Email

A Message from Mike: Reckless Tax-and-Spending Spree Bad for Economy and American Families

| From | Senator Mike Crapo <[email protected]> |

| Subject | A Message from Mike: Reckless Tax-and-Spending Spree Bad for Economy and American Families |

| Date | December 20, 2021 5:50 PM |

Links have been removed from this email. Learn more in the FAQ.

Links have been removed from this email. Learn more in the FAQ.

United States Senator Mike Crapo - Idaho

As Republican Ranking Member

of the U.S. Senate Finance Committee, I have taken every opportunity

to push back against the Democrats' reckless tax-and-spend bill that

is front-loaded with inflationary spending and full of job-killing tax

hikes.

*Despite Raging Inflation, Democrats Want to Print, Borrow and

Spend Trillions More *

The Administration and Congressional Democrats

continue to push a massive new spending package that does nothing to

address supply chain issues, nor inflation in consumer and producer

prices.

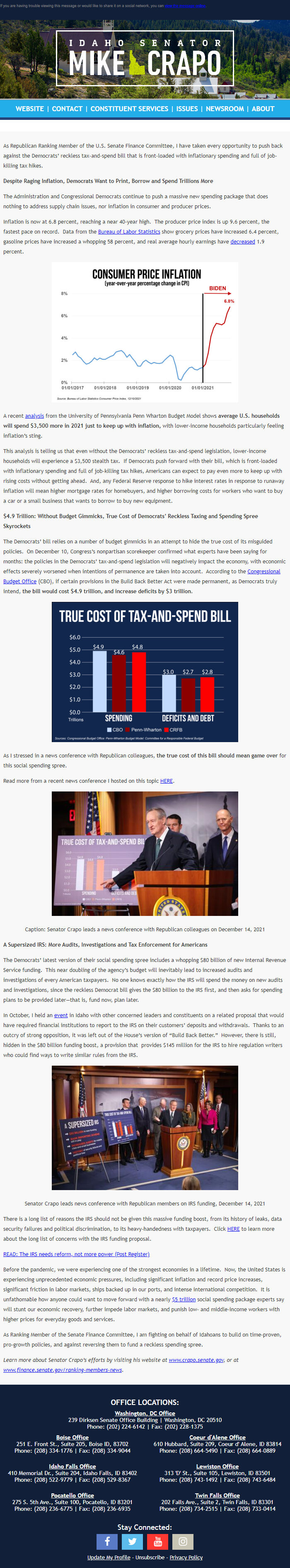

Inflation is now at 6.8 percent, reaching a near 40-year

high.

The producer price index is up 9.6 percent, the fastest pace on

record.

Data from the Bureau of Labor Statistics [link 1] show grocery

prices have increased 6.4 percent, gasoline prices have increased a

whopping 58 percent, and real average hourly earnings have decreased

[link 2] 1.9 percent.

[image =

[link removed]]

A

recent analysis [link 3] from the University of Pennsylvania Penn

Wharton Budget Model shows *average U.S. households will spend $3,500

more in 2021 just to keep up with inflation, *with lower-income

households particularly feeling inflation's sting.

This analysis is

telling us that even without the Democrats' reckless tax-and-spend

legislation, lower-income households will experience a $3,500 stealth

tax.

If Democrats push forward with their bill, which is front-loaded

with inflationary spending and full of job-killing tax hikes,

Americans can expect to pay even more to keep up with rising costs

without getting ahead.

And, any Federal Reserve response to hike

interest rates in response to runaway inflation will mean higher

mortgage rates for homebuyers, and higher borrowing costs for workers

who want to buy a car or a small business that wants to borrow to buy

new equipment.

*$4.9 Trillion: Without Budget Gimmicks, True Cost of

Democrats' Reckless Taxing and Spending Spree Skyrockets*

The

Democrats' bill relies on a number of budget gimmicks in an attempt to

hide the true cost of its misguided policies.

On December 10,

Congress's nonpartisan scorekeeper confirmed what experts have been

saying for months: the policies in the Democrats' tax-and-spend

legislation will negatively impact the economy, with economic effects

severely worsened when intentions of permanence are taken into

account.

According to the Congressional Budget Office [link 4] (CBO),

if certain provisions in the Build Back Better Act were made

permanent, as Democrats truly intend, *the bill would cost $4.9

trillion, and increase deficits by $3 trillion*.

[image =

[link removed]]

As

I stressed in a news conference with Republican colleagues, *the true

cost of this bill should mean game over* for this social spending

spree.

Read more from a recent news conference I hosted on this topic

HERE [link 5].

[image =

[link removed]]

Caption:

Senator Crapo leads a news conference with Republican colleagues on

December 14, 2021

*A Supersized IRS: More Audits, Investigations and

Tax Enforcement for Americans*

The Democrats' latest version of their

social spending spree includes a whopping $80 billion of new Internal

Revenue Service funding.

This near doubling of the agency's budget

will inevitably lead to increased audits and investigations of every

American taxpayers.

No one knows exactly how the IRS will spend the

money on new audits and investigations, since the reckless Democrat

bill gives the $80 billion to the IRS first, and then asks for

spending plans to be provided later--that is, fund now, plan

later.

In October, I held an event [link 6] in Idaho with other

concerned leaders and constituents on a related proposal that would

have required financial institutions to report to the IRS on their

customers' deposits and withdrawals.

Thanks to an outcry of strong

opposition, it was left out of the House's version of "Build Back

Better."

However, there is still, hidden in the $80 billion funding

boost, a provision that

provides $145 million for the IRS to hire

regulation writers who could find ways to write similar rules from the

IRS.

[image =

[link removed]]

Senator

Crapo leads news conference with Republican members on IRS funding,

December 14, 2021

There is a long list of reasons the IRS should not

be given this massive funding boost, from its history of leaks, data

security failures and political discrimination, to its

heavy-handedness with taxpayers.

Click HERE [link 7] to learn more

about the long list of concerns with the IRS funding proposal.

READ:

The IRS needs reform, not more power (Post Register) [link 8]

Before

the pandemic, we were experiencing one of the strongest economies in a

lifetime.

Now, the United States is experiencing unprecedented

economic pressures, including significant inflation and record price

increases, significant friction in labor markets, ships backed up in

our ports, and intense international competition.

It is unfathomable

how anyone could want to move forward with a nearly $5 trillion [link

9] social spending package experts say will stunt our economic

recovery, further impede labor markets, and punish low- and

middle-income workers with higher prices for everyday goods and

services.

As Ranking Member of the Senate Finance Committee, I am

fighting on behalf of Idahoans to build on time-proven, pro-growth

policies, and against reversing them to fund a reckless spending

spree.

*Learn more about Senator Crapo's efforts by visiting his

website at **www.crapo.senate.gov* [link 10]*, or at

**www.finance.senate.gov/ranking-members-news* [link 11]*. *

----------------------

footnotes

----------------------

[link 1]

[link removed]

[link 2]

[link removed]

[link

3]

[link removed]

[link

4]

[link removed]

[link

5]

[link removed]

[link

6]

[link removed]

[link

7]

[link removed]

[link

8]

[link removed]

[link

9]

[link removed]

[link

10] [link removed]

[link 11]

[link removed]

Contact

Information:

Website:

Offices:

239 Dirksen Senate

Building

Washington D.C., 20510

Phone: (202) 224-6142

Idaho Falls

410 Memorial Drive

Suite 205

Idaho Falls, ID 83402

Phone: (208)

522-9779

Boise

251 East Front Street

Suite 205

Boise, ID 83702

Phone: (208) 334-1776

Lewiston

313 'D' Street

Suite 105

Lewiston,

ID 83501

Phone: (208) 743-1492

Caldwell

524 East Cleveland

Blvd.

Suite 220

Caldwell, ID 83605

Phone: (208) 455-0360

Pocatello

275 South 5th Avenue

Suite 100

Pocatello, ID 83201

Phone: (208)

236-6775

Coeur d' Alene

610 Hubbard Street

Suite 209

Coeur d'

Alene, ID 83814

Phone: (208) 664-5490

Twin Falls

202 Falls

Avenue

Suite 2

Twin Falls, ID 83301

Phone: (208) 734-2515

Unsubscribe:

[link removed]

Privacy

Policy:

[link removed]

As Republican Ranking Member

of the U.S. Senate Finance Committee, I have taken every opportunity

to push back against the Democrats' reckless tax-and-spend bill that

is front-loaded with inflationary spending and full of job-killing tax

hikes.

*Despite Raging Inflation, Democrats Want to Print, Borrow and

Spend Trillions More *

The Administration and Congressional Democrats

continue to push a massive new spending package that does nothing to

address supply chain issues, nor inflation in consumer and producer

prices.

Inflation is now at 6.8 percent, reaching a near 40-year

high.

The producer price index is up 9.6 percent, the fastest pace on

record.

Data from the Bureau of Labor Statistics [link 1] show grocery

prices have increased 6.4 percent, gasoline prices have increased a

whopping 58 percent, and real average hourly earnings have decreased

[link 2] 1.9 percent.

[image =

[link removed]]

A

recent analysis [link 3] from the University of Pennsylvania Penn

Wharton Budget Model shows *average U.S. households will spend $3,500

more in 2021 just to keep up with inflation, *with lower-income

households particularly feeling inflation's sting.

This analysis is

telling us that even without the Democrats' reckless tax-and-spend

legislation, lower-income households will experience a $3,500 stealth

tax.

If Democrats push forward with their bill, which is front-loaded

with inflationary spending and full of job-killing tax hikes,

Americans can expect to pay even more to keep up with rising costs

without getting ahead.

And, any Federal Reserve response to hike

interest rates in response to runaway inflation will mean higher

mortgage rates for homebuyers, and higher borrowing costs for workers

who want to buy a car or a small business that wants to borrow to buy

new equipment.

*$4.9 Trillion: Without Budget Gimmicks, True Cost of

Democrats' Reckless Taxing and Spending Spree Skyrockets*

The

Democrats' bill relies on a number of budget gimmicks in an attempt to

hide the true cost of its misguided policies.

On December 10,

Congress's nonpartisan scorekeeper confirmed what experts have been

saying for months: the policies in the Democrats' tax-and-spend

legislation will negatively impact the economy, with economic effects

severely worsened when intentions of permanence are taken into

account.

According to the Congressional Budget Office [link 4] (CBO),

if certain provisions in the Build Back Better Act were made

permanent, as Democrats truly intend, *the bill would cost $4.9

trillion, and increase deficits by $3 trillion*.

[image =

[link removed]]

As

I stressed in a news conference with Republican colleagues, *the true

cost of this bill should mean game over* for this social spending

spree.

Read more from a recent news conference I hosted on this topic

HERE [link 5].

[image =

[link removed]]

Caption:

Senator Crapo leads a news conference with Republican colleagues on

December 14, 2021

*A Supersized IRS: More Audits, Investigations and

Tax Enforcement for Americans*

The Democrats' latest version of their

social spending spree includes a whopping $80 billion of new Internal

Revenue Service funding.

This near doubling of the agency's budget

will inevitably lead to increased audits and investigations of every

American taxpayers.

No one knows exactly how the IRS will spend the

money on new audits and investigations, since the reckless Democrat

bill gives the $80 billion to the IRS first, and then asks for

spending plans to be provided later--that is, fund now, plan

later.

In October, I held an event [link 6] in Idaho with other

concerned leaders and constituents on a related proposal that would

have required financial institutions to report to the IRS on their

customers' deposits and withdrawals.

Thanks to an outcry of strong

opposition, it was left out of the House's version of "Build Back

Better."

However, there is still, hidden in the $80 billion funding

boost, a provision that

provides $145 million for the IRS to hire

regulation writers who could find ways to write similar rules from the

IRS.

[image =

[link removed]]

Senator

Crapo leads news conference with Republican members on IRS funding,

December 14, 2021

There is a long list of reasons the IRS should not

be given this massive funding boost, from its history of leaks, data

security failures and political discrimination, to its

heavy-handedness with taxpayers.

Click HERE [link 7] to learn more

about the long list of concerns with the IRS funding proposal.

READ:

The IRS needs reform, not more power (Post Register) [link 8]

Before

the pandemic, we were experiencing one of the strongest economies in a

lifetime.

Now, the United States is experiencing unprecedented

economic pressures, including significant inflation and record price

increases, significant friction in labor markets, ships backed up in

our ports, and intense international competition.

It is unfathomable

how anyone could want to move forward with a nearly $5 trillion [link

9] social spending package experts say will stunt our economic

recovery, further impede labor markets, and punish low- and

middle-income workers with higher prices for everyday goods and

services.

As Ranking Member of the Senate Finance Committee, I am

fighting on behalf of Idahoans to build on time-proven, pro-growth

policies, and against reversing them to fund a reckless spending

spree.

*Learn more about Senator Crapo's efforts by visiting his

website at **www.crapo.senate.gov* [link 10]*, or at

**www.finance.senate.gov/ranking-members-news* [link 11]*. *

----------------------

footnotes

----------------------

[link 1]

[link removed]

[link 2]

[link removed]

[link

3]

[link removed]

[link

4]

[link removed]

[link

5]

[link removed]

[link

6]

[link removed]

[link

7]

[link removed]

[link

8]

[link removed]

[link

9]

[link removed]

[link

10] [link removed]

[link 11]

[link removed]

Contact

Information:

Website:

Offices:

239 Dirksen Senate

Building

Washington D.C., 20510

Phone: (202) 224-6142

Idaho Falls

410 Memorial Drive

Suite 205

Idaho Falls, ID 83402

Phone: (208)

522-9779

Boise

251 East Front Street

Suite 205

Boise, ID 83702

Phone: (208) 334-1776

Lewiston

313 'D' Street

Suite 105

Lewiston,

ID 83501

Phone: (208) 743-1492

Caldwell

524 East Cleveland

Blvd.

Suite 220

Caldwell, ID 83605

Phone: (208) 455-0360

Pocatello

275 South 5th Avenue

Suite 100

Pocatello, ID 83201

Phone: (208)

236-6775

Coeur d' Alene

610 Hubbard Street

Suite 209

Coeur d'

Alene, ID 83814

Phone: (208) 664-5490

Twin Falls

202 Falls

Avenue

Suite 2

Twin Falls, ID 83301

Phone: (208) 734-2515

Unsubscribe:

[link removed]

Privacy

Policy:

[link removed]

Message Analysis

- Sender: Mike Crapo

- Political Party: Republican

- Country: United States

- State/Locality: Idaho

- Office: United States Senate