| From | Center for Jobs and the Economy <[email protected]> |

| Subject | California Energy Price Data for November 2021 |

| Date | December 7, 2021 12:15 AM |

Links have been removed from this email. Learn more in the FAQ.

Links have been removed from this email. Learn more in the FAQ.

Web Version [link removed] | Update Preferences [link removed] [link removed] California Energy Price Data

for November 2021

Below are the monthly updates from the most current November 2021 fuel price data (GasBuddy.com) and September 2021 electricity and natural gas price data (US Energy Information Administration). To view additional data and analysis related to the California economy visit our website at [[link removed]].

The most recent data reflects continuing rises in energy costs from California’s regulatory policies, but also incorporates more national and global effects as limits on oil and gas production met growing demand from economies that were recovering prior to the latest Omicron threats. Tighter energy supplies reflect COVID-related factors affecting production company activities in the US, along with actions on both the state [[link removed]] and federal [[link removed]] levels to reduce overall domestic oil and gas production and supplies [[link removed]]. While the president previously urged OPEC [[link removed]] to step up production to backfill domestic shortfalls as prices began to rise, that group and allied countries instead committed only to modest increases [[link removed]]that likely will maintain prices near their current levels.

Energy price spikes in the past have often led to recessions [[link removed]]. Households have less flexibility to adjust energy consumption in the face of sharply rising prices, with the subsequent shift in spending crowding out other discretionary purchases even as the prices on those purchases also rise due to higher energy cost effects on businesses as well. The recent surge in energy prices nationally and globally consequently raises concerns over potential consequences to still-recovering economies, although the duration of the price spikes has yet to be seen.

The situation in California is different. The recent price spikes add on to cost increases that already have occurred over a long period due to the state’s regulatory policies. Households have not had to contend with price increases over the past month as in the rest of the states, but also with sustained rises over the past few years. The full effects have been masked by the performance of the overall economy which is dominated by growth in the high tech industries. Wages within this part of the economy make the cost of living in the state more affordable for these households, while the energy intensive components such as servers and associated manufacturing have been moved to other states and nations in order to shelter company profits and growth from California costs.

For lower and increasingly middle income households, rising energy costs have a far greater effect on discretionary incomes if not the ability to maintain current standards of living. As illustrated in the Center’s Affordability Index [[link removed]], the results instead are not a transitory spike now being seen elsewhere, but a sustained effect grinding away at household incomes even as they have risen in past years.

The data this month also incorporates updates from Energy Information Administration with the final electricity prices and consumption for 2020. This revised data again confirms the growing “tax” imposed on household energy consumption coming from the state regulatory policies. In seeking to promote the state’s regulation-heavy approach to climate change, some commenters still attempt to dismiss the state’s soaring electricity rates by maintaining that overall, California still has some of the lowest monthly utility bills in the country.

This claim, however, relies on outdated data. In 2010 when the state’s first actions under AB 32 began implementation, California in fact had one of the lowest average monthly electricity bills in the country—the 43rd highest, or to put it other terms the 9th lowest among the states and DC. In the final 2020 revised data, California instead comes out 22nd highest and in the most current results (12-month running average) has already risen to 19th. Natural gas rates for households soared from 37th highest in 2010 to 9th highest in the latest results. Average gasoline prices in November were the highest in the nation, not only for that month but for the entire period that tracking is available.

In 2010 in the same year that California began implementing its current regulation-heavy approach to climate change, Congress failed to enact similar provisions on the federal level. The Waxman-Markey Bill [[link removed]]incorporated many of the measures already underway or being developed through California’s program, but this legislation only narrowly passed the House and was never brought up for a vote in the Senate.

The failure to adopt California’s approach on the national level, however, had little effect on overall progress on reducing climate change emissions. From 2010 to 2019 during a period of economic expansion, California’s [[link removed]] greenhouse gas (ghg) emissions dropped 6.6%. Nationally [[link removed]], emissions were down 6.2%. Combining the two sources, California contributed 7% of the national drop in emissions despite representing 14% of the national economy as measured by real GDP (2019). The core difference instead was the cost of achieving those reductions.

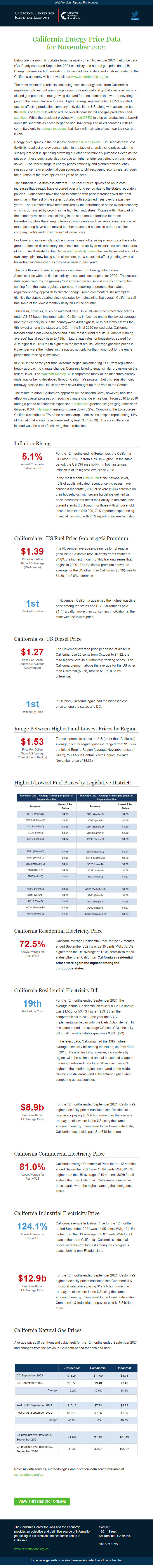

Inflation Rising 5.1% Annual Change in

California CPI

For the 12 months ending September, the California CPI rose 5.1%, up from 4.7% in August. In the same period, the US CPI rose 5.4%. In both instances, inflation is at its highest level since 2008.

In the most recent Gallup Poll [[link removed]] at the national level, 45% of adults indicated recent price increases have caused a moderate (35%) or severe (10%) hardship on their households, with severe hardships defined as price increases that affect their ability to maintain their current standard of living. For those with a household income less than $40,000, 71% reported experiencing financial hardship, with 28% reporting severe hardship.

California vs. US Fuel Price Gap at 42% Premium $1.39 Price Per Gallon

Above US Average

(CA Average)

The November average price per gallon of regular gasoline in California rose 16 cents from October to $4.69, the highest in our monthly tracking series that begins in 2000. The California premium above the average for the US other than California ($3.30) rose to $1.39, a 42.0% difference.

1st Ranked By Price

In November, California again had the highest gasoline price among the states and DC. Californians paid $1.71 a gallon more than consumers in Oklahoma, the state with the lowest price.

California vs. US Diesel Price $1.27 Price Per Gallon

Above US Average

(CA Average)

The November average price per gallon of diesel in California rose 20 cents from October to $4.82, the third highest level in our monthly tracking series. The California premium above the average for the US other than California ($3.56) rose to $1.27, a 35.6% difference.

1st Ranked By Price

In October, California again had the highest diesel price among the states and DC.

Range Between Highest and Lowest Prices by Region $1.53 Price Per Gallon

Above US Average

(Central Sierra Region)

The cost premium above the US (other than California) average price for regular gasoline ranged from $1.32 in the Inland Empire Region (average November price of $4.62), to $1.53 in Central Sierra Region (average November price of $4.83).

Highest/Lowest Fuel Prices by Legislative District: California Residential Electricity Price 72.5% Above Average for

Rest of US

California average Residential Price for the 12 months ended September 2021 was 22.35 cents/kWh, 72.5% higher than the US average of 12.96 cents/kWh for all states other than California. California's residential prices were again the highest among the contiguous states.

California Residential Electricity Bill 19th Ranked By Cost

For the 12 months ended September 2021, the average annual Residential electricity bill in California was $1,525, or 53.4% higher ($531) than the comparable bill in 2010 (the year the AB 32 implementation began with the Early Action items). In this same period, the average US (less CA) electricity bill for all the other states grew only 6.8% ($93).

In the latest data, California had the 19th highest average electricity bill among the states, up from 43rd in 2010. Residential bills, however, vary widely by region, with the estimated annual household usage in the recent released data for 2020 as much as 78% higher in the interior regions compared to the milder climate coastal areas, and substantially higher when comparing across counties.

$8.9b Premium Above

US Average Price

For the 12 months ended September 2021, California's higher electricity prices translated into Residential ratepayers paying $8.9 billion more than the average ratepayers elsewhere in the US using the same amount of energy. Compared to the lowest rate state, California households paid $11.6 billion more.

California Commercial Electricity Price 81.0% Above Average for

Rest of US

California average Commercial Price for the 12 months ended September 2021 was 18.84 cents/kWh, 81.0% higher than the US average of 10.41 cents/kWh for all states other than California. California's commercial prices again were the highest among the contiguous states.

California Industrial Electricity Price 124.1% Above Average for

Rest of US

California average Industrial Price for the 12 months ended September 2021 was 14.95 cents/kWh, 124.1% higher than the US average of 6.67 cents/kWh for all states other than California. California's industrial prices were the 2nd highest among the contiguous states, behind only Rhode Island.

$12.9b Premium Above

US Average Price

For the 12 months ended September 2021, California's higher electricity prices translated into Commercial & Industrial ratepayers paying $12.9 billion more than ratepayers elsewhere in the US using the same amount of energy. Compared to the lowest rate states, Commercial & Industrial ratepayers paid $16.5 billion more.

California Natural Gas Prices

Average prices ($ per thousand cubic feet) for the 12 months ended September 2021 and changes from the previous 12-month period for each end user:

Note: All data sources, methodologies and historical data series available at [[link removed]]

View this Report Online [[link removed]] The California Center for Jobs and the Economy provides an objective and definitive source of information pertaining to job creation and economic trends in California. [[link removed]] Contact 1301 I Street Sacramento, CA 95814 916.553.4093 If you no longer wish to receive these emails, select here to unsubscribe. [link removed]

for November 2021

Below are the monthly updates from the most current November 2021 fuel price data (GasBuddy.com) and September 2021 electricity and natural gas price data (US Energy Information Administration). To view additional data and analysis related to the California economy visit our website at [[link removed]].

The most recent data reflects continuing rises in energy costs from California’s regulatory policies, but also incorporates more national and global effects as limits on oil and gas production met growing demand from economies that were recovering prior to the latest Omicron threats. Tighter energy supplies reflect COVID-related factors affecting production company activities in the US, along with actions on both the state [[link removed]] and federal [[link removed]] levels to reduce overall domestic oil and gas production and supplies [[link removed]]. While the president previously urged OPEC [[link removed]] to step up production to backfill domestic shortfalls as prices began to rise, that group and allied countries instead committed only to modest increases [[link removed]]that likely will maintain prices near their current levels.

Energy price spikes in the past have often led to recessions [[link removed]]. Households have less flexibility to adjust energy consumption in the face of sharply rising prices, with the subsequent shift in spending crowding out other discretionary purchases even as the prices on those purchases also rise due to higher energy cost effects on businesses as well. The recent surge in energy prices nationally and globally consequently raises concerns over potential consequences to still-recovering economies, although the duration of the price spikes has yet to be seen.

The situation in California is different. The recent price spikes add on to cost increases that already have occurred over a long period due to the state’s regulatory policies. Households have not had to contend with price increases over the past month as in the rest of the states, but also with sustained rises over the past few years. The full effects have been masked by the performance of the overall economy which is dominated by growth in the high tech industries. Wages within this part of the economy make the cost of living in the state more affordable for these households, while the energy intensive components such as servers and associated manufacturing have been moved to other states and nations in order to shelter company profits and growth from California costs.

For lower and increasingly middle income households, rising energy costs have a far greater effect on discretionary incomes if not the ability to maintain current standards of living. As illustrated in the Center’s Affordability Index [[link removed]], the results instead are not a transitory spike now being seen elsewhere, but a sustained effect grinding away at household incomes even as they have risen in past years.

The data this month also incorporates updates from Energy Information Administration with the final electricity prices and consumption for 2020. This revised data again confirms the growing “tax” imposed on household energy consumption coming from the state regulatory policies. In seeking to promote the state’s regulation-heavy approach to climate change, some commenters still attempt to dismiss the state’s soaring electricity rates by maintaining that overall, California still has some of the lowest monthly utility bills in the country.

This claim, however, relies on outdated data. In 2010 when the state’s first actions under AB 32 began implementation, California in fact had one of the lowest average monthly electricity bills in the country—the 43rd highest, or to put it other terms the 9th lowest among the states and DC. In the final 2020 revised data, California instead comes out 22nd highest and in the most current results (12-month running average) has already risen to 19th. Natural gas rates for households soared from 37th highest in 2010 to 9th highest in the latest results. Average gasoline prices in November were the highest in the nation, not only for that month but for the entire period that tracking is available.

In 2010 in the same year that California began implementing its current regulation-heavy approach to climate change, Congress failed to enact similar provisions on the federal level. The Waxman-Markey Bill [[link removed]]incorporated many of the measures already underway or being developed through California’s program, but this legislation only narrowly passed the House and was never brought up for a vote in the Senate.

The failure to adopt California’s approach on the national level, however, had little effect on overall progress on reducing climate change emissions. From 2010 to 2019 during a period of economic expansion, California’s [[link removed]] greenhouse gas (ghg) emissions dropped 6.6%. Nationally [[link removed]], emissions were down 6.2%. Combining the two sources, California contributed 7% of the national drop in emissions despite representing 14% of the national economy as measured by real GDP (2019). The core difference instead was the cost of achieving those reductions.

Inflation Rising 5.1% Annual Change in

California CPI

For the 12 months ending September, the California CPI rose 5.1%, up from 4.7% in August. In the same period, the US CPI rose 5.4%. In both instances, inflation is at its highest level since 2008.

In the most recent Gallup Poll [[link removed]] at the national level, 45% of adults indicated recent price increases have caused a moderate (35%) or severe (10%) hardship on their households, with severe hardships defined as price increases that affect their ability to maintain their current standard of living. For those with a household income less than $40,000, 71% reported experiencing financial hardship, with 28% reporting severe hardship.

California vs. US Fuel Price Gap at 42% Premium $1.39 Price Per Gallon

Above US Average

(CA Average)

The November average price per gallon of regular gasoline in California rose 16 cents from October to $4.69, the highest in our monthly tracking series that begins in 2000. The California premium above the average for the US other than California ($3.30) rose to $1.39, a 42.0% difference.

1st Ranked By Price

In November, California again had the highest gasoline price among the states and DC. Californians paid $1.71 a gallon more than consumers in Oklahoma, the state with the lowest price.

California vs. US Diesel Price $1.27 Price Per Gallon

Above US Average

(CA Average)

The November average price per gallon of diesel in California rose 20 cents from October to $4.82, the third highest level in our monthly tracking series. The California premium above the average for the US other than California ($3.56) rose to $1.27, a 35.6% difference.

1st Ranked By Price

In October, California again had the highest diesel price among the states and DC.

Range Between Highest and Lowest Prices by Region $1.53 Price Per Gallon

Above US Average

(Central Sierra Region)

The cost premium above the US (other than California) average price for regular gasoline ranged from $1.32 in the Inland Empire Region (average November price of $4.62), to $1.53 in Central Sierra Region (average November price of $4.83).

Highest/Lowest Fuel Prices by Legislative District: California Residential Electricity Price 72.5% Above Average for

Rest of US

California average Residential Price for the 12 months ended September 2021 was 22.35 cents/kWh, 72.5% higher than the US average of 12.96 cents/kWh for all states other than California. California's residential prices were again the highest among the contiguous states.

California Residential Electricity Bill 19th Ranked By Cost

For the 12 months ended September 2021, the average annual Residential electricity bill in California was $1,525, or 53.4% higher ($531) than the comparable bill in 2010 (the year the AB 32 implementation began with the Early Action items). In this same period, the average US (less CA) electricity bill for all the other states grew only 6.8% ($93).

In the latest data, California had the 19th highest average electricity bill among the states, up from 43rd in 2010. Residential bills, however, vary widely by region, with the estimated annual household usage in the recent released data for 2020 as much as 78% higher in the interior regions compared to the milder climate coastal areas, and substantially higher when comparing across counties.

$8.9b Premium Above

US Average Price

For the 12 months ended September 2021, California's higher electricity prices translated into Residential ratepayers paying $8.9 billion more than the average ratepayers elsewhere in the US using the same amount of energy. Compared to the lowest rate state, California households paid $11.6 billion more.

California Commercial Electricity Price 81.0% Above Average for

Rest of US

California average Commercial Price for the 12 months ended September 2021 was 18.84 cents/kWh, 81.0% higher than the US average of 10.41 cents/kWh for all states other than California. California's commercial prices again were the highest among the contiguous states.

California Industrial Electricity Price 124.1% Above Average for

Rest of US

California average Industrial Price for the 12 months ended September 2021 was 14.95 cents/kWh, 124.1% higher than the US average of 6.67 cents/kWh for all states other than California. California's industrial prices were the 2nd highest among the contiguous states, behind only Rhode Island.

$12.9b Premium Above

US Average Price

For the 12 months ended September 2021, California's higher electricity prices translated into Commercial & Industrial ratepayers paying $12.9 billion more than ratepayers elsewhere in the US using the same amount of energy. Compared to the lowest rate states, Commercial & Industrial ratepayers paid $16.5 billion more.

California Natural Gas Prices

Average prices ($ per thousand cubic feet) for the 12 months ended September 2021 and changes from the previous 12-month period for each end user:

Note: All data sources, methodologies and historical data series available at [[link removed]]

View this Report Online [[link removed]] The California Center for Jobs and the Economy provides an objective and definitive source of information pertaining to job creation and economic trends in California. [[link removed]] Contact 1301 I Street Sacramento, CA 95814 916.553.4093 If you no longer wish to receive these emails, select here to unsubscribe. [link removed]

Message Analysis

- Sender: California Center for Jobs and the Economy

- Political Party: n/a

- Country: United States

- State/Locality: California

- Office: n/a

-

Email Providers:

- Campaign Monitor