| From | IPA Financial Inclusion Program <[email protected]> |

| Subject | IPA Consumer Protection Quarterly | Issue 5: January 2022 |

| Date | January 21, 2022 1:08 PM |

Links have been removed from this email. Learn more in the FAQ.

Links have been removed from this email. Learn more in the FAQ.

The newest edition of our consumer protection newsletter.

View this email in your browser

[link removed]

[link removed]

More evidence, less poverty

IPA Consumer Protection Quarterly

Issue No. 5 – January 2022

Welcome back to the Consumer Protection Quarterly, IPA's newsletter on the latest consumer protection research across the globe. This newsletter is part of IPA's Consumer Protection Research Initiative

[link removed]

. Each quarter we send you the latest research, insights, and inspiration for financial consumer protection. If you have something to share, please reach out: [email protected]

mailto:[email protected]?subject=Consumer%20Protection%20Quarterly

.

You are receiving this email because of your past participation in IPA consumer protection or financial inclusion events, and/or because you signed up for our consumer protection practitioner's forum mailing interest list

[link removed]

. If there are others you think may benefit from this newsletter, please forward. You can manage your email preferences here

[link removed]

.

What's new and what's next

[link removed]

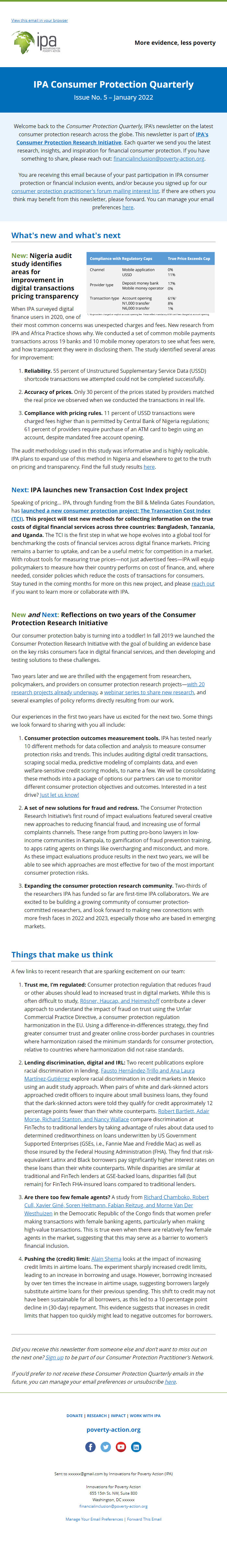

New: Nigeria audit study identifies areas for improvement in digital transactions pricing transparency

When IPA surveyed digital finance users in 2020, one of their most common concerns was unexpected charges and fees. New research from IPA and Africa Practice shows why. We conducted a set of common mobile payments transactions across 19 banks and 10 mobile money operators to see what fees were, and how transparent they were in disclosing them. The study identified several areas for improvement:

Reliability. 55 percent of Unstructured Supplementary Service Data (USSD) shortcode transactions we attempted could not be completed successfully.

Accuracy of prices. Only 30 percent of the prices stated by providers matched the real price we observed when we conducted the transactions in real life.

Compliance with pricing rules. 11 percent of USSD transactions were charged fees higher than is permitted by Central Bank of Nigeria regulations; 61 percent of providers require purchase of an ATM card to begin using an account, despite mandated free account opening.

The audit methodology used in this study was informative and is highly replicable. IPA plans to expand use of this method in Nigeria and elsewhere to get to the truth on pricing and transparency. Find the full study results here

[link removed]

.

Next: IPA launches new Transaction Cost Index project

Speaking of pricing… IPA, through funding from the Bill & Melinda Gates Foundation, has launched a new consumer protection project:

[link removed]

The Transaction Cost Index (TCI)

[link removed]

. This project will test new methods for collecting information on the true costs of digital financial services across three countries: Bangladesh, Tanzania, and Uganda. The TCI is the first step in what we hope evolves into a global tool for benchmarking the costs of financial services across digital finance markets. Pricing remains a barrier to uptake, and can be a useful metric for competition in a market. With robust tools for measuring true prices—not just advertised fees—IPA will equip policymakers to measure how their country performs on cost of finance, and, where needed, consider policies which reduce the costs of transactions for consumers. Stay tuned in the coming months for more on this new project, and please reach out

mailto:[email protected]

if you want to learn more or collaborate with IPA.

New and Next: Reflections on two years of the Consumer Protection Research Initiative

Our consumer protection baby is turning into a toddler! In fall 2019 we launched the Consumer Protection Research Initiative with the goal of building an evidence base on the key risks consumers face in digital financial services, and then developing and testing solutions to these challenges.

Two years later and we are thrilled with the engagement from researchers, policymakers, and providers on consumer protection research projects—with 20 research projects already underway

[link removed]

, a webinar series to share new research

[link removed]

, and several examples of policy reforms directly resulting from our work.

Our experiences in the first two years have us excited for the next two. Some things we look forward to sharing with you all include:

Consumer protection outcomes measurement tools. IPA has tested nearly 10 different methods for data collection and analysis to measure consumer protection risks and trends. This includes auditing digital credit transactions, scraping social media, predictive modeling of complaints data, and even welfare-sensitive credit scoring models, to name a few. We will be consolidating these methods into a package of options our partners can use to monitor different consumer protection objectives and outcomes. Interested in a test drive? Just let us know!

mailto:[email protected]

A set of new solutions for fraud and redress. The Consumer Protection Research Initiative’s first round of impact evaluations featured several creative new approaches to reducing financial fraud, and increasing use of formal complaints channels. These range from putting pro-bono lawyers in low-income communities in Kampala, to gamification of fraud prevention training, to apps rating agents on things like overcharging and misconduct, and more. As these impact evaluations produce results in the next two years, we will be able to see which approaches are most effective for two of the most important consumer protection risks.

Expanding the consumer protection research community. Two-thirds of the researchers IPA has funded so far are first-time IPA collaborators. We are excited to be building a growing community of consumer protection-committed researchers, and look forward to making new connections with more fresh faces in 2022 and 2023, especially those who are based in emerging markets.

Things that make us think

A few links to recent research that are sparking excitement on our team:

Trust me, I’m regulated: Consumer protection regulation that reduces fraud or other abuses should lead to increased trust in digital markets. While this is often difficult to study, Rösner, Haucap, and Heimeshoff

[link removed]

contribute a clever approach to understand the impact of fraud on trust using the Unfair Commercial Practice Directive, a consumer protection regulation harmonization in the EU. Using a difference-in-differences strategy, they find greater consumer trust and greater online cross-border purchases in countries where harmonization raised the minimum standards for consumer protection, relative to countries where harmonization did not raise standards.

Lending discrimination, digital and IRL: Two recent publications explore racial discrimination in lending. Fausto Hernández-Trillo and Ana Laura Martínez-Gutiérrez

[link removed]

explore racial discrimination in credit markets in Mexico using an audit study approach. When pairs of white and dark-skinned actors approached credit officers to inquire about small business loans, they found that the dark-skinned actors were told they qualify for credit approximately 12 percentage points fewer than their white counterparts. Robert Bartlett, Adair Morse, Richard Stanton, and Nancy Wallace

[link removed]

compare discrimination at FinTechs to traditional lenders by taking advantage of rules about data used to determined creditworthiness on loans underwritten by US Government Supported Enterprises (GSEs, i.e., Fannie Mae and Freddie Mac) as well as those insured by the Federal Housing Administration (FHA). They find that risk-equivalent Latinx and Black borrowers pay significantly higher interest rates on these loans than their white counterparts. While disparities are similar at traditional and FinTech lenders at GSE-backed loans, disparities fall (but remain) for FinTech FHA-insured loans compared to traditional lenders.

Are there too few female agents? A study from Richard Chamboko, Robert Cull, Xavier Giné, Soren Heitmann, Fabian Reitzug, and Morne Van Der Westhuizen

[link removed]

in the Democratic Republic of the Congo finds that women prefer making transactions with female banking agents, particularly when making high-value transactions. This is true even when there are relatively few female agents in the market, suggesting that this may serve as a barrier to women’s financial inclusion.

Pushing the (credit) limit: Alain Shema

[link removed]

looks at the impact of increasing credit limits in airtime loans. The experiment sharply increased credit limits, leading to an increase in borrowing and usage. However, borrowing increased by over ten times the increase in airtime usage, suggesting borrowers largely substitute airtime loans for their previous spending. This shift to credit may not have been sustainable for all borrowers, as this led to a 10 percentage point decline in (30-day) repayment. This evidence suggests that increases in credit limits that happen too quickly might lead to negative outcomes for borrowers.

Did you receive this newsletter from someone else and don’t want to miss out on the next one? Sign up

[link removed]

to be part of our Consumer Protection Practitioner’s Network.

If you’d prefer to not receive these Consumer Protection Quarterly emails in the future, you can manage your email preferences or unsubscribe here

[link removed]

.

DONATE

[link removed]

| RESEARCH

[link removed]

| IMPACT

[link removed]

| WORK WITH IPA

[link removed]

poverty-action.org

[link removed]

[link removed]

[link removed]

[link removed]

[link removed]

Sent to [email protected] by Innovations for Poverty Action (IPA)

Innovations for Poverty Action

655 15th St. NW, Suite 800

Washington, DC xxxxxx

[email protected]

mailto:[email protected]

Manage Your Email Preferences

[link removed]

| Forward This Email

[link removed]

View this email in your browser

[link removed]

[link removed]

More evidence, less poverty

IPA Consumer Protection Quarterly

Issue No. 5 – January 2022

Welcome back to the Consumer Protection Quarterly, IPA's newsletter on the latest consumer protection research across the globe. This newsletter is part of IPA's Consumer Protection Research Initiative

[link removed]

. Each quarter we send you the latest research, insights, and inspiration for financial consumer protection. If you have something to share, please reach out: [email protected]

mailto:[email protected]?subject=Consumer%20Protection%20Quarterly

.

You are receiving this email because of your past participation in IPA consumer protection or financial inclusion events, and/or because you signed up for our consumer protection practitioner's forum mailing interest list

[link removed]

. If there are others you think may benefit from this newsletter, please forward. You can manage your email preferences here

[link removed]

.

What's new and what's next

[link removed]

New: Nigeria audit study identifies areas for improvement in digital transactions pricing transparency

When IPA surveyed digital finance users in 2020, one of their most common concerns was unexpected charges and fees. New research from IPA and Africa Practice shows why. We conducted a set of common mobile payments transactions across 19 banks and 10 mobile money operators to see what fees were, and how transparent they were in disclosing them. The study identified several areas for improvement:

Reliability. 55 percent of Unstructured Supplementary Service Data (USSD) shortcode transactions we attempted could not be completed successfully.

Accuracy of prices. Only 30 percent of the prices stated by providers matched the real price we observed when we conducted the transactions in real life.

Compliance with pricing rules. 11 percent of USSD transactions were charged fees higher than is permitted by Central Bank of Nigeria regulations; 61 percent of providers require purchase of an ATM card to begin using an account, despite mandated free account opening.

The audit methodology used in this study was informative and is highly replicable. IPA plans to expand use of this method in Nigeria and elsewhere to get to the truth on pricing and transparency. Find the full study results here

[link removed]

.

Next: IPA launches new Transaction Cost Index project

Speaking of pricing… IPA, through funding from the Bill & Melinda Gates Foundation, has launched a new consumer protection project:

[link removed]

The Transaction Cost Index (TCI)

[link removed]

. This project will test new methods for collecting information on the true costs of digital financial services across three countries: Bangladesh, Tanzania, and Uganda. The TCI is the first step in what we hope evolves into a global tool for benchmarking the costs of financial services across digital finance markets. Pricing remains a barrier to uptake, and can be a useful metric for competition in a market. With robust tools for measuring true prices—not just advertised fees—IPA will equip policymakers to measure how their country performs on cost of finance, and, where needed, consider policies which reduce the costs of transactions for consumers. Stay tuned in the coming months for more on this new project, and please reach out

mailto:[email protected]

if you want to learn more or collaborate with IPA.

New and Next: Reflections on two years of the Consumer Protection Research Initiative

Our consumer protection baby is turning into a toddler! In fall 2019 we launched the Consumer Protection Research Initiative with the goal of building an evidence base on the key risks consumers face in digital financial services, and then developing and testing solutions to these challenges.

Two years later and we are thrilled with the engagement from researchers, policymakers, and providers on consumer protection research projects—with 20 research projects already underway

[link removed]

, a webinar series to share new research

[link removed]

, and several examples of policy reforms directly resulting from our work.

Our experiences in the first two years have us excited for the next two. Some things we look forward to sharing with you all include:

Consumer protection outcomes measurement tools. IPA has tested nearly 10 different methods for data collection and analysis to measure consumer protection risks and trends. This includes auditing digital credit transactions, scraping social media, predictive modeling of complaints data, and even welfare-sensitive credit scoring models, to name a few. We will be consolidating these methods into a package of options our partners can use to monitor different consumer protection objectives and outcomes. Interested in a test drive? Just let us know!

mailto:[email protected]

A set of new solutions for fraud and redress. The Consumer Protection Research Initiative’s first round of impact evaluations featured several creative new approaches to reducing financial fraud, and increasing use of formal complaints channels. These range from putting pro-bono lawyers in low-income communities in Kampala, to gamification of fraud prevention training, to apps rating agents on things like overcharging and misconduct, and more. As these impact evaluations produce results in the next two years, we will be able to see which approaches are most effective for two of the most important consumer protection risks.

Expanding the consumer protection research community. Two-thirds of the researchers IPA has funded so far are first-time IPA collaborators. We are excited to be building a growing community of consumer protection-committed researchers, and look forward to making new connections with more fresh faces in 2022 and 2023, especially those who are based in emerging markets.

Things that make us think

A few links to recent research that are sparking excitement on our team:

Trust me, I’m regulated: Consumer protection regulation that reduces fraud or other abuses should lead to increased trust in digital markets. While this is often difficult to study, Rösner, Haucap, and Heimeshoff

[link removed]

contribute a clever approach to understand the impact of fraud on trust using the Unfair Commercial Practice Directive, a consumer protection regulation harmonization in the EU. Using a difference-in-differences strategy, they find greater consumer trust and greater online cross-border purchases in countries where harmonization raised the minimum standards for consumer protection, relative to countries where harmonization did not raise standards.

Lending discrimination, digital and IRL: Two recent publications explore racial discrimination in lending. Fausto Hernández-Trillo and Ana Laura Martínez-Gutiérrez

[link removed]

explore racial discrimination in credit markets in Mexico using an audit study approach. When pairs of white and dark-skinned actors approached credit officers to inquire about small business loans, they found that the dark-skinned actors were told they qualify for credit approximately 12 percentage points fewer than their white counterparts. Robert Bartlett, Adair Morse, Richard Stanton, and Nancy Wallace

[link removed]

compare discrimination at FinTechs to traditional lenders by taking advantage of rules about data used to determined creditworthiness on loans underwritten by US Government Supported Enterprises (GSEs, i.e., Fannie Mae and Freddie Mac) as well as those insured by the Federal Housing Administration (FHA). They find that risk-equivalent Latinx and Black borrowers pay significantly higher interest rates on these loans than their white counterparts. While disparities are similar at traditional and FinTech lenders at GSE-backed loans, disparities fall (but remain) for FinTech FHA-insured loans compared to traditional lenders.

Are there too few female agents? A study from Richard Chamboko, Robert Cull, Xavier Giné, Soren Heitmann, Fabian Reitzug, and Morne Van Der Westhuizen

[link removed]

in the Democratic Republic of the Congo finds that women prefer making transactions with female banking agents, particularly when making high-value transactions. This is true even when there are relatively few female agents in the market, suggesting that this may serve as a barrier to women’s financial inclusion.

Pushing the (credit) limit: Alain Shema

[link removed]

looks at the impact of increasing credit limits in airtime loans. The experiment sharply increased credit limits, leading to an increase in borrowing and usage. However, borrowing increased by over ten times the increase in airtime usage, suggesting borrowers largely substitute airtime loans for their previous spending. This shift to credit may not have been sustainable for all borrowers, as this led to a 10 percentage point decline in (30-day) repayment. This evidence suggests that increases in credit limits that happen too quickly might lead to negative outcomes for borrowers.

Did you receive this newsletter from someone else and don’t want to miss out on the next one? Sign up

[link removed]

to be part of our Consumer Protection Practitioner’s Network.

If you’d prefer to not receive these Consumer Protection Quarterly emails in the future, you can manage your email preferences or unsubscribe here

[link removed]

.

DONATE

[link removed]

| RESEARCH

[link removed]

| IMPACT

[link removed]

| WORK WITH IPA

[link removed]

poverty-action.org

[link removed]

[link removed]

[link removed]

[link removed]

[link removed]

Sent to [email protected] by Innovations for Poverty Action (IPA)

Innovations for Poverty Action

655 15th St. NW, Suite 800

Washington, DC xxxxxx

[email protected]

mailto:[email protected]

Manage Your Email Preferences

[link removed]

| Forward This Email

[link removed]

Message Analysis

- Sender: Poverty Action

- Political Party: n/a

- Country: United States

- State/Locality: Washington

- Office: n/a

-

Email Providers:

- Pardot

- Litmus