|

|

Build Back Better Act Clears Procedural Vote in House, Awaits Next Steps |

|

Following the passage of the bipartisan infrastructure bill last Friday night, Democrats in Congress passed a key procedural vote to set up eventual passage of the Build Back Better Act, H.R. 5376, as they worked toward securing commitments from a group of holdout members.

The group of six House members committed to voting for the transformative legislation once the Congressional Budget Office confirms that the bill is fully paid for, most likely before Thanksgiving. If passed by the House, the bill must then go to the Senate, where it will likely be amended, then sent back to the House.

The bill represents President Biden’s plan to strengthen and invest in middle class families and contains numerous benefits for older Americans, including:

The bipartisan infrastructure bill, which passed the House 228-206 last Friday night, will be signed by President Biden at a White House event on Monday. It includes $39 billion in public transit -- key for older Americans who travel by bus and train -- and $65 billion to bring broadband to every American, including 22 million seniors who lack internet access at home.

“These bills are historic and will help older Americans,“ said Richard Fiesta, Executive Director of the Alliance. “To address prescription drug prices, home care, hearing and more all at once will truly make a major difference in seniors’ lives.”

|

|

Alliance Activists Make the Case for the Build Back Better Act |

|

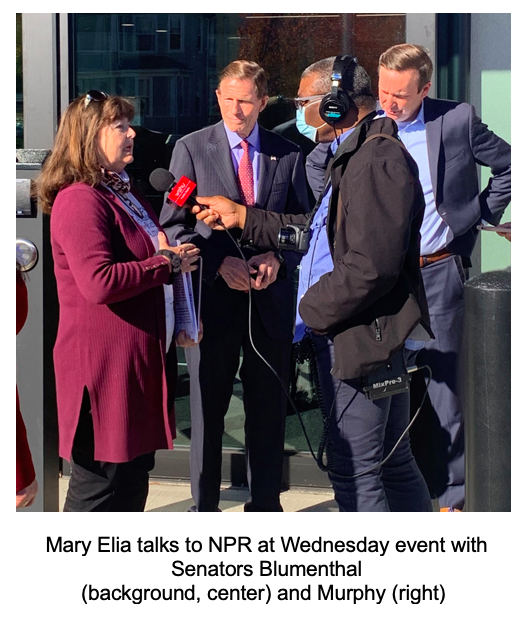

Alliance chapters across the country have been working hard to solidify support for the Build Back Better Act. In Connecticut on Wednesday, Mary Elia, Corresponding Secretary for the Connecticut Alliance, joined the U.S. Senators from Connecticut, Richard Blumenthal and Chris Murphy, and State Senator Matt Lesser at a press conference to bring attention to the provisions in the bill that will lower drug prices.

In addition to drug price negotiation, those provisions include a $35 per-month limit on the cost of insulin under Medicare and a cap on out-of-pocket prescription drug costs at $2,000 per year. |

|

|

"We also support limiting drug corporations' ability to raise prices faster than inflation, another key part of the bill," said Robert Roach, Jr., President of the Alliance. “Together, these provisions will allow millions of Americans to afford the drugs they need to stay healthy.” |

|

Members of the Colorado Alliance joined Rep. Jason Crow (CO) on Thursday to build support for the legislation in their state, and Nevada Alliance members are joining three of their Representatives, Steven Horsford, Susie Lee and Dina Titus, today to amplify the message. |

|

Legislation is Introduced in House to Reduce Barriers for Older Workers |

|

U.S. Representatives Marie Newman (IL), Don Beyer (VA), Suzanne Bonamici (OR) and Sylvia Garcia (TX) recently introduced the Supporting Older Workers Act, H.R. 5531, a bill designed to improve and advance the employment, economic success and well-being of America’s older workers.

The legislation would reduce barriers for older workers by improving career counseling and training opportunities; creating a grant program to support older worker coordinators; and establishing a new Older Workers Bureau at the Department of Labor (DOL). |

|

|

Specifically, it would address workforce disparities by allowing communities to use federal funding to focus on older workers’ employment options and training needs and to create specialized centers for older workers at local American Jobs Centers. |

|

The special coordinators will partner with labor organizations, Area Agencies on Aging, community colleges, nonprofits and others to increase resources and add support for older workers. The Older Workers Bureau will encompass policy development, research and reporting, and technical assistance.

“We must continue to fight employment discrimination against older workers,” said Joseph Peters, Jr., Secretary-Treasurer of the Alliance. “This legislation addresses the unique barriers that older workers face, particularly with the coronavirus putting them at greater risk.” |

|

KHN: Medicare Enrollment Blitz Doesn’t Include Options to Move Into Medigap

By Harris Meyer |

|

Medicare’s annual open-enrollment season is here and millions of beneficiaries — prompted by a massive advertising campaign and aided by a detailed federal website — will choose a private Medicare Advantage plan.

But those who have instead opted for traditional Medicare face a critical decision about private insurance. Too often the import of that choice is not well communicated.

If beneficiaries decide to use traditional Medicare when they first join the program, they can pick a private supplemental plan — a Medigap plan — to help cover Medicare’s sizable deductibles and copayments for hospital stays, physician visits and other services.

But many people don’t realize that, in most states, beneficiaries have guaranteed access to a Medigap plan for only six months after they enroll in Medicare Part B — either at age 65 or when they leave private health insurance and join Part B.

While the Medicare.gov website offers a guide to these Medigap plans — labeled A through N — it’s a complicated decision because each plan provides different kinds of coverage — for 10 categories of benefits. Then there are the variants with high deductibles and limited provider networks. Premiums vary sharply, of course. And because seniors enroll in these plans throughout the year as they reach Medicare eligibility, there is far less publicity about the options. |

|

Thanks for reading. Every day, we're fighting to lower prescription drug prices and protect retirees' earned benefits and health care. But we can't do it without your help. Please support our work by donating below. |

|

|

|

|

Alliance for Retired Americans | 815 16th Street, NW | Washington, DC 20006 | www.retiredamericans.org