Email

The Supreme Court of Canada and Transboundary Indigenous Rights Claims, and High Tax Rates on Top Earners in Atlantic Canada and Quebec

| From | Fraser Institute <[email protected]> |

| Subject | The Supreme Court of Canada and Transboundary Indigenous Rights Claims, and High Tax Rates on Top Earners in Atlantic Canada and Quebec |

| Date | March 26, 2022 3:00 PM |

Links have been removed from this email. Learn more in the FAQ.

Links have been removed from this email. Learn more in the FAQ.

Having trouble viewing? Try the web version [link removed] of this email. Latest Research The Supreme Court of Canada and Transboundary Indigenous Rights Claims: Understanding the Implications of the 2021 Decision in Desautel [[link removed]]

Somewhat below the radar in the midst of the COVID-19 pandemic, major judicial developments are continuing on Indigenous rights.

Read More [[link removed]] High Tax Rates on Top Earners in Atlantic Canada and Quebec [[link removed]]

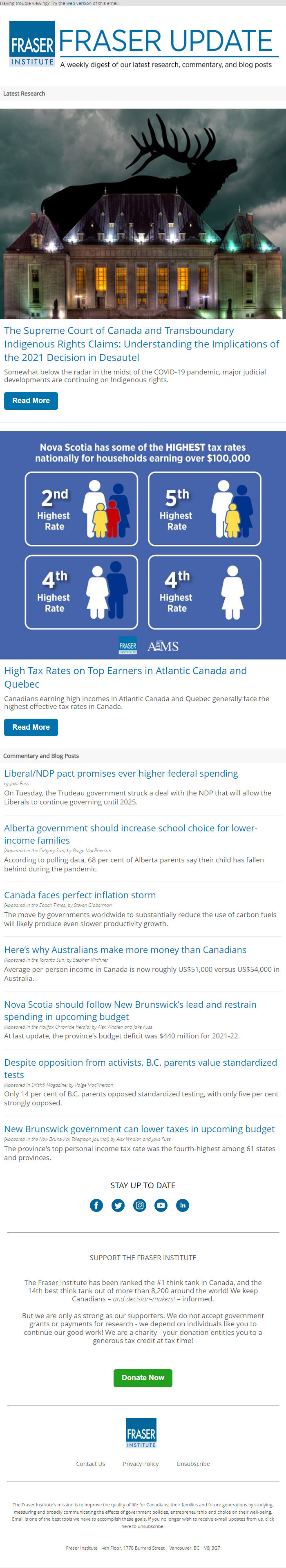

Canadians earning high incomes in Atlantic Canada and Quebec generally face the highest effective tax rates in Canada.

Read More [[link removed]] Commentary and Blog Posts Liberal/NDP pact promises ever higher federal spending [[link removed]] by Jake Fuss

On Tuesday, the Trudeau government struck a deal with the NDP that will allow the Liberals to continue governing until 2025.

Alberta government should increase school choice for lower-income families [[link removed]] (Appeared in the Calgary Sun) by Paige MacPherson

According to polling data, 68 per cent of Alberta parents say their child has fallen behind during the pandemic.

Canada faces perfect inflation storm [[link removed]] (Appeared in the Epoch Times) by Steven Globerman

The move by governments worldwide to substantially reduce the use of carbon fuels will likely produce even slower productivity growth.

Here’s why Australians make more money than Canadians [[link removed]] (Appeared in the Toronto Sun) by Stephen Kirchner

Average per-person income in Canada is now roughly US$51,000 versus US$54,000 in Australia.

Nova Scotia should follow New Brunswick’s lead and restrain spending in upcoming budget [[link removed]] (Appeared in the Halifax Chronicle Herald) by Alex Whalen and Jake Fuss

At last update, the province’s budget deficit was $440 million for 2021-22.

Despite opposition from activists, B.C. parents value standardized tests [[link removed]] (Appeared in Drishti Magazine) by Paige MacPherson

Only 14 per cent of B.C. parents opposed standardized testing, with only five per cent strongly opposed.

New Brunswick government can lower taxes in upcoming budget [[link removed]] (Appeared in the New Brunswick Telegraph-Journal) by Alex Whalen and Jake Fuss

The province's top personal income tax rate was the fourth-highest among 61 states and provinces.

STAY UP TO DATE

SUPPORT THE FRASER INSTITUTE

The Fraser Institute has been ranked the #1 think tank in Canada, and the 14th best think tank out of more than 8,200 around the world! We keep Canadians – and decision-makers! – informed.

But we are only as strong as our supporters. We do not accept government grants or payments for research - we depend on individuals like you to continue our good work! We are a charity - your donation entitles you to a generous tax credit at tax time!

Donate Now [[link removed][campaignid]]

Contact Us [[link removed]] Privacy Policy [[link removed]] Unsubscribe [link removed] The Fraser Institute's mission is to improve the quality of life for Canadians, their families and future generations by studying, measuring and broadly communicating the effects of government policies, entrepreneurship and choice on their well-being. Email is one of the best tools we have to accomplish these goals. If you no longer wish to receive e-mail updates from us, click here to unsubscribe [link removed].

Fraser Institute 4th Floor, 1770 Burrard Street Vancouver, BC V6J 3G7

Somewhat below the radar in the midst of the COVID-19 pandemic, major judicial developments are continuing on Indigenous rights.

Read More [[link removed]] High Tax Rates on Top Earners in Atlantic Canada and Quebec [[link removed]]

Canadians earning high incomes in Atlantic Canada and Quebec generally face the highest effective tax rates in Canada.

Read More [[link removed]] Commentary and Blog Posts Liberal/NDP pact promises ever higher federal spending [[link removed]] by Jake Fuss

On Tuesday, the Trudeau government struck a deal with the NDP that will allow the Liberals to continue governing until 2025.

Alberta government should increase school choice for lower-income families [[link removed]] (Appeared in the Calgary Sun) by Paige MacPherson

According to polling data, 68 per cent of Alberta parents say their child has fallen behind during the pandemic.

Canada faces perfect inflation storm [[link removed]] (Appeared in the Epoch Times) by Steven Globerman

The move by governments worldwide to substantially reduce the use of carbon fuels will likely produce even slower productivity growth.

Here’s why Australians make more money than Canadians [[link removed]] (Appeared in the Toronto Sun) by Stephen Kirchner

Average per-person income in Canada is now roughly US$51,000 versus US$54,000 in Australia.

Nova Scotia should follow New Brunswick’s lead and restrain spending in upcoming budget [[link removed]] (Appeared in the Halifax Chronicle Herald) by Alex Whalen and Jake Fuss

At last update, the province’s budget deficit was $440 million for 2021-22.

Despite opposition from activists, B.C. parents value standardized tests [[link removed]] (Appeared in Drishti Magazine) by Paige MacPherson

Only 14 per cent of B.C. parents opposed standardized testing, with only five per cent strongly opposed.

New Brunswick government can lower taxes in upcoming budget [[link removed]] (Appeared in the New Brunswick Telegraph-Journal) by Alex Whalen and Jake Fuss

The province's top personal income tax rate was the fourth-highest among 61 states and provinces.

STAY UP TO DATE

SUPPORT THE FRASER INSTITUTE

The Fraser Institute has been ranked the #1 think tank in Canada, and the 14th best think tank out of more than 8,200 around the world! We keep Canadians – and decision-makers! – informed.

But we are only as strong as our supporters. We do not accept government grants or payments for research - we depend on individuals like you to continue our good work! We are a charity - your donation entitles you to a generous tax credit at tax time!

Donate Now [[link removed][campaignid]]

Contact Us [[link removed]] Privacy Policy [[link removed]] Unsubscribe [link removed] The Fraser Institute's mission is to improve the quality of life for Canadians, their families and future generations by studying, measuring and broadly communicating the effects of government policies, entrepreneurship and choice on their well-being. Email is one of the best tools we have to accomplish these goals. If you no longer wish to receive e-mail updates from us, click here to unsubscribe [link removed].

Fraser Institute 4th Floor, 1770 Burrard Street Vancouver, BC V6J 3G7

Message Analysis

- Sender: Fraser Institute

- Political Party: n/a

- Country: Canada

- State/Locality: n/a

- Office: n/a

-

Email Providers:

- Campaign Monitor