March 18, 2022

Permission to republish original opeds and cartoons granted.

Fauci warns ‘we can’t just say we’re done, now we’re going to move on’ from Covid even as cases, hospitalizations and deaths keep plummeting

By Robert Romano

“We need to be flexible, and if in fact we do see a turnaround and a resurgence, we have to be able to pivot and go back to any degree of mitigation that is commensurate with what the situation is. So, we can’t just say we’re done, now we’re going to move on.”

That was Dr. Anthony Fauci, Director of the National Institute of Allergies and Infectious Diseases (NIAID), on CNN with Jake Tapper on March 17, hypothesizing that if, somehow, the world were to experience a resurgence of Covid with increasing rates of cases, hospitalizations and deaths, then there might be a return to some of the government-imposed restrictions that have been experienced since 2020, including mask mandates and lockdowns.

Well, good thing there is not a resurgence then, as cases and deaths continue to plummet in the U.S. and around the world.

According to the latest projections from the Institute for Health Metrics and Evaluation (IHME), daily probable cases in the U.S. are down from their peak of 4.84 million daily on Jan. 3 to 173,000 today. Globally, daily probable cases peaked on March 3 at 50.6 million, now down to 35 million, and expected to drop to 4.6 million by May 1.

Similarly, the fatality rate of the virus has continued to decline throughout the pandemic, both in the U.S. and around the world.

In the U.S., the current Covid daily fatality rate from the January peak in cases was 2,517 on Jan. 30, at a rate of 0.05 percent.

That was down from the prior peak daily fatality rate of 2,023 on Sept. 24, 2021, or 0.5 percent out of peak daily probable cases of 401,000 on Aug. 20, 2021.

Which was down from the prior peak daily fatality rate of 3,421 on Jan. 24, 2021, or 0.68 percent out of 501,000 peak daily probable cases on Dec. 27, 2020.

Which is about the same as it was on the Aug. 2, 2020 peak daily fatality rate of 1,108, or 0.69 percent out of 159,000 peak daily probable cases on July 9, 2020.

Which was about half as low as the initial peak daily fatality rate of 2,304 on April 17, 2020, or 1.4 percent out of 165,000 peak daily probable cases on March 25, 2020.

To summarize, the fatality rate of the virus in the U.S. has fallen from 1.4 percent in 2020, to just 0.05 percent today. That’s a big difference.

Globally, the peak daily fatality rate will be down to 8,233 on March 29, IHME projects, or 0.016 percent out of 50.9 million peak daily probable cases on March 5.

That is way down from the peak daily fatality rate of 7,584 on April 17, 2020, or 0.3 percent out of 2.4 million peak daily probable cases on March 29, 2020.

In fact, throughout the entire pandemic, as treatments improved and as seniors who were the most susceptible to the virus took more precautions, and later, after vaccines were introduced, both the hospitalization and fatality rates have fallen dramatically.

And as the virus has become less deadly, throughout the entire pandemic, government restrictions have been eased after the initial lockdowns from 2020.

While countries like China have recently experienced their first large outbreaks, IHME says that is also in the rear view mirror. In China, cases peaked on March 5 at 37.3 million, and continue dropping to 26.5 million and will be 1.1 million by May 1, and fatalities will peak at 4,975 on or about March 31, a fatality rate of 0.013 percent.

Fauci acknowledged the drop in cases and fatalities, noting, “Hopefully, the cases will continue to come down as the weather gets warmer.” Yes, hopefully that is the case.

Which, maybe that tells the American people everything they need to know about Covid in 2022. Even with the dire sounding warnings that there could be a massive resurgence of Covid, those like Fauci who are making those warnings still say the numbers are headed in the right direction.

Meaning, if we continue not to see a turnaround in the pandemic, and there is no resurgence of the deadlier strains of Covid from 2020 and 2021, other than perhaps seasonal, non-mandatory Covid vaccines the same way the flu vaccine is currently administered, then maybe we really can say we’re done and move on.

Robert Romano is the Vice President of Public Policy at Americans for Limited Government Foundation.

Video: Progressive Democrats Ask Biden to Declare A Climate Emergency

To view online: https://www.youtube.com/watch?v=cIX7E0oy0hQ

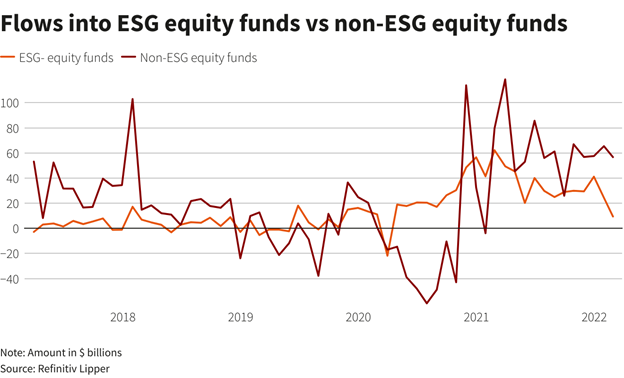

ALG Editor’s Note: In the following featured report from Reuters’ Patturaja Murugaboopathy and Simon Jessop, global investment in Environmental, Social and Governance (ESG) investing has taken a big hit after Russia’s invasion of Ukraine has sparked renewed interest in oil, coal and gas production in the West to offset energy dependence on aggressor nations like Russia:

Reuters: Demand for ESG funds wanes as Ukraine war puts focus on oil and gas

By Patturaja Murugaboopathy and Simon Jessop

Demand for sustainable stock funds waned in February as Russia's invasion of Ukraine hit investor sentiment and higher gas prices and energy security fears bolstered the appeal of the traditional Oil & Gas sector.

Interest in environmental, social and corporate governance (ESG) issues such as climate change has surged in recent years, leading many investors to avoid the high carbon-emitting energy sector, but this got a boost after the conflict began in late February.

While the STOXX Europe 600 (.STOXX) fell 3.4%, the Oil & Gas sector (.SXEP) rose 0.8%, buoyed by a 10.8% gain in Brent crude futures and a 15% gain in European natural gas prices (.TRNLTTFMc1).

Equity ESG funds, which make up the bulk of funds focused on sustainable investing, saw a 60% slowdown in inflows to $9.4 billion during the month, Refinitiv data showed, compared with inflows of $24.4 billion in the prior month.

Reuters Graphics

Total flows across all equity funds, meanwhile, slowed to $56.7 billion from $65.4 billion, for a 13% drop.

To view online: https://www.reuters.com/business/sustainable-business/global-markets-esg-graphic-pix-2022-03-17/