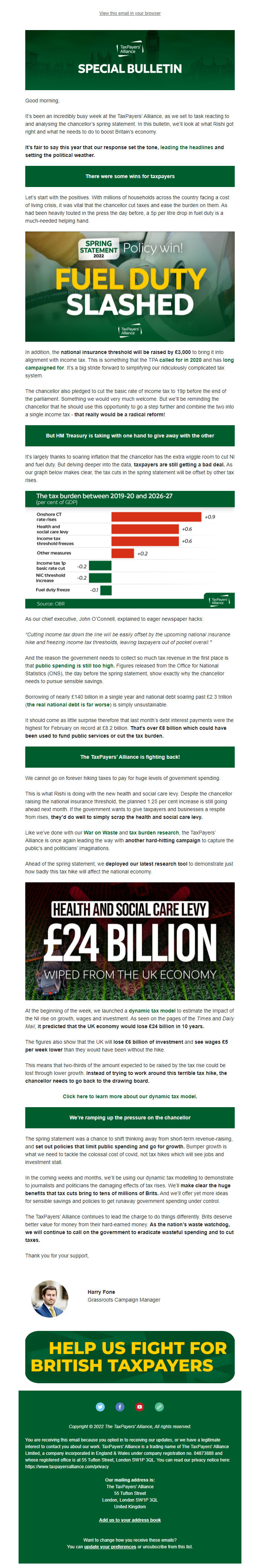

It’s largely thanks to soaring inflation that the chancellor has the extra wiggle room to cut NI and fuel duty. But delving deeper into the data, taxpayers are still getting a bad deal. As our graph below makes clear, the tax cuts in the spring statement will be offset by other tax rises.

As our chief executive, John O’Connell, explained to eager newspaper hacks:

“Cutting income tax down the line will be easily offset by the upcoming national insurance hike and freezing income tax thresholds, leaving taxpayers out of pocket overall."

And the reason the government needs to collect so much tax revenue in the first place is that public spending is still too high. ([link removed]) Figures released from the Office for National Statistics (ONS), the day before the spring statement, show exactly why the chancellor needs to pursue sensible savings.

Borrowing of nearly £140 billion in a single year and national debt soaring past £2.3 trillion (the real national debt is far worse ([link removed]) ) is simply unsustainable.

It should come as little surprise therefore that last month’s debt interest payments were the highest for February on record at £8.2 billion. That's over £8 billion which could have been used to fund public services or cut the tax burden.

The TaxPayers’ Alliance is fighting back!

We cannot go on forever hiking taxes to pay for huge levels of government spending.

This is what Rishi is doing with the new health and social care levy. Despite the chancellor raising the national insurance threshold, the planned 1.25 per cent increase is still going ahead next month. If the government wants to give taxpayers and businesses a respite from rises, they’d do well to simply scrap the health and social care levy.

Like we’ve done with our War on Waste ([link removed]) and tax burden research ([link removed]) , the TaxPayers’ Alliance is once again leading the way with another hard-hitting campaign to capture the public’s and politicians’ imaginations.

Ahead of the spring statement, we deployed our latest research tool to demonstrate just how badly this tax hike will affect the national economy.

[link removed]

At the beginning of the week, we launched a dynamic tax model ([link removed]) to estimate the impact of the NI rise on growth, wages and investment. As seen on the pages of the Times and Daily Mail, it predicted that the UK economy would lose £24 billion in 10 years.

The figures also show that the UK will lose £6 billion of investment and see wages £5 per week lower than they would have been without the hike.

This means that two-thirds of the amount expected to be raised by the tax rise could be lost through lower growth. Instead of trying to work around this terrible tax hike, the chancellor needs to go back to the drawing board.

Click here to learn more about our dynamic tax model. ([link removed])

We’re ramping up the pressure on the chancellor

The spring statement was a chance to shift thinking away from short-term revenue-raising, and set out policies that limit public spending and go for growth. Bumper growth is what we need to tackle the colossal cost of covid, not tax hikes which will see jobs and investment stall.

In the coming weeks and months, we’ll be using our dynamic tax modelling to demonstrate to journalists and politicians the damaging effects of tax rises. We’ll make clear the huge benefits that tax cuts bring to tens of millions of Brits. And we’ll offer yet more ideas for sensible savings and policies to get runaway government spending under control.

The TaxPayers’ Alliance continues to lead the charge to do things differently. Brits deserve better value for money from their hard-earned money. As the nation’s waste watchdog, we will continue to call on the government to eradicate wasteful spending and to cut taxes.

Thank you for your support,

Harry Fone

Grassroots Campaign Manager

[link removed]

============================================================

** Twitter ([link removed])

** [link removed] ([link removed])

** YouTube ([link removed])

** Website ([link removed])

Copyright © 2022 The TaxPayers' Alliance, All rights reserved.

You are receiving this email because you opted in to receiving our updates, or we have a legitimate interest to contact you about our work.

TaxPayers' Alliance is a trading name of The TaxPayers' Alliance Limited, a company incorporated in England & Wales under company registration no. 04873888 and whose registered office is at 55 Tufton Street, London SW1P 3QL.

You can read our privacy notice here: [link removed]

Our mailing address is:

The TaxPayers' Alliance

55 Tufton Street

London, London SW1P 3QL

United Kingdom

Want to change how you receive these emails?

You can ** update your preferences ([link removed])

or ** unsubscribe from this list ([link removed])

.

View this email in your browser ([link removed])

Good morning,

It’s been an incredibly busy week at the TaxPayers’ Alliance, as we set to task reacting to and analysing the chancellor’s spring statement. In this bulletin, we’ll look at what Rishi got right and what he needs to do to boost Britain’s economy.

It’s fair to say this year that our response set the tone, leading the headlines ([link removed]) and setting the political weather.

There were some wins for taxpayers

Let’s start with the positives. With millions of households across the country facing a cost of living crisis, it was vital that the chancellor cut taxes and ease the burden on them. As had been heavily touted in the press the day before, a 5p per litre drop in fuel duty is a much-needed helping hand.

[link removed]

In addition, the national insurance threshold will be raised by £3,000 to bring it into alignment with income tax. This is something that the TPA called for in 2020 ([link removed]) and has long campaigned for ([link removed]) . It’s a big stride forward to simplifying our ridiculously complicated tax system.

The chancellor also pledged to cut the basic rate of income tax to 19p before the end of the parliament. Something we would very much welcome. But we’ll be reminding the chancellor that he should use this opportunity to go a step further and combine the two into a single income tax - that really would be a radical reform!

But HM Treasury is taking with one hand to give away with the other

It’s largely thanks to soaring inflation that the chancellor has the extra wiggle room to cut NI and fuel duty. But delving deeper into the data, taxpayers are still getting a bad deal. As our graph below makes clear, the tax cuts in the spring statement will be offset by other tax rises.

As our chief executive, John O’Connell, explained to eager newspaper hacks:

“Cutting income tax down the line will be easily offset by the upcoming national insurance hike and freezing income tax thresholds, leaving taxpayers out of pocket overall."

And the reason the government needs to collect so much tax revenue in the first place is that public spending is still too high. ([link removed]) Figures released from the Office for National Statistics (ONS), the day before the spring statement, show exactly why the chancellor needs to pursue sensible savings.

Borrowing of nearly £140 billion in a single year and national debt soaring past £2.3 trillion (the real national debt is far worse ([link removed]) ) is simply unsustainable.

It should come as little surprise therefore that last month’s debt interest payments were the highest for February on record at £8.2 billion. That's over £8 billion which could have been used to fund public services or cut the tax burden.

The TaxPayers’ Alliance is fighting back!

We cannot go on forever hiking taxes to pay for huge levels of government spending.

This is what Rishi is doing with the new health and social care levy. Despite the chancellor raising the national insurance threshold, the planned 1.25 per cent increase is still going ahead next month. If the government wants to give taxpayers and businesses a respite from rises, they’d do well to simply scrap the health and social care levy.

Like we’ve done with our War on Waste ([link removed]) and tax burden research ([link removed]) , the TaxPayers’ Alliance is once again leading the way with another hard-hitting campaign to capture the public’s and politicians’ imaginations.

Ahead of the spring statement, we deployed our latest research tool to demonstrate just how badly this tax hike will affect the national economy.

[link removed]

At the beginning of the week, we launched a dynamic tax model ([link removed]) to estimate the impact of the NI rise on growth, wages and investment. As seen on the pages of the Times and Daily Mail, it predicted that the UK economy would lose £24 billion in 10 years.

The figures also show that the UK will lose £6 billion of investment and see wages £5 per week lower than they would have been without the hike.

This means that two-thirds of the amount expected to be raised by the tax rise could be lost through lower growth. Instead of trying to work around this terrible tax hike, the chancellor needs to go back to the drawing board.

Click here to learn more about our dynamic tax model. ([link removed])

We’re ramping up the pressure on the chancellor

The spring statement was a chance to shift thinking away from short-term revenue-raising, and set out policies that limit public spending and go for growth. Bumper growth is what we need to tackle the colossal cost of covid, not tax hikes which will see jobs and investment stall.

In the coming weeks and months, we’ll be using our dynamic tax modelling to demonstrate to journalists and politicians the damaging effects of tax rises. We’ll make clear the huge benefits that tax cuts bring to tens of millions of Brits. And we’ll offer yet more ideas for sensible savings and policies to get runaway government spending under control.

The TaxPayers’ Alliance continues to lead the charge to do things differently. Brits deserve better value for money from their hard-earned money. As the nation’s waste watchdog, we will continue to call on the government to eradicate wasteful spending and to cut taxes.

Thank you for your support,

Harry Fone

Grassroots Campaign Manager

[link removed]

============================================================

** Twitter ([link removed])

** [link removed] ([link removed])

** YouTube ([link removed])

** Website ([link removed])

Copyright © 2022 The TaxPayers' Alliance, All rights reserved.

You are receiving this email because you opted in to receiving our updates, or we have a legitimate interest to contact you about our work.

TaxPayers' Alliance is a trading name of The TaxPayers' Alliance Limited, a company incorporated in England & Wales under company registration no. 04873888 and whose registered office is at 55 Tufton Street, London SW1P 3QL.

You can read our privacy notice here: [link removed]

Our mailing address is:

The TaxPayers' Alliance

55 Tufton Street

London, London SW1P 3QL

United Kingdom

Want to change how you receive these emails?

You can ** update your preferences ([link removed])

or ** unsubscribe from this list ([link removed])

.

Message Analysis

- Sender: TaxPayers' Alliance

- Political Party: n/a

- Country: United Kingdom

- State/Locality: n/a

- Office: n/a

-

Email Providers:

- MailChimp