Email

John + the Oregon Political Tax Credit = Keeping Oregon Blue in 2022

| From | Team OR Dems <[email protected]> |

| Subject | John + the Oregon Political Tax Credit = Keeping Oregon Blue in 2022 |

| Date | December 18, 2021 12:17 AM |

Links have been removed from this email. Learn more in the FAQ.

Links have been removed from this email. Learn more in the FAQ.

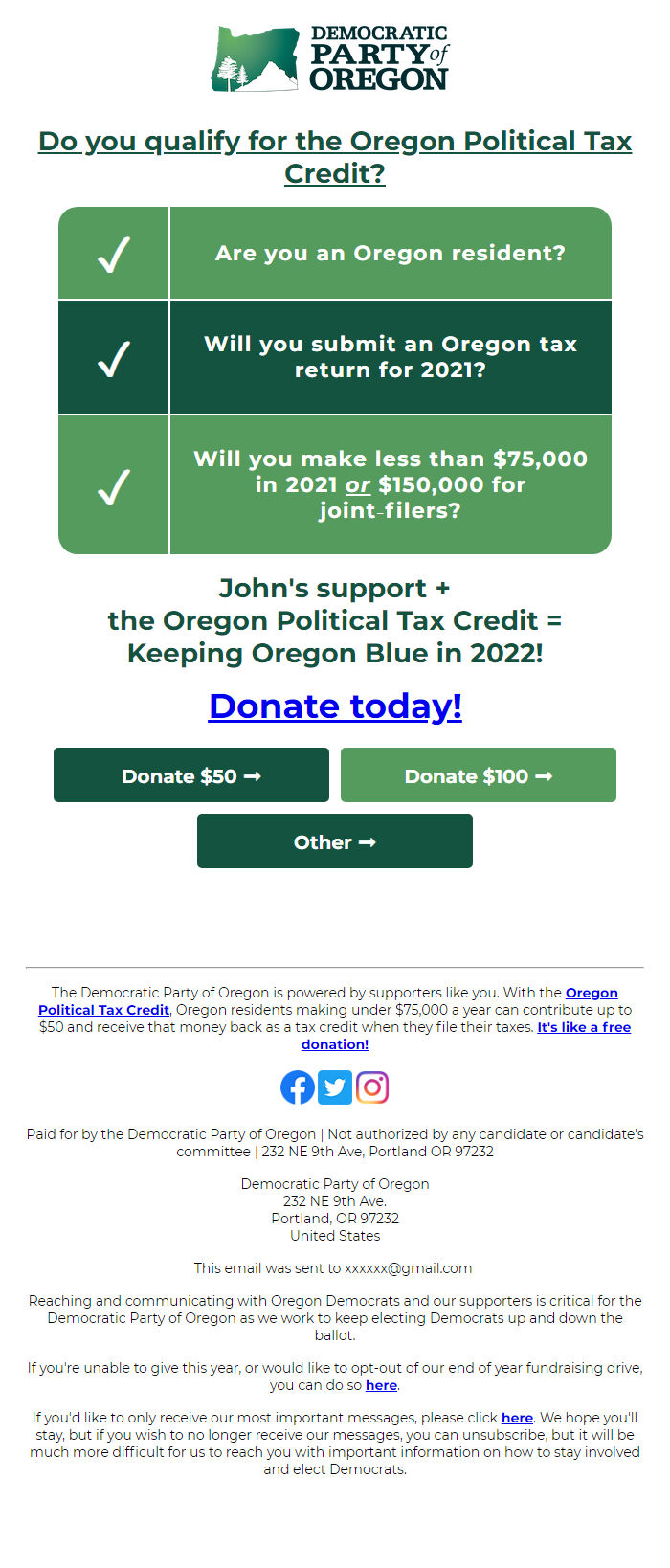

Do you qualify for the Oregon Political Tax Credit?

✓ Are you an Oregon resident?

✓ Will you submit an Oregon tax return for 2021?

✓ Will you make less than $75,000 in 2021 or $150,000 for joint‑filers?

John's support +

the Oregon Political Tax Credit =

Keeping Oregon Blue in 2022!

Donate today! [[link removed]]

Donate $50 ➞ [[link removed]]

Donate $100 ➞ [[link removed]]

Other ➞ [[link removed]]

The Democratic Party of Oregon is powered by supporters like you. With the Oregon Political Tax Credit [[link removed]] , Oregon residents making under $75,000 a year can contribute up to $50 and receive that money back as a tax credit when they file their taxes. It's like a free donation! [[link removed]]

[link removed] [[link removed]] [link removed] [[link removed]] [link removed] [[link removed]]

Paid for by the Democratic Party of Oregon | Not authorized by any candidate or candidate's committee | 232 NE 9th Ave, Portland OR 97232

Democratic Party of Oregon

232 NE 9th Ave.

Portland, OR 97232

United States

This email was sent to [email protected]

Reaching and communicating with Oregon Democrats and our supporters is critical for the Democratic Party of Oregon as we work to keep electing Democrats up and down the ballot.

If you're unable to give this year, or would like to opt-out of our end of year fundraising drive, you can do so here [[link removed]] .

If you'd like to only receive our most important messages, please click here [[link removed]] . We hope you'll stay, but if you wish to no longer receive our messages, you can unsubscribe: [link removed] , but it will be much more difficult for us to reach you with important information on how to stay involved and elect Democrats.

✓ Are you an Oregon resident?

✓ Will you submit an Oregon tax return for 2021?

✓ Will you make less than $75,000 in 2021 or $150,000 for joint‑filers?

John's support +

the Oregon Political Tax Credit =

Keeping Oregon Blue in 2022!

Donate today! [[link removed]]

Donate $50 ➞ [[link removed]]

Donate $100 ➞ [[link removed]]

Other ➞ [[link removed]]

The Democratic Party of Oregon is powered by supporters like you. With the Oregon Political Tax Credit [[link removed]] , Oregon residents making under $75,000 a year can contribute up to $50 and receive that money back as a tax credit when they file their taxes. It's like a free donation! [[link removed]]

[link removed] [[link removed]] [link removed] [[link removed]] [link removed] [[link removed]]

Paid for by the Democratic Party of Oregon | Not authorized by any candidate or candidate's committee | 232 NE 9th Ave, Portland OR 97232

Democratic Party of Oregon

232 NE 9th Ave.

Portland, OR 97232

United States

This email was sent to [email protected]

Reaching and communicating with Oregon Democrats and our supporters is critical for the Democratic Party of Oregon as we work to keep electing Democrats up and down the ballot.

If you're unable to give this year, or would like to opt-out of our end of year fundraising drive, you can do so here [[link removed]] .

If you'd like to only receive our most important messages, please click here [[link removed]] . We hope you'll stay, but if you wish to no longer receive our messages, you can unsubscribe: [link removed] , but it will be much more difficult for us to reach you with important information on how to stay involved and elect Democrats.

Message Analysis

- Sender: Democratic Party of Oregon

- Political Party: Democratic

- Country: United States

- State/Locality: Oregon

- Office: n/a

-

Email Providers:

- NGP VAN