| From | Energy and Policy Institute <[email protected]> |

| Subject | Major investors warn utilities against carbon capture and offsets |

| Date | December 3, 2021 1:03 PM |

Links have been removed from this email. Learn more in the FAQ.

Links have been removed from this email. Learn more in the FAQ.

** Major investors warn utilities against carbon capture and offsets ([link removed])

------------------------------------------------------------

By Joe Smyth on Dec 02, 2021 11:18 am

A group of hundreds of major investors is urging electric utilities not to use offsets as part of their decarbonization efforts, and to minimize reliance on carbon capture because of its risks and high costs.

But despite the warnings from major investors, the Department of Energy continues to fund projects, begun during the Trump administration, that study carbon capture proposals at coal-fired power plants. Some of those coal carbon capture projects are also seeking loan guarantees from the Department of Energy – effectively turning to the federal government to finance projects that investors have avoided.

Meanwhile, a new study found that declining renewable energy costs undermine the case for carbon capture, particularly in the power sector and for hydrogen production.

** Investors urge utilities to minimize reliance on carbon capture and not use offsets

------------------------------------------------------------

The Climate Action 100+ group of investors published a report ([link removed]) in October, “Investor interventions to accelerate net zero electric utilities,” which “will inform constructive engagement between investors and electric utility companies on their net zero transitions.” The Climate Action 100+ coalition includes more than 600 global investors that collectively manage assets worth more than $60 trillion, including giants like BlackRock and State Street Global Advisors which are among the top shareholders of most major investor-owned utilities in the U.S.

The investors’ report follows benchmarks ([link removed]) that Climate Action 100+ published in March, which assessed the climate plans and performance of 159 large companies, including several electric utilities. Each of the utility companies assessed mostly failed ([link removed]) to meet the criteria that the investors established.

The October report detailing steps that electric utilities should take to decarbonize is the latest in the Climate Action 100+ group’s Global Sector Strategies ([link removed]) , which outline investors’ expectations of companies in key sectors such as steel, aviation, and now utilities. The report states that utilities in advanced economies such as the U.S. should “Set a company-wide emissions target for annual emissions from electricity generation reaching net zero by 2035,” and that more than half of those emissions reductions should occur by 2030 (from a 2019 baseline).

The report also advises utilities to minimize their reliance on carbon capture, avoid offsets, and “focus primarily on minimising the use of fossil fuels and particularly coal.”

Set a clear decarbonisation strategy identifying the main measures they intend to use to deliver their targets and specify the contributions they expect each to make towards those targets. Decarbonisation strategies will vary by company but should:

• Focus on measures which reduce gross emissions. Consistent with the concept of prioritising emission reductions above offsetting, power companies should focus primarily on minimising the use of fossil fuels and particularly coal.

• Minimise the reliance on CCUS (Carbon Capture Utilisation and Storage). In addition to prioritising reductions in gross emissions, the stubbornly high costs of CCUS in the power sector make it a risky and potentially expensive decarbonisation strategy. Power companies should disclose the expected contribution of CCUS to any targets and conduct and publish a feasibility study setting out its CCUS strategy.

• Not use carbon offsets to reduce generation emissions to net zero. A consistent feature of 1.5 ºC pathways as set out by the IPCC is the near full decarbonisation of electricity generation. SBTi [Science Based Targets Initiative] does not count the contribution of offsets to company emissions targets. Since cost effective sources of low carbon electricity are already available, the finite resources (land and water) required for offsets should be reserved for ‘hard to abate’ sectors.

** Cheap renewable energy erodes the value of carbon capture in the power sector

------------------------------------------------------------

Those “stubbornly high costs of CCUS in the power sector” highlighted in the Climate Action 100+ report are also echoed in a new paper ([link removed]) by researchers at the Grantham Institute for Climate Change and the Environment, “Cost reductions in renewables can substantially erode the value of carbon capture and storage in mitigation pathways.”

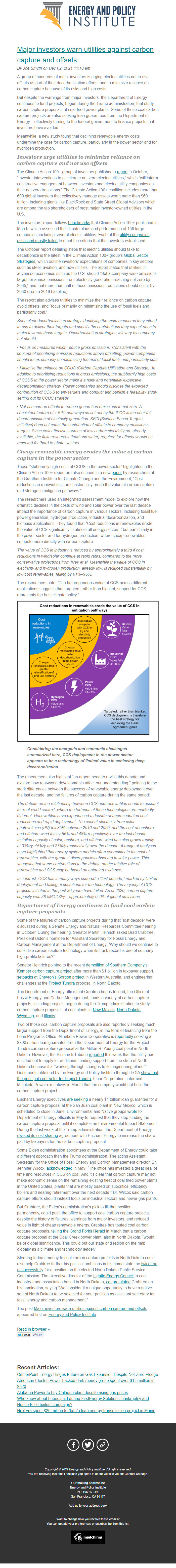

The researchers used an integrated assessment model to explore how the dramatic declines in the costs of wind and solar power over the last decade impact the importance of carbon capture in various sectors, including fossil fuel power generation, hydrogen production, industrial decarbonization, and biomass applications. They found that “Cost reductions in renewables erode the value of CCS significantly in almost all energy sectors,” but particularly in the power sector and for hydrogen production, where cheap renewables compete more directly with carbon capture:

The value of CCS in industry is reduced by approximately a third if cost reductions in wind/solar continue at rapid rates, compared to the more conservative projections from Krey et al. Meanwhile the value of CCS in electricity and hydrogen production, already low, is reduced substantially by low-cost renewables, falling by 61%–96%.

The researchers note: “The heterogeneous value of CCS across different applications suggests that targeted, rather than blanket, support for CCS represents the best climate policy.”

Considering the energetic and economic challenges summarized here, CCS deployment in the power sector appears to be a technology of limited value in achieving deep decarbonization.

The researchers also highlight “an urgent need to revisit this debate and explore how real-world developments affect our understanding,” pointing to the stark differences between the success of renewable energy deployment over the last decade, and the failures of carbon capture during the same period:

The debate on the relationship between CCS and renewables needs to account for real-world context, where the fortunes of these technologies are markedly different. Renewables have experienced a decade of unprecedented cost reductions and rapid deployment. The cost of electricity from solar photovoltaics (PV) fell 85% between 2010 and 2020, and the cost of onshore and offshore wind fell by 56% and 48% respectively over the last decade. Installed capacity of solar, onshore, and offshore wind has also grown rapidly, at 33%/y, 15%/y and 27%/y respectively over the decade. A range of analyses have highlighted that energy system models often overestimate the cost of renewables, with the greatest discrepancies observed in solar power. This suggests that some contributions to the debate on the relative role of renewables and CCS may be based on outdated evidence.

In contrast, CCS has in many ways suffered a ‘‘lost decade,” marked by limited deployment and falling expectations for the technology. The majority of CCS projects initiated in the past 30 years have failed. As of 2020, carbon capture capacity was 38.5MtCO2/y—approximately 0.1% of global emissions.

** Department of Energy continues to fund coal carbon capture proposals

------------------------------------------------------------

Some of the failures of carbon capture projects during that “lost decade” were discussed during a Senate Energy and Natural Resources Committee hearing in October. During the hearing, Senator Martin Heinrich asked Brad Crabtree, President Biden’s nominee for Assistant Secretary for Fossil Energy and Carbon Management at the Department of Energy, “Why should we continue to subsidize carbon capture technology when its track record is one of so many high-profile failures?”

Senator Heinrich pointed to the recent demolition of Southern Company’s Kemper carbon capture project ([link removed]) after more than $1 billion in taxpayer support, setbacks at Chevron’s Gorgon project ([link removed]) in Western Australia, and engineering challenges at the Project Tundra ([link removed]) proposal in North Dakota.

IFRAME: [1][link removed]

The Department of Energy office that Crabtree hopes to lead, the Office of Fossil Energy and Carbon Management, funds a variety of carbon capture projects, including projects begun during the Trump administration to study carbon capture proposals at coal plants in New Mexico ([link removed]) , North Dakota ([link removed]) , Wyoming ([link removed]) , and Illinois ([link removed]) .

Two of those coal carbon capture proposals are also reportedly seeking much larger support from the Department of Energy, in the form of financing from the Loan Programs Office. Minnkota Power Cooperative is reportedly ([link removed]) seeking a $700 million loan guarantee from the Department of Energy for the Project Tundra carbon capture proposal at the Milton R. Young coal plant in North Dakota. However, the Bismarck Tribune reported ([link removed]) this week that the utility had decided not to apply for additional funding support from the state of North Dakota because it is “working through changes to its engineering plans.” Documents obtained by the Energy

and Policy Institute through FOIA show that the principal contractor for Project Tundra ([link removed]) , Fluor Corporation, informed Minnkota Power executives in March that the company would not build the carbon capture project.

Enchant Energy executives are seeking ([link removed]) a nearly $1 billion loan guarantee for a carbon capture proposal at the San Juan coal plant in New Mexico, which is scheduled to close in June. Environmental and Native groups wrote ([link removed]) to Department of Energy officials in May to request that they stop funding the carbon capture proposal until it completes an Environmental Impact Statement. During the last week of the Trump administration, the Department of Energy revised its cost sharing ([link removed]) agreement with Enchant Energy to increase the share paid by taxpayers for the carbon capture proposal.

Some Biden administration appointees at the Department of Energy could take a different approach than the Trump administration. The acting Assistant Secretary for the Office of Fossil Energy and Carbon Management director, Dr. Jennifer Wilcox, acknowledged ([link removed]) in May: “The office has invested a great deal of time and resources in CCS on coal. And it’s clear that carbon capture may not make economic sense on the remaining existing fleet of coal fired power plants in the United States, plants that are mostly based on subcritical efficiency boilers and nearing retirement over the next decade.” Dr. Wilcox said carbon capture efforts should instead focus on industrial sectors and newer gas plants.

But Crabtree, the Biden’s administration’s pick to fill that position permanently, could push the office to support coal carbon capture projects, despite the history of failures, warnings from major investors, and reduced value in light of cheap renewable energy. Crabtree has touted coal carbon capture proposals, telling the Grand Forks Herald ([link removed]) in March that a carbon capture proposal at the Coal Creek power plant, also in North Dakota, “would be of global significance. This could put our state and region on the map globally as a climate and technology leader.”

Steering federal money to coal carbon capture projects in North Dakota could also help Crabtree further his political ambitions in his home state; he twice ran unsuccessfully ([link removed]) for a position on the elected North Dakota Public Service Commission. The executive director of the Lignite Energy Council ([link removed]) , a coal industry trade association based in North Dakota, congratulated ([link removed]) Crabtree on his nomination, saying “We consider it a unique opportunity to have a native son of North Dakota to be selected for your position as assistant secretary for fossil energy and carbon management.”

The post Major investors warn utilities against carbon capture and offsets ([link removed]) appeared first on Energy and Policy Institute ([link removed]) .

References

1. [link removed]

Read in browser » ([link removed])

[link removed] [link removed]

** Recent Articles:

------------------------------------------------------------

** CenterPoint Energy Hinges Future on Gas Expansion Despite Net-Zero Pledge ([link removed])

** American Electric Power-backed dark money group spent over $1.5 million in 2020 ([link removed])

** Alabama Power to buy Calhoun plant despite rising gas prices ([link removed])

** Who knew about bribes paid during FirstEnergy Solutions’ bankruptcy and House Bill 6 bailout campaign? ([link removed])

** NextEra spent $20 million to “ban” clean energy transmission project in Maine ([link removed]

============================================================

** Facebook ([link removed])

** Twitter ([link removed])

** Website ([link removed])

Copyright © 2021 Energy and Policy Institute, All rights reserved.

You are receiving this email because you opted in at our website via our Contact Us page.

Our mailing address is:

Energy and Policy Institute

P.O. Box 170399

San Francisco, CA 94117

USA

Want to change how you receive these emails?

You can ** update your preferences ([link removed])

or ** unsubscribe from this list ([link removed])

.

Email Marketing Powered by Mailchimp

[link removed]

------------------------------------------------------------

By Joe Smyth on Dec 02, 2021 11:18 am

A group of hundreds of major investors is urging electric utilities not to use offsets as part of their decarbonization efforts, and to minimize reliance on carbon capture because of its risks and high costs.

But despite the warnings from major investors, the Department of Energy continues to fund projects, begun during the Trump administration, that study carbon capture proposals at coal-fired power plants. Some of those coal carbon capture projects are also seeking loan guarantees from the Department of Energy – effectively turning to the federal government to finance projects that investors have avoided.

Meanwhile, a new study found that declining renewable energy costs undermine the case for carbon capture, particularly in the power sector and for hydrogen production.

** Investors urge utilities to minimize reliance on carbon capture and not use offsets

------------------------------------------------------------

The Climate Action 100+ group of investors published a report ([link removed]) in October, “Investor interventions to accelerate net zero electric utilities,” which “will inform constructive engagement between investors and electric utility companies on their net zero transitions.” The Climate Action 100+ coalition includes more than 600 global investors that collectively manage assets worth more than $60 trillion, including giants like BlackRock and State Street Global Advisors which are among the top shareholders of most major investor-owned utilities in the U.S.

The investors’ report follows benchmarks ([link removed]) that Climate Action 100+ published in March, which assessed the climate plans and performance of 159 large companies, including several electric utilities. Each of the utility companies assessed mostly failed ([link removed]) to meet the criteria that the investors established.

The October report detailing steps that electric utilities should take to decarbonize is the latest in the Climate Action 100+ group’s Global Sector Strategies ([link removed]) , which outline investors’ expectations of companies in key sectors such as steel, aviation, and now utilities. The report states that utilities in advanced economies such as the U.S. should “Set a company-wide emissions target for annual emissions from electricity generation reaching net zero by 2035,” and that more than half of those emissions reductions should occur by 2030 (from a 2019 baseline).

The report also advises utilities to minimize their reliance on carbon capture, avoid offsets, and “focus primarily on minimising the use of fossil fuels and particularly coal.”

Set a clear decarbonisation strategy identifying the main measures they intend to use to deliver their targets and specify the contributions they expect each to make towards those targets. Decarbonisation strategies will vary by company but should:

• Focus on measures which reduce gross emissions. Consistent with the concept of prioritising emission reductions above offsetting, power companies should focus primarily on minimising the use of fossil fuels and particularly coal.

• Minimise the reliance on CCUS (Carbon Capture Utilisation and Storage). In addition to prioritising reductions in gross emissions, the stubbornly high costs of CCUS in the power sector make it a risky and potentially expensive decarbonisation strategy. Power companies should disclose the expected contribution of CCUS to any targets and conduct and publish a feasibility study setting out its CCUS strategy.

• Not use carbon offsets to reduce generation emissions to net zero. A consistent feature of 1.5 ºC pathways as set out by the IPCC is the near full decarbonisation of electricity generation. SBTi [Science Based Targets Initiative] does not count the contribution of offsets to company emissions targets. Since cost effective sources of low carbon electricity are already available, the finite resources (land and water) required for offsets should be reserved for ‘hard to abate’ sectors.

** Cheap renewable energy erodes the value of carbon capture in the power sector

------------------------------------------------------------

Those “stubbornly high costs of CCUS in the power sector” highlighted in the Climate Action 100+ report are also echoed in a new paper ([link removed]) by researchers at the Grantham Institute for Climate Change and the Environment, “Cost reductions in renewables can substantially erode the value of carbon capture and storage in mitigation pathways.”

The researchers used an integrated assessment model to explore how the dramatic declines in the costs of wind and solar power over the last decade impact the importance of carbon capture in various sectors, including fossil fuel power generation, hydrogen production, industrial decarbonization, and biomass applications. They found that “Cost reductions in renewables erode the value of CCS significantly in almost all energy sectors,” but particularly in the power sector and for hydrogen production, where cheap renewables compete more directly with carbon capture:

The value of CCS in industry is reduced by approximately a third if cost reductions in wind/solar continue at rapid rates, compared to the more conservative projections from Krey et al. Meanwhile the value of CCS in electricity and hydrogen production, already low, is reduced substantially by low-cost renewables, falling by 61%–96%.

The researchers note: “The heterogeneous value of CCS across different applications suggests that targeted, rather than blanket, support for CCS represents the best climate policy.”

Considering the energetic and economic challenges summarized here, CCS deployment in the power sector appears to be a technology of limited value in achieving deep decarbonization.

The researchers also highlight “an urgent need to revisit this debate and explore how real-world developments affect our understanding,” pointing to the stark differences between the success of renewable energy deployment over the last decade, and the failures of carbon capture during the same period:

The debate on the relationship between CCS and renewables needs to account for real-world context, where the fortunes of these technologies are markedly different. Renewables have experienced a decade of unprecedented cost reductions and rapid deployment. The cost of electricity from solar photovoltaics (PV) fell 85% between 2010 and 2020, and the cost of onshore and offshore wind fell by 56% and 48% respectively over the last decade. Installed capacity of solar, onshore, and offshore wind has also grown rapidly, at 33%/y, 15%/y and 27%/y respectively over the decade. A range of analyses have highlighted that energy system models often overestimate the cost of renewables, with the greatest discrepancies observed in solar power. This suggests that some contributions to the debate on the relative role of renewables and CCS may be based on outdated evidence.

In contrast, CCS has in many ways suffered a ‘‘lost decade,” marked by limited deployment and falling expectations for the technology. The majority of CCS projects initiated in the past 30 years have failed. As of 2020, carbon capture capacity was 38.5MtCO2/y—approximately 0.1% of global emissions.

** Department of Energy continues to fund coal carbon capture proposals

------------------------------------------------------------

Some of the failures of carbon capture projects during that “lost decade” were discussed during a Senate Energy and Natural Resources Committee hearing in October. During the hearing, Senator Martin Heinrich asked Brad Crabtree, President Biden’s nominee for Assistant Secretary for Fossil Energy and Carbon Management at the Department of Energy, “Why should we continue to subsidize carbon capture technology when its track record is one of so many high-profile failures?”

Senator Heinrich pointed to the recent demolition of Southern Company’s Kemper carbon capture project ([link removed]) after more than $1 billion in taxpayer support, setbacks at Chevron’s Gorgon project ([link removed]) in Western Australia, and engineering challenges at the Project Tundra ([link removed]) proposal in North Dakota.

IFRAME: [1][link removed]

The Department of Energy office that Crabtree hopes to lead, the Office of Fossil Energy and Carbon Management, funds a variety of carbon capture projects, including projects begun during the Trump administration to study carbon capture proposals at coal plants in New Mexico ([link removed]) , North Dakota ([link removed]) , Wyoming ([link removed]) , and Illinois ([link removed]) .

Two of those coal carbon capture proposals are also reportedly seeking much larger support from the Department of Energy, in the form of financing from the Loan Programs Office. Minnkota Power Cooperative is reportedly ([link removed]) seeking a $700 million loan guarantee from the Department of Energy for the Project Tundra carbon capture proposal at the Milton R. Young coal plant in North Dakota. However, the Bismarck Tribune reported ([link removed]) this week that the utility had decided not to apply for additional funding support from the state of North Dakota because it is “working through changes to its engineering plans.” Documents obtained by the Energy

and Policy Institute through FOIA show that the principal contractor for Project Tundra ([link removed]) , Fluor Corporation, informed Minnkota Power executives in March that the company would not build the carbon capture project.

Enchant Energy executives are seeking ([link removed]) a nearly $1 billion loan guarantee for a carbon capture proposal at the San Juan coal plant in New Mexico, which is scheduled to close in June. Environmental and Native groups wrote ([link removed]) to Department of Energy officials in May to request that they stop funding the carbon capture proposal until it completes an Environmental Impact Statement. During the last week of the Trump administration, the Department of Energy revised its cost sharing ([link removed]) agreement with Enchant Energy to increase the share paid by taxpayers for the carbon capture proposal.

Some Biden administration appointees at the Department of Energy could take a different approach than the Trump administration. The acting Assistant Secretary for the Office of Fossil Energy and Carbon Management director, Dr. Jennifer Wilcox, acknowledged ([link removed]) in May: “The office has invested a great deal of time and resources in CCS on coal. And it’s clear that carbon capture may not make economic sense on the remaining existing fleet of coal fired power plants in the United States, plants that are mostly based on subcritical efficiency boilers and nearing retirement over the next decade.” Dr. Wilcox said carbon capture efforts should instead focus on industrial sectors and newer gas plants.

But Crabtree, the Biden’s administration’s pick to fill that position permanently, could push the office to support coal carbon capture projects, despite the history of failures, warnings from major investors, and reduced value in light of cheap renewable energy. Crabtree has touted coal carbon capture proposals, telling the Grand Forks Herald ([link removed]) in March that a carbon capture proposal at the Coal Creek power plant, also in North Dakota, “would be of global significance. This could put our state and region on the map globally as a climate and technology leader.”

Steering federal money to coal carbon capture projects in North Dakota could also help Crabtree further his political ambitions in his home state; he twice ran unsuccessfully ([link removed]) for a position on the elected North Dakota Public Service Commission. The executive director of the Lignite Energy Council ([link removed]) , a coal industry trade association based in North Dakota, congratulated ([link removed]) Crabtree on his nomination, saying “We consider it a unique opportunity to have a native son of North Dakota to be selected for your position as assistant secretary for fossil energy and carbon management.”

The post Major investors warn utilities against carbon capture and offsets ([link removed]) appeared first on Energy and Policy Institute ([link removed]) .

References

1. [link removed]

Read in browser » ([link removed])

[link removed] [link removed]

** Recent Articles:

------------------------------------------------------------

** CenterPoint Energy Hinges Future on Gas Expansion Despite Net-Zero Pledge ([link removed])

** American Electric Power-backed dark money group spent over $1.5 million in 2020 ([link removed])

** Alabama Power to buy Calhoun plant despite rising gas prices ([link removed])

** Who knew about bribes paid during FirstEnergy Solutions’ bankruptcy and House Bill 6 bailout campaign? ([link removed])

** NextEra spent $20 million to “ban” clean energy transmission project in Maine ([link removed]

============================================================

** Facebook ([link removed])

** Twitter ([link removed])

** Website ([link removed])

Copyright © 2021 Energy and Policy Institute, All rights reserved.

You are receiving this email because you opted in at our website via our Contact Us page.

Our mailing address is:

Energy and Policy Institute

P.O. Box 170399

San Francisco, CA 94117

USA

Want to change how you receive these emails?

You can ** update your preferences ([link removed])

or ** unsubscribe from this list ([link removed])

.

Email Marketing Powered by Mailchimp

[link removed]

Message Analysis

- Sender: Energy and Policy Institute

- Political Party: n/a

- Country: United States

- State/Locality: n/a

- Office: n/a

-

Email Providers:

- MailChimp