| From | Fraser Institute <[email protected]> |

| Subject | Impact of personal income tax changes, and The Misery Index |

| Date | January 22, 2022 6:00 PM |

Links have been removed from this email. Learn more in the FAQ.

Links have been removed from this email. Learn more in the FAQ.

Having trouble viewing? Try the web version [link removed] of this email.

==============

FRASER UPDATE

A weekly digest of our latest research, commentary, and blog posts

==============

Latest Research

---------------------

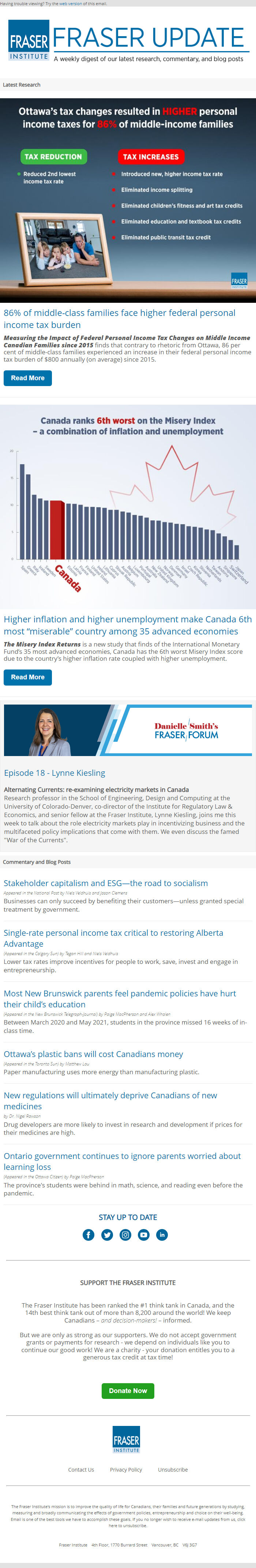

86% of middle-class families face higher federal personal income tax burden

Measuring the Impact of Federal Personal Income Tax Changes on Middle Income Canadian Families since 2015 finds that contrary to rhetoric from Ottawa, 86 per cent of middle-class families experienced an increase in their federal personal income tax burden of $800 annually (on average) since 2015.

Read More [[link removed]]

Higher inflation and higher unemployment make Canada 6th most “miserable” country among 35 advanced economies

The Misery Index Returns is a new study that finds of the International Monetary Fund’s 35 most advanced economies, Canada has the 6th worst Misery Index score due to the country’s higher inflation rate coupled with higher unemployment.

Read More [[link removed]]

Fraser Forum Podcast

---------------------

Episode 18 - Lynne Kiesling [[link removed]]

Alternating Currents: re-examining electricity markets in Canada

Research professor in the School of Engineering, Design and Computing at the University of Colorado-Denver, co-director of the Institute for Regulatory Law & Economics, and senior fellow at the Fraser Institute, Lynne Kiesling, joins me this week to talk about the role electricity markets play in incentivizing business and the multifaceted policy implications that come with them. We even discuss the famed "War of the Currents".

Commentary and Blog Posts

---------------------

Stakeholder capitalism and ESG—the road to socialism [[link removed]]

(Appeared in the National Post) by Niels Veldhuis and Jason Clemens

Businesses can only succeed by benefiting their customers—unless granted special treatment by government.

Single-rate personal income tax critical to restoring Alberta Advantage [[link removed]]

(Appeared in the Calgary Sun) by Tegan Hill and Niels Veldhuis

Lower tax rates improve incentives for people to work, save, invest and engage in entrepreneurship.

Most New Brunswick parents feel pandemic policies have hurt their child’s education [[link removed]]

(Appeared in the New Brunswick Telegraph-Journal) by Paige MacPherson and Alex Whalen

Between March 2020 and May 2021, students in the province missed 16 weeks of in-class time.

Ottawa’s plastic bans will cost Canadians money [[link removed]]

(Appeared in the Toronto Sun) by Matthew Lau

Paper manufacturing uses more energy than manufacturing plastic.

New regulations will ultimately deprive Canadians of new medicines [[link removed]]

by Dr. Nigel Rawson

Drug developers are more likely to invest in research and development if prices for their medicines are high.

Ontario government continues to ignore parents worried about learning loss [[link removed]]

(Appeared in the Ottawa Citizen) by Paige MacPherson

The province's students were behind in math, science, and reading even before the pandemic.

SUPPORT THE FRASER INSTITUTE

---------------------

The Fraser Institute has been ranked the #1 think tank in Canada, and the 14th best think tank out of more than 8,200 around the world! We keep Canadians – and decision-makers! – informed.

But we are only as strong as our supporters. We do not accept government grants or payments for research - we depend on individuals like you to continue our good work! We are a charity - your donation entitles you to a generous tax credit at tax time!

Donate Now [[link removed]]

Contact Us [[link removed]]

Privacy Policy [[link removed]]

Unsubscribe [link removed]

The Fraser Institute's mission is to improve the quality of life for Canadians, their families and future generations by studying, measuring and broadly communicating the effects of government policies, entrepreneurship and choice on their well-being. Email is one of the best tools we have to accomplish these goals. If you no longer wish to receive e-mail updates from us, click here to unsubscribe [link removed].

Fraser Institute | 4th Floor, 1770 Burrard Street, Vancouver, BC V6J 3G7

==============

FRASER UPDATE

A weekly digest of our latest research, commentary, and blog posts

==============

Latest Research

---------------------

86% of middle-class families face higher federal personal income tax burden

Measuring the Impact of Federal Personal Income Tax Changes on Middle Income Canadian Families since 2015 finds that contrary to rhetoric from Ottawa, 86 per cent of middle-class families experienced an increase in their federal personal income tax burden of $800 annually (on average) since 2015.

Read More [[link removed]]

Higher inflation and higher unemployment make Canada 6th most “miserable” country among 35 advanced economies

The Misery Index Returns is a new study that finds of the International Monetary Fund’s 35 most advanced economies, Canada has the 6th worst Misery Index score due to the country’s higher inflation rate coupled with higher unemployment.

Read More [[link removed]]

Fraser Forum Podcast

---------------------

Episode 18 - Lynne Kiesling [[link removed]]

Alternating Currents: re-examining electricity markets in Canada

Research professor in the School of Engineering, Design and Computing at the University of Colorado-Denver, co-director of the Institute for Regulatory Law & Economics, and senior fellow at the Fraser Institute, Lynne Kiesling, joins me this week to talk about the role electricity markets play in incentivizing business and the multifaceted policy implications that come with them. We even discuss the famed "War of the Currents".

Commentary and Blog Posts

---------------------

Stakeholder capitalism and ESG—the road to socialism [[link removed]]

(Appeared in the National Post) by Niels Veldhuis and Jason Clemens

Businesses can only succeed by benefiting their customers—unless granted special treatment by government.

Single-rate personal income tax critical to restoring Alberta Advantage [[link removed]]

(Appeared in the Calgary Sun) by Tegan Hill and Niels Veldhuis

Lower tax rates improve incentives for people to work, save, invest and engage in entrepreneurship.

Most New Brunswick parents feel pandemic policies have hurt their child’s education [[link removed]]

(Appeared in the New Brunswick Telegraph-Journal) by Paige MacPherson and Alex Whalen

Between March 2020 and May 2021, students in the province missed 16 weeks of in-class time.

Ottawa’s plastic bans will cost Canadians money [[link removed]]

(Appeared in the Toronto Sun) by Matthew Lau

Paper manufacturing uses more energy than manufacturing plastic.

New regulations will ultimately deprive Canadians of new medicines [[link removed]]

by Dr. Nigel Rawson

Drug developers are more likely to invest in research and development if prices for their medicines are high.

Ontario government continues to ignore parents worried about learning loss [[link removed]]

(Appeared in the Ottawa Citizen) by Paige MacPherson

The province's students were behind in math, science, and reading even before the pandemic.

SUPPORT THE FRASER INSTITUTE

---------------------

The Fraser Institute has been ranked the #1 think tank in Canada, and the 14th best think tank out of more than 8,200 around the world! We keep Canadians – and decision-makers! – informed.

But we are only as strong as our supporters. We do not accept government grants or payments for research - we depend on individuals like you to continue our good work! We are a charity - your donation entitles you to a generous tax credit at tax time!

Donate Now [[link removed]]

Contact Us [[link removed]]

Privacy Policy [[link removed]]

Unsubscribe [link removed]

The Fraser Institute's mission is to improve the quality of life for Canadians, their families and future generations by studying, measuring and broadly communicating the effects of government policies, entrepreneurship and choice on their well-being. Email is one of the best tools we have to accomplish these goals. If you no longer wish to receive e-mail updates from us, click here to unsubscribe [link removed].

Fraser Institute | 4th Floor, 1770 Burrard Street, Vancouver, BC V6J 3G7

Message Analysis

- Sender: Fraser Institute

- Political Party: n/a

- Country: Canada

- State/Locality: n/a

- Office: n/a

-

Email Providers:

- Campaign Monitor