Email

American Electric Power-backed dark money group spent over $1.5 million in 2020

| From | Energy and Policy Institute <[email protected]> |

| Subject | American Electric Power-backed dark money group spent over $1.5 million in 2020 |

| Date | November 23, 2021 1:04 PM |

Links have been removed from this email. Learn more in the FAQ.

Links have been removed from this email. Learn more in the FAQ.

** American Electric Power-backed dark money group spent over $1.5 million in 2020 ([link removed])

------------------------------------------------------------

By Dave Anderson on Nov 22, 2021 07:14 pm

Empowering Ohio’s Economy, a group funded solely by American Electric Power, contributed more than $1.5 million to dark money groups in 2020, according to the organization’s tax filings.

The source of Empowering Ohio’s Economy’s funding remained a secret until last year, when the group became ensnared in the public corruption scandal surrounding Ohio’s House Bill 6 ([link removed]) , the 2019 law that increased and extended ratepayer-funded subsidies for the Ohio Valley Electric Corporation coal plants ([link removed].) largely owned by AEP. Nicholas Akins, the CEO of American Electric Power (AEP), admitted during an earnings call ([link removed]) in August 2020 that AEP had contributed

$8.7 million to Empower Ohio’s Economy since 2015, which represented all of the group’s funding as of 2019.

Empowering Ohio’s Economy contributed a total of $700,000 to Generation Now Inc. ([link removed]) , a “purported ([link removed].) ” 501(c)(4) social welfare group connected to now former Ohio Speaker Larry Householder, from 2017 to 2019. Generation Now pleaded guilty earlier this year ([link removed]) to racketeering in connection with nearly $60 million in bribe payments secretly paid by another Ohio utility, FirstEnergy, involved in the passage of H.B. 6. Householder was also indicted last year and awaits trial next year ([link removed]) .

AEP announced in June that it received a subpoena from the Securities and Exchange Commission seeking documents related to H.B. 6 ([link removed]) . The utility also faces several lawsuits filed by shareholders related to the scandal, and a federal judge is set to hear arguments ([link removed]) on AEP’s motion to dismiss ([link removed]) one of those lawsuits ([link removed]) on Tuesday.

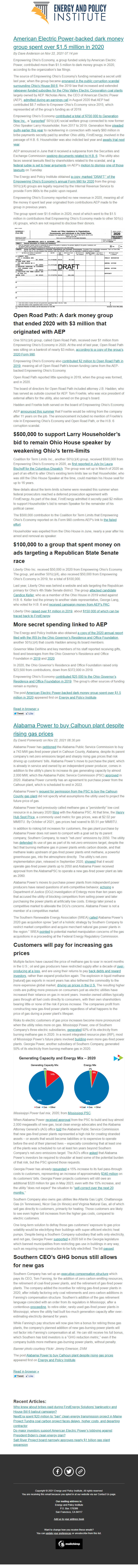

The Energy and Policy Institute obtained a copy, marked “DRAFT,” of the Empowering Ohio’s Economy’s annual Form 990 for 2020 ([link removed]) from the group. 501(c)(4) groups are legally required by the Internal Revenue Service to provide Form 990s to the public upon request.

Empowering Ohio’s Economy reported no new revenue in 2020, meaning all of the money it spent last year originated from contributions AEP made to the group in previous years.

The group spent over $1.6 million in 2020, most of which went to the $1.5 million in contributions that Empowering Ohio’s Economy made to other 501(c)(4) groups, which are not required to disclose their donors.

** Open Road Path: A dark money group that ended 2020 with $3 million that originated with AEP

------------------------------------------------------------

One 501(c)(4) group, called Open Road Path, received over $1 million from Empowering Ohio’s Economy in 2020. At the end of last year, Open Road Path was sitting on a bankroll of nearly $3 million, according to a copy of the group’s 2020 Form 990 ([link removed]) .

Empowering Ohio’s Economy also contributed $2 million to Open Road Path in 2019 ([link removed]) , meaning all of Open Road Path’s known funding came from the AEP-backed Empowering Ohio’s Economy.

Open Road Path reported little spending in 2019, when the group was formed, and in 2020.

The board of directors for Open Road Path included attorney J.B. Hadden, who has served as outside counsel for AEP. Tom Froehle, who was vice president of external affairs for the utility, also served on the group’s board.

Hadden and Froehle both served on the board of Empowering Ohio’s Economy.

AEP announced this summer ([link removed]) that Froehle would be retiring from the company after 11 years on the job. The announcement included no mention of Froehle’s role in Empowering Ohio’s Economy and Open Road Path, or the H.B. 6 corruption scandal.

** $500,000 to support Larry Householder’s bid to remain Ohio House speaker by weakening Ohio’s term-limits

------------------------------------------------------------

Coalition for Term Limits Inc., another 501(c)(4) group, received $500,000 from Empowering Ohio’s Economy in 2020, as first reported in July by Laura Bischoff for the Columbus Dispatch ([link removed]) . The group was set up in March of 2020 as part of an effort to alter Ohio’s existing term-limits law so that Householder, who was still the Ohio House Speaker at the time, could maintain his House seat for up to 16 years.

New details about the term-limits scheme were revealed this summer when federal prosecutors reached a deferred prosecution agreement with FirstEnergy. As part of the deal, FirstEnergy admitted it secretly paid $2 million to support Householder’s bid to remain Speaker for the remainder of his political career.

The $500,000 contribution to the Coalition for Term Limits that Empowering Ohio’s Economy reported on its Form 990 confirms AEP’s link to the failed effort ([link removed]) .

Householder was expelled from the Ohio House in June, nearly a year after his arrest and removal as speaker.

** $100,000 to a group that spent money on ads targeting a Republican State Senate race

------------------------------------------------------------

Liberty Ohio Inc. received $50,000 in 2020 from Empowering Ohio’s Economy. The group, yet another 501(c)(4), also received $50,000 from Empowering Ohio’s Economy in 2019, for a total of $100,000.

Last year, Liberty Ohio was behind a website and ads targeting the Republican primary for Ohio’s 4th State Senate district. The group attacked candidate Candice Keller ([link removed]) , who as a member of the Ohio House in 2019 voted against H.B. 6. Keller lost the primary to another state representative, George Lang, who voted for H.B. 6 and received campaign money from AEP’s PAC ([link removed]) .

Liberty Ohio raised over $1 million in 2019 ([link removed]) , about $150,000 of which can be traced back to FirstEnergy ([link removed]) .

** More secret spending linked to AEP

------------------------------------------------------------

The Energy and Policy Institute also obtained a copy of the 2020 annual report filed with the IRS by the Ohio Governor’s Residence and Office Foundation ([link removed]) , another 501(c)(4) that counts Hadden among its board members.

Governor Mike DeWine and key members of his staff reported receiving gifts, food and beverages from the Ohio Governor’s Residence and Office Foundation in 2019 ([link removed]) and 2020 ([link removed]) .

In 2020, the Ohio Governor’s Residence and Office Foundation raised only $23,500 from contributions, down from $372,000 in 2019.

Empowering Ohio’s Economy contributed $25,000 to the Ohio Governor’s Residence and Office Foundation in 2019 ([link removed]) . The group’s other sources of funding remain a mystery.

The post American Electric Power-backed dark money group spent over $1.5 million in 2020 ([link removed]) appeared first on Energy and Policy Institute ([link removed]) .

Read in browser » ([link removed])

[link removed] [link removed]

** Alabama Power to buy Calhoun plant despite rising gas prices ([link removed])

------------------------------------------------------------

By David Pomerantz on Nov 22, 2021 06:30 pm

Alabama Power has petitioned ([link removed]) the Alabama Public Service Commission to buy a 743 MW gas-fired power plant in Calhoun County, Alabama, despite its parent company’s net-zero emissions target and sharply rising gas prices that risk driving up customers’ bills. Alabama Power’s move to purchase the plant, which is already in service and owned by an independent power producer, comes in addition to the utility’s plans to increase its gas generating capacity by almost 2,000 MW, which the Alabama Public Service Commission (PSC) approved ([link removed]) in 2020. Alabama Power currently has an agreement to purchase power from the Calhoun plant, which is scheduled to end in 2022.

Alabama Power’s request for permission from the PSC to buy the Calhoun County gas plant ([link removed]) did not specify what assumptions the utility used to project the future price of gas.

Alabama Power had previously called methane gas a “persistently” low-cost resource in a January 2020 filing ([link removed]) with the Alabama PSC. At that time, the Henry Hub Spot Price ([link removed]) , a commonly used metric for gas prices, was at $2.02 per MMBTU. By October of 2021, gas prices had soared to $5.51 per MMBTU.

In addition to risking bill increases for customers, the gas plant purchase by Alabama Power does not seem to comport with a goal set by its parent company, Southern Company, to reach “net-zero” emissions by 2050. The utility has defended ([link removed]) its use of gas as part of its net-zero emissions target, despite the fact that burning methane gas in power plants emits carbon dioxide, and that methane leaks upstream of gas-fired power plants emit methane, a powerful greenhouse gas, into the atmosphere directly. The utility’s net-zero implementation plan, released in September 2020, showed ([link removed]) that it would operate gas-fired power plants up to 2050 and Alabama Power received approval from the AlabamaPSC to operate a new gas-fired power plant as late as 2060.

Alabama Power’s moves to purchase power plants from independent power producers have raised questions of anti-competitive behavior, echoing ([link removed]) a Department of Justice (DOJ) investigation of Entergy more than ten years ago that accused the utility of blocking competitors from selling power and later purchasing the power plants at artificially low costs. Entergy later joined a competitive market to alleviate the DOJ’s concerns. Alabama Power is not a member of a competitive market.

The Southern Renewable Energy Association (SREA) called ([link removed]) Alabama Power’s 2020 gas acquisition spree “part of a holistic strategy by Southern Company to restrict market competition and acquire merchant natural gas power plants in the region.” SREA pointed ([link removed]) to potential market manipulation concerns of the gas acquisitions in a proceeding at the Federal Energy Regulatory Commission.

** Customers will pay for increasing gas prices

------------------------------------------------------------

Multiple factors have caused the price of methane gas to soar in recent months in the U.S.; oil and gas producers have restricted supply after a decade of over-producing at a loss ([link removed]) , and are using their returns to pay back debts and reward investors ([link removed]) , rather than expand production again. The explosion in liquid methane [natural] gas exports in recent years has also tethered the commodity to the more expensive global market, driving up prices in the U.S. ([link removed]) The resulting higher costs are putting more pressure on consumers just as electric utilities have increased their reliance on gas in recent years.

Investor-owned utilities typically pass through all fuel costs directly to consumers, with their own shareholders bearing little or none of the risk if prices increase. The companies profit from constructing new gas-fired power plants regardless of what happens to the price of gas during a power plant’s lifespan.

Risks to electric customers of gas price increases become more pronounced when the utility relies more on gas. Mississippi Power, one of Southern Company’s three electric subsidiaries, generated ([link removed]) 92% of its electricity from burning methane gas in 2020. In a recent integrated resource plan (IRP), most of Mississippi Power’s future plans involved building ([link removed]) even more gas-fired power plants. Georgia Power, another subsidiary of Southern Company, generated 50% of its electricity from burning methane gas in 2020.

Mississippi Power fuel mix, 2020, from Mississippi PSC ([link removed]) .

When Alabama Power received approval ([link removed]) from the PSC to build and buy almost 2,000 megawatts of new gas, local clean energy advocates and the Alabama Attorney General’s (AG) office told ([link removed]) the Alabama Public Service Commission that new gas-fired power plants represented a high risk for creating stranded assets – or assets that would become liabilities or to expensive to operate before the end of their planned lives – especially considering that at least one of the plants was scheduled to run at least ten years beyond Southern Company’s net-zero emissions target. The AG’s office asked ([link removed]) that Alabama Power’s investors be required to shoulder at least some

of the potential burden of that risk, but the PSC ignored those requests.

Georgia Power has already requested ([link removed]) a 15% increase to its fuel pass-through costs to customers, representing an increase of approximately $340 million ([link removed]) on its customers’ bills. Georgia Power projects customers will still owe an additional $320 million for gas in May 2023, even with the 15% increase, and the utility “does not expect” the situation to “self-correct over the next 20 months. ([link removed]) ”

Southern Company also owns gas utilities like Atlanta Gas Light, Chattanooga Gas (in Tennessee), Nicor Gas (in Illinois) and Virginia Natural Gas, all of which sell gas directly to customers, primarily for heating. Those customers are likely to see even higher bill increases from the higher gas costs, compared to electric customers.

One long-term solution to defray those gas customers’ exposure to gas price volatility would be electrifying their buildings with super-efficient electric heat pumps. Despite being a Southern Company subsidiary that sells only electricity, and not gas, Georgia Power supported ([link removed]) a 2020 bill in the Georgia legislature which banned municipalities from restricting gas use in buildings in any way, such as requiring new construction to be fully electrified. The bill passed ([link removed]) .

** Southern CEO’s GHG bonus still allows for new gas

------------------------------------------------------------

Southern Company has set up an executive compensation structure ([link removed]) which pays its CEO, Tom Fanning, for the addition of zero-carbon emitting resources, the retirement of coal-fired power plants, and the retirement of gas-fired power plants. The company added the incentive for retiring gas-fired power plants in 2020, after initially factoring only coal retirements and zero-carbon additions in Fanning’s compensation structure. Southern’s addition of the gas retirement language coincided with an order from its regulators in Mississippi, after a contentious proceeding ([link removed]) , to retire older, rarely used gas-fired power plants in Mississippi, where the utility had built too much generation capacity after over-estimating electricity demand for years.

While Fanning’s pay structure will now give him a bonus for retiring those gas plants, the company’s planned addition of new gas-burning power plants will not factor into Fanning’s compensation at all. He can still receive his full bonus, which Southern has told investors is a “GHG reduction metric,” even if the company builds more methane gas-burning power plants, without penalty.

Banner photo courtesy Flickr: Jimmy Emerson, DVM

The post Alabama Power to buy Calhoun plant despite rising gas prices ([link removed]) appeared first on Energy and Policy Institute ([link removed]) .

Read in browser » ([link removed])

[link removed] [link removed]

** Recent Articles:

------------------------------------------------------------

** Who knew about bribes paid during FirstEnergy Solutions’ bankruptcy and House Bill 6 bailout campaign? ([link removed])

** NextEra spent $20 million to “ban” clean energy transmission project in Maine ([link removed])

** Project Tundra coal carbon project faces delays, higher costs, and departing contractor ([link removed])

** Do major investors support American Electric Power’s lobbying against President Biden’s clean energy plan? ([link removed])

** Salt River Project board narrowly approves nearly $1 billion gas plant expansion ([link removed]

============================================================

** Facebook ([link removed])

** Twitter ([link removed])

** Website ([link removed])

Copyright © 2021 Energy and Policy Institute, All rights reserved.

You are receiving this email because you opted in at our website via our Contact Us page.

Our mailing address is:

Energy and Policy Institute

P.O. Box 170399

San Francisco, CA 94117

USA

Want to change how you receive these emails?

You can ** update your preferences ([link removed])

or ** unsubscribe from this list ([link removed])

.

Email Marketing Powered by Mailchimp

[link removed]

------------------------------------------------------------

By Dave Anderson on Nov 22, 2021 07:14 pm

Empowering Ohio’s Economy, a group funded solely by American Electric Power, contributed more than $1.5 million to dark money groups in 2020, according to the organization’s tax filings.

The source of Empowering Ohio’s Economy’s funding remained a secret until last year, when the group became ensnared in the public corruption scandal surrounding Ohio’s House Bill 6 ([link removed]) , the 2019 law that increased and extended ratepayer-funded subsidies for the Ohio Valley Electric Corporation coal plants ([link removed].) largely owned by AEP. Nicholas Akins, the CEO of American Electric Power (AEP), admitted during an earnings call ([link removed]) in August 2020 that AEP had contributed

$8.7 million to Empower Ohio’s Economy since 2015, which represented all of the group’s funding as of 2019.

Empowering Ohio’s Economy contributed a total of $700,000 to Generation Now Inc. ([link removed]) , a “purported ([link removed].) ” 501(c)(4) social welfare group connected to now former Ohio Speaker Larry Householder, from 2017 to 2019. Generation Now pleaded guilty earlier this year ([link removed]) to racketeering in connection with nearly $60 million in bribe payments secretly paid by another Ohio utility, FirstEnergy, involved in the passage of H.B. 6. Householder was also indicted last year and awaits trial next year ([link removed]) .

AEP announced in June that it received a subpoena from the Securities and Exchange Commission seeking documents related to H.B. 6 ([link removed]) . The utility also faces several lawsuits filed by shareholders related to the scandal, and a federal judge is set to hear arguments ([link removed]) on AEP’s motion to dismiss ([link removed]) one of those lawsuits ([link removed]) on Tuesday.

The Energy and Policy Institute obtained a copy, marked “DRAFT,” of the Empowering Ohio’s Economy’s annual Form 990 for 2020 ([link removed]) from the group. 501(c)(4) groups are legally required by the Internal Revenue Service to provide Form 990s to the public upon request.

Empowering Ohio’s Economy reported no new revenue in 2020, meaning all of the money it spent last year originated from contributions AEP made to the group in previous years.

The group spent over $1.6 million in 2020, most of which went to the $1.5 million in contributions that Empowering Ohio’s Economy made to other 501(c)(4) groups, which are not required to disclose their donors.

** Open Road Path: A dark money group that ended 2020 with $3 million that originated with AEP

------------------------------------------------------------

One 501(c)(4) group, called Open Road Path, received over $1 million from Empowering Ohio’s Economy in 2020. At the end of last year, Open Road Path was sitting on a bankroll of nearly $3 million, according to a copy of the group’s 2020 Form 990 ([link removed]) .

Empowering Ohio’s Economy also contributed $2 million to Open Road Path in 2019 ([link removed]) , meaning all of Open Road Path’s known funding came from the AEP-backed Empowering Ohio’s Economy.

Open Road Path reported little spending in 2019, when the group was formed, and in 2020.

The board of directors for Open Road Path included attorney J.B. Hadden, who has served as outside counsel for AEP. Tom Froehle, who was vice president of external affairs for the utility, also served on the group’s board.

Hadden and Froehle both served on the board of Empowering Ohio’s Economy.

AEP announced this summer ([link removed]) that Froehle would be retiring from the company after 11 years on the job. The announcement included no mention of Froehle’s role in Empowering Ohio’s Economy and Open Road Path, or the H.B. 6 corruption scandal.

** $500,000 to support Larry Householder’s bid to remain Ohio House speaker by weakening Ohio’s term-limits

------------------------------------------------------------

Coalition for Term Limits Inc., another 501(c)(4) group, received $500,000 from Empowering Ohio’s Economy in 2020, as first reported in July by Laura Bischoff for the Columbus Dispatch ([link removed]) . The group was set up in March of 2020 as part of an effort to alter Ohio’s existing term-limits law so that Householder, who was still the Ohio House Speaker at the time, could maintain his House seat for up to 16 years.

New details about the term-limits scheme were revealed this summer when federal prosecutors reached a deferred prosecution agreement with FirstEnergy. As part of the deal, FirstEnergy admitted it secretly paid $2 million to support Householder’s bid to remain Speaker for the remainder of his political career.

The $500,000 contribution to the Coalition for Term Limits that Empowering Ohio’s Economy reported on its Form 990 confirms AEP’s link to the failed effort ([link removed]) .

Householder was expelled from the Ohio House in June, nearly a year after his arrest and removal as speaker.

** $100,000 to a group that spent money on ads targeting a Republican State Senate race

------------------------------------------------------------

Liberty Ohio Inc. received $50,000 in 2020 from Empowering Ohio’s Economy. The group, yet another 501(c)(4), also received $50,000 from Empowering Ohio’s Economy in 2019, for a total of $100,000.

Last year, Liberty Ohio was behind a website and ads targeting the Republican primary for Ohio’s 4th State Senate district. The group attacked candidate Candice Keller ([link removed]) , who as a member of the Ohio House in 2019 voted against H.B. 6. Keller lost the primary to another state representative, George Lang, who voted for H.B. 6 and received campaign money from AEP’s PAC ([link removed]) .

Liberty Ohio raised over $1 million in 2019 ([link removed]) , about $150,000 of which can be traced back to FirstEnergy ([link removed]) .

** More secret spending linked to AEP

------------------------------------------------------------

The Energy and Policy Institute also obtained a copy of the 2020 annual report filed with the IRS by the Ohio Governor’s Residence and Office Foundation ([link removed]) , another 501(c)(4) that counts Hadden among its board members.

Governor Mike DeWine and key members of his staff reported receiving gifts, food and beverages from the Ohio Governor’s Residence and Office Foundation in 2019 ([link removed]) and 2020 ([link removed]) .

In 2020, the Ohio Governor’s Residence and Office Foundation raised only $23,500 from contributions, down from $372,000 in 2019.

Empowering Ohio’s Economy contributed $25,000 to the Ohio Governor’s Residence and Office Foundation in 2019 ([link removed]) . The group’s other sources of funding remain a mystery.

The post American Electric Power-backed dark money group spent over $1.5 million in 2020 ([link removed]) appeared first on Energy and Policy Institute ([link removed]) .

Read in browser » ([link removed])

[link removed] [link removed]

** Alabama Power to buy Calhoun plant despite rising gas prices ([link removed])

------------------------------------------------------------

By David Pomerantz on Nov 22, 2021 06:30 pm

Alabama Power has petitioned ([link removed]) the Alabama Public Service Commission to buy a 743 MW gas-fired power plant in Calhoun County, Alabama, despite its parent company’s net-zero emissions target and sharply rising gas prices that risk driving up customers’ bills. Alabama Power’s move to purchase the plant, which is already in service and owned by an independent power producer, comes in addition to the utility’s plans to increase its gas generating capacity by almost 2,000 MW, which the Alabama Public Service Commission (PSC) approved ([link removed]) in 2020. Alabama Power currently has an agreement to purchase power from the Calhoun plant, which is scheduled to end in 2022.

Alabama Power’s request for permission from the PSC to buy the Calhoun County gas plant ([link removed]) did not specify what assumptions the utility used to project the future price of gas.

Alabama Power had previously called methane gas a “persistently” low-cost resource in a January 2020 filing ([link removed]) with the Alabama PSC. At that time, the Henry Hub Spot Price ([link removed]) , a commonly used metric for gas prices, was at $2.02 per MMBTU. By October of 2021, gas prices had soared to $5.51 per MMBTU.

In addition to risking bill increases for customers, the gas plant purchase by Alabama Power does not seem to comport with a goal set by its parent company, Southern Company, to reach “net-zero” emissions by 2050. The utility has defended ([link removed]) its use of gas as part of its net-zero emissions target, despite the fact that burning methane gas in power plants emits carbon dioxide, and that methane leaks upstream of gas-fired power plants emit methane, a powerful greenhouse gas, into the atmosphere directly. The utility’s net-zero implementation plan, released in September 2020, showed ([link removed]) that it would operate gas-fired power plants up to 2050 and Alabama Power received approval from the AlabamaPSC to operate a new gas-fired power plant as late as 2060.

Alabama Power’s moves to purchase power plants from independent power producers have raised questions of anti-competitive behavior, echoing ([link removed]) a Department of Justice (DOJ) investigation of Entergy more than ten years ago that accused the utility of blocking competitors from selling power and later purchasing the power plants at artificially low costs. Entergy later joined a competitive market to alleviate the DOJ’s concerns. Alabama Power is not a member of a competitive market.

The Southern Renewable Energy Association (SREA) called ([link removed]) Alabama Power’s 2020 gas acquisition spree “part of a holistic strategy by Southern Company to restrict market competition and acquire merchant natural gas power plants in the region.” SREA pointed ([link removed]) to potential market manipulation concerns of the gas acquisitions in a proceeding at the Federal Energy Regulatory Commission.

** Customers will pay for increasing gas prices

------------------------------------------------------------

Multiple factors have caused the price of methane gas to soar in recent months in the U.S.; oil and gas producers have restricted supply after a decade of over-producing at a loss ([link removed]) , and are using their returns to pay back debts and reward investors ([link removed]) , rather than expand production again. The explosion in liquid methane [natural] gas exports in recent years has also tethered the commodity to the more expensive global market, driving up prices in the U.S. ([link removed]) The resulting higher costs are putting more pressure on consumers just as electric utilities have increased their reliance on gas in recent years.

Investor-owned utilities typically pass through all fuel costs directly to consumers, with their own shareholders bearing little or none of the risk if prices increase. The companies profit from constructing new gas-fired power plants regardless of what happens to the price of gas during a power plant’s lifespan.

Risks to electric customers of gas price increases become more pronounced when the utility relies more on gas. Mississippi Power, one of Southern Company’s three electric subsidiaries, generated ([link removed]) 92% of its electricity from burning methane gas in 2020. In a recent integrated resource plan (IRP), most of Mississippi Power’s future plans involved building ([link removed]) even more gas-fired power plants. Georgia Power, another subsidiary of Southern Company, generated 50% of its electricity from burning methane gas in 2020.

Mississippi Power fuel mix, 2020, from Mississippi PSC ([link removed]) .

When Alabama Power received approval ([link removed]) from the PSC to build and buy almost 2,000 megawatts of new gas, local clean energy advocates and the Alabama Attorney General’s (AG) office told ([link removed]) the Alabama Public Service Commission that new gas-fired power plants represented a high risk for creating stranded assets – or assets that would become liabilities or to expensive to operate before the end of their planned lives – especially considering that at least one of the plants was scheduled to run at least ten years beyond Southern Company’s net-zero emissions target. The AG’s office asked ([link removed]) that Alabama Power’s investors be required to shoulder at least some

of the potential burden of that risk, but the PSC ignored those requests.

Georgia Power has already requested ([link removed]) a 15% increase to its fuel pass-through costs to customers, representing an increase of approximately $340 million ([link removed]) on its customers’ bills. Georgia Power projects customers will still owe an additional $320 million for gas in May 2023, even with the 15% increase, and the utility “does not expect” the situation to “self-correct over the next 20 months. ([link removed]) ”

Southern Company also owns gas utilities like Atlanta Gas Light, Chattanooga Gas (in Tennessee), Nicor Gas (in Illinois) and Virginia Natural Gas, all of which sell gas directly to customers, primarily for heating. Those customers are likely to see even higher bill increases from the higher gas costs, compared to electric customers.

One long-term solution to defray those gas customers’ exposure to gas price volatility would be electrifying their buildings with super-efficient electric heat pumps. Despite being a Southern Company subsidiary that sells only electricity, and not gas, Georgia Power supported ([link removed]) a 2020 bill in the Georgia legislature which banned municipalities from restricting gas use in buildings in any way, such as requiring new construction to be fully electrified. The bill passed ([link removed]) .

** Southern CEO’s GHG bonus still allows for new gas

------------------------------------------------------------

Southern Company has set up an executive compensation structure ([link removed]) which pays its CEO, Tom Fanning, for the addition of zero-carbon emitting resources, the retirement of coal-fired power plants, and the retirement of gas-fired power plants. The company added the incentive for retiring gas-fired power plants in 2020, after initially factoring only coal retirements and zero-carbon additions in Fanning’s compensation structure. Southern’s addition of the gas retirement language coincided with an order from its regulators in Mississippi, after a contentious proceeding ([link removed]) , to retire older, rarely used gas-fired power plants in Mississippi, where the utility had built too much generation capacity after over-estimating electricity demand for years.

While Fanning’s pay structure will now give him a bonus for retiring those gas plants, the company’s planned addition of new gas-burning power plants will not factor into Fanning’s compensation at all. He can still receive his full bonus, which Southern has told investors is a “GHG reduction metric,” even if the company builds more methane gas-burning power plants, without penalty.

Banner photo courtesy Flickr: Jimmy Emerson, DVM

The post Alabama Power to buy Calhoun plant despite rising gas prices ([link removed]) appeared first on Energy and Policy Institute ([link removed]) .

Read in browser » ([link removed])

[link removed] [link removed]

** Recent Articles:

------------------------------------------------------------

** Who knew about bribes paid during FirstEnergy Solutions’ bankruptcy and House Bill 6 bailout campaign? ([link removed])

** NextEra spent $20 million to “ban” clean energy transmission project in Maine ([link removed])

** Project Tundra coal carbon project faces delays, higher costs, and departing contractor ([link removed])

** Do major investors support American Electric Power’s lobbying against President Biden’s clean energy plan? ([link removed])

** Salt River Project board narrowly approves nearly $1 billion gas plant expansion ([link removed]

============================================================

** Facebook ([link removed])

** Twitter ([link removed])

** Website ([link removed])

Copyright © 2021 Energy and Policy Institute, All rights reserved.

You are receiving this email because you opted in at our website via our Contact Us page.

Our mailing address is:

Energy and Policy Institute

P.O. Box 170399

San Francisco, CA 94117

USA

Want to change how you receive these emails?

You can ** update your preferences ([link removed])

or ** unsubscribe from this list ([link removed])

.

Email Marketing Powered by Mailchimp

[link removed]

Message Analysis

- Sender: Energy and Policy Institute

- Political Party: n/a

- Country: United States

- State/Locality: n/a

- Office: n/a

-

Email Providers:

- MailChimp