March 10, 2022

Permission to republish original opeds and cartoons granted.

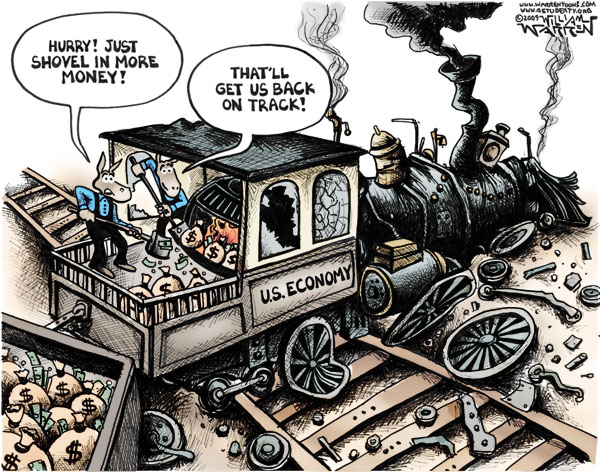

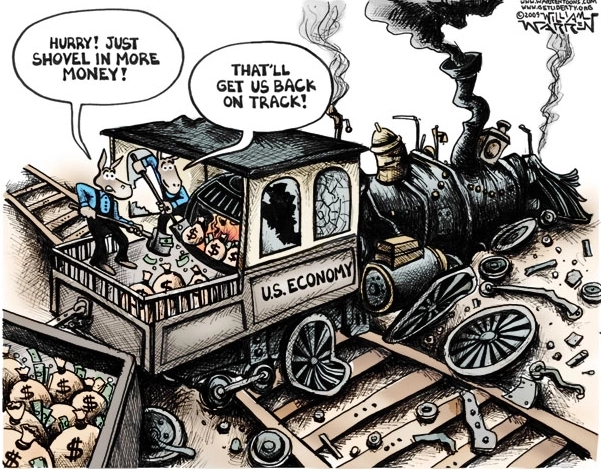

With inflation on fire at 7.9 percent, Congress pours on more gasoline with another $1.5 trillion omnibus spending bill

By Robert Romano

Inflation has hit 7.9 percent over the past twelve months, according to the Bureau of Labor Statistics, amid more than $6 trillion of new spending and borrowing by Congress to fight Covid, compounded by the supply chain crisis that was also caused by Covid as oil has surged to well over $100 a barrel.

And, even with inflation accelerating, Congress is moving another $1.5 trillion omnibus spending bill through the House and Senate this week in time for a March 11 deadline, when the current continuing resolution funding the government expires.

This legislation will not cut any spending. Last year’s omnibus was $1.4 trillion.

It will not defund or repeal any of President Joe Biden’s Covid vaccine mandates for health care workers, federal contractors and the military, even as Covid infection, hospitalization and fatality rates continue to plummet, and even after the Centers for Disease Control and Prevention (CDC) have lifted its own masking guidance because low transmission levels.

It does not provide for any new oil or natural gas exploration via federal leasing, no approval for the Keystone XL pipeline, no streamlining of regulatory approvals for refineries, pipelines and liquified natural gas terminals, and it does not defund and repeal Environmental, Social and Governance (ESG) regulations and financial subsidies via the federal employee retirement plan and state and private pension investments into green companies, which restricts capitalization for carbon-based oil, gas and coal energies, and even nuclear energy, which is not even carbon-based.

During Covid, producers across the world and industries including oil and gas slowed down production throughout 2020 because demand collapsed, and as the economy has reopened, production has still not caught up. Biden mentioned this in the State of the Union Address on March 1 related to semiconductors, but neglected to relate it to the current energy crisis, which is now being compounded by Russia’s invasion of Ukraine and Western oil and gas embargos against Russia.

Given the supply side of the equation, boosting production would absolutely help bring prices down. But Biden isn’t budging.

On spending, it will do nothing to eliminate the inflation, which in very large part is owed to the trillions of spending that has already occurred: the $2.2 trillion CARES Act and $900 billion phase four legislation under former President Donald Trump, and the $1.9 trillion stimulus and $550 billion of new infrastructure spending under President Joe Biden.

The national debt has increased by $7 trillion since Jan. 2020 to $30.2 trillion, of which the Fed monetized half, or $3.4 trillion, by increasing its share of U.S. treasuries to a record $5.7 trillion.

As a result, the M2 money supply has increased by $6.4 trillion to $21.8 trillion, a 42 percent increase. More than 90 percent of every new dollar of debt was paid for by printing it.

Combined with close to peak employment numbers — the unemployment rate is down to 3.8 percent — and 5.7 percent inflation-adjusted economic growth in 2021, and a key indicator that has predicted almost every recession in modern history, the 10-year, 2-year treasuries spread is down to 0.26 percent. Once it inverts, that will signal a recession on average within 14 months.

So, of course there was always going to be inflation, and the war in Ukraine and embargoes notwithstanding, given the trillions of dollars of printed money and the economy overheating, Biden’s coming recession was inevitable—and with its $1.5 trillion omnibus spending bill, Congress isn’t doing a thing to stop it.

Robert Romano is the Vice President of Public Policy at Americans for Limited Government Foundation.

ALG strongly urges no vote on Omnibus

March 9, 2022, Fairfax, Va.—Americans for Limited Government President Rick Manning today issued the following statement urging the House to oppose the omnibus spending bill up for a vote this morning:

“The House of Representatives is voting on the Omnibus federal government funding legislation this morning after Congress only received it at 2 a.m. According to U.S. Rep. Chip Roy, it contains an additional 6 percent increase in spending above the planned increases, not including additional Covid and Ukraine spending; it fails to lift any of the vaccine mandates leaving Americans subject to job loss by federal government regulation, and bans Russian oil imports while not opening up any avenues for additional domestic oil or even authorizing the Keystone XL pipeline. This decision to not make changes to allow the increase in domestic oil and natural gas production ensures that Russian oil will be replaced by Iranian and/or Venezuelan oil — countries led by two of the worse despots in the world.

“This legislation was jointly negotiated by the House and Senate, and unless Senate Republican leadership proves otherwise by opposing it, will represent a complete capitulation by the Senate GOP on the only legislation they have leverage over because it requires 60 votes for passage. Americans for Limited Government strenuously urges a no vote on this bill.”

To view online: https://getliberty.org/2022/03/alg-strongly-urges-no-vote-on-omnibus/

ALG Editor’s Note: In the following featured column from the New York Post, Charlie Gasparino chronicles how federal incentives and subsidies that provide for federal, state and private pension plan investments into Environmental, Social and Governance (ESG) hedge funds restrict capitalization into carbon-based oil, natural and coal energies:

![]()

Russian invasion sheds light on hypocrisy of Gary Gensler, woke ESG investment

By Charles Gasparino

Vladimir Putin’s invasion of Ukraine has further exposed the hypocrisy of the woke investment fad known as ESG.

ESG is the acronym for environmental social governance. It’s an amorphous group of edicts that have been adopted by big Wall Street firms, investment managers and many corporations to allegedly make the world a better place.

Follow ESG edicts and you will help protect the environment by investing in windmills instead of oil companies. Board diversity is big under ESG rules. So is supporting social justice, which is why you see so much corporate money flowing to groups like Black Lives Matter.

Do all of that and you can virtue signal ‘til the cows come home despite obvious drawbacks. Reducing your carbon footprint might be a good thing but do it as the ESG zealots want and you get what we have now: Higher energy prices because of the inefficiencies of windmills.

That’s a tax — and a big one — on the working class.

Who doesn’t want board diversity? But when diversity trumps skills it’s the shareholders who suffer. Those shareholders aren’t a bunch of rich white dudes. They’re teachers, police and firefighters who depend on fully-funded pensions.

Yes, Black Lives Matter sounds good on paper — that’s why major corporations funneled money into its coffers following the tragic murder of George Floyd by a white police officer. Dig deeper and you will discover the organization’s Marxist foundations, sketchy finances and ample evidence of its violent tactics.

Where was Gensler?

ESG is the Swiss cheese of corporate governance but it may also become law. Since his appointment last year, Securities and Exchange Commission’s lefty chair Gary Gensler has been working hard to make ESG a standard every public company must adhere to or face sanctions from Wall Street’s top cop.

ESG followers have no problem investing in Russian companies despite the issues in the country.

Then came Putin’s war on Ukraine, and the whole ESG charade has been exposed even if Gensler and his corporate lackeys still won’t fully admit it. Bodies are piling up, bloody images of Ukrainian women and children are seen daily almost in real time, yet under ESG coda it’s OK to be operating a McDonald’s in Moscow. You can also invest in a company owned by one of Putin’s oligarch pals because big exchanges like Nasdaq exempt foreign companies like those in Russia from their ESG listing standards. (Nasdaq did recently suspend trading in Russian companies.)

There is a case to be made that ESG has funded Putin’s tanks and artillery. Same with China’s President, Xi Jinping, who is setting his sights on Taiwan while operating a gulag to oppress anyone who challenges his autocratic rule.

You see for years, ESG prevented no investment fund, bank or company from doing business with Putin or Xi. Only now when Putin’s bloodlust appears to have now gone too far, are the wokesters walking back their hypocrisy. They’re all scrambling to dump Russian investments from funds. Big companies are debating whether to pull out of Russian altogether as the Putin war machine rages on.

Companies practicing ESG values donate to organizations like Black Lives Matter, who have used violent tactics.

The absurdity of all of this, of course, is that Putin has never hid who he really was. He had already leveled Chechnya killing tens of thousands of innocents; thousands of civilians died when he aided Syrian dictator Bashar al-Assad with indiscriminate bombing to suppress an uprising. Stories abound of his henchmen searching the globe to assassinate all rivals. All under the nose of Gensler and some of Wall Street’s allegedly smartest investors who blindly followed their ESG guidelines that allowed them to do business with a madman.

If you’re blood isn’t boiling just yet, consider this: Gensler, the ESG hyping SEC chair, has between $5.5 million to $26 million across two emerging markets funds with a considerable stake in Russian assets, according to Fox Business’s Eleanor Terrett.

No word yet from Gensler if he plans to virtue-signal his way out of that investment.

Hidden ‘Valley’

Media banking sensation Aryeh Bourkoff loves to name drop. Bragging to corporate fat cats that he’s plugged in everywhere is how he banked last year’s $43 billion mega deal between WarnerMedia and Discovery Inc., I am told.

I don’t know if everyone is really talking to Aryeh, but every year he does hold some sort of movers-and-shakers conference in Deer Valley, Utah. It’s a more secret, and for my money, less relevant version of the Allen & Co., Sun Valley media powwow and this year’s version begins today. While no one outside Aryeh’s inner circle is supposed to know who’s going, through the magic of reporting, I’ve obtained the entire “highly confidential” list of invitees.

Question I have: Why should it be such a secret that Aryeh wants some face time with Paris Hilton? (Yes, she’s on the list.) And what makes her such a media mover and shaker? Ditto for Lance Armstrong, Naomi Campbell, Maria Sharapova and Robert De Niro (De Niro is a maybe).

To be fair, there are some interesting corporate types attending, though I’m not sure why their attendance is such a state secret since all of them have significant public profiles. People like Shari Redstone of Viacom, her CEO Bob Bakish, David Zaslav of the aforementioned Discovery, and investment wiz Dan Loeb, are out and about in NYC all the time and they don’t even make Page Six.

SEC chair Gary Genlser reportedly has $5.5 million to $26 million in emerging market funds with plenty of stakes in Russian assets.Anastasia Vlasova/Getty Images

Oh yeah, there appears to be one journalist attending, CNBC’s Andrew Ross Sorkin. He’s on TV every day, so he’s not that bashful about being noticed. Full disclosure: Maybe I’m a little jealous my friend Andrew got the invite and I didn’t.

I bet it’s because Aryeh knows I can’t keep a secret.

To view online: https://nypost.com/2022/03/05/russian-invasion-sheds-light-on-hypocrisy-of-gary-gensler-corporate-wokesters/