| From | American Energy Alliance <[email protected]> |

| Subject | Rewarding Virginians for a smart choice |

| Date | February 17, 2022 3:26 PM |

Links have been removed from this email. Learn more in the FAQ.

Links have been removed from this email. Learn more in the FAQ.

Your Daily Energy News

View this email in your browser ([link removed])

DAILY ENERGY NEWS | 02/17/2022

Subscribe Now ([link removed])

** Elections have consquences.

------------------------------------------------------------

Washington Examiner ([link removed]) (2/16/22) reports: "Under Gov. Glenn Youngkin, Virginia is cutting a path back in the direction of affordable and reliable energy supplies. It could yield economic and environmental benefits for state residents. If Youngkin is successful in his efforts to free Virginians from policies that drive up the cost of utility bills, his approach would serve as a sharp contrast to the Biden administration’s incessant assault on domestic energy production. For starters, Youngkin has signaled his determination to withdraw Virginia from a multistate climate change agreement known as the Regional Greenhouse Gas Initiative. The RGGI is built around 'cap and trade' regulations that limit carbon dioxide emissions. Participating states compel electric utilities to purchase carbon allowances at quarterly auctions whenever the utilities surpass

the initiative’s cap on emissions. But it is the ratepayers who absorb the cost of the auctions in the form of carbon taxes. Youngkin explained how this works in his executive order calling for a reevaluation of Virginia’s participation in the climate change scheme. The order also highlights a filing from Dominion Energy, the state’s largest utility, that found that the RGGI will cost ratepayers between $1 billion and $1.2 billion over the next four years. Having the RGGI in place at the state level while the Biden administration creates upward pressure on energy prices nationally would prove untenable for Virginians. Tom Pyle, president of the American Energy Alliance, a nonprofit consumer advocacy group that favors free market energy policies, said 'greenflation' is taking root in response to President Joe Biden’s quixotic attempt to replace fossil fuels with unreliable, intermittent, and expensive renewable energy."

[link removed]

** "Shock. Shock. Shock. Gas prices are at the highest level in 7 years while Exxon Mobil, Chevron, Shell & BP made nearly $25 billion in profits last quarter – the highest level in over 7 years. The problem is not inflation. The problem is corporate greed, collusion & profiteering."

------------------------------------------------------------

– Senator Bernie Sanders (I-VT) ([link removed])

============================================================

Dear Texans: Don't believe him. And remember that his sidekick, Brian Deese, is sitting over at the WH figuring out ways to cripple the oil and gas industry. It's time to divest from Larry Fink.

** Reuters ([link removed])

(2/17/22) reports: "At the risk of being dropped from Texas pension funds, BlackRock Inc (BLK.N) has ramped up its message that the world's largest asset manager is a friend of the oil and gas industries. As a large and long-term investor in fossil fuel companies, 'we want to see these companies succeed and prosper,' BlackRock executives wrote in a letter that a spokesman confirmed was sent at the start of the year to officials, trade groups and others in energy-rich Texas. 'We will continue to invest in and support fossil fuel companies, including Texas fossil fuel companies,' states the memo, signed by Dalia Blass, BlackRock's head of external affairs, and Mark McCombe, BlackRock's chief client officer. Although the message is consistent with its other statements, the emphasis is new after years in which BlackRock has stressed its efforts to take climate change and other environmental, social and governance (ESG) issues into account in its investment and proxy voting decisions. BlackRock

faces a balancing act as some pension funds and endowments move to divest from fossil fuel stocks over climate-change concerns, and because of its size."

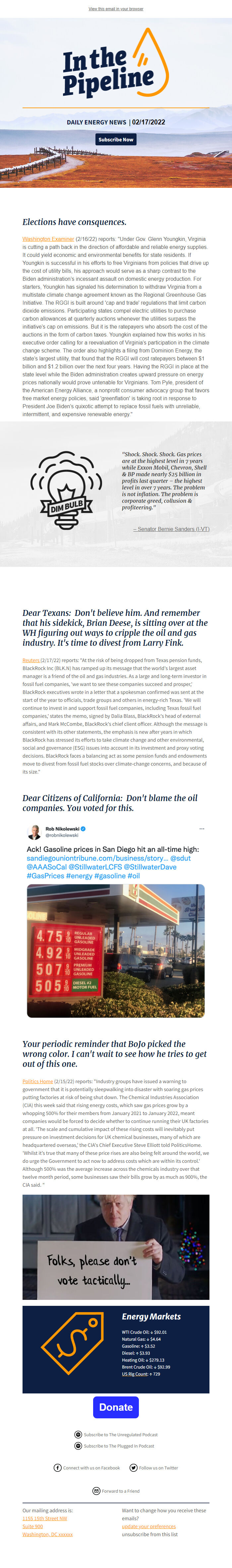

Dear Citizens of California: Don't blame the oil companies. You voted for this.

** ([link removed])

Your periodic reminder that BoJo picked the wrong color. I can't wait to see how he tries to get out of this one.

** Politics Home ([link removed])

(2/15/22) reports: "Industry groups have issued a warning to government that it is potentially sleepwalking into disaster with soaring gas prices putting factories at risk of being shut down. The Chemical Industries Association (CIA) this week said that rising energy costs, which saw gas prices grow by a whopping 500% for their members from January 2021 to January 2022, meant companies would be forced to decide whether to continue running their UK factories at all. 'The scale and cumulative impact of these rising costs will inevitably put pressure on investment decisions for UK chemical businesses, many of which are headquartered overseas,' the CIA's Chief Executive Steve Elliott told PoliticsHome. 'Whilst it’s true that many of these price rises are also being felt around the world, we do urge the Government to act now to address costs which are within its control.' Although 500% was the average increase across the chemicals industry over that twelve month period, some businesses saw their

bills grow by as much as 900%, the CIA said. "

Energy Markets

WTI Crude Oil: ↓ $92.01

Natural Gas: ↓ $4.64

Gasoline: ↑ $3.52

Diesel: ↑ $3.93

Heating Oil: ↓ $279.13

Brent Crude Oil: ↓ $92.99

** US Rig Count ([link removed])

: ↑ 729

** Donate ([link removed])

** Subscribe to The Unregulated Podcast ([link removed])

** Subscribe to The Unregulated Podcast ([link removed])

** Subscribe to The Plugged In Podcast ([link removed])

** Subscribe to The Plugged In Podcast ([link removed])

** Connect with us on Facebook ([link removed])

** Connect with us on Facebook ([link removed])

** Follow us on Twitter ([link removed])

** Follow us on Twitter ([link removed])

** Forward to a Friend ([link removed])

** Forward to a Friend ([link removed])

Our mailing address is:

** 1155 15th Street NW ([link removed])

** Suite 900 ([link removed])

** Washington, DC xxxxxx ([link removed])

Want to change how you receive these emails?

** update your preferences ([link removed])

** unsubscribe from this list ([link removed])

View this email in your browser ([link removed])

DAILY ENERGY NEWS | 02/17/2022

Subscribe Now ([link removed])

** Elections have consquences.

------------------------------------------------------------

Washington Examiner ([link removed]) (2/16/22) reports: "Under Gov. Glenn Youngkin, Virginia is cutting a path back in the direction of affordable and reliable energy supplies. It could yield economic and environmental benefits for state residents. If Youngkin is successful in his efforts to free Virginians from policies that drive up the cost of utility bills, his approach would serve as a sharp contrast to the Biden administration’s incessant assault on domestic energy production. For starters, Youngkin has signaled his determination to withdraw Virginia from a multistate climate change agreement known as the Regional Greenhouse Gas Initiative. The RGGI is built around 'cap and trade' regulations that limit carbon dioxide emissions. Participating states compel electric utilities to purchase carbon allowances at quarterly auctions whenever the utilities surpass

the initiative’s cap on emissions. But it is the ratepayers who absorb the cost of the auctions in the form of carbon taxes. Youngkin explained how this works in his executive order calling for a reevaluation of Virginia’s participation in the climate change scheme. The order also highlights a filing from Dominion Energy, the state’s largest utility, that found that the RGGI will cost ratepayers between $1 billion and $1.2 billion over the next four years. Having the RGGI in place at the state level while the Biden administration creates upward pressure on energy prices nationally would prove untenable for Virginians. Tom Pyle, president of the American Energy Alliance, a nonprofit consumer advocacy group that favors free market energy policies, said 'greenflation' is taking root in response to President Joe Biden’s quixotic attempt to replace fossil fuels with unreliable, intermittent, and expensive renewable energy."

[link removed]

** "Shock. Shock. Shock. Gas prices are at the highest level in 7 years while Exxon Mobil, Chevron, Shell & BP made nearly $25 billion in profits last quarter – the highest level in over 7 years. The problem is not inflation. The problem is corporate greed, collusion & profiteering."

------------------------------------------------------------

– Senator Bernie Sanders (I-VT) ([link removed])

============================================================

Dear Texans: Don't believe him. And remember that his sidekick, Brian Deese, is sitting over at the WH figuring out ways to cripple the oil and gas industry. It's time to divest from Larry Fink.

** Reuters ([link removed])

(2/17/22) reports: "At the risk of being dropped from Texas pension funds, BlackRock Inc (BLK.N) has ramped up its message that the world's largest asset manager is a friend of the oil and gas industries. As a large and long-term investor in fossil fuel companies, 'we want to see these companies succeed and prosper,' BlackRock executives wrote in a letter that a spokesman confirmed was sent at the start of the year to officials, trade groups and others in energy-rich Texas. 'We will continue to invest in and support fossil fuel companies, including Texas fossil fuel companies,' states the memo, signed by Dalia Blass, BlackRock's head of external affairs, and Mark McCombe, BlackRock's chief client officer. Although the message is consistent with its other statements, the emphasis is new after years in which BlackRock has stressed its efforts to take climate change and other environmental, social and governance (ESG) issues into account in its investment and proxy voting decisions. BlackRock

faces a balancing act as some pension funds and endowments move to divest from fossil fuel stocks over climate-change concerns, and because of its size."

Dear Citizens of California: Don't blame the oil companies. You voted for this.

** ([link removed])

Your periodic reminder that BoJo picked the wrong color. I can't wait to see how he tries to get out of this one.

** Politics Home ([link removed])

(2/15/22) reports: "Industry groups have issued a warning to government that it is potentially sleepwalking into disaster with soaring gas prices putting factories at risk of being shut down. The Chemical Industries Association (CIA) this week said that rising energy costs, which saw gas prices grow by a whopping 500% for their members from January 2021 to January 2022, meant companies would be forced to decide whether to continue running their UK factories at all. 'The scale and cumulative impact of these rising costs will inevitably put pressure on investment decisions for UK chemical businesses, many of which are headquartered overseas,' the CIA's Chief Executive Steve Elliott told PoliticsHome. 'Whilst it’s true that many of these price rises are also being felt around the world, we do urge the Government to act now to address costs which are within its control.' Although 500% was the average increase across the chemicals industry over that twelve month period, some businesses saw their

bills grow by as much as 900%, the CIA said. "

Energy Markets

WTI Crude Oil: ↓ $92.01

Natural Gas: ↓ $4.64

Gasoline: ↑ $3.52

Diesel: ↑ $3.93

Heating Oil: ↓ $279.13

Brent Crude Oil: ↓ $92.99

** US Rig Count ([link removed])

: ↑ 729

** Donate ([link removed])

** Subscribe to The Unregulated Podcast ([link removed])

** Subscribe to The Unregulated Podcast ([link removed])

** Subscribe to The Plugged In Podcast ([link removed])

** Subscribe to The Plugged In Podcast ([link removed])

** Connect with us on Facebook ([link removed])

** Connect with us on Facebook ([link removed])

** Follow us on Twitter ([link removed])

** Follow us on Twitter ([link removed])

** Forward to a Friend ([link removed])

** Forward to a Friend ([link removed])

Our mailing address is:

** 1155 15th Street NW ([link removed])

** Suite 900 ([link removed])

** Washington, DC xxxxxx ([link removed])

Want to change how you receive these emails?

** update your preferences ([link removed])

** unsubscribe from this list ([link removed])

Message Analysis

- Sender: American Energy Alliance (AEA)

- Political Party: n/a

- Country: United States

- State/Locality: n/a

- Office: n/a

-

Email Providers:

- MailChimp