| From | Center for Jobs and the Economy <[email protected]> |

| Subject | California Employment Report for November 2021 |

| Date | December 18, 2021 12:45 AM |

Links have been removed from this email. Learn more in the FAQ.

Links have been removed from this email. Learn more in the FAQ.

Web Version [link removed] | Update Preferences [link removed] [link removed] California Employment Report

for November 2021

The Center for Jobs and the Economy has released our initial analysis of the November Employment Report from the California Employment Development Department. For additional information and data about the California economy visit [[link removed]].

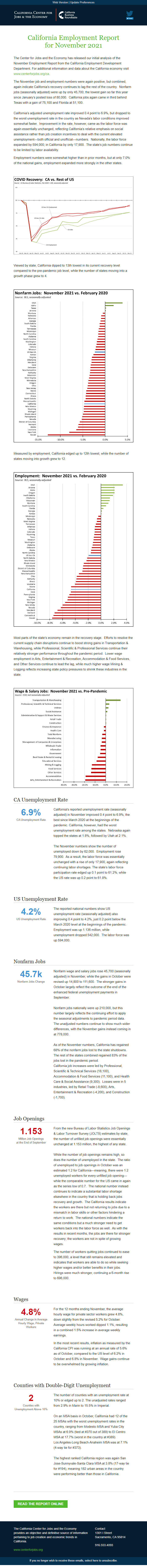

The November job and employment numbers were again positive, but combined, again indicate California’s recovery continues to lag the rest of the country. Nonfarm jobs (seasonally adjusted) were up by only 45,700, the lowest gain so far this year since January’s posted loss of 80,000. California jobs again came in third behind Texas with a gain of 75,100 and Florida at 51,100.

California’s adjusted unemployment rate improved 0.4 point to 6.9%, but dropped to the worst unemployment rate in the country as Nevada’s labor conditions improved somewhat faster. Improvement in the rate, however, came as the labor force was again essentially unchanged, reflecting California’s relative emphasis on social assistance rather than job creation incentives to deal with the current elevated unemployment—both official and unofficial—numbers. Nationally, the labor force expanded by 594,000; in California by only 17,900. The state’s job numbers continue to be limited by labor availability.

Employment numbers were somewhat higher than in prior months, but at only 7.0% of the national gains, employment expanded more strongly in the other states.

Viewed by state, California dipped to 13th lowest in its current recovery level compared to the pre-pandemic job level, while the number of states moving into a growth phase grew to 4.

Measured by employment, California edged up to 12th lowest, while the number of states moving into growth grew to 12.

Most parts of the state’s economy remain in the recovery stage. Efforts to resolve the current supply chain disruptions continue to boost strong gains in Transportation & Warehousing, while Professional, Scientific & Professional Services continue their relatively stronger performance throughout the pandemic period. Lower wage employment in Arts, Entertainment & Recreation, Accommodation & Food Services, and Other Services continue to lead the lag, while much higher wage Mining & Logging reflects increasing state policy pressures to shrink these industries in the state.

CA Unemployment Rate 6.9% CA Unemployment Rate

California's reported unemployment rate (seasonally adjusted) in November improved 0.4 point to 6.9%, the best since March 2020 at the beginnings of the pandemic. California, however, had the worst unemployment rate among the states. Nebraska again topped the states at 1.8%, followed by Utah at 2.1%.

The November numbers show the number of unemployed down by 62,000. Employment rose 79,900. As a result, the labor force was essentially unchanged with a rise of only 17,900, again reflecting continuing labor shortages. The state’s labor force participation rate edged up 0.1 point to 61.2%, while the US rate was up 0.2 point to 61.8%.

US Unemployment Rate 4.2% US Unemployment Rate

The reported national numbers show US unemployment rate (seasonally adjusted) also improving 0.4 point to 4.2%, just 0.2 point below the March 2020 level at the beginnings of the pandemic. Employment was up 1.136 million, while unemployment dropped 542,000. The labor force was up 594,000.

Nonfarm Jobs 45.7k Nonfarm Jobs Change

Nonfarm wage and salary jobs rose 45,700 (seasonally adjusted) in November, while the gains in October were revised up 14,800 to 111,600. The stronger gains in October largely reflect the outcome of the end of the enhanced federal unemployment payments in September.

Nonfarm jobs nationally were up 210,000, but this number largely reflects the continuing effort to apply the seasonal adjustments to pandemic period data. The unadjusted numbers continue to show much wider differences, with the November gains instead coming in at 778,000.

As of the November numbers, California has regained 68% of the nonfarm jobs lost to the state shutdowns. The rest of the states combined regained 83% of the jobs lost in the pandemic period.

California job increases were led by Professional, Scientific & Technical Services (18,100), Accommodation & Food Services (11,100), and Health Care & Social Assistance (9,300). Losses were in 5 industries, led by Retail Trade (-8,600), Arts, Entertainment & Recreation (-4,200), and Construction (-1,700).

Job Openings 1.153 Million Job Openings

at the End of September

From the new Bureau of Labor Statistics Job Openings & Labor Turnover Survey (JOLTS) estimates by state, the number of unfilled job openings were essentially unchanged at 1.153 million, the highest of any state.

While the number of job openings remains high, so does the number of unemployed in the state. The ratio of unemployed to job openings in October was an estimated 1.2 for California—meaning, there were 1.2 unemployed workers for every unfilled job opening—while the comparable number for the US came in again as the series low of 0.7. The national number instead continues to indicate a substantial labor shortage elsewhere in the country that is holding back jobs recovery and growth. The California results indicate the workers are there but not returning to jobs due to a mismatch in labor skills or other factors hindering a return to work. The national numbers indicate the same conditions but a much stronger need to get workers back into the labor force as well. As with the results in recent months, the jobs are there for stronger recovery; the workers are not in spite of growing wages.

The number of workers quitting jobs continued to ease to 396,000, a level that still remains elevated and indicates that workers are able to do so while seeking higher wages and/or better benefits in their jobs. Hirings were much stronger, continuing a 6-month rise to 696,000.

Wages 4.8% Annual Change in Average Hourly Wage, Private Workers

For the 12 months ending November, the average hourly wage for private sector workers grew 4.8%, down slightly from the revised 5.2% for October. Average weekly hours worked dipped 1.1%, resulting in a combined 1.5% increase in average weekly earnings.

In the most recent results, inflation as measured by the California CPI was running at an annual rate of 5.6% as of October, compared to the US level of 6.2% in October and 6.8% in November. Wage gains continue to be overwhelmed by growing inflation.

Counties with Double-Digit Unemployment 2 Counties with Unemployment Above 10%

The number of counties with an unemployment rate at 10% or edged up to 2. The unadjusted rates ranged from 2.9% in Marin to 15.5% in Imperial.

On an MSA basis in October, California had 12 of the 25 MSAs with the worst unemployment rates in the country, ranging from Modesto MSA and Yuba City MSAs at 6.9% (tied at #370 out of 389) to El Centro MSA at 17.7% (worst in the country at #389).

Los Angeles-Long Beach-Anaheim MSA was at 7.1% (4-way tie for #373).

The highest ranked California region was again San Jose-Sunnyvale-Santa Clara MSA at 3.8% (17-way tie for #194), meaning 182 urban areas in the country were performing better than those in California.

Read the Report Online [[link removed]] The California Center for Jobs and the Economy provides an objective and definitive source of information pertaining to job creation and economic trends in California. [[link removed]] Contact 1301 I Street Sacramento, CA 95814 916.553.4093 If you no longer wish to receive these emails, select here to unsubscribe. [link removed]

for November 2021

The Center for Jobs and the Economy has released our initial analysis of the November Employment Report from the California Employment Development Department. For additional information and data about the California economy visit [[link removed]].

The November job and employment numbers were again positive, but combined, again indicate California’s recovery continues to lag the rest of the country. Nonfarm jobs (seasonally adjusted) were up by only 45,700, the lowest gain so far this year since January’s posted loss of 80,000. California jobs again came in third behind Texas with a gain of 75,100 and Florida at 51,100.

California’s adjusted unemployment rate improved 0.4 point to 6.9%, but dropped to the worst unemployment rate in the country as Nevada’s labor conditions improved somewhat faster. Improvement in the rate, however, came as the labor force was again essentially unchanged, reflecting California’s relative emphasis on social assistance rather than job creation incentives to deal with the current elevated unemployment—both official and unofficial—numbers. Nationally, the labor force expanded by 594,000; in California by only 17,900. The state’s job numbers continue to be limited by labor availability.

Employment numbers were somewhat higher than in prior months, but at only 7.0% of the national gains, employment expanded more strongly in the other states.

Viewed by state, California dipped to 13th lowest in its current recovery level compared to the pre-pandemic job level, while the number of states moving into a growth phase grew to 4.

Measured by employment, California edged up to 12th lowest, while the number of states moving into growth grew to 12.

Most parts of the state’s economy remain in the recovery stage. Efforts to resolve the current supply chain disruptions continue to boost strong gains in Transportation & Warehousing, while Professional, Scientific & Professional Services continue their relatively stronger performance throughout the pandemic period. Lower wage employment in Arts, Entertainment & Recreation, Accommodation & Food Services, and Other Services continue to lead the lag, while much higher wage Mining & Logging reflects increasing state policy pressures to shrink these industries in the state.

CA Unemployment Rate 6.9% CA Unemployment Rate

California's reported unemployment rate (seasonally adjusted) in November improved 0.4 point to 6.9%, the best since March 2020 at the beginnings of the pandemic. California, however, had the worst unemployment rate among the states. Nebraska again topped the states at 1.8%, followed by Utah at 2.1%.

The November numbers show the number of unemployed down by 62,000. Employment rose 79,900. As a result, the labor force was essentially unchanged with a rise of only 17,900, again reflecting continuing labor shortages. The state’s labor force participation rate edged up 0.1 point to 61.2%, while the US rate was up 0.2 point to 61.8%.

US Unemployment Rate 4.2% US Unemployment Rate

The reported national numbers show US unemployment rate (seasonally adjusted) also improving 0.4 point to 4.2%, just 0.2 point below the March 2020 level at the beginnings of the pandemic. Employment was up 1.136 million, while unemployment dropped 542,000. The labor force was up 594,000.

Nonfarm Jobs 45.7k Nonfarm Jobs Change

Nonfarm wage and salary jobs rose 45,700 (seasonally adjusted) in November, while the gains in October were revised up 14,800 to 111,600. The stronger gains in October largely reflect the outcome of the end of the enhanced federal unemployment payments in September.

Nonfarm jobs nationally were up 210,000, but this number largely reflects the continuing effort to apply the seasonal adjustments to pandemic period data. The unadjusted numbers continue to show much wider differences, with the November gains instead coming in at 778,000.

As of the November numbers, California has regained 68% of the nonfarm jobs lost to the state shutdowns. The rest of the states combined regained 83% of the jobs lost in the pandemic period.

California job increases were led by Professional, Scientific & Technical Services (18,100), Accommodation & Food Services (11,100), and Health Care & Social Assistance (9,300). Losses were in 5 industries, led by Retail Trade (-8,600), Arts, Entertainment & Recreation (-4,200), and Construction (-1,700).

Job Openings 1.153 Million Job Openings

at the End of September

From the new Bureau of Labor Statistics Job Openings & Labor Turnover Survey (JOLTS) estimates by state, the number of unfilled job openings were essentially unchanged at 1.153 million, the highest of any state.

While the number of job openings remains high, so does the number of unemployed in the state. The ratio of unemployed to job openings in October was an estimated 1.2 for California—meaning, there were 1.2 unemployed workers for every unfilled job opening—while the comparable number for the US came in again as the series low of 0.7. The national number instead continues to indicate a substantial labor shortage elsewhere in the country that is holding back jobs recovery and growth. The California results indicate the workers are there but not returning to jobs due to a mismatch in labor skills or other factors hindering a return to work. The national numbers indicate the same conditions but a much stronger need to get workers back into the labor force as well. As with the results in recent months, the jobs are there for stronger recovery; the workers are not in spite of growing wages.

The number of workers quitting jobs continued to ease to 396,000, a level that still remains elevated and indicates that workers are able to do so while seeking higher wages and/or better benefits in their jobs. Hirings were much stronger, continuing a 6-month rise to 696,000.

Wages 4.8% Annual Change in Average Hourly Wage, Private Workers

For the 12 months ending November, the average hourly wage for private sector workers grew 4.8%, down slightly from the revised 5.2% for October. Average weekly hours worked dipped 1.1%, resulting in a combined 1.5% increase in average weekly earnings.

In the most recent results, inflation as measured by the California CPI was running at an annual rate of 5.6% as of October, compared to the US level of 6.2% in October and 6.8% in November. Wage gains continue to be overwhelmed by growing inflation.

Counties with Double-Digit Unemployment 2 Counties with Unemployment Above 10%

The number of counties with an unemployment rate at 10% or edged up to 2. The unadjusted rates ranged from 2.9% in Marin to 15.5% in Imperial.

On an MSA basis in October, California had 12 of the 25 MSAs with the worst unemployment rates in the country, ranging from Modesto MSA and Yuba City MSAs at 6.9% (tied at #370 out of 389) to El Centro MSA at 17.7% (worst in the country at #389).

Los Angeles-Long Beach-Anaheim MSA was at 7.1% (4-way tie for #373).

The highest ranked California region was again San Jose-Sunnyvale-Santa Clara MSA at 3.8% (17-way tie for #194), meaning 182 urban areas in the country were performing better than those in California.

Read the Report Online [[link removed]] The California Center for Jobs and the Economy provides an objective and definitive source of information pertaining to job creation and economic trends in California. [[link removed]] Contact 1301 I Street Sacramento, CA 95814 916.553.4093 If you no longer wish to receive these emails, select here to unsubscribe. [link removed]

Message Analysis

- Sender: California Center for Jobs and the Economy

- Political Party: n/a

- Country: United States

- State/Locality: California

- Office: n/a

-

Email Providers:

- Campaign Monitor