| From | American Energy Alliance <[email protected]> |

| Subject | The enemy of my enemy... |

| Date | December 9, 2021 6:03 PM |

Links have been removed from this email. Learn more in the FAQ.

Links have been removed from this email. Learn more in the FAQ.

Your Daily Energy News

View this email in your browser ([link removed])

DAILY ENERGY NEWS | 12/09/2021

Subscribe Now ([link removed])

** You'll never guess who is lashing out at government handouts this week. Listen to episode #61 of The Unregulated Podcast on our website ([link removed]) , or wherever you stream.

------------------------------------------------------------

[link removed]

** The show is available on all your favorite platforms including Sound Cloud ([link removed]) , Apple Podcasts ([link removed]) , Spotify ([link removed]) , Stitcher ([link removed]) , Podbay ([link removed]) , Blubrry ([link removed]) , and TuneIn ([link removed]) .

------------------------------------------------------------

[link removed]

** "The policies elitists are proposing will impose higher energy costs, which many people—the working poor, those on fixed incomes, and those on lower-middle incomes—will struggle to pay for. Yet the elites make no sacrifices themselves."

------------------------------------------------------------

– H. Sterling Burnett, The Heartland Institute ([link removed])

============================================================

Reality bites.

** ([link removed])

What's that line about elections having consequences?

** Virginia Mercury ([link removed])

(12/8/21) reports: "Gov.-elect Glenn Youngkin is pledging to use executive action to pull Virginia out of the Regional Greenhouse Gas Initiative, a carbon market involving 10 other Mid-Atlantic and New England states. 'RGGI describes itself as a regional market for carbon, but it is really a carbon tax that is fully passed on to ratepayers. It’s a bad deal for Virginians. It’s a bad deal for Virginia businesses,' Youngkin told the Hampton Roads Chamber of Commerce Wednesday. 'I promised to lower the cost of living in Virginia and this is just the beginning.' A transition aide for Youngkin said that because Virginia’s participation in RGGI is governed by a contract agreement signed by the Department of Environmental Quality, the governor can withdraw Virginia from that agreement by executive action...Youngkin’s pledge comes less than a week after Virginia completed its first full cycle of quarterly carbon auctions, from which it netted $228 million earmarked by law for flood protection and

low-income energy efficiency programs. Earlier this week, Dominion Energy filed an application to update the charges it will pass onto customers for RGGI participation, which are expected to increase the average residential customer’s monthly bill by $4.37 beginning on Sept. 1, 2022. "

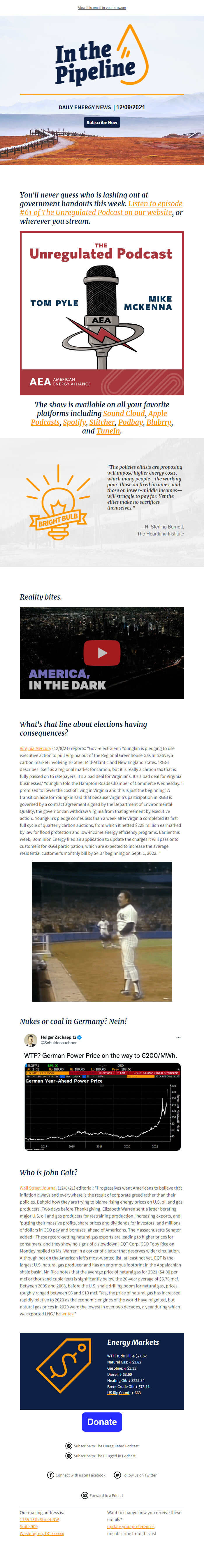

Nukes or coal in Germany? Nein!

** ([link removed])

Who is John Galt?

** Wall Street Journal ([link removed])

(12/8/21) editorial: "Progressives want Americans to believe that inflation always and everywhere is the result of corporate greed rather than their policies. Behold how they are trying to blame rising energy prices on U.S. oil and gas producers. Two days before Thanksgiving, Elizabeth Warren sent a letter berating major U.S. oil and gas producers for restraining production, increasing exports, and 'putting their massive profits, share prices and dividends for investors, and millions of dollars in CEO pay and bonuses' ahead of Americans. The Massachusetts Senator added: 'These record-setting natural gas exports are leading to higher prices for consumers, and they show no signs of a slowdown.' EQT Corp. CEO Toby Rice on Monday replied to Ms. Warren in a corker of a letter that deserves wider circulation. Although not on the American left’s most-wanted list, at least not yet, EQT is the largest U.S. natural gas producer and has an enormous footprint in the Appalachian shale basin. Mr. Rice

notes that the average price of natural gas for 2021 ($4.80 per mcf or thousand cubic feet) is significantly below the 20-year average of $5.70 mcf. Between 2005 and 2008, before the U.S. shale drilling boom for natural gas, prices roughly ranged between $6 and $13 mcf. 'Yes, the price of natural gas has increased rapidly relative to 2020 as the economic engines of the world have reignited, but natural gas prices in 2020 were the lowest in over two decades, a year during which we exported LNG,' he ** writes ([link removed])

."

Energy Markets

WTI Crude Oil: ↓ $71.62

Natural Gas: ↓ $3.82

Gasoline: ↓ $3.33

Diesel: ↓ $3.60

Heating Oil: ↓ $225.84

Brent Crude Oil: ↓ $75.11

** US Rig Count ([link removed])

: ↑ 663

** Donate ([link removed])

** Subscribe to The Unregulated Podcast ([link removed])

** Subscribe to The Unregulated Podcast ([link removed])

** Subscribe to The Plugged In Podcast ([link removed])

** Subscribe to The Plugged In Podcast ([link removed])

** Connect with us on Facebook ([link removed])

** Connect with us on Facebook ([link removed])

** Follow us on Twitter ([link removed])

** Follow us on Twitter ([link removed])

** Forward to a Friend ([link removed])

** Forward to a Friend ([link removed])

Our mailing address is:

** 1155 15th Street NW ([link removed])

** Suite 900 ([link removed])

** Washington, DC xxxxxx ([link removed])

Want to change how you receive these emails?

** update your preferences ([link removed])

** unsubscribe from this list ([link removed])

View this email in your browser ([link removed])

DAILY ENERGY NEWS | 12/09/2021

Subscribe Now ([link removed])

** You'll never guess who is lashing out at government handouts this week. Listen to episode #61 of The Unregulated Podcast on our website ([link removed]) , or wherever you stream.

------------------------------------------------------------

[link removed]

** The show is available on all your favorite platforms including Sound Cloud ([link removed]) , Apple Podcasts ([link removed]) , Spotify ([link removed]) , Stitcher ([link removed]) , Podbay ([link removed]) , Blubrry ([link removed]) , and TuneIn ([link removed]) .

------------------------------------------------------------

[link removed]

** "The policies elitists are proposing will impose higher energy costs, which many people—the working poor, those on fixed incomes, and those on lower-middle incomes—will struggle to pay for. Yet the elites make no sacrifices themselves."

------------------------------------------------------------

– H. Sterling Burnett, The Heartland Institute ([link removed])

============================================================

Reality bites.

** ([link removed])

What's that line about elections having consequences?

** Virginia Mercury ([link removed])

(12/8/21) reports: "Gov.-elect Glenn Youngkin is pledging to use executive action to pull Virginia out of the Regional Greenhouse Gas Initiative, a carbon market involving 10 other Mid-Atlantic and New England states. 'RGGI describes itself as a regional market for carbon, but it is really a carbon tax that is fully passed on to ratepayers. It’s a bad deal for Virginians. It’s a bad deal for Virginia businesses,' Youngkin told the Hampton Roads Chamber of Commerce Wednesday. 'I promised to lower the cost of living in Virginia and this is just the beginning.' A transition aide for Youngkin said that because Virginia’s participation in RGGI is governed by a contract agreement signed by the Department of Environmental Quality, the governor can withdraw Virginia from that agreement by executive action...Youngkin’s pledge comes less than a week after Virginia completed its first full cycle of quarterly carbon auctions, from which it netted $228 million earmarked by law for flood protection and

low-income energy efficiency programs. Earlier this week, Dominion Energy filed an application to update the charges it will pass onto customers for RGGI participation, which are expected to increase the average residential customer’s monthly bill by $4.37 beginning on Sept. 1, 2022. "

Nukes or coal in Germany? Nein!

** ([link removed])

Who is John Galt?

** Wall Street Journal ([link removed])

(12/8/21) editorial: "Progressives want Americans to believe that inflation always and everywhere is the result of corporate greed rather than their policies. Behold how they are trying to blame rising energy prices on U.S. oil and gas producers. Two days before Thanksgiving, Elizabeth Warren sent a letter berating major U.S. oil and gas producers for restraining production, increasing exports, and 'putting their massive profits, share prices and dividends for investors, and millions of dollars in CEO pay and bonuses' ahead of Americans. The Massachusetts Senator added: 'These record-setting natural gas exports are leading to higher prices for consumers, and they show no signs of a slowdown.' EQT Corp. CEO Toby Rice on Monday replied to Ms. Warren in a corker of a letter that deserves wider circulation. Although not on the American left’s most-wanted list, at least not yet, EQT is the largest U.S. natural gas producer and has an enormous footprint in the Appalachian shale basin. Mr. Rice

notes that the average price of natural gas for 2021 ($4.80 per mcf or thousand cubic feet) is significantly below the 20-year average of $5.70 mcf. Between 2005 and 2008, before the U.S. shale drilling boom for natural gas, prices roughly ranged between $6 and $13 mcf. 'Yes, the price of natural gas has increased rapidly relative to 2020 as the economic engines of the world have reignited, but natural gas prices in 2020 were the lowest in over two decades, a year during which we exported LNG,' he ** writes ([link removed])

."

Energy Markets

WTI Crude Oil: ↓ $71.62

Natural Gas: ↓ $3.82

Gasoline: ↓ $3.33

Diesel: ↓ $3.60

Heating Oil: ↓ $225.84

Brent Crude Oil: ↓ $75.11

** US Rig Count ([link removed])

: ↑ 663

** Donate ([link removed])

** Subscribe to The Unregulated Podcast ([link removed])

** Subscribe to The Unregulated Podcast ([link removed])

** Subscribe to The Plugged In Podcast ([link removed])

** Subscribe to The Plugged In Podcast ([link removed])

** Connect with us on Facebook ([link removed])

** Connect with us on Facebook ([link removed])

** Follow us on Twitter ([link removed])

** Follow us on Twitter ([link removed])

** Forward to a Friend ([link removed])

** Forward to a Friend ([link removed])

Our mailing address is:

** 1155 15th Street NW ([link removed])

** Suite 900 ([link removed])

** Washington, DC xxxxxx ([link removed])

Want to change how you receive these emails?

** update your preferences ([link removed])

** unsubscribe from this list ([link removed])

Message Analysis

- Sender: American Energy Alliance (AEA)

- Political Party: n/a

- Country: United States

- State/Locality: n/a

- Office: n/a

-

Email Providers:

- MailChimp