|

|

|

|

Welcome to Union Station, our weekly newsletter that keeps you abreast of the legislation, national trends, and public debate surrounding public-sector union policy.

FEDERAL APPEALS COURT REJECTS CLAIMS OVER AGENCY FEE REFUNDS

On Nov. 5, the U.S. Court of Appeals for the Seventh Circuit rejected two claims in which plaintiffs sought refunds of agency fees they had paid to their unions before the U.S. Supreme Court ruled such fees unconstitutional.

What is at issue?

Mark Janus, a former Illinois state employee, sought damages for fees he had paid to his union before the Supreme Court barred the collection of agency fees in 2018. His attorneys pointed to Harris v. Quinn, a 2014 decision in which the high court struck down an Illinois statute compelling a specific class of home healthcare workers to pay fees to the Service Employees International Union.

His attorneys claimed that Harris suggested the ultimate unconstitutionality of agency fees, arguing unions were not acting in good faith when they continued to collect agency fees and should be held liable for refunds. Janus' attorneys also cited Harper v. Virginia Department of Taxation (1993), in which the Supreme Court held that "a rule of federal law, once announced and applied to the parties to the controversy, must be given full retroactive effect by all courts adjudicating federal law."

How did the court rule?

The three-judge appellate panel, comprising Judges Diane Wood, Daniel Manion, and Ilana Rovner, unanimously rejected Janus' claim, affirming the district court's earlier decision. Writing for the court, Wood said,

|

“

|

No one doubts that Mr. Janus is entitled to declaratory and injunctive relief. The Supreme Court declared that the status quo violated his First Amendment rights and that 'States and public-sector unions may no longer extract agency fees from nonconsenting employees.' Mr. Janus is now protected from that practice. Any remaining relief was for the district court to consider. That court declined to grant monetary damages, on the ground that AFSCME's good-faith defense shielded the union from such

liability. We agree with that conclusion.

|

”

|

Wood, Manion, and Rovner were appointed to the Seventh Circuit by Presidents Bill Clinton (D), Ronald Reagan (R), and George H.W. Bush (R), respectively.

What is at issue?

Stacey Mooney, an Illinois public-school teacher, sought restitution for previously paid agency fees.

How did the court rule?

The same three-judge panel unanimously rejected the claim, citing its reasoning as laid out in the Janus case.

|

THE BIG PICTURE

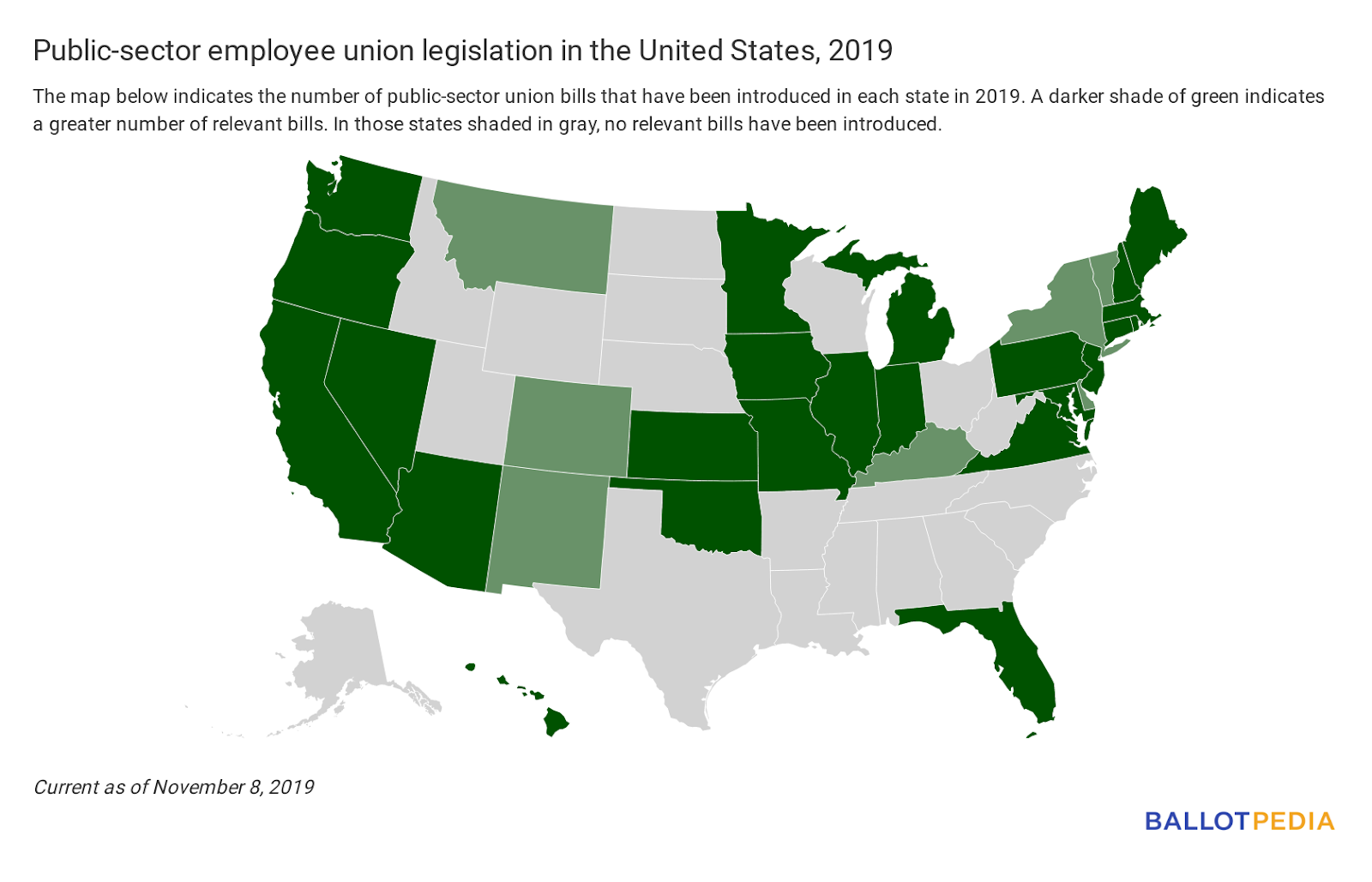

Number of relevant bills by state

We are currently tracking 106 pieces of legislation dealing with public-sector employee union policy. On the map below, a darker shade of green indicates a greater number of relevant bills. Click here for a complete list of all the bills we're tracking.

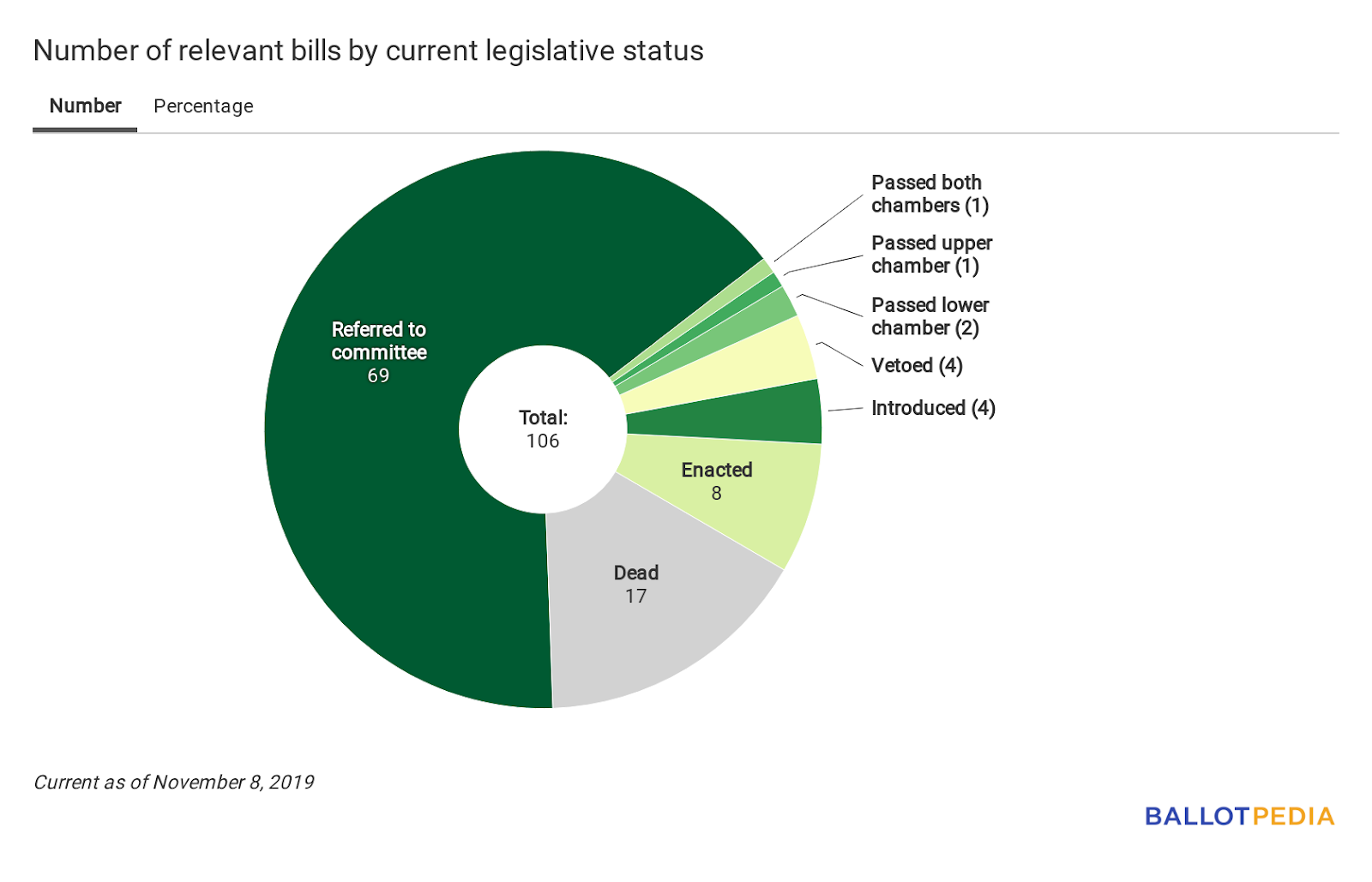

Number of relevant bills by current legislative status

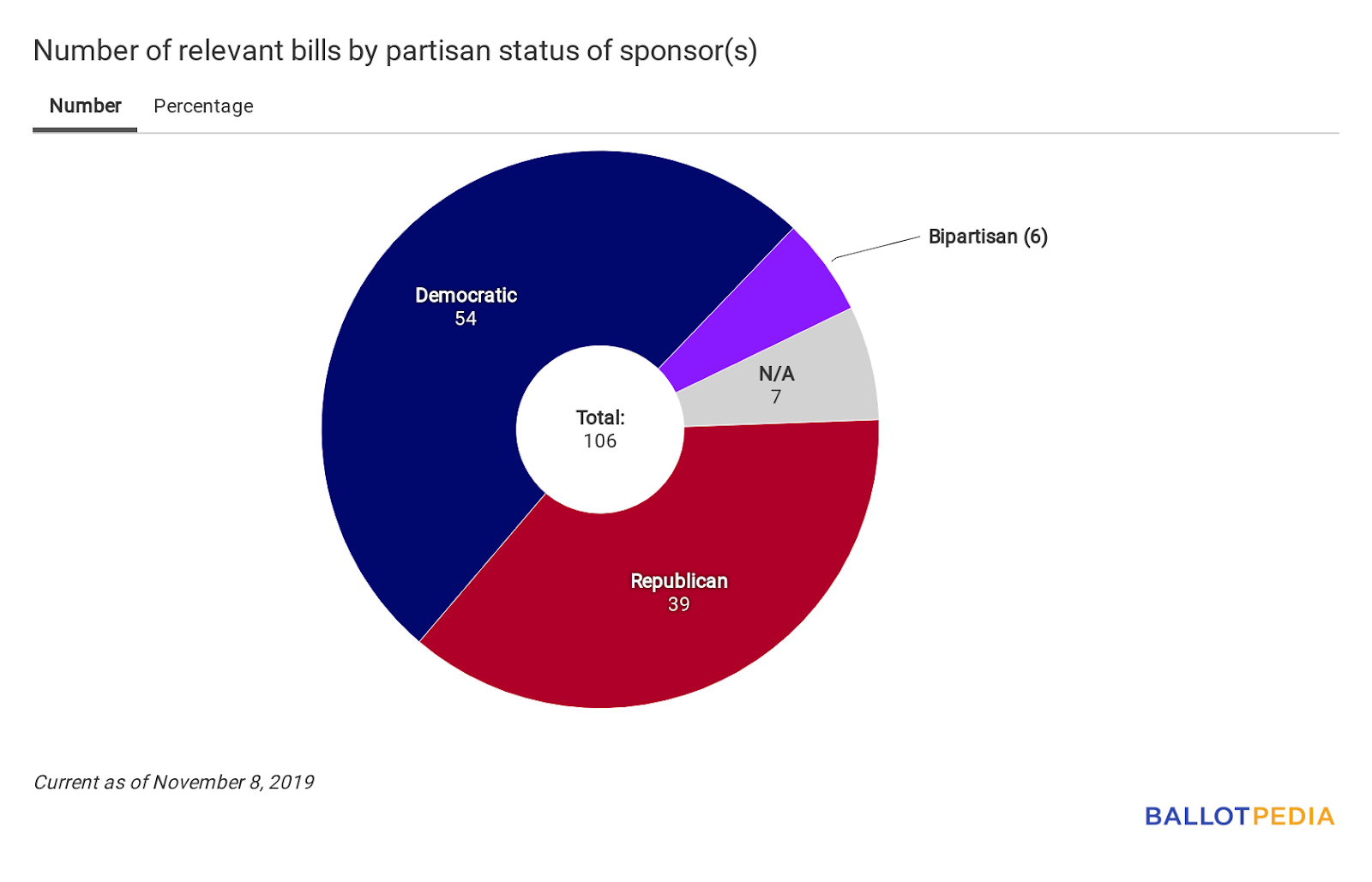

Number of relevant bills by partisan status of sponsor(s)

|

RECENT LEGISLATIVE ACTIONS

Below is a complete list of legislative actions taken since our last issue. Bills are listed in alphabetical order, first by state then by bill number.

- Florida S0624: This bill would repeal a requirement that school districts and collective bargaining units negotiate specified memoranda of understanding. It would repeal a requirement that unions include specific information in their applications for renewal of registration. It would also remove a requirement that certain unions petition the Public Employees Relations Commission for recertification.

- Referred to Senate Governmental Oversight and Accountability and Appropriations Committees Nov. 6.

- Florida S0804: This bill would revise the requirements for dues deduction authorizations.

Thank you for reading! Let us know what you think! Reply to this email with any feedback or recommendations. |

|

Ballotpedia depends on the support of our readers.

The Lucy Burns Institute, publisher of Ballotpedia, is a 501(c)(3) nonprofit organization. All donations are tax deductible to the extent of the law. Donations to the Lucy Burns Institute or Ballotpedia do not support any candidates or campaigns.

|

|

|

|

|