| From | Badger Institute <[email protected]> |

| Subject | Top Picks: Wisconsinites embracing school choice |

| Date | February 26, 2022 2:01 PM |

Links have been removed from this email. Learn more in the FAQ.

Links have been removed from this email. Learn more in the FAQ.

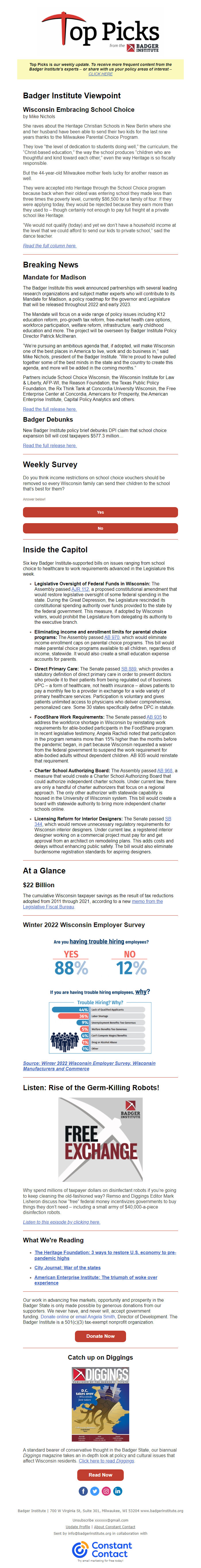

New policy blueprint, DPI debunked, bills advance Top Picks is our weekly update. To receive more frequent content from the Badger Institute’s experts – or share with us your policy areas of interest – CLICK HERE Badger Institute Viewpoint Wisconsin Embracing School Choice by Mike Nichols She raves about the Heritage Christian Schools in New Berlin where she and her husband have been able to send their two kids for the last nine years thanks to the Milwaukee Parental Choice Program. They love “the level of dedication to students doing well,” the curriculum, the “Christ-based education,” the way the school produces “children who are thoughtful and kind toward each other,” even the way Heritage is so fiscally responsible. But the 44-year-old Milwaukee mother feels lucky for another reason as well. They were accepted into Heritage through the School Choice program because back when their oldest was entering school they made less than three times the poverty level, currently $86,500 for a family of four. If they were applying today, they would be rejected because they earn more than they used to – though certainly not enough to pay full freight at a private school like Heritage. “We would not qualify (today) and yet we don’t have a household income at the level that we could afford to send our kids to private school,” said the dance teacher. Read the full column here. Breaking News Mandate for Madison The Badger Institute this week announced partnerships with several leading research organizations and subject matter experts who will contribute to its Mandate for Madison, a policy roadmap for the governor and Legislature that will be released throughout 2022 and early 2023. The Mandate will focus on a wide range of policy issues including K12 education reform, pro-growth tax reform, free-market health care options, workforce participation, welfare reform, infrastructure, early childhood education and more. The project will be overseen by Badger Institute Policy Director Patrick McIlheran. “We’re pursuing an ambitious agenda that, if adopted, will make Wisconsin one of the best places in America to live, work and do business in,” said Mike Nichols, president of the Badger Institute. “We’re proud to have pulled together some of the best minds in the state and the country to create this agenda, and more will be added in the coming months.” Partners include School Choice Wisconsin, the Wisconsin Institute for Law & Liberty, AFP-WI, the Reason Foundation, the Texas Public Policy Foundation, the Rx Think Tank at Concordia University Wisconsin, the Free Enterprise Center at Concordia, Americans for Prosperity, the American Enterprise Institute, Capital Policy Analytics and others. Read the full release here. Badger Debunks New Badger Institute policy brief debunks DPI claim that school choice expansion bill will cost taxpayers $577.3 million… Read the full release here. Weekly Survey Do you think income restrictions on school choice vouchers should be removed so every Wisconsin family can send their children to the school that’s best for them? Answer below! Yes No Inside the Capitol Six key Badger Institute-supported bills on issues ranging from school choice to healthcare to work requirements advanced in the Legislature this week. Legislative Oversight of Federal Funds in Wisconsin: The Assembly passed AJR 112, a proposed constitutional amendment that would restore legislative oversight of some federal spending in the state. During the Great Depression, the Legislature rescinded its constitutional spending authority over funds provided to the state by the federal government. This measure, if adopted by Wisconsin voters, would prohibit the Legislature from delegating its authority to the executive branch. Eliminating income and enrollment limits for parental choice programs: The Assembly passed AB 970, which would eliminate income enrollment caps on parental choice programs. This bill would make parental choice programs available to all children, regardless of income, statewide. It would also create a small education expense accounts for parents. Direct Primary Care: The Senate passed SB 889, which provides a statutory definition of direct primary care in order to prevent doctors who provide it to their patients from being regulated out of business. DPC – a form of healthcare, not health insurance – allows patients to pay a monthly fee to a provider in exchange for a wide variety of primary healthcare services. Participation is voluntary and gives patients unlimited access to physicians who deliver comprehensive, personalized care. Some 30 states specifically define DPC in statute. FoodShare Work Requirements: The Senate passed AB 935 to address the workforce shortage in Wisconsin by reinstating work requirements for able-bodied participants in the FoodShare program. In recent legislative testimony, Angela Rachidi noted that participation in the program remains more than 15% higher than the months before the pandemic began, in part because Wisconsin requested a waiver from the federal government to suspend the work requirement for able-bodied adults without dependent children. AB 935 would reinstate that requirement. Charter School Authorizing Board: The Assembly passed AB 968, a measure that would create a Charter School Authorizing Board that could authorize independent charter schools. Under current law, there are only a handful of charter authorizers that focus on a regional approach. The only other authorizer with statewide capability is housed in the University of Wisconsin system. This bill would create a board with statewide authority to bring more independent charter schools online. Licensing Reform for Interior Designers: The Senate passed SB 344, which would remove unnecessary regulatory requirements for Wisconsin interior designers. Under current law, a registered interior designer working on a commercial project must pay for and get approval from an architect on remodeling plans. This adds costs and delays without enhancing public safety. The bill would also eliminate burdensome registration standards for aspiring designers. At a Glance $22 Billion The cumulative Wisconsin taxpayer savings as the result of tax reductions adopted from 2011 through 2021, according to a new memo from the Legislative Fiscal Bureau. Winter 2022 Wisconsin Employer Survey Source: Winter 2022 Wisconsin Employer Survey, Wisconsin Manufacturers and Commerce Listen: Rise of the Germ-Killing Robots! Why spend millions of taxpayer dollars on disinfectant robots if you’re going to keep cleaning the old-fashioned way? Remso and Diggings Editor Mark Lisheron discuss how “free” federal money incentivizes governments to buy things they don’t need – including a small army of $40,000-a-piece disinfection robots. Listen to this episode by clicking here. What We're Reading The Heritage Foundation: 3 ways to restore U.S. economy to pre-pandemic highs City Journal: War of the states American Enterprise Institute: The triumph of woke over experience Our work in advancing free markets, opportunity and prosperity in the Badger State is only made possible by generous donations from our supporters. We never have, and never will, accept government funding. Donate online or email Angela Smith, Director of Development. The Badger Institute is a 501(c)(3) tax-exempt nonprofit organization. Donate Now Catch up on Diggings A standard bearer of conservative thought in the Badger State, our biannual Diggings magazine takes an in-depth look at policy and cultural issues that affect Wisconsin residents. Click here to read Diggings. Read Now Badger Institute | 700 W Virginia St, Suite 301, Milwaukee, WI 53204 www.badgerinstitute.org Unsubscribe [email protected] Update Profile | About Constant Contact Sent by [email protected] in collaboration with Try email marketing for free today!

Message Analysis

- Sender: Badger Institute

- Political Party: n/a

- Country: United States

- State/Locality: Wisconsin

- Office: n/a

-

Email Providers:

- Constant Contact